GLOBAL SURGICAL ROBOTICS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

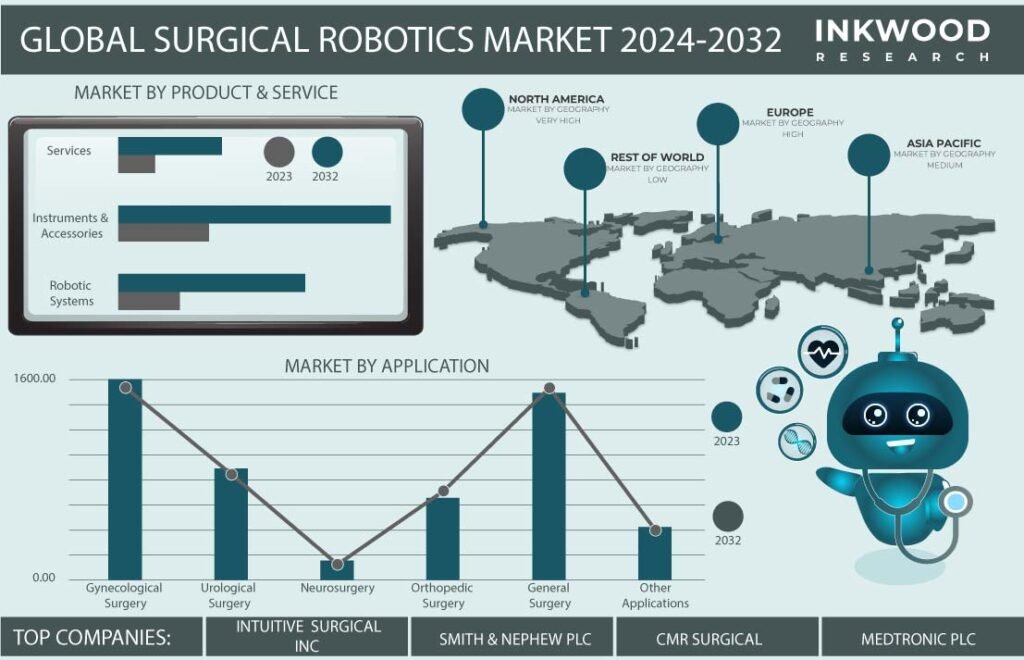

Global Surgical Robotics Market by Product & Service (Robotic Systems, Instruments & Accessories, Services) Market by Application (Gynecological Surgery, Urological Surgery, Neurosurgery, Orthopedic Surgery, General Surgery, Other Applications) Market by End-user (Hospitals, Ambulatory Surgery Centers, Other End-users) by Geography

REPORTS » HEALTHCARE » SURGICAL DEVICES » GLOBAL SURGICAL ROBOTICS MARKET FORECAST 2024-2032

MARKET OVERVIEW

The global surgical robotics market is expected to reach $25644.37 by 2032, growing at a CAGR of 9.29% during the forecast period, 2024-2032.

Surgical care serves as the cornerstone of healthcare services, encompassing both planned and urgent procedures crucial for population health. Introducing robotics has emerged as a potent solution to address widespread concerns about pathogen transmission while sustaining surgical activity. The primary objective behind integrating robotics is to reduce direct contact between healthcare providers and patients.

Robotic surgical systems are leveraging cutting-edge technologies such as artificial intelligence, machine learning, and precision instruments, empowering surgeons to conduct minimally invasive procedures with heightened accuracy, control, and skill.

The goal is to elevate surgical outcomes by equipping surgeons with advanced tools and a more user-friendly interface to perform intricate procedures. These systems typically comprise robotic arms controlled by surgeons through a console, accompanied by specialized instruments that can be inserted through small incisions in the patient’s body.

Read our latest blog on the Surgical Robotics Market

GROWTH ENABLERS

Key growth enablers of the global surgical robotics market are:

- Surging elderly population

- The increasing aging population poses a significant challenge to the healthcare industry, exacerbating existing labor shortages.

- By 2020, the population of individuals aged 60 and above surpassed the count of children under the age of 5. According to the World Health Organization (WHO), by 2050, a staggering 80% of the elderly populace will reside in nations categorized as low- and middle-income economies.

- This demographic shift highlights a significant global trend toward an increasingly aging population. As life expectancies rise and birth rates decline in many parts of the world, societies are witnessing a notable increase in the proportion of older individuals compared to younger age groups.

- Surgical robots present a solution by augmenting the capabilities of healthcare providers. These advanced systems offer precise and minimally invasive procedures, reducing the physical strain on surgeons and allowing them to perform intricate operations with enhanced accuracy.

