GLOBAL PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

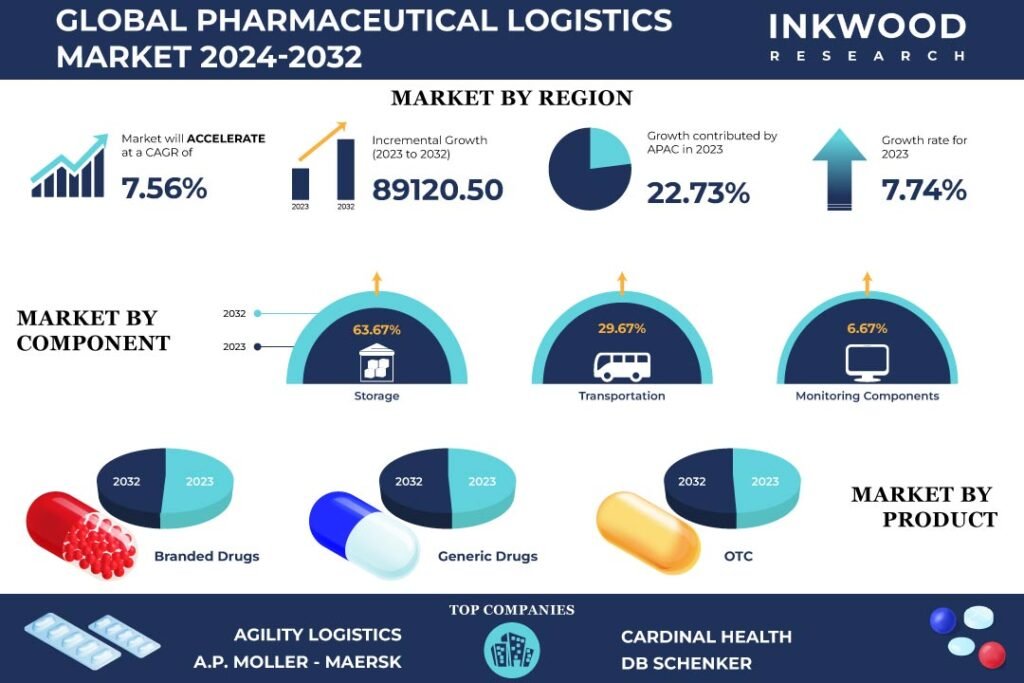

Global Pharmaceutical Logistics Market by Product (Branded Drugs, Generic Drugs, OTC) Market by Therapy Area (Communicable Diseases, Oncology, Diabetes, Cardiovascular Diseases, Autoimmune Diseases, Neurological Disorders, Pain Management, Respiratory Diseases, Other Therapy Areas) Market by Type (Non-cold Chain Logistics, Cold Chain Logistics) Market by Component (Storage, Transportation, Monitoring Components) by Geography

REPORTS » LOGISTICS & SUPPLY CHAIN » SUPPLY CHAIN MANAGEMENT » GLOBAL PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

MARKET OVERVIEW

The global pharmaceutical logistics market size was $95,426.44 million in 2023 and is estimated to reach $184,546.94 million by 2032, growing at a CAGR of 7.56% during the forecast period. The base year considered for the study is 2023, and the estimated period is between 2024 and 2032.

The global pharmaceutical logistics market encompasses a vital sector ensuring the safe and efficient transport of pharmaceutical products. At its core lies pharmaceutical cold chain logistics, a specialized domain essential for preserving the integrity of temperature-sensitive medications. Key players in this market include pharmaceutical logistics companies, 3PL (third-party) pharmaceutical logistics providers specializing in pharmaceutical logistics, and temperature-controlled logistics experts like ASC pharmaceutical logistics.

Logistics management in the pharmaceutical industry plays a fundamental role in ensuring the timely delivery of medications while maintaining stringent quality standards. Further, pharmaceutical logistic services are tailored to meet the industry’s requirements, incorporating storage, transportation, and distribution of pharmaceutical products under controlled conditions. Various factors, including the global expansion of pharmaceutical logistics markets, increasing regulatory requirements, and the growing emphasis on patient safety, stimulate the demand for pharmaceutical logistics services.

As pharmaceutical companies extend their reach into new geographic regions, the need for efficient and reliable logistics solutions becomes paramount. Within the pharmaceutical logistics industry, there is a continuous focus on innovation and technology adoption to enhance supply chain visibility, traceability, and compliance. Moreover, from temperature-monitoring devices to advanced data analytics, these technologies play a crucial role in optimizing logistics processes and mitigating risks associated with product spoilage or contamination.

