RUSSIA LIQUEFIED NATURAL GAS (LNG) MARKET

Natural gas is a fossil fuel majorly comprising of methane. As with other fossil fuels, it is formed deep beneath the earth’s surface due to the decomposition of dead plants and animals under extreme heat and pressures. Natural gas is cleaner than most other fossilized fuels. However, its calorific value is lower than the fossil fuels like petrol, diesel, and LPG.

To learn more about this report, request a free sample copy

The high demand for electricity and heat is one of the primary factors driving the natural gas demand in Russia. Given the climatic conditions in Russia, heat becomes a necessary aspect of survival. The January temperatures vary from -3º C in southern parts of the country to -26º C in the Far East region. The length of the heating season also varies from five months to ten months, depending on the region. Therefore, natural gas is as essential for Russia as food and water.

Natural gas is the primary fuel for electricity and heat production in Russia. Its power and heat production share had increased from 66% in 1999 to 72% in 2015. However, gas consumption by the power industry, after peaking in 2013, followed a declining trend for the past few years following the economic slowdown in the country.

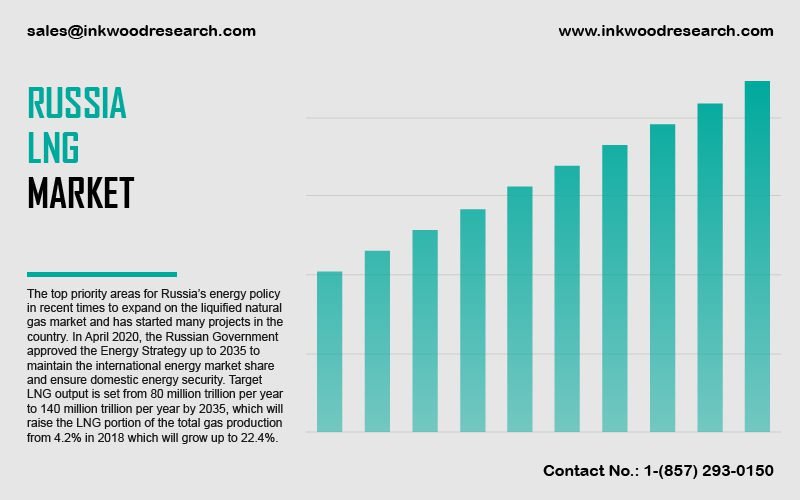

One of the top priorities of Russia’s energy policy is expanding the liquified natural gas market. As a result, it has started many projects in the country. Several strategic documents and government representatives’ statements indicate the same.

After the 1970s, Russia increasingly prioritized LNG market expansion. This is due to the losses faced by the US due to the cold war. There were subsequent exports of LNG to the US market from the Yamal peninsula. The North Star Project in the 1970s increased the participation of American companies in the market. Due to the several reforms that followed, President Putin decided to end the monopoly of Gazprom’s gas export in 2013. It allowed other public-private partners like Novatek & Rosneft to grow in the LNG market, particularly in designing and supplying LNG sources to Asia and Europe.

In April 2020, the Russian Government approved the Energy Strategy up to 2035 to maintain the international energy market share and ensure domestic energy security. With regard to the Energy Strategy, it is tough to accomplish these goals without an extensive LNG production rise. The LNG output is aimed at 140 million trillion per year by 2035, which will raise the LNG share of the total gas production from 4.2% in 2018, growing up to 22.4%.

The top LNG companies in the country are Gazprom, Yamal LNG, Novatek, Rosneft, etc.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RUSSIA LNG MARKET: EXECUTIVE SUMMARY

- RUSSIA OVERALL ECONOMIC CONDITIONS

- RUSSIA PRIMARY ENERGY CONSUMPTION

- NATURAL GAS

- RUSSIA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- TOTAL PROVED RESERVES

- NATURAL GAS PRODUCTION

- NATURAL GAS CONSUMPTION

- RUSSIA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- LIQUIFIED NATURAL GAS

- VALUE CHAIN ANALYSIS

- EXPLORATION AND PRODUCTION

- LIQUEFACTION

- SHIPPING

- STORAGE AND REGASIFICATION

- END-USERS

- TRADE

- EXPORTS

- IMPORTS

- LNG TERMINALS

- LIST OF LNG EXPORT TERMINALS

- REGULATORY FRAMEWORK FOR LNG

- VALUE CHAIN ANALYSIS

LIST OF TABLES

TABLE 1: RUSSIA NATURAL GAS TOTAL PROVED RESERVES, 2000, 2010, AND 2020 (IN TRILLION CUBIC METERS)

TABLE 2: RUSSIA NATURAL GAS PRODUCTION, 2016-2020 (IN EXAJOULES)

TABLE 3: RUSSIA NATURAL GAS CONSUMPTION, 2016-2020 (IN EXAJOULES)

TABLE 4: RUSSIA LNG EXPORTS, 2016-2020 (IN BILLION CUBIC METERS)

TABLE 5: RUSSIA LNG IMPORTS, 2016-2020 (IN BILLION CUBIC METERS)

TABLE 6: LNG EXPORT TERMINALS, EXISTING

TABLE 7: LNG EXPORT TERMINALS, NOT YET BUILT

TABLE 8: REGULATORY FRAMEWORK

LIST OF FIGURES

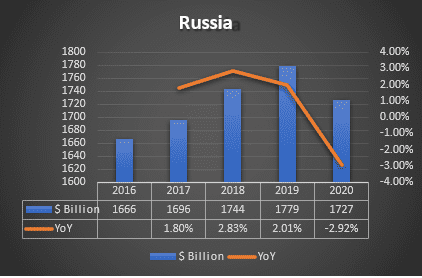

FIGURE 1: RUSSIA GROSS DOMESTIC PRODUCT, 2016-2020 ($ BILLION)

FIGURE 2: PRIMARY ENERGY CONSUMPTION, BY FUEL TYPES, 2019 & 2020 (IN %)

FIGURE 3: PRIMARY ENERGY CONSUMPTION, 2016-2020 (EXAJOULES)

FIGURE 4: RUSSIA NATURAL GAS PRODUCTION VS CONSUMPTION, 2016-2020 (IN EXAJOULES)

FIGURE 5: VALUE CHAIN ANALYSIS

RUSSIA GROSS DOMESTIC PRODUCT, 2016-2020, ($ BILLION)

GDP (constant 2010 US$)

Source: World Bank

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.