GLOBAL WORKPLACE TRANSFORMATION MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

Global Workplace Transformation Market by Service (Application Management, Asset Management, Desktop Virtualization, Enterprise Mobility & Telecom, Field Services, Service Desk, Unified Communication & Collaboration, Workplace Automation, Workplace Upgradation & Migration, Other Services) Market by Size (Large Enterprise, Small & Medium Enterprise) Market by End Use (Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, IT & Telecom, Manufacturing, Media & Communications, Retail) by Geography

REPORTS » INFORMATION TECHNOLOGY » ENTERPRISE SOLUTION » GLOBAL WORKPLACE TRANSFORMATION MARKET FORECAST 2024-2032

MARKET OVERVIEW

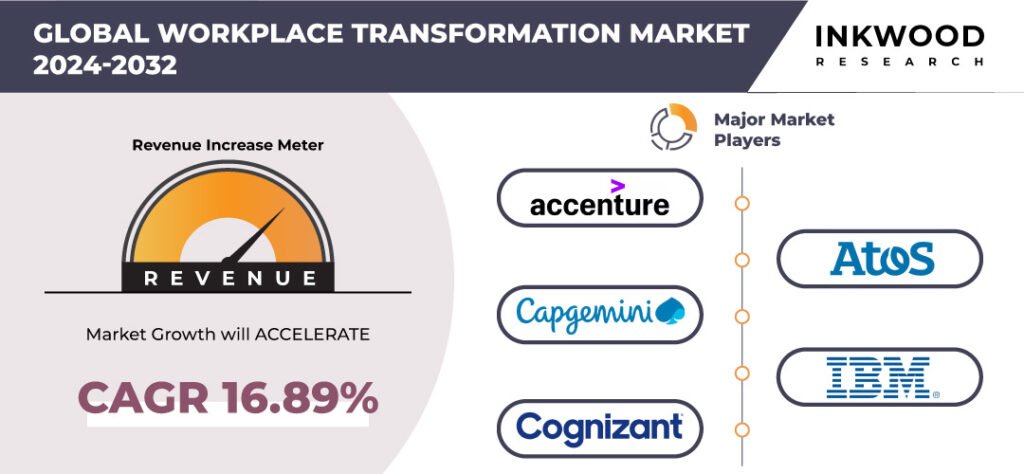

The global workplace transformation market is projected to grow at a CAGR of 16.89% during the forecast period 2024-2032. The base year regarded for the studied market is 2023, and the forecasting years are from 2024 to 2032.

The market study has also analyzed the impact of COVID-19 on the global workplace transformation industry qualitatively as well as quantitatively.

Workplace transformation addresses the evolving demands of the modern workforce by rethinking and restructuring conventional work environments, procedures, and technologies. This involves using various tactics and technological tools to create adaptable, innovative, and collaborative workspaces that enhance productivity, employee satisfaction, and organizational agility. Workplace transition plans frequently include initiatives like digitalization, automation, flexible work schedules, remote work facilitation, and cultural changes that promote innovation and teamwork.

Read our latest blog on the Workplace Transformation Market

GROWTH ENABLERS

Key growth enablers of the global workplace transformation market:

- The evolving landscape of work facilitated by organizational restructuring

- Increasing adoption of the bring your own device (BYOD) policy in enterprises

- The global pandemic from 2020 to 2022 accelerated the adoption of remote work. This shift benefited numerous industries globally and fueled demand for technologies and services that facilitate geographically dispersed teams. The accessibility of work through mobile devices, laptops, and tablets from any location has further driven the acceptance of policies like bring your own device (BYOD).

- The rising adoption of bring your own device (BYOD) policies is a major driver of growth in the global workspace transformation market. Additionally, companies benefit from the cost-saving advantages of bring your own device (BYOD) policies, as they no longer need to cover the entire expense of providing a work device to each employee. Therefore, BYOD can result in substantial savings on hardware acquisition and upkeep.

- Employees often prefer using their own devices due to their familiarity and comfort level with them. This preference can result in increased employee satisfaction and potentially higher productivity levels.

- Moreover, BYOD enables employees to work from any location with an internet connection, promoting remote work and flexible work arrangements. This is in line with the current demands of the workforce.