- Integration of AI-ML in robotic surgery systems

- Deployment of robotics in healthcare

GROWTH RESTRAINTS

Key growth restraining factors of the global surgical robotics market are:

- Potential hazards associated with robotic surgery

- One of the notable challenges is the potential for human error in operating intricate robotic technology. Surgeons require specialized training to maneuver these systems effectively, and any misjudgment or mishandling could lead to adverse outcomes.

- The introduction of mechanical elements in robotic systems amplifies the risk of technical failures. Various components, including the camera, robotic arms, and instruments, hold the potential for malfunction during procedures, compromising the surgery’s progress and patient safety.

- A critical concern arises from the energy source within these robotic systems, which is susceptible to electric arcing. This phenomenon poses a significant risk of unintended internal burn injuries due to the cautery device.

- High installation costs of robotic surgery systems

- Lack of trained professionals

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Surgical Robotics Market | Top Market Trends

- AI integration in surgical robotics offers numerous opportunities to revolutionize surgical practices. Its ability to process vast amounts of data makes it a valuable learning tool for surgeons at all career stages. AI systems excel at identifying patterns and trends in large datasets, uncovering innovative surgical approaches that were previously unexplored.

- Big data plays a transformative role in shaping the landscape of surgical robotics by providing a pathway to collective surgical knowledge. By harnessing extensive data, the field can establish a comprehensive repository of wisdom and experiences from surgical practices. This reservoir of information becomes fundamental for technology-augmented real-time clinical decision support systems.

- Miniature robots feature bio-inspired sensing, actuation, and movement, particularly in cell manipulation using optical, AFM-based, and microfluidic methods. Micro robotics, which includes robots smaller than 1 mm or capable of handling micrometer-sized components, defines this field. They also function as training tools for inexperienced surgeons under the guidance of experienced mentors, thereby increasing surgical accessibility for patients.

MARKET SEGMENTATION

Market Segmentation – Product & Service, Application, and End-User –

Market by Product & Service:

- Robotic Systems

- Instruments & Accessories

- Instruments & accessories are the largest revenue-generating products & services in the global surgical robotics market.

- The instruments and accessories of surgical robotics encompass surgical assist arms, endo wrist technology, 3D stereoscopic vision, knee systems, surgical knives, imaging systems, retractors, dividers, and more.

- In surgical robotics, the instruments attached to the robotic arms are meticulously designed to surpass the capabilities of the human wrist in terms of range of motion. Each arm is designated for specific surgical tasks, covering a range of high-precision functions, including dissecting, clamping, tissue manipulation, and suturing.

- Services

Market by Application:

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- General Surgery

- General surgery is the prominent application in the market in terms of revenue share.

- General surgery encompasses the treatment of abdominal organs such as the esophagus, stomach, intestines, liver, and pancreas, as well as addressing skin, breast, soft tissue, and trauma. Additionally, it deals with conditions like peripheral artery disease and hernias and includes performing endoscopic procedures such as gastroscopy and colonoscopy.

- The field of general surgery, along with its various subspecialties, has seen significant advancements in utilizing robotic technology for minimally invasive procedures over the past decade.

- Robotic advancements have empowered surgeons to perform a wide range of operations involving abdominal organs and solid tissues, including the gallbladder, esophagus, stomach, intestines, colon, rectum, and endocrine organs, through smaller incisions.

- Other Applications

Market by End-User:

- Hospitals

- Ambulatory Surgery Centers

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

-

- North America is anticipated to be the most dynamic regional market, with a share of 43.96% in 2023. The region is the largest consumer of surgical robotic systems globally, owing to the demand for advanced surgeries in major economies, such as the United States and Canada. For instance, the Da Vinci Surgical System is the most used robotic surgical system in the United States.

- The United States is one of the biggest markets for surgical robots. More robotic-assisted surgeries are conducted within the United States than in any other country globally. The trend is in the direction of robotic-assisted surgery.

- Europe: The United Kingdom, France, Germany, Spain, Italy, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of the World: Latin America, and the Middle East & Africa

MAJOR PLAYERS

The major players in the global surgical robotics market are:

- Zimmer Biomet Holdings Inc

- Smith & Nephew

- Stryker Corporation

- Medtronic PLC

- Intuitive Surgical Inc

Key strategies adopted by some of these companies:

- Asensus Surgical Inc announced a collaboration with NVIDIA in September 2023 to develop the development of Asensus’s Intelligent Surgical Unit and improve its capability to deliver advanced clinical intelligence.

