CHINA AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

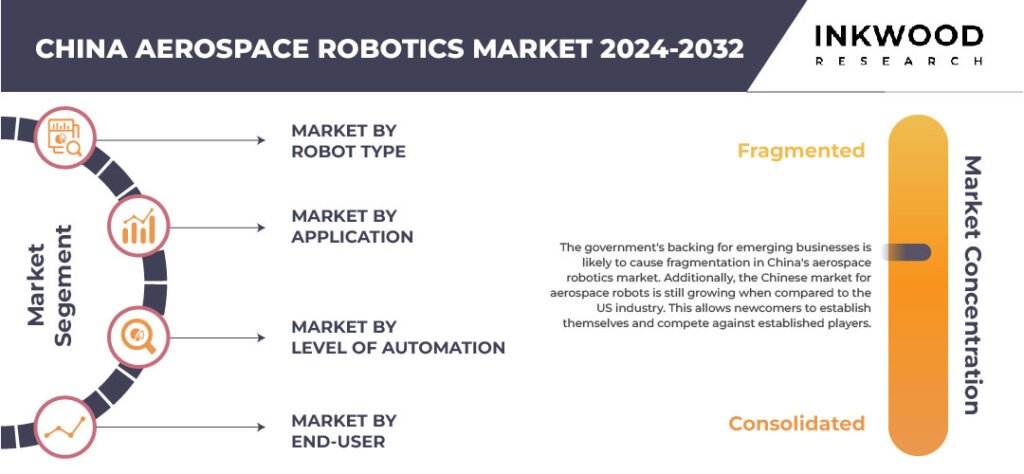

China Aerospace Robotics Market by Robot Type (Articulated Robots, Cartesian Robots, Scara Robots, Cylindrical Robots, Delta Robots, Collaborative Robots) Market by Application (Drilling & Fastening, Non-destructive Testing & Inspection, Welding & Soldering, Sealing & Dispensing, Material Handling, Assembling & Disassembling, Other Applications) Market by Level of Automation (Fully Automated, Semi-automated, Manual Systems With Robotic Assistance) Market by End-user (Original Equipment Manufacturers (OEM), Maintenance, Repair, and Overhauls (MRO))

MARKET OVERVIEW

The China aerospace robotics market is predicted to develop at a CAGR of 10.91% over the forecast period of 2024-2032. It is set to reach a revenue of $706.92 million by 2032.

The China aerospace robotics market is experiencing significant growth propelled by rising aircraft demand across the commercial, military, and civil sectors. This surge is largely due to the expanding aviation industry in China, which is necessitating increased production capacity and efficiency. As the demand for new aircraft continues to elevate, manufacturers are turning to automation and robotics to meet production targets and maintain high standards of quality. The integration of robotics into aerospace manufacturing processes is boosting efficiency and enabling manufacturers to handle the complexities associated with modern aircraft designs.

To Know More About This Report, Request a Free Sample Copy

Automation and robotics are crucial in enhancing aerospace manufacturing efficiency. Robotics technology allows for precision and repeatability in tasks such as welding, drilling, and assembly, which are critical in aircraft production. By automating these processes, manufacturers can reduce human error, improve product consistency, and speed up production times. This, in turn, helps meet the growing demand for aircraft while maintaining stringent quality standards. The adoption of robotics is also helping manufacturers optimize resource use, thereby reducing waste and operational costs.

Technological advancements have significantly enhanced robotic capabilities, further driving their adoption in the aerospace sector. Innovations in robotics, such as advanced sensors, machine learning algorithms, and collaborative robots, have expanded the range of tasks that robots can perform. These advancements enable robots to operate in more complex and dynamic environments, performing tasks that were previously difficult or impossible. As a result, aerospace manufacturers are increasingly incorporating these advanced robotic systems into their production lines to achieve higher levels of precision and efficiency.

China Aerospace Robotics Market: 10.91% CAGR (2024-2032)

Need a custom report or have specific data requirements? Let us know!

Despite the benefits, the high initial costs associated with implementing robotics in aircraft manufacturing are a major restraint on market demand in China. Setting up robotic systems requires significant investment in both hardware and software, as well as in training personnel to operate and maintain the equipment. For many companies, especially smaller manufacturers, these costs can be prohibitive. The financial burden of adopting robotics technology can slow down the pace of its integration into the aerospace manufacturing process, limiting the overall market growth.

Another prominent challenge impeding the demand for advanced robotics in the aerospace sector is the lack of a trained workforce. The operation and maintenance of sophisticated robotic systems require specialized skills and knowledge, which are currently in short supply. The aerospace industry in China faces a skills gap, with many workers needing additional training to handle advanced robotics technology. This shortage of skilled personnel can limit the ability of manufacturers to fully leverage the benefits of automation and robotics, slowing down the adoption of these technologies and affecting overall market growth.