- Growing adoption of workplace mobility solutions to foster market demand

GROWTH RESTRAINTS

Key growth restraining factors of the global workplace transformation market:

- High initial investment hindering market growth

- Workplace transformation encompasses the adoption of new software, hardware, communication tools, automation solutions, and employee upskilling to adapt to evolving work models and technologies. However, these transformations often require substantial investments in time and resources.

- Organizations may hesitate to allocate significant financial resources upfront due to uncertainties about expected returns on investment and budget constraints. The complexity involved in implementing workplace transformation initiatives can exacerbate these concerns, causing some organizations to delay or hesitate in their adoption.

- Moreover, quantifying the return on investment (ROI) from workplace transformation initiatives can be challenging, particularly for small and medium enterprises (SMEs) with limited budgets. This difficulty in demonstrating tangible ROI may hinder the willingness of organizations to allocate resources for large-scale transformation projects.

- Challenges associated with organizational process transformation and integration

- Rising concerns regarding the security and privacy of data are impeding market demand

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Workplace Transformation Market | Top Market Trends

- Organizations are increasingly adopting remote work policies. This shift is driven by several factors, such as flexible work arrangements, changing labor demographics, and technological advancements enabling employees to work from anywhere with an internet connection.

- Companies are actively reducing costs through streamlined processes, optimized resource allocation, and technology utilization. This includes adopting remote work to reduce office space and overhead costs and implementing advanced technologies like cloud computing, automation, and AI to enhance efficiency and lower labor expenses.

- The emergence of new technologies like artificial intelligence, automation, and digitalization is reshaping the workforce landscape. This transformation is creating a more tech-savvy and adaptable workforce as businesses integrate advanced technologies more extensively into their operations.

MARKET SEGMENTATION

Market Segmentation – Service, Size, and End Use –

Market by Service:

- Application Management

- Asset Management

- Desktop Virtualization

- Enterprise Mobility & Telecom

- Enterprise mobility and telecom services enable remote work and connectivity through mobile devices and telecommunications networks. These services involve implementing strategies and technologies that enable employees to access business applications and data from anywhere, utilizing smartphones, tablets, and laptops. This includes solutions such as mobile device management, mobile application management, and mobile content management to ensure security and enhance productivity.

- Additionally, telecom services encompass providing voice and data communication services to ensure seamless connectivity among employees, regardless of their location. This includes offerings such as voice-over IP (VoIP), unified communications (UC), video conferencing, and collaboration tools.

- The COVID-19 pandemic further accelerated the adoption of remote and hybrid work models, intensifying the need for transformative workplace solutions that facilitate mobile and remote collaboration. Companies are actively pursuing digital workplace transformation services to modernize and enhance agility. In this regard, telecom and enterprise mobility services play a crucial role in enabling businesses to digitize their processes and offer employees the flexibility to work from any location.

- Furthermore, the enterprise mobility and telecom segment is crucial in enabling modern work environments characterized by flexibility, mobility, and connectivity. As businesses continue to embrace remote and digital work practices, the demand for these services is expected to grow ahead. This will drive innovation and investment in the global workplace transformation market.

- Field Services

- Service Desk

- Unified Communication & Collaboration

- Workplace Automation

- Workplace Upgradation & Migration

- Other Services

Market by Size:

- Large Enterprise

- Small & Medium Enterprise

Market by End Use:

- Banking, Financial Services, and Insurance (BFSI)

- The global pandemic has propelled remote work trends across industries, including banking, financial services, and insurance (BFSI). As employees increasingly work from home or adopt hybrid models, the demand for technologies supporting remote collaboration and ensuring productivity grows. Workplace transformation initiatives in the BFSI sector aim to enable seamless remote work capabilities while maintaining stringent security and compliance standards.

- Moreover, the BFSI sector’s customers’ preference for digital and personalized experiences drives organizations to invest in technologies enabling omnichannel interactions, real-time analytics, and predictive insights. This emphasis on digital innovation, coupled with the imperative to facilitate remote work and comply with regulatory standards, has fueled significant expansion in the BFSI industry within the global workplace transformation industry.

- Hence, continued investments in workplace transformation are crucial for the BFSI industry to maintain its competitive edge and achieve commercial success as it evolves.

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Communications

- Retail

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- The utilization of advanced technologies like cloud computing, artificial intelligence (AI), big data and analytics, mobility and social media, cybersecurity, and the internet of things (IoT) has spurred innovation and change in North America. These advancements have further aided significant transformation in the region. As a result, North America’s business ecosystem has expanded.