- In May 2023, Zimmer Biomet Holdings Inc announced the acquisition of OSSIS, a privately held medical device company.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product & Service, Application, and End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Ethicon, Zimmer Biomet Holdings Inc, Smith & Nephew, Stryker Corporation, Accuray Incorporated, CMR Surgical Ltd., Globus Medical Inc, Intuitive Surgical Inc, Medtronic PLC, Medrobotics Corporation, Stereotaxis Inc, Asensus Surgical Inc, Titan Medical Inc, Synaptive Medical Inc, Think Surgical Inc |

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON SURGICAL ROBOTICS MARKET

- MAJOR MARKET FINDINGS

- SIGNIFICANT TRANSFORMATION DUE TO AUTOMATED MICROSURGERY

- TECHNOLOGICAL ADVANCEMENTS IN MINIMALLY INVASIVE SURGERIES

- ROBOTIC TELESURGERY IS BECOMING FEASIBLE

-

MARKET DYNAMICS

- KEY DRIVERS

- SURGING ELDERLY POPULATION

- INTEGRATION OF AI-ML IN ROBOTIC SURGERY SYSTEMS

- DEPLOYMENT OF ROBOTICS IN HEALTHCARE

- KEY RESTRAINTS

- POTENTIAL HAZARDS ASSOCIATED WITH ROBOTIC SURGERY

- HIGH INSTALLATION COSTS OF ROBOTIC SURGERY SYSTEMS

- LACK OF TRAINED PROFESSIONALS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- APPLICATIONS OF ARTIFICIAL INTELLIGENCE (AI)

- BIG DATA USE AUGMENTS THE DECISION-MAKING CAPABILITIES

- MINIATURE ROBOTS ENHANCE ACCURACY AND REDUCE INVASIVENESS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR GERMANY

- GROWTH PROSPECT MAPPING FOR JAPAN

- GROWTH PROSPECT MAPPING FOR LATIN AMERICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- KEY MARKET TRENDS

-

MARKET BY PRODUCT & SERVICE

- ROBOTIC SYSTEMS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- INSTRUMENTS & ACCESSORIES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SERVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ROBOTIC SYSTEMS

-

MARKET BY APPLICATION

- GYNECOLOGICAL SURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- UROLOGICAL SURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NEUROSURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ORTHOPEDIC SURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GENERAL SURGERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GYNECOLOGICAL SURGERY

-

MARKET BY END-USER

- HOSPITALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AMBULATORY SURGERY CENTERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOSPITALS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA SURGICAL ROBOTICS MARKET DRIVERS

- NORTH AMERICA SURGICAL ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA SURGICAL ROBOTICS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE SURGICAL ROBOTICS MARKET DRIVERS

- EUROPE SURGICAL ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE SURGICAL ROBOTICS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC SURGICAL ROBOTICS MARKET DRIVERS

- ASIA-PACIFIC SURGICAL ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC SURGICAL ROBOTICS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD SURGICAL ROBOTICS MARKET DRIVERS

- REST OF WORLD SURGICAL ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD SURGICAL ROBOTICS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA SURGICAL ROBOTICS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- ETHICON

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ZIMMER BIOMET HOLDINGS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SMITH & NEPHEW

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- STRYKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ACCURAY INCORPORATED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CMR SURGICAL LTD.

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GLOBUS MEDICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- INTUITIVE SURGICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEDTRONIC PLC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEDROBOTICS CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- STEREOTAXIS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ASENSUS SURGICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- TITAN MEDICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SYNAPTIVE MEDICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- THINK SURGICAL INC

- COMPANY OVERVIEW

- PRODUCT LIST

- ETHICON

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SURGICAL ROBOTICS

TABLE 2: TOP COUNTRIES WITH THE LARGEST PERCENTAGE OF OLDER POPULATION

TABLE 3: GLOBAL SURGICAL ROBOTICS MARKET, BY PRODUCT & SERVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL SURGICAL ROBOTICS MARKET, BY PRODUCT & SERVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 5: GLOBAL ROBOTIC SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL ROBOTIC SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 7: GLOBAL INSTRUMENTS & ACCESSORIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL INSTRUMENTS & ACCESSORIES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 9: GLOBAL SERVICES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL SERVICES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 11: GLOBAL SURGICAL ROBOTICS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL SURGICAL ROBOTICS MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 13: GLOBAL GYNECOLOGICAL SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL GYNECOLOGICAL SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 15: GLOBAL UROLOGICAL SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 16: GLOBAL UROLOGICAL SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 17: GLOBAL NEUROSURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL NEUROSURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 19: GLOBAL ORTHOPEDIC SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL ORTHOPEDIC SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 21: GLOBAL GENERAL SURGERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL GENERAL SURGERY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 23: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 25: GLOBAL SURGICAL ROBOTICS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL SURGICAL ROBOTICS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 27: GLOBAL HOSPITALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL HOSPITALS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 29: GLOBAL AMBULATORY SURGERY CENTERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: GLOBAL AMBULATORY SURGERY CENTERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 31: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 32: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 33: GLOBAL SURGICAL ROBOTICS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 34: GLOBAL SURGICAL ROBOTICS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 35: NORTH AMERICA SURGICAL ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 36: NORTH AMERICA SURGICAL ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 37: KEY PLAYERS OPERATING IN NORTH AMERICA SURGICAL ROBOTICS MARKET

