GLOBAL SURFACE WARSHIPS MARKET FORECAST 2022-2030

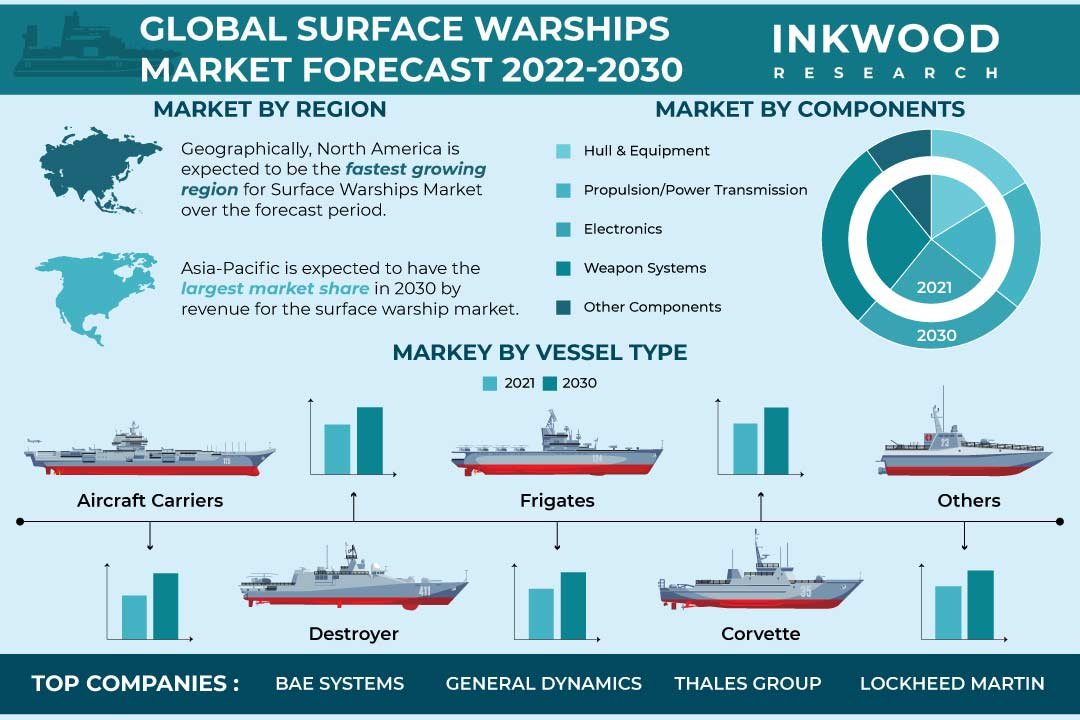

Global Surface Warships Market by Vessel Type (Aircraft Carriers, Destroyers, Frigates, Corvettes, Other Vessel Types) Market by Component (Hull & Equipment, Propulsion/Power Transmission, Electronics, Weapon Systems, Other Components) Market by Operation (Attack, Surveillance & Intelligence, Logistics, Amphibious, Other Operations) by Geography

In terms of revenue, the global surface warships market was valued at $33.03 billion in 2021, and is expected to reach $43.05 billion by 2030, growing with a 2.88% CAGR during the forecast period, 2022-2030.

Strong naval capabilities are essential due to rising geopolitical conflicts and global insecurity. Based on the purpose or function that each warship serves, naval ships are categorized. The differentiating characteristics of the world’s naval forces include aircraft carriers, destroyers, corvettes, frigates, and support vessels. These platforms offer crucial combat support, maritime security, power projection, deterrence, and sea control capabilities. 63 countries currently operate 1,181 surface warships larger than OPVs in the world’s navy forces. Over the previous two years, the value reflects an increase of 9.4%. There are now 20 aircraft carriers in service, and three nations (China, India, and the United States) are building four more.

Read our latest blog on the Surface Warships Market

Key growth enablers for the global surface warships market are:

- Rising number of maritime threats

- The geopolitical tensions between the United States and China have been one of the key factors anticipated accelerating global surface warship market growth.