- Additionally, stringent labor laws and regulations in North America prompt organizations to invest in workforce transformation solutions to ensure compliance and mitigate legal risks. These solutions often involve implementing advanced technology and automation to streamline processes and improve efficiency. By proactively addressing labor law requirements, companies can also enhance employee satisfaction and retention rates.

- Looking ahead, a change in worker demographics is a significant driver of the global workplace transformation market. The rise in the use of business mobility services, which boosts employee productivity and cuts down on operating costs, is another key factor contributing to this market growth.

- The adoption of workplace transformation solutions in North America has been further expedited by major industry participants such as Hewlett Packard Enterprise Development LP, Cisco Systems Inc, IBM Corporation, and Intel Corporation. The cutting-edge technologies and services provided by these market leaders meet the shifting demands of contemporary companies striving to maintain their competitiveness in a rapidly changing environment.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Switzerland, Poland, Nordic Countries, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Singapore, Indonesia, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global workplace transformation market:

- Accenture

- Atos SE

- Capgemini

- IBM Corporation

- Cognizant Technology Solutions Corporation

- NTT DATA Corporation

Key strategies adopted by some of these companies:

- EY AI Workforce, introduced in October 2023, is a cutting-edge HR solution from IBM and EY. It helps businesses integrate artificial intelligence (AI) into their core HR operations, marking a significant advancement in AI’s ability to enhance productivity within HR departments.

- Atos SE announced an extension of its managed services agreement with BlueCrest, a multinational provider of automated parcel and postal technologies, in March 2024. This extension marks the final step in BlueCrest’s transformation into a fully Azure Cloud-native company, emphasizing the expanded managed services with a focus on Azure Cloud.

- Cognizant announced an extended collaboration with Microsoft Corp in April 2024. The collaboration aims to provide millions of users access to Microsoft’s generative AI and Copilots. This will, in turn, revolutionize enterprise business processes, elevate employee experiences, and expedite innovation across various industries simultaneously.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Service, Size, and End Use |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Accenture, Atos SE, Capgemini, Citrix, Cisco Systems Inc, Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, NTT DATA Corporation, Unisys Corporation, Cognizant Technology Solutions Corporation, Dell Technologies Inc, DXC Technology Company, Fujitsu Limited, HCL Technologies Limited |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- SURGING ADOPTION ACROSS INDUSTRIES, INCLUDING IT, FINANCE, HEALTHCARE, AND RETAIL

- THE INTEGRATION OF UNIFIED COMMUNICATION PLATFORMS IS ON THE RISE

MARKET DYNAMICS

- KEY DRIVERS

- THE EVOLVING LANDSCAPE OF WORK FACILITATED BY ORGANIZATIONAL RESTRUCTURING

- INCREASING ADOPTION OF THE BRING YOUR OWN DEVICE (BYOD) POLICY IN ENTERPRISES

- GROWING ADOPTION OF WORKPLACE MOBILITY SOLUTIONS TO FOSTER MARKET DEMAND

- KEY RESTRAINTS

- HIGH INITIAL INVESTMENT HINDERING MARKET GROWTH

- CHALLENGES ASSOCIATED WITH ORGANIZATIONAL PROCESS TRANSFORMATION AND INTEGRATION

- RISING CONCERNS REGARDING THE SECURITY AND PRIVACY OF DATA ARE IMPEDING MARKET DEMAND

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- INCREASING ADOPTION OF REMOTE WORK POLICY IN PREVALENCE

- ACTIVE REDUCTION OF OPERATIONAL EXPENSES IS DRIVING MARKET EFFICIENCY

- EMERGING TECHNOLOGIES LIKE ARTIFICIAL INTELLIGENCE, AUTOMATION, AND DIGITALIZATION ARE GAINING TRACTION

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR NORTH AMERICA

- GROWTH PROSPECT MAPPING FOR EUROPE

- GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

- GROWTH PROSPECT MAPPING FOR REST OF WORLD

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- TECHNOLOGY PROVIDERS

- CONSULTING FIRMS

- INTEGRATION PARTNERS

- TRAINING AND EDUCATION PROVIDERS

- SERVICE MANAGEMENT PROVIDERS

- END-USERS

- KEY BUYING CRITERIA

- TECHNOLOGY COMPATIBILITY AND SCALABILITY

- SECURITY

- ASSOCIATED BENEFITS

- SUPPORT AND MAINTENANCE

- KEY MARKET TRENDS

MARKET BY SERVICE

- APPLICATION MANAGEMENT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ASSET MANAGEMENT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DESKTOP VIRTUALIZATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ENTERPRISE MOBILITY & TELECOM