The China aerospace robotics market segmentation incorporates the market by robot type, application, level of automation, and end-user. The end-user segment is further divided into original equipment manufacturers (OEM) and maintenance, repair, and overhauls (MRO). OEMs in the aerospace sector are heavily investing in robotics to enhance their production capabilities. By integrating advanced robotic systems into their manufacturing processes, OEMs are able to achieve higher precision, consistency, and efficiency. This is particularly important in the aerospace industry, where the complexity and precision required for aircraft components necessitate the use of cutting-edge technology. Robotics helps OEMs meet stringent quality standards and reduce production times, thereby keeping up with the growing demand for new aircraft.

On the other hand, the MRO sub-segment is also observing substantial adoption of robotics technology. Maintenance, repair, and overhaul operations are crucial for ensuring the longevity and safety of aircraft. Robotics in MRO activities can streamline inspections, repairs, and maintenance tasks, which are often labor-intensive and time-consuming. Automated systems can perform detailed inspections using advanced sensors and imaging technologies, identifying issues that human inspectors might miss. This leads to quicker turnaround times and higher accuracy in maintenance processes, ultimately enhancing the reliability and safety of aircraft.

Some of the leading players in the China aerospace robotics market include Nachi-Fujikoshi Corp, Seiko Epson, Yaskawa Electric Corporation, etc.

Yaskawa Electric Corporation offers a range of products, including industrial robots that support cutting-edge industries, as well as servo motors, AC drives, and inverters. The company is also advancing social infrastructure sectors such as elevators, air conditioning, oil and gas, pumps, photovoltaic generation, and logistics. Additionally, Yaskawa serves industries like automotive, electric vehicles (EVs), semiconductors, electronic components, next-generation telecommunications, food manufacturing, agriculture, and biomedical. Yaskawa operates in regions including the Americas, Europe, and Asia-Pacific, with its headquarters located in Kitakyushu, Fukuoka, Japan.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Robot Type, Application, Level of Automation, and End-User |

| Countries Analyzed | China |

| Companies Analyzed | Comau SpA (A Stellantis NV Company), FANUC Corporation, Kawasaki Heavy Industries Ltd, Nachi-Fujikoshi Corp, Seiko Epson, Yaskawa Electric Corporation, SIASUN |

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- INCREASING USE OF ROBOTICS TO MANAGE THE BACKLOG OF AIRCRAFT ORDERS

- ENHANCED SAFETY AND PRECISION IN AEROSPACE MANUFACTURING THROUGH ROBOTICS

MARKET DYNAMICS

- KEY DRIVERS

- RISING AIRCRAFT DEMAND IN THE COMMERCIAL, MILITARY, AND CIVIL SECTORS

- AUTOMATION AND ROBOTICS TO BOOST AEROSPACE MANUFACTURING EFFICIENCY

- ENHANCED ROBOTIC CAPABILITIES DUE TO TECHNOLOGICAL ADVANCEMENTS

- KEY RESTRAINTS

- HIGH INITIAL COSTS OF ROBOTICS IN AIRCRAFT MANUFACTURING HINDER MARKET DEMAND

- SAFETY AND REGULATORY CONCERNS REGARDING ROBOTICS INTEGRATION TO CHALLENGE MARKET GROWTH

- LACK OF TRAINED WORKFORCE FOR ADVANCED ROBOTICS IMPEDES MARKET DEMAND

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- RISING INTEGRATION OF COLLABORATIVE ROBOTS (COBOTS) IN AIRCRAFT ASSEMBLY AND MANUFACTURING

- DEVELOPMENT OF MOBILE ROBOTIC PLATFORMS FOR FLEXIBLE MANUFACTURING AND ADAPTIVE PRODUCTION LINES

- ADOPTION OF 3D PRINTING TECHNOLOGIES INTEGRATED WITH ROBOTIC SYSTEMS FOR RAPID PROTOTYPING AND CUSTOMIZED COMPONENT FABRICATION

- GROWING FOCUS ON PREDICTIVE MAINTENANCE AND CONDITION MONITORING USING IOT-ENABLED ROBOTIC SYSTEMS TO OPTIMIZE MANUFACTURING PROCESSES

- PESTLE ANALYSIS

- POLITICAL

- ECONOMICAL

- SOCIAL

- TECHNOLOGICAL

- LEGAL

- ENVIRONMENTAL

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR CHINA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS

- ASSEMBLY AND INTEGRATION OF ROBOTS

- SYSTEM DESIGN AND ENGINEERING

- DEPLOYMENT AND INSTALLATION

- TRAINING AND SUPPORT

- KEY BUYING CRITERIA

- COST

- PRECISION AND ACCURACY

- RELIABILITY AND DURABILITY

- EASE OF PROGRAMMING AND OPERATION

- MAINTENANCE AND SUPPORT

- KEY MARKET TRENDS

MARKET BY ROBOT TYPE

- ARTICULATED ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARTESIAN ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SCARA ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CYLINDRICAL ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DELTA ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COLLABORATIVE ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ARTICULATED ROBOTS

MARKET BY APPLICATION

- DRILLING & FASTENING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NON-DESTRUCTIVE TESTING & INSPECTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WELDING & SOLDERING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEALING & DISPENSING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MATERIAL HANDLING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ASSEMBLING & DISASSEMBLING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DRILLING & FASTENING