Read our latest blog on the Pharmaceutical Logistics Market

GROWTH ENABLERS

Key growth enablers of the global pharmaceutical logistics market:

- Rising need for temperature-controlled solutions in pharmaceuticals

- The pharmaceutical industry depends on maintaining temperature-controlled conditions to ensure product quality and efficacy. Air freight is the preferred mode of transport, particularly for biologics and mRNA substances.

- Investments in logistics infrastructure, such as by DHL, highlight the industry’s commitment to product integrity and safety.

- Expansion of ocean freight services in pharmaceutical industry

- Rise in consumer preference for over-the-counter medicines

- Surge in pharmaceutical logistics during the global COVID-19 pandemic

GROWTH RESTRAINTS

Key growth restraining factors of the global pharmaceutical logistics market:

- Rigorous regulatory requirements in pharmaceutical logistics

- Ensuring real-time transparency and reliability in pharmaceutical logistics

- Real-time transparency in pharmaceutical logistics is important for tracking products, especially during recalls or to combat counterfeiting, and for immediate response to temperature deviations.

- Ensuring reliability is crucial to prevent any disruptions or mistakes that may jeopardize patient safety, comply with regulatory standards, and minimize additional expenses resulting from inefficiencies or waste.

- Achieving both transparency and reliability requires investment in technology, processes, personnel, and cooperation among supply chain parties despite challenges such as complexity and technical limitations.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Pharmaceutical Logistics Market | Top Market Trends

- The global pharmaceutical logistics market is experiencing a notable increase in the need for customized services, particularly for cell and gene therapies, a trend prominently led by North America. This surge reflects a growing confidence in advanced therapies, evidenced by substantial investments, with more than 900 firms engaged in over 1,000 ongoing clinical trials. Noteworthy players such as DHL and CRYOPDP are actively enhancing their offerings to provide specialized services, including the handling of cryogenic shipments.

- Digitization is reshaping pharmaceutical logistics, powered by the need for enhanced supply chain efficiency and security. Major players like DB Schenker and TrakCel are leveraging digital solutions, including AI and IoT, to optimize processes and ensure regulatory compliance. Further, knowledge graphs are expected to simplify supply chain complexities, leading the way for proactive logistics models.

- Clinical trial logistics is transitioning towards personalized and direct-to-patient services, with a goal of enhancing recruitment, retention, and overall patient satisfaction. Companies like Yourway and Parexel are expanding globally, particularly in the Asia-Pacific, to meet the rising demand for clinical trial support. This global expansion of clinical trials, driven by technological advancements and regulatory changes, presents significant growth opportunities in the pharmaceutical logistics sector.

MARKET SEGMENTATION

Market Segmentation – Product, Therapy Area, Type, and Component – Market by Product:- Branded Drugs

- In 2023, the branded drugs segment was the dominating product category in the global pharmaceutical logistics market.

- Branded drugs, protected by patents and sold under specific trademarks, generate high revenue for manufacturers but lower margins for wholesalers and pharmacies.

- Despite their higher cost, they are favored in markets like the United States and the United Kingdom due to perceived quality and reimbursement policies. However, the arrival of generic alternatives often leads to swift declines in branded drug sales, contributing to the strong pharmaceutical logistics market domain.

- Generic Drugs

- OTC

- Communicable Diseases

- Oncology

- Diabetes

- Cardiovascular Diseases

- Autoimmune Diseases

- Neurological Disorders

- Pain Management

- Respiratory Diseases

- Other Therapy Areas

- Non-Cold Chain Logistics

- Cold Chain Logistics

- The cold chain logistics is expected to be the fastest-growing type over the forecast period.

- Cold chain logistics ensures the integrity of temperature-sensitive pharmaceuticals, integral for medications, vaccines, and biologics. It involves meticulous planning across manufacturing, packaging, transportation, and distribution stages, especially exemplified in the distribution of COVID-19 vaccines.

- The challenges involve high expenses and the risk of product spoilage. However, technological advancements such as IoT and AI are driving market expansion by enhancing efficiency and reducing risks.

- Storage

- Warehouse

- Refrigerated Containers

- Transportation

- Overland Logistics

- Sea Freight Logistics

- Air Freight Logistics

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Software

- Hardware

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- In 2023, Europe was the largest region in the global pharmaceutical logistics market.

- The demand for pharmaceutical logistics in Europe is increasing because of the heightened need for vaccines and medications spurred by the COVID-19 pandemic.

- Companies are prioritizing cost reduction and rapid assistance, fueling the growth of the market. Health spending in Europe, reaching 8.3% of GDP in 2020, with Germany and France at the forefront, is poised for further expansion due to the pandemic.