- The United States’ Indo-Pacific command serves as the largest unified combatant command. The development of QUAD (Quadrilateral Security Dialogue) is an informal strategic forum between the United States, Japan, and India.

- The alliance was developed in the year 2007. However, the change in the political climate in 2020 has led to the nation’s cumulatively opposing China on trade and the military front.

- Heavy investments in indigenous programs focusing on naval developments

- Fleet modernization programs

Key growth restraining factors are:

- Coastline restrictions

- High cost of ship-building

- Paucity of funds

- The United States Navy proposed budget cuts of roughly $4.8 billion for FY 2021. The budget cut remains inconsistent with the United States Navy’s Plan of acquiring 355-fleet naval forces.

- The legislation states that the United States is currently focusing on increasing the lethality of the fleet and making modernization investments.

- The government is investing in designing unmanned system and acquiring hypersonic and advanced strike missiles, among others.

Global Surface Warships Market | Top Trends

- In 2018, China became the global leader in terms of ship-building orders. China’s ship-building industry captured 43.9% of the global market in 2018.

- The United States leaders use unmanned surface and undersea-based technology to develop combat systems with aided agility. The current global market consists of 63 USVs. These USVs have been tested and demonstrated.

- The United States Navy currently purchased 43 ships from 2021-2024. Between 2025-2049, the naval forces plan on purchasing additional 249 ships to acquire a fleet of 304 ships. The tactical requirement of these ships is primarily due to the changing geopolitical environment on a global basis.

To know more about this report, request a free sample copy

Market Segmentation – Vessel Type, Components, and Operations –

Market by Vessel Type:

- Aircraft Carrier

- A warship that acts as a sea-based airbase is an aircraft carrier. The warship has a full-length flight deck, making it easier to deploy and recover aircraft.

- The system also offers armament facilities at sea for naval operations involving planes.

- The naval force’s capital ship is an aircraft carrier, in essence. The installation enables the naval aircraft forces to project power globally.

- Aircraft carriers are one of the essential elements of the modern Navy because of their diplomatic and tactical strength.

- Destroyers

- Frigates

- Corvettes

- Other Vessel Types

Market By Component:

- Hull & Equipment

- Propulsion/Power Transmission

- Electronics

- Navies worldwide must be able to communicate, share sensitive information, and carry out many operations at once to complete multinational missions.

- To achieve real interoperability, systems used in C2 structures across all nations must be compatible and interoperable.

- While many other countries are building ships with various weapon systems, the United States Navy and other nations rely on the Aegis Combat Systems as the foundation for interoperability. Their current interoperability is predicated on using tactical data links like Links 11, 16, and 22.

- Weapon Systems

- Other Components

Market by Operation:

- Attack

- Surveillance & Intelligence

- Logistics

- Amphibious

- Other Operations

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Sweden, Finland, Greece, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, North Korea, Myanmar, Vietnam, and Rest of Asia-Pacific

- Between 2022 and 2025, seven Project 17a (Shivalik) Frigates are expected to go into service.

- The Indian Navy published a Request for Information (RFI) in January 2018 for six OPVs weighing 2,500 tons. In August 2018, the project obtained approval.

- In March 2011, the Coast Guard received a contract for eight OPVs (later decreased to six). However, the construction program has not yet started. In 2019, the first of five Project 21 OPVs was serviced.

- Rest of World: Latin America, the Middle East & Africa

Major players in the global surface warships market are:

- BAE Systems

- Thales Group

- General Dynamics

- Lockheed Martin

- Naval Group

- Other Companies

Key strategies adopted by some of these companies:

The United States Navy awarded BAE System a 5-year IDIQ contract worth $34.9 million in January 2020. BAE System is expected to support and sustain various C5ISR systems through this contract win.

The United States Navy granted General Dynamics Electric Boat a $22.2 billion purchase agreement in December 2019. This contract covers the construction of nine further Virginia-class submarines. Additionally, throughout the agreement, a tenth ship could potentially be built. Due to this possibility, the contract’s total potential value is anticipated to increase to about $24.1 billion.