TABLE 38: EUROPE SURGICAL ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: EUROPE SURGICAL ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 40: KEY PLAYERS OPERATING IN EUROPE SURGICAL ROBOTICS MARKET

TABLE 41: ASIA-PACIFIC SURGICAL ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 42: ASIA-PACIFIC SURGICAL ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 43: KEY PLAYERS OPERATING IN ASIA-PACIFIC SURGICAL ROBOTICS MARKET

TABLE 44: REST OF WORLD SURGICAL ROBOTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: REST OF WORLD SURGICAL ROBOTICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 46: KEY PLAYERS OPERATING IN REST OF WORLD SURGICAL ROBOTICS MARKET

TABLE 47: LIST OF MERGERS & ACQUISITIONS

TABLE 48: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 49: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 50: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR JAPAN

FIGURE 6: GROWTH PROSPECT MAPPING FOR LATIN AMERICA

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL SURGICAL ROBOTICS MARKET, GROWTH POTENTIAL, BY PRODUCT & SERVICE, IN 2023

FIGURE 10: GLOBAL SURGICAL ROBOTICS MARKET, BY ROBOTIC SYSTEMS, 2024-2032 (IN $ MILLION)

FIGURE 11: GLOBAL SURGICAL ROBOTICS MARKET, BY INSTRUMENTS & ACCESSORIES, 2024-2032 (IN $ MILLION)

FIGURE 12: GLOBAL SURGICAL ROBOTICS MARKET, BY SERVICES, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL SURGICAL ROBOTICS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2023

FIGURE 14: GLOBAL SURGICAL ROBOTICS MARKET, BY GYNECOLOGICAL SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL SURGICAL ROBOTICS MARKET, BY UROLOGICAL SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL SURGICAL ROBOTICS MARKET, BY NEUROSURGERY, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL SURGICAL ROBOTICS MARKET, BY ORTHOPEDIC SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL SURGICAL ROBOTICS MARKET, BY GENERAL SURGERY, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL SURGICAL ROBOTICS MARKET, BY OTHER APPLICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL SURGICAL ROBOTICS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 21: GLOBAL SURGICAL ROBOTICS MARKET, BY HOSPITALS, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL SURGICAL ROBOTICS MARKET, BY AMBULATORY SURGERY CENTERS, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL SURGICAL ROBOTICS MARKET, BY OTHER END-USERS, 2024-2032 (IN $ MILLION)

FIGURE 24: NORTH AMERICA SURGICAL ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 25: UNITED STATES SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 26: CANADA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 27: EUROPE SURGICAL ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 28: UNITED KINGDOM SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 29: GERMANY SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 30: FRANCE SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 31: ITALY SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 32: SPAIN SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: REST OF EUROPE SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 34: ASIA-PACIFIC SURGICAL ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN%)

FIGURE 35: CHINA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: JAPAN SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: INDIA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: SOUTH KOREA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: INDONESIA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: THAILAND SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: VIETNAM SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: AUSTRALIA & NEW ZEALAND SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: REST OF ASIA-PACIFIC SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 44: REST OF WORLD SURGICAL ROBOTICS MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 45: LATIN AMERICA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: MIDDLE EAST & AFRICA SURGICAL ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

Robotic surgeries offer advantages such as reduced blood loss, smaller incisions, and faster recovery times. While they may reduce certain risks associated with traditional surgeries, the overall safety and success of a procedure depend on various factors, including the surgeon’s expertise and the patient’s specific condition.

The cost-effectiveness of robotic surgery can vary based on several factors, including the specific procedure, hospital or clinic fees, and post-operative care. While initial costs might be higher due to equipment and training, reduced hospital stays and fewer complications can lead to long-term cost savings.

Not all surgeons are trained in robotic surgery, and those who use this technology undergo specific training programs to ensure proficiency and safety.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032