- Asia-Pacific: China, Japan, India, South Korea, Australia & New Zealand, Thailand, Indonesia, Vietnam, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global pharmaceutical logistics market:

- Agility Logistics

- AP Moller – Maersk

- Cardinal Health

- Cencora (AmerisourceBergen)

- CEVA Logistics

- DB Schenker

- Deutsche Post AG

- DSV

- FedEx

- Kuehne + Nagel

- Marken (acquired by UPS)

- Medline

- SEKO Logistics

- United Parcel Service (UPS)

- VersaCold Logistics Services (acquired by Lineage LLC)

Key strategies adopted by some of these companies:

- Kuehne+Nagel entered into an agreement to acquire City Zone Express, a subsidiary of Chasen Holdings Ltd, a Singapore Exchange Mainboard-listed company, in March 2024.

- CEVA Logistics unveiled its sustainable warehouse in Kemps Creek, Sydney, in March 2024.

- Maersk partnered with PUMA in March 2024 to establish Chile’s first semi-automated omnichannel fulfillment distribution center.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product, Therapy Area, Type, and Component |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Agility Logistics, AP Moller – Maersk, Cardinal Health, Cencora (AmerisourceBergen), CEVA Logistics, DB Schenker, Deutsche Post AG, DSV, FedEx, Kuehne + Nagel, Marken (acquired by UPS), Medline, SEKO Logistics, United Parcel Service (UPS), VersaCold Logistics Services (acquired by Lineage LLC) |

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON PHARMACEUTICAL LOGISTICS MARKET

- MAJOR MARKET FINDINGS

- BRANDED DRUGS ARE THE MOST COMMONLY USED PRODUCTS IN THE PHARMACEUTICAL LOGISTICS MARKET

- COMMUNICABLE DISEASES HOLD THE LARGEST MARKET SHARE IN THE THERAPY AREA

- COLD CHAIN LOGISTICS IS THE FASTEST-GROWING TYPE WITHIN THE PHARMACEUTICAL LOGISTICS MARKET

- MONITORING OF PHARMACEUTICAL LOGISTICS OPERATIONS IS INCREASINGLY BECOMING A FOCUS AREA

-

MARKET DYNAMICS

- KEY DRIVERS

- RISING NEED FOR TEMPERATURE-CONTROLLED SOLUTIONS IN PHARMACEUTICALS

- EXPANSION OF OCEAN FREIGHT SERVICES IN PHARMACEUTICAL INDUSTRY

- RISE IN CONSUMER PREFERENCE FOR OVER-THE-COUNTER MEDICINES

- SURGE IN PHARMACEUTICAL LOGISTICS DURING THE GLOBAL COVID-19 PANDEMIC

- KEY RESTRAINTS

- RIGOROUS REGULATORY REQUIREMENTS IN PHARMACEUTICAL LOGISTICS

- ENSURING REAL-TIME TRANSPARENCY AND RELIABILITY IN PHARMACEUTICAL LOGISTICS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- SURGE IN DEMAND FOR CELL & GENE THERAPY LOGISTICS

- REVOLUTIONIZING PHARMACEUTICAL LOGISTICS THROUGH DIGITAL TRANSFORMATION

- INCREASING CLINICAL TRIALS LOGISTICS DEMANDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR GERMANY

- GROWTH PROSPECT MAPPING FOR INDIA

- GROWTH PROSPECT MAPPING FOR JAPAN

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- MANUFACTURING

- STORAGE

- TRANSPORTATION

- DISTRIBUTION

- MONITORING COMPONENTS

- CONSUMPTION

- REGULATORY FRAMEWORK

- THE DRUG SUPPLY CHAIN SECURITY ACT

- THE FALSE MEDICINES DIRECTIVE (FMD)

- BRAZIL’S SERIALIZATION AND DIGITAL LEAFLETS

- GOOD MANUFACTURING PRACTICE (GMP), GOOD DISTRIBUTION PRACTICE (GDP), AND GOOD WAREHOUSING PRACTICE (GWP)

- KEY BUYING CRITERIA

- TYPE OF LOGISTICS

- SERVICES OFFERED

- MODE OF TRANSPORTATION

- APPLICATION

- REGULATORY COMPLIANCE

- TECHNOLOGICAL CAPABILITIES

- COST

- RELIABILITY

- AGILITY

- KEY MARKET TRENDS

-

MARKET BY PRODUCT

- BRANDED DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GENERIC DRUGS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTC

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BRANDED DRUGS

-

MARKET BY THERAPY AREA

- COMMUNICABLE DISEASES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ONCOLOGY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DIABETES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARDIOVASCULAR DISEASES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AUTOIMMUNE DISEASES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NEUROLOGICAL DISORDERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PAIN MANAGEMENT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RESPIRATORY DISEASES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER THERAPY AREAS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COMMUNICABLE DISEASES

-

MARKET BY TYPE

- NON-COLD CHAIN LOGISTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COLD CHAIN LOGISTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NON-COLD CHAIN LOGISTICS

-

MARKET BY COMPONENT

- STORAGE

- WAREHOUSE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- REFRIGERATED CONTAINERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WAREHOUSE

- TRANSPORTATION

- OVERLAND LOGISTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEA FREIGHT LOGISTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AIR FREIGHT LOGISTICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OVERLAND LOGISTICS

- MONITORING COMPONENTS

- HARDWARE

- SENSORS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RFID DEVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TELEMATICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NETWORKING DEVICES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SENSORS

- SOFTWARE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HARDWARE

- STORAGE

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET DRIVERS

- NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE PHARMACEUTICAL LOGISTICS MARKET DRIVERS

- EUROPE PHARMACEUTICAL LOGISTICS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE PHARMACEUTICAL LOGISTICS MARKET

- COUNTRY ANALYSIS

- GERMANY

- GERMANY PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- UNITED KINGDOM PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- GERMANY

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET DRIVERS

- ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET DRIVERS

- REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA PHARMACEUTICAL LOGISTICS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY MARKET STRATEGIES

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AGILITY LOGISTICS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- AP MOLLER – MAERSK

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- CARDINAL HEALTH

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- CENCORA (AMERISOURCEBERGEN)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- CEVA LOGISTICS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- DB SCHENKER

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- DEUTSCHE POST AG

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- DSV

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- FEDEX

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- KUEHNE + NAGEL

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- MARKEN (ACQUIRED BY UPS)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- MEDLINE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- SEKO LOGISTICS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- UNITED PARCEL SERVICE (UPS)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- VERSACOLD LOGISTICS SERVICES (ACQUIRED BY LINEAGE LLC)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- AGILITY LOGISTICS

- KEY MARKET STRATEGIES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – PHARMACEUTICAL LOGISTICS

TABLE 2: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY PRODUCT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL BRANDED DRUGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL BRANDED DRUGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL GENERIC DRUGS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL GENERIC DRUGS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL OTC MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL OTC MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY THERAPY AREA, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY THERAPY AREA, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL COMMUNICABLE DISEASES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL COMMUNICABLE DISEASES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL ONCOLOGY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL ONCOLOGY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL DIABETES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL DIABETES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL CARDIOVASCULAR DISEASES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL CARDIOVASCULAR DISEASES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL AUTOIMMUNE DISEASES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL AUTOIMMUNE DISEASES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL NEUROLOGICAL DISORDERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL NEUROLOGICAL DISORDERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL PAIN MANAGEMENT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL PAIN MANAGEMENT MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL RESPIRATORY DISEASES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL RESPIRATORY DISEASES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: GLOBAL OTHER THERAPY AREAS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL OTHER THERAPY AREAS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 32: GLOBAL NON-COLD CHAIN LOGISTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL NON-COLD CHAIN LOGISTICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: GLOBAL COLD CHAIN LOGISTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL COLD CHAIN LOGISTICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY COMPONENT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY COMPONENT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 38: GLOBAL STORAGE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL STORAGE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 40: GLOBAL STORAGE MARKET, BY SERVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL STORAGE MARKET, BY SERVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: GLOBAL TRANSPORTATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL TRANSPORTATION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 44: GLOBAL TRANSPORTATION MARKET, BY SERVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL TRANSPORTATION MARKET, BY SERVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 46: GLOBAL MONITORING COMPONENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL MONITORING COMPONENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 48: GLOBAL MONITORING COMPONENTS MARKET, BY SERVICE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: GLOBAL MONITORING COMPONENTS MARKET, BY SERVICE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 50: GLOBAL HARDWARE MARKET, BY HARDWARE TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 51: GLOBAL HARDWARE MARKET, BY HARDWARE TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 52: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY REGIONAL OUTLOOK, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 53: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY REGIONAL OUTLOOK, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 54: NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 56: KEY PLAYERS OPERATING IN NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET

TABLE 57: EUROPE PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 58: EUROPE PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 59: KEY PLAYERS OPERATING IN EUROPE PHARMACEUTICAL LOGISTICS MARKET

TABLE 60: ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 61: ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 62: KEY PLAYERS OPERATING IN ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET

TABLE 63: REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 64: REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 65: KEY PLAYERS OPERATING IN REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET

TABLE 66: LIST OF MERGERS & ACQUISITIONS

TABLE 67: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 68: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 69: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 6: GROWTH PROSPECT MAPPING FOR JAPAN

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2023

FIGURE 12: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY BRANDED DRUGS, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY GENERIC DRUGS, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY OTC, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, GROWTH POTENTIAL, BY THERAPY AREA, IN 2023

FIGURE 16: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY COMMUNICABLE DISEASES, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY ONCOLOGY, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY DIABETES, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY CARDIOVASCULAR DISEASES, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY AUTOIMMUNE DISEASES, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY NEUROLOGICAL DISORDERS, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY PAIN MANAGEMENT, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY RESPIRATORY DISEASES, 2024-2032 (IN $ MILLION)

FIGURE 24: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY OTHER THERAPY AREAS, 2024-2032 (IN $ MILLION)

FIGURE 25: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2023

FIGURE 26: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY NON-COLD CHAIN LOGISTICS, 2024-2032 (IN $ MILLION)

FIGURE 27: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY COLD CHAIN LOGISTICS, 2024-2032 (IN $ MILLION)

FIGURE 28: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2023

FIGURE 29: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY STORAGE, 2024-2032 (IN $ MILLION)

FIGURE 30: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY WAREHOUSE, 2024-2032 (IN $ MILLION)

FIGURE 31: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY REFRIGERATED CONTAINERS, 2024-2032 (IN $ MILLION)

FIGURE 32: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY TRANSPORTATION, 2024-2032 (IN $ MILLION)

FIGURE 33: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY OVERLAND LOGISTICS, 2024-2032 (IN $ MILLION)

FIGURE 34: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY SEA FREIGHT LOGISTICS, 2024-2032 (IN $ MILLION)

FIGURE 35: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY AIR FREIGHT LOGISTICS, 2024-2032 (IN $ MILLION)

FIGURE 36: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY MONITORING COMPONENTS, 2024-2032 (IN $ MILLION)

FIGURE 37: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY HARDWARE, 2024-2032 (IN $ MILLION)

FIGURE 38: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY SENSORS, 2024-2032 (IN $ MILLION)

FIGURE 39: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY RFID DEVICES, 2024-2032 (IN $ MILLION)

FIGURE 40: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY TELEMATICS, 2024-2032 (IN $ MILLION)

FIGURE 41: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY NETWORKING DEVICES, 2024-2032 (IN $ MILLION)

FIGURE 42: GLOBAL PHARMACEUTICAL LOGISTICS MARKET, BY SOFTWARE, 2024-2032 (IN $ MILLION)

FIGURE 43: NORTH AMERICA PHARMACEUTICAL LOGISTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 44: UNITED STATES PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: CANADA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: EUROPE PHARMACEUTICAL LOGISTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 47: GERMANY PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 48: UNITED KINGDOM PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: FRANCE PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 50: ITALY PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 51: SPAIN PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 52: BELGIUM PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 53: POLAND PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 54: REST OF EUROPE PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 55: ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 56: CHINA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 57: JAPAN PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 58: INDIA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 59: AUSTRALIA & NEW ZEALAND PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 60: SOUTH KOREA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 61: THAILAND PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 62: INDONESIA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 63: VIETNAM PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 64: REST OF ASIA-PACIFIC PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 65: REST OF WORLD PHARMACEUTICAL LOGISTICS MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 66: LATIN AMERICA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 67: MIDDLE EAST & AFRICA PHARMACEUTICAL LOGISTICS MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

The global pharmaceutical logistics market is anticipated to generate a revenue of $184,546.94 million in 2032.

The cold chain logistics is predicted to be the fastest-growing type throughout the forecast duration spanning from 2024 to 2032.

In 2023, storage held the dominant position in the global pharmaceutical logistics market by claiming a market share of more than 63%.

RELATED REPORTS

-

GLOBAL GREEN LOGISTICS MARKET FORECAST 2024-2032

-

INDIA GREEN LOGISTICS MARKET FORECAST 2024-2032

-

SINGAPORE GREEN LOGISTICS MARKET FORECAST 2024-2032

-

SWEDEN GREEN LOGISTICS MARKET FORECAST 2024-2032

-

UNITED KINGDOM GREEN LOGISTICS MARKET FORECAST 2024-2032

-

UNITED STATES PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

-

JAPAN PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

-

INDIA PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

-

GERMANY PHARMACEUTICAL LOGISTICS MARKET FORECAST 2024-2032

-

GLOBAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET FORECAST 2023-2032