Report Synopsis:

| Report Scope | Details |

| Market Forecast Years | 2022-2030 |

| Base Year | 2021 |

| Market Historical Years | 2018-2021 |

| Forecast Units | Revenue ($ Billion) |

| Segments Analyzed | Vessel Type, Component, and Operation |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | BAE Systems, General Dynamics, Thales Group, Lockheed Martin, Naval Group, The Damen Group, Hyundai Heavy Industries, Huntington Ingalls Industries, Fincantieri SpA, Navantia SA |

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- RISING NUMBER OF MARITIME THREATS

- HEAVY INVESTMENTS IN INDIGENOUS PROGRAMS FOCUSING ON NAVAL DEVELOPMENTS

- FLEET MODERNIZATION PROGRAMS

- KEY RESTRAINTS

- COASTLINE RESTRICTIONS

- HIGH COST OF SHIP-BUILDING

- PAUCITY OF FUNDS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON SURFACE WARSHIPS MARKET

- KEY MARKET TRENDS

- MARKET TECHNOLOGIES – SUPPORTING THE GLOBAL SURFACE WARSHIPS MARKET

- UNMANNED SURFACE VEHICLES

- STEALTH TECHNOLOGY

- COMPOSITES

- ELECTRIC DRIVE MECHANISM

- UNMANNED MINE DETECTION

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PEST ANALYSIS – SURFACE WARSHIPS MARKET