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FIELD SERVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SERVICE DESK

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- UNIFIED COMMUNICATION & COLLABORATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WORKPLACE AUTOMATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WORKPLACE UPGRADATION & MIGRATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER SERVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- APPLICATION MANAGEMENT

MARKET BY SIZE

- LARGE ENTERPRISE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SMALL & MEDIUM ENTERPRISE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- LARGE ENTERPRISE

MARKET BY END USE

- BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GOVERNMENT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HEALTHCARE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- IT & TELECOM

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MANUFACTURING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MEDIA & COMMUNICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RETAIL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA WORKPLACE TRANSFORMATION MARKET DRIVERS

- NORTH AMERICA WORKPLACE TRANSFORMATION MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA WORKPLACE TRANSFORMATION MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE WORKPLACE TRANSFORMATION MARKET DRIVERS

- EUROPE WORKPLACE TRANSFORMATION MARKET CHALLENGES

- KEY PLAYERS IN EUROPE WORKPLACE TRANSFORMATION MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- SWITZERLAND

- SWITZERLAND WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- NORDIC COUNTRIES

- NORDIC COUNTRIES WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET DRIVERS

- ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- SINGAPORE

- SINGAPORE WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD WORKPLACE TRANSFORMATION MARKET DRIVERS

- REST OF WORLD WORKPLACE TRANSFORMATION MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD WORKPLACE TRANSFORMATION MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA WORKPLACE TRANSFORMATION MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- ACCENTURE

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- ATOS SE

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- CAPGEMINI

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- CITRIX

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- CISCO SYSTEMS INC

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- DELL TECHNOLOGIES INC

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- DXC TECHNOLOGY COMPANY

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- FUJITSU LIMITED

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- HCL TECHNOLOGIES LIMITED

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- IBM CORPORATION

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- INTEL CORPORATION

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- NTT DATA CORPORATION

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- UNISYS CORPORATION

- COMPANY OVERVIEW

- SERVICES

- STRENGTHS & CHALLENGES

- ACCENTURE

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – WORKPLACE TRANSFORMATION

TABLE 2: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SERVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SERVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL APPLICATION MANAGEMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL APPLICATION MANAGEMENT MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL ASSET MANAGEMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL ASSET MANAGEMENT MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL DESKTOP VIRTUALIZATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL DESKTOP VIRTUALIZATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL ENTERPRISE MOBILITY & TELECOM MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL ENTERPRISE MOBILITY & TELECOM MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL FIELD SERVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL FIELD SERVICES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL SERVICE DESK MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL SERVICE DESK MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL UNIFIED COMMUNICATION & COLLABORATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL UNIFIED COMMUNICATION & COLLABORATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL WORKPLACE AUTOMATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL WORKPLACE AUTOMATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL WORKPLACE UPGRADATION & MIGRATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL WORKPLACE UPGRADATION & MIGRATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL OTHER SERVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL OTHER SERVICES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SIZE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SIZE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL LARGE ENTERPRISE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL LARGE ENTERPRISE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: GLOBAL SMALL & MEDIUM ENTERPRISE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL SMALL & MEDIUM ENTERPRISE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY END USE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY END USE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 32: GLOBAL BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI) MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: GLOBAL GOVERNMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL GOVERNMENT MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: GLOBAL HEALTHCARE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL HEALTHCARE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 38: GLOBAL IT & TELECOM MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL IT & TELECOM MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 40: GLOBAL MANUFACTURING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL MANUFACTURING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: GLOBAL MEDIA & COMMUNICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL MEDIA & COMMUNICATIONS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 44: GLOBAL RETAIL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL RETAIL MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 46: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 48: NORTH AMERICA WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: NORTH AMERICA WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 50: KEY PLAYERS OPERATING IN NORTH AMERICA WORKPLACE TRANSFORMATION MARKET

TABLE 51: EUROPE WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 52: EUROPE WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 53: KEY PLAYERS OPERATING IN EUROPE WORKPLACE TRANSFORMATION MARKET