MARKET BY LEVEL OF AUTOMATION

- FULLY AUTOMATED

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEMI-AUTOMATED

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FULLY AUTOMATED

MARKET BY END-USER

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MAINTENANCE, REPAIR, AND OVERHAULS (MRO)

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- COMAU SPA (A STELLANTIS NV COMPANY)

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- FANUC CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KAWASAKI HEAVY INDUSTRIES LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- NACHI-FUJIKOSHI CORP

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SEIKO EPSON

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SIASUN

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- YASKAWA ELECTRIC CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- COMAU SPA (A STELLANTIS NV COMPANY)

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – AEROSPACE ROBOTICS

TABLE 2: CHINA AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: CHINA AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: CHINA AEROSPACE ROBOTICS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: CHINA AEROSPACE ROBOTICS MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: CHINA AEROSPACE ROBOTICS MARKET, BY LEVEL OF AUTOMATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: CHINA AEROSPACE ROBOTICS MARKET, BY LEVEL OF AUTOMATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: CHINA AEROSPACE ROBOTICS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: CHINA AEROSPACE ROBOTICS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: LIST OF MERGERS & ACQUISITIONS

TABLE 11: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 12: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 4: MARKET MATURITY ANALYSIS

FIGURE 5: MARKET CONCENTRATION ANALYSIS

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: KEY BUYING CRITERIA

FIGURE 8: CHINA AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY ROBOT TYPE, IN 2023

FIGURE 9: CHINA AEROSPACE ROBOTICS MARKET, BY ARTICULATED ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 10: CHINA AEROSPACE ROBOTICS MARKET, BY CARTESIAN ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 11: CHINA AEROSPACE ROBOTICS MARKET, BY SCARA ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 12: CHINA AEROSPACE ROBOTICS MARKET, BY CYLINDRICAL ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 13: CHINA AEROSPACE ROBOTICS MARKET, BY DELTA ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 14: CHINA AEROSPACE ROBOTICS MARKET, BY COLLABORATIVE ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 15: CHINA AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2023

FIGURE 16: CHINA AEROSPACE ROBOTICS MARKET, BY DRILLING & FASTENING, 2024-2032 (IN $ MILLION)

FIGURE 17: CHINA AEROSPACE ROBOTICS MARKET, BY NON-DESTRUCTIVE TESTING & INSPECTION, 2024-2032 (IN $ MILLION)

FIGURE 18: CHINA AEROSPACE ROBOTICS MARKET, BY WELDING & SOLDERING, 2024-2032 (IN $ MILLION)

FIGURE 19: CHINA AEROSPACE ROBOTICS MARKET, BY SEALING & DISPENSING, 2024-2032 (IN $ MILLION)

FIGURE 20: CHINA AEROSPACE ROBOTICS MARKET, BY MATERIAL HANDLING, 2024-2032 (IN $ MILLION)

FIGURE 21: CHINA AEROSPACE ROBOTICS MARKET, BY ASSEMBLING & DISASSEMBLING, 2024-2032 (IN $ MILLION)

FIGURE 22: CHINA AEROSPACE ROBOTICS MARKET, BY OTHER APPLICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 23: CHINA AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY LEVEL OF AUTOMATION, IN 2023

FIGURE 24: CHINA AEROSPACE ROBOTICS MARKET, BY FULLY AUTOMATED, 2024-2032 (IN $ MILLION)

FIGURE 25: CHINA AEROSPACE ROBOTICS MARKET, BY SEMI-AUTOMATED, 2024-2032 (IN $ MILLION)

FIGURE 26: CHINA AEROSPACE ROBOTICS MARKET, BY MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE, 2024-2032 (IN $ MILLION)

FIGURE 27: CHINA AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 28: CHINA AEROSPACE ROBOTICS MARKET, BY ORIGINAL EQUIPMENT MANUFACTURERS (OEM), 2024-2032 (IN $ MILLION)

FIGURE 29: CHINA AEROSPACE ROBOTICS MARKET, BY MAINTENANCE, REPAIR, AND OVERHAULS (MRO), 2024-2032 (IN $ MILLION)

FAQ’s

RELATED REPORTS

-

CHINA BATTERY MARKET FORECAST 2024-2032

-

GERMANY BATTERY MARKET FORECAST 2024-2032

-

GLOBAL AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

UNITED STATES AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

FRANCE AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

GERMANY RNA INTERFERENCE (RNAI) DRUG DELIVERY MARKET FORECAST 2024-2032

-

SOUTH KOREA RNA INTERFERENCE (RNAI) DRUG DELIVERY MARKET FORECAST 2024-2032

-

UNITED KINGDOM RNA INTERFERENCE (RNAI) DRUG DELIVERY MARKET FORECAST 2024-2032

-

JAPAN ENTERPRISE RESOURCE PLANNING (ERP) MARKET FORECAST 2024-2032

-

FINLAND ENTERPRISE RESOURCE PLANNING (ERP) MARKET FORECAST 2024-2032