- POLITICAL

- ECONOMIC

- SOCIAL

- TECHNOLOGICAL

- MARKET BY VESSEL TYPE

- AIRCRAFT CARRIERS

- DESTROYERS

- FRIGATES

- CORVETTES

- OTHER VESSEL TYPES

- MARKET BY COMPONENT

- HULL & EQUIPMENT

- PROPULSION/POWER TRANSMISSION

- ELECTRONICS

- WEAPON SYSTEMS

- OTHER COMPONENTS

- MARKET BY OPERATION

- ATTACK

- SURVEILLANCE & INTELLIGENCE

- LOGISTICS

- AMPHIBIOUS

- OTHER OPERATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SWEDEN

- FINLAND

- GREECE

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- NORTH KOREA

- MYANMAR

- VIETNAM

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BAE SYSTEMS

- FINCANTIERI SPA

- GENERAL DYNAMICS

- HUNTINGTON INGALLS INDUSTRIES

- HYUNDAI HEAVY INDUSTRIES

- LOCKHEED MARTIN

- NAVAL GROUP

- NAVANTIA SA

- THALES GROUP

- THE DAMEN GROUP

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – SURFACE WARSHIPS

TABLE 2: SERVICE LIFE OF THE UNITED STATES NAVAL INVENTORY

TABLE 3: THE UNITED STATES NAVAL BUDGET PLANS TO PURCHASE SURFACE WARSHIPS

TABLE 4: NUMBER OF USV MANUFACTURERS BY COUNTRY

TABLE 5: GLOBAL SURFACE WARSHIPS MARKET, BY VESSEL TYPE, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 6: GLOBAL SURFACE WARSHIPS MARKET, BY VESSEL TYPE, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 7: GLOBAL AIRCRAFT CARRIERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 8: GLOBAL AIRCRAFT CARRIERS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 9: GLOBAL DESTROYERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 10: GLOBAL DESTROYERS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 11: GLOBAL FRIGATES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 12: GLOBAL FRIGATES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 13: GLOBAL CORVETTES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 14: GLOBAL CORVETTES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 15: GLOBAL OTHER VESSEL TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 16: GLOBAL OTHER VESSEL TYPES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 17: GLOBAL SURFACE WARSHIPS MARKET, BY COMPONENT, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 18: GLOBAL SURFACE WARSHIPS MARKET, BY COMPONENT, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 19: GLOBAL HULL & EQUIPMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 20: GLOBAL HULL & EQUIPMENT MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 21: GLOBAL PROPULSION/POWER TRANSMISSION MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 22: GLOBAL PROPULSION/POWER TRANSMISSION MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 23: GLOBAL ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 24: GLOBAL ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 25: GLOBAL WEAPON SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 26: GLOBAL WEAPON SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 27: GLOBAL OTHER COMPONENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 28: GLOBAL OTHER COMPONENTS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 29: GLOBAL SURFACE WARSHIPS MARKET, BY OPERATION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 30: GLOBAL SURFACE WARSHIPS MARKET, BY OPERATION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 31: GLOBAL ATTACK MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 32: GLOBAL ATTACK MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 33: GLOBAL SURVEILLANCE & INTELLIGENCE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 34: GLOBAL SURVEILLANCE & INTELLIGENCE MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 35: GLOBAL LOGISTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 36: GLOBAL LOGISTICS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 37: GLOBAL AMPHIBIOUS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 38: GLOBAL AMPHIBIOUS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 39: GLOBAL OTHER OPERATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 40: GLOBAL OTHER OPERATIONS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 41: GLOBAL SURFACE WARSHIPS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 42: GLOBAL SURFACE WARSHIPS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 43: NORTH AMERICA SURFACE WARSHIPS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 44: NORTH AMERICA SURFACE WARSHIPS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 45: LEADING PLAYERS OPERATING IN NORTH AMERICA SURFACE WARSHIPS MARKET

TABLE 46: EUROPE SURFACE WARSHIPS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 47: EUROPE SURFACE WARSHIPS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 48: LEADING PLAYERS OPERATING IN EUROPE SURFACE WARSHIPS MARKET

TABLE 49: ASIA-PACIFIC SURFACE WARSHIPS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 50: ASIA-PACIFIC SURFACE WARSHIPS MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 51: LEADING PLAYERS OPERATING IN ASIA-PACIFIC SURFACE WARSHIPS MARKET

TABLE 52: REST OF WORLD SURFACE WARSHIPS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ BILLION)

TABLE 53: REST OF WORLD SURFACE WARSHIPS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ BILLION)

TABLE 54: LEADING PLAYERS OPERATING IN REST OF WORLD SURFACE WARSHIPS MARKET

TABLE 55: LIST OF MERGERS & ACQUISITIONS

TABLE 56: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 57: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 58: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: ANNUAL NUMBER OF DESTROYERS & FRIGATES COMMISSIONED INTO CHINESE NAVAL FORCES

FIGURE 2: TOP COASTLINES IN TERMS OF LENGTH (IN KILOMETERS)

FIGURE 3: KEY MARKET TRENDS

FIGURE 4: INCREASE IN THE SERVICE LIFE OF THE UNITED STATES NAVAL INVENTORY

FIGURE 5: PROCUREMENT PLANS OF THE UNITED STATES NAVAL FORCE

FIGURE 6: ANNUAL SHIPS TO BE PURCHASED BY THE US NAVAL FORCE

FIGURE 7: PORTER’S FIVE FORCES ANALYSIS

FIGURE 8: OPPORTUNITY MATRIX

FIGURE 9: VENDOR LANDSCAPE

FIGURE 10: SOUTH CHINA SEA – POLITICAL RIVALRY

FIGURE 11: GLOBAL SURFACE WARSHIPS MARKET, GROWTH POTENTIAL, BY VESSEL TYPE, IN 2021

FIGURE 12: GLOBAL SURFACE WARSHIPS MARKET, BY AIRCRAFT CARRIERS, 2022-2030 (IN $ BILLION)

FIGURE 13: GLOBAL SURFACE WARSHIPS MARKET, BY DESTROYERS, 2022-2030 (IN $ BILLION)

FIGURE 14: GLOBAL SURFACE WARSHIPS MARKET, BY FRIGATES, 2022-2030 (IN $ BILLION)

FIGURE 15: GLOBAL SURFACE WARSHIPS MARKET, BY CORVETTES, 2022-2030 (IN $ BILLION)

FIGURE 16: GLOBAL SURFACE WARSHIPS MARKET, BY OTHER VESSEL TYPES, 2022-2030 (IN $ BILLION)

