NORTH AMERICA FISH OIL MARKET FORECAST 2021-2028

North America Fish Oil Market by Species (Anchovy, Mackerel, Sardines, Cod, Herring, Menhaden, Other Species) by Application (Aquaculture (Salmon & Trout, Marine Fish, Crustaceans, Tilapias, Eels, Cyprinids, Other Aquaculture), Animal Nutrition & Pet Food, Pharmaceuticals, Supplements & Functional Food, Other Applications) and by Geography

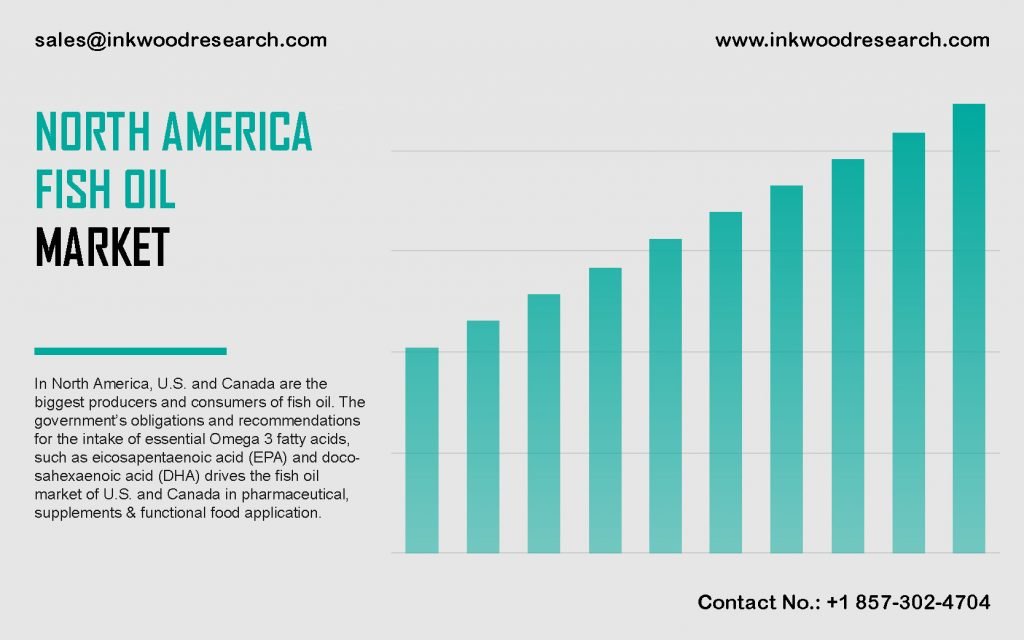

The North America fish oil market is set to project a CAGR of 7.06% in terms of revenue and 4.73% in terms of volume during the forecast period, 2021-2028. The government regulations with regard to the intake of essential omega-3 fatty acids and the major use of fish oil as a feeding ingredient are the key drivers of market growth.

To learn more about this report, request a free sample copy

The United States and Canada are analyzed for the North America fish oil market growth assessment. As per the National Health Interview Survey, fish oil was the most popular natural product in the United States. The industry performance has further supplemented the increases in per capita disposable income, which has enabled higher-margin purchases of fish oil and dietary supplements. The rising interest in the health benefits of fish oil consumption has also propelled the market growth in the country. The US is the biggest producer and consumer of fish oil in the North American region. The country entails a healthy production base of fish oil. The thriving seafood industry of Alaska contributes majorly to the market growth. Omega-3 fish oil is a major health supplement in the US. This is accredited to the growing awareness among consumers, along with government recommendations. Moreover, in 2016, the country was ranked among the leading fish & fishery exporters. Such factors facilitate market growth in the United States.

Omega Protein Corporation (Omega Protein) provides nutritional ingredients. The company is majorly engaged in the marketing, processing, and distribution of fish meal, organic fish soluble, and fish oil products. It is one of the biggest producers of omega-3 fish oil globally, along with being one of the largest manufacturers of protein-rich specialty fishmeal and organic fish soluble in North America. The company has operations in North America, Central America, South America, Asia, and Europe.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- SIGNIFICANT GROWTH IN THE AQUACULTURE INDUSTRY

- HEALTH BENEFITS OF FISH OIL

- INCREASING DEMAND FOR FISH OIL AMONG THE ELDERLY

- RISING DEMAND FROM SUPPLEMENT AND FUNCTIONAL FOOD APPLICATIONS

- KEY RESTRAINTS

- UNFAVORABLE CLIMATIC CONDITIONS

- LACK OF FISH OIL SUPPLY

- STERN GOVERNMENT REGULATIONS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON FISH OIL MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY SPECIES