TABLE 54: ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 56: KEY PLAYERS OPERATING IN ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET

TABLE 57: REST OF WORLD WORKPLACE TRANSFORMATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 58: REST OF WORLD WORKPLACE TRANSFORMATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 59: KEY PLAYERS OPERATING IN REST OF WORLD WORKPLACE TRANSFORMATION MARKET

TABLE 60: LIST OF MERGERS & ACQUISITIONS

TABLE 61: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 62: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR NORTH AMERICA

FIGURE 4: GROWTH PROSPECT MAPPING FOR EUROPE

FIGURE 5: GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

FIGURE 6: GROWTH PROSPECT MAPPING FOR REST OF WORLD

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: GLOBAL WORKPLACE TRANSFORMATION MARKET, GROWTH POTENTIAL, BY SERVICE, IN 2023

FIGURE 12: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY APPLICATION MANAGEMENT, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY ASSET MANAGEMENT, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY DESKTOP VIRTUALIZATION, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY ENTERPRISE MOBILITY & TELECOM, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY FIELD SERVICES, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SERVICE DESK, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY UNIFIED COMMUNICATION & COLLABORATION, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY WORKPLACE AUTOMATION, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY WORKPLACE UPGRADATION & MIGRATION, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY OTHER SERVICES, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL WORKPLACE TRANSFORMATION MARKET, GROWTH POTENTIAL, BY SIZE, IN 2023

FIGURE 23: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY LARGE ENTERPRISE, 2024-2032 (IN $ MILLION)

FIGURE 24: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY SMALL & MEDIUM ENTERPRISE, 2024-2032 (IN $ MILLION)

FIGURE 25: GLOBAL WORKPLACE TRANSFORMATION MARKET, GROWTH POTENTIAL, BY END USE, IN 2023

FIGURE 26: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI), 2024-2032 (IN $ MILLION)

FIGURE 27: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY GOVERNMENT, 2024-2032 (IN $ MILLION)

FIGURE 28: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY HEALTHCARE, 2024-2032 (IN $ MILLION)

FIGURE 29: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY IT & TELECOM, 2024-2032 (IN $ MILLION)

FIGURE 30: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY MANUFACTURING, 2024-2032 (IN $ MILLION)

FIGURE 31: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY MEDIA & COMMUNICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 32: GLOBAL WORKPLACE TRANSFORMATION MARKET, BY RETAIL, 2024-2032 (IN $ MILLION)

FIGURE 33: NORTH AMERICA WORKPLACE TRANSFORMATION MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 34: UNITED STATES WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 35: CANADA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: EUROPE WORKPLACE TRANSFORMATION MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 37: UNITED KINGDOM WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: GERMANY WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: FRANCE WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: ITALY WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: SPAIN WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: SWITZERLAND WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: POLAND WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 44: NORDIC COUNTRIES WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: REST OF EUROPE WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 47: CHINA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 48: JAPAN WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: INDIA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 50: SOUTH KOREA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 51: SINGAPORE WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 52: INDONESIA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 53: AUSTRALIA & NEW ZEALAND WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 54: REST OF ASIA-PACIFIC WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 55: REST OF WORLD WORKPLACE TRANSFORMATION MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 56: LATIN AMERICA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FIGURE 57: MIDDLE EAST & AFRICA WORKPLACE TRANSFORMATION MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

Factors driving the growth of the global workplace transformation market include the increasing adoption of remote work, technological advancements, changing workforce demographics, and the need for agile and flexible work environments.

Some key players operating in the global workplace transformation market include Accenture, Atos SE, Cisco Systems Inc, IBM Corporation, Hewlett Packard Enterprise Development LP, Unisys Corporation, and Intel Corporation.

RELATED REPORTS

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032

-

TAIWAN BABY DIAPER MARKET FORECAST 2025-2032

-

SOUTH AFRICA BABY DIAPER MARKET FORECAST 2025-2032

-

INDONESIA BABY DIAPER MARKET FORECAST 2025-2032

-

INDIA BABY DIAPER MARKET FORECAST 2025-2032

-

BRAZIL BABY DIAPER MARKET FORECAST 2025-2032

-

AUSTRALIA & NEW ZEALAND BABY DIAPER MARKET FORECAST 2025-2032

-

ALGERIA BABY DIAPER MARKET FORECAST 2025-2032