FIGURE 17: GLOBAL SURFACE WARSHIPS MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2021

FIGURE 18: GLOBAL SURFACE WARSHIPS MARKET, BY HULL & EQUIPMENT, 2022-2030 (IN $ BILLION)

FIGURE 19: GLOBAL SURFACE WARSHIPS MARKET, BY PROPULSION/POWER TRANSMISSION, 2022-2030 (IN $ BILLION)

FIGURE 20: GLOBAL SURFACE WARSHIPS MARKET, BY ELECTRONICS, 2022-2030 (IN $ BILLION)

FIGURE 21: GLOBAL SURFACE WARSHIPS MARKET, BY WEAPON SYSTEMS, 2022-2030 (IN $ BILLION)

FIGURE 22: GLOBAL SURFACE WARSHIPS MARKET, BY OTHER COMPONENTS, 2022-2030 (IN $ BILLION)

FIGURE 23: GLOBAL SURFACE WARSHIPS MARKET, GROWTH POTENTIAL, BY OPERATION, IN 2021

FIGURE 24: GLOBAL SURFACE WARSHIPS MARKET, BY ATTACK, 2022-2030 (IN $ BILLION)

FIGURE 25: GLOBAL SURFACE WARSHIPS MARKET, BY SURVEILLANCE & INTELLIGENCE, 2022-2030 (IN $ BILLION)

FIGURE 26: GLOBAL SURFACE WARSHIPS MARKET, BY LOGISTICS, 2022-2030 (IN $ BILLION)

FIGURE 27: GLOBAL SURFACE WARSHIPS MARKET, BY AMPHIBIOUS, 2022-2030 (IN $ BILLION)

FIGURE 28: GLOBAL SURFACE WARSHIPS MARKET, BY OTHER OPERATIONS, 2022-2030 (IN $ BILLION)

FIGURE 29: NORTH AMERICA SURFACE WARSHIPS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 30: UNITED STATES SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 31: CANADA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 32: EUROPE SURFACE WARSHIPS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 33: UNITED KINGDOM SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 34: GERMANY SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 35: FRANCE SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 36: ITALY SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 37: SWEDEN SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 38: FINLAND SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 39: GREECE SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 40: REST OF EUROPE SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 41: ASIA-PACIFIC SURFACE WARSHIPS MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 42: CHINA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 43: JAPAN SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 44: INDIA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 45: SOUTH KOREA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 46: INDONESIA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 47: NORTH KOREA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 48: MYANMAR SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 49: VIETNAM SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 50: REST OF ASIA-PACIFIC SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 51: REST OF WORLD SURFACE WARSHIPS MARKET, REGIONAL OUTLOOK, 2021 & 2030 (IN %)

FIGURE 52: LATIN AMERICA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

FIGURE 53: MIDDLE EAST & AFRICA SURFACE WARSHIPS MARKET, 2022-2030 (IN $ BILLION)

- MARKET BY VESSEL TYPE

- AIRCRAFT CARRIERS

- DESTROYERS

- FRIGATES

- CORVETTES

- OTHER VESSEL TYPES

- MARKET BY COMPONENT

- HULL & EQUIPMENT

- PROPULSION/POWER TRANSMISSION

- ELECTRONICS

- WEAPON SYSTEMS

- OTHER COMPONENTS

- MARKET BY OPERATION

- ATTACK

- SURVEILLANCE & INTELLIGENCE

- LOGISTICS

- AMPHIBIOUS

- OTHER OPERATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SWEDEN

- FINLAND

- GREECE

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- NORTH KOREA

- MYANMAR

- VIETNAM

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

Frequently Asked Questions (FAQs):

What is the worth of the global surface warships market?

The global surface warships market was valued at $33.03 billion in 2021.

Which vessel type is expected to be the fastest-growing?

The aircraft carriers vessel type is expected to be the fastest-growing.

Which component is expected to capture the largest market share?

The weapon systems component is expected to capture the largest market share during the forecast period.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.