- ANCHOVY

- MACKEREL

- SARDINES

- COD

- HERRING

- MENHADEN

- OTHER SPECIES

- MARKET BY APPLICATION

- AQUACULTURE

- SALMON & TROUT

- MARINE FISH

- CRUSTACEANS

- TILAPIAS

- EELS

- CYPRINIDS

- OTHER AQUACULTURE

- ANIMAL NUTRITION & PET FOOD

- PHARMACEUTICALS

- SUPPLEMENTS & FUNCTIONAL FOOD

- OTHER APPLICATIONS

- AQUACULTURE

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PARTNERSHIP, CONTRACT/AGREEMENT & COLLABORATION

- BUSINESS EXPANSION

- COMPANY PROFILES

- OMEGA PROTEIN CORPORATION

- FMC CORPORATION

- COPEINCA AS

- CORPESCA SA

- COLPEX INTERNATIONAL

- TRIPLENINE GROUP A/S

- FF SKAGEN A/S

- MARVESA HOLDINGS NV

- PESQUERA DIAMANTE SA

- PESQUERA EXALMAR

- ROYAL DSM NV

- CRODA INTERNATIONAL PLC

- BASF SE

- GC REIBER VIVOMEGA OILS

- LYSI HF

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – FISH OIL

TABLE 2: NORTH AMERICA FISH OIL MARKET, BY SPECIES, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: NORTH AMERICA FISH OIL MARKET, BY SPECIES, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA FISH OIL MARKET, BY SPECIES, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 5: NORTH AMERICA FISH OIL MARKET, BY SPECIES, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 6: NORTH AMERICA FISH OIL MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: NORTH AMERICA FISH OIL MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: NORTH AMERICA FISH OIL MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 9: NORTH AMERICA FISH OIL MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 10: NORTH AMERICA FISH OIL MARKET, BY AQUACULTURE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: NORTH AMERICA FISH OIL MARKET, BY AQUACULTURE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 12: NORTH AMERICA FISH OIL MARKET, BY AQUACULTURE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 13: NORTH AMERICA FISH OIL MARKET, BY AQUACULTURE, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 14: NORTH AMERICA FISH OIL MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: NORTH AMERICA FISH OIL MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 16: NORTH AMERICA FISH OIL MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 17: NORTH AMERICA FISH OIL MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 18: LEADING PLAYERS OPERATING IN NORTH AMERICA FISH OIL MARKET

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: NORTH AMERICA FISH OIL MARKET, GROWTH POTENTIAL, BY SPECIES, IN 2020

FIGURE 6: NORTH AMERICA FISH OIL MARKET, BY ANCHOVY, 2021-2028 (IN $ MILLION)

FIGURE 7: NORTH AMERICA FISH OIL MARKET, BY MACKEREL, 2021-2028 (IN $ MILLION)

FIGURE 8: NORTH AMERICA FISH OIL MARKET, BY SARDINES, 2021-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA FISH OIL MARKET, BY COD, 2021-2028 (IN $ MILLION)

FIGURE 10: NORTH AMERICA FISH OIL MARKET, BY HERRING, 2021-2028 (IN $ MILLION)

FIGURE 11: NORTH AMERICA FISH OIL MARKET, BY MENHADEN, 2021-2028 (IN $ MILLION)

FIGURE 12: NORTH AMERICA FISH OIL MARKET, BY OTHER SPECIES, 2021-2028 (IN $ MILLION)

FIGURE 13: NORTH AMERICA FISH OIL MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 14: NORTH AMERICA FISH OIL MARKET, BY AQUACULTURE, 2021-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA FISH OIL MARKET, GROWTH POTENTIAL, BY AQUACULTURE, IN 2020

FIGURE 16: NORTH AMERICA FISH OIL MARKET, BY SALMON & TROUT, 2021-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA FISH OIL MARKET, BY MARINE FISH, 2021-2028 (IN $ MILLION)

FIGURE 18: NORTH AMERICA FISH OIL MARKET, BY CRUSTACEANS, 2021-2028 (IN $ MILLION)

FIGURE 19: NORTH AMERICA FISH OIL MARKET, BY TILAPIAS, 2021-2028 (IN $ MILLION)

FIGURE 20: NORTH AMERICA FISH OIL MARKET, BY EELS, 2021-2028 (IN $ MILLION)

FIGURE 21: NORTH AMERICA FISH OIL MARKET, BY CYPRINIDS, 2021-2028 (IN $ MILLION)

FIGURE 22: NORTH AMERICA FISH OIL MARKET, BY OTHER AQUACULTURE, 2021-2028 (IN $ MILLION)

FIGURE 23: NORTH AMERICA FISH OIL MARKET, BY ANIMAL NUTRITION & PET FOOD, 2021-2028 (IN $ MILLION)

FIGURE 24: NORTH AMERICA FISH OIL MARKET, BY PHARMACEUTICALS, 2021-2028 (IN $ MILLION)

FIGURE 25: NORTH AMERICA FISH OIL MARKET, BY SUPPLEMENTS & FUNCTIONAL FOOD, 2021-2028 (IN $ MILLION)

FIGURE 26: NORTH AMERICA FISH OIL MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 27: NORTH AMERICA FISH OIL MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 28: UNITED STATES FISH OIL MARKET, 2021-2028 (IN $ MILLION)

FIGURE 29: CANADA FISH OIL MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY SPECIES

- ANCHOVY

- MACKEREL

- SARDINES

- COD

- HERRING

- MENHADEN

- OTHER SPECIES

- MARKET BY APPLICATION

- AQUACULTURE

- SALMON & TROUT

- MARINE FISH

- CRUSTACEANS

- TILAPIAS

- EELS

- CYPRINIDS

- OTHER AQUACULTURE

- ANIMAL NUTRITION & PET FOOD

- PHARMACEUTICALS

- SUPPLEMENTS & FUNCTIONAL FOOD

- OTHER APPLICATIONS

- AQUACULTURE

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.