NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET FORECAST 2018-2026

North America Automotive Heat Exchanger Market by Vehicle Type (Conventional Ice Vehicles, Pure Electric Vehicles, Other Vehicles) by Design (Tube-Fin, Plate–Bar)by Applications (Radiators, Inter Coolers, Air-conditioning, Oil Coolers, Exhaust Gas Heat Exchanger) by Geography

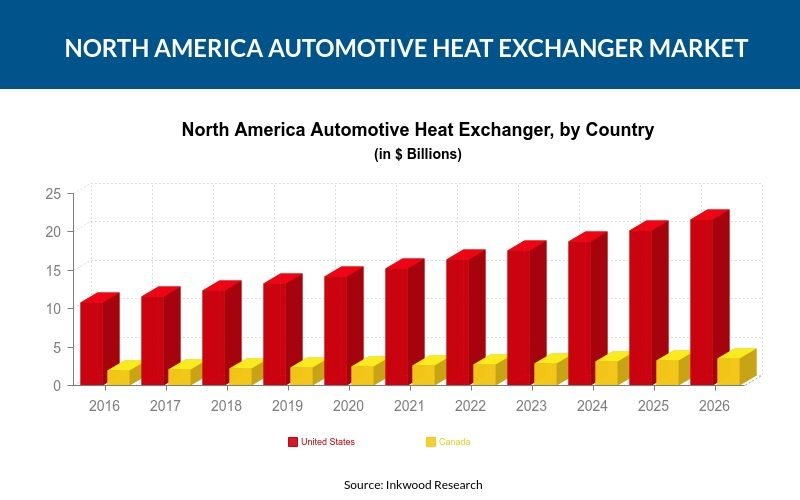

North America accounted for the third largest market share of the global automotive heat exchanger market, by generating $11.51 billion by the end of 2017. The market is expected to reach $21.07 billion by 2026, growing at an estimated CAGR of 6.95% during the forecast period (2018-2026).

To learn more about this report, request a free sample copy

The United States and Canada are the major regions of the North American automotive heat exchanger market. The United States generated the largest revenue share in 2017, i.e., xx% of the overall North America market, owing to the large vehicle production and sales in this region. The increasing demand for automotive components had a direct influence on the demand for automotive heat exchangers market. Canada ranks second in manufacturing vehicles in the North America region, and its market is expected to grow at a CAGR of xx% during the forecast period of 2018-2016.

Top companies leading this region are Mable, American Industrial Heat Transfer Inc., Modline manufacturing, Denso, Valeo, Visteon, etc.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- ELECTRIC VEHICLES IS EXPECTED TO BE THE FASTEST GROWING VEHICLE TYPE SEGMENT

- GROWING ADOPTION OF ENERGY-EFFICIENT EQUIPMENT

- MARKET DYNAMICS

- MARKET DEFINITION

- MARKET DRIVERS

- RAPID GROWTH IN THE AUTOMOTIVE INDUSTRY

- GROWING AUTOMOTIVE AFTERMARKET DEMANDS

- STRINGENT EMISSION REGULATIONS IN DIFFERENT COUNTRIES

- INCREASING DEMAND FOR TURBOCHARGED ENGINES

- MARKET RESTRAINTS

- LOW AVAILABILITY OF CHEAP RAW MATERIALS

- COMPLEXITY AND FUNCTIONAL ISSUES OF HEAT EXCHANGERS

- MARKET OPPORTUNITIES

- DEVELOPMENT AND INCREASING DEMAND FOR ALUMINIUM HEAT EXCHANGERS

- INCREASING DEMAND FOR HYBRID POWERTRAINS

- MARKET CHALLENGES

- PACKAGING RELATED ISSUES

- ELECTRIC VEHICLES AFFECT THE MARKET FOR IC ENGINE HEAT EXCHANGER

- MARKET BY VEHICLE TYPE

- CONVENTIONAL ICE VEHICLES

- PURE ELECTRIC VEHICLES

- OTHER VEHICLES

- MARKET BY DESIGN

- TUBE – FIN

- PLATE – BAR

- OTHER DESIGNS

- MARKET BY APPLICATIONS

- RADIATORS

- INTERCOOLERS

- AIR-CONDITIONING

- OIL COOLERS

- EXHAUST GAS HEAT EXCHANGER

- OTHER APPLICATIONS

- KEY ANALYTICS

- PORTERS FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS: AUTOMOTIVE INDUSTRY

- BACKWARD SUPPLY CHAIN

- FORWARD SUPPLY CHAIN

- PORTERS FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- UNITED STATES

- CANADA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- COMPANY PROFILES

- AKG THERMAL SYSTEMS, INC

- AMERICAN INDUSTRIAL HEAT TRANSFER INC

- BANCO PRODUCTS LTD

- CLIMETAL HEAT EXCHANGERS

- CLIZEN

- CONSTELLIUM N.V.

- DENSO

- G&M RADIATOR

- HANON SYSTEMS

- HRS PROCESS SYSTEMS

- MAHLE

- MODINE MANUFACTURING

- NIPPON LIGHT METAL COMPANY

- PRECISION MICRO

- VALEO S.A

TABLE 1: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2026 (IN $ BILLION)TABLE 2: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2018-2026, (IN $ BILLION)TABLE 3: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN, 2018-2026, (IN $ BILLION)TABLE 4: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATIONS, 2018-2026, (IN $ BILLION)TABLE 5: OPPORTUNITY MATRIX FOR AUTOMOTIVE HEAT EXCHANGER MARKETTABLE 6: VENDOR LANDSCAPE OF AUTOMOTIVE HEAT EXCHANGER MARKETTABLE 7: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2018-2026 (IN $ BILLION)

FIGURE 1: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATIONS, 2017 & 2026 (IN %)FIGURE 2: WORLDWIDE ELECTRIC VEHICLE MARKET, 2017-2026 (IN $ MILLION)FIGURE 3: UNITED STATES AUTOMOTIVE-RELATED CO2 EMISSIONS (MILLION METRIC TONS)FIGURE 4: AUTOMOTIVE ENGINE MARKET BY CYLINDER COUNT 2015 AND 2024 (%)FIGURE 5: VOLATILITY IN ALUMINUM PRICES (1000$ PER METRIC TON) – 6 MONTHS ANALYSIS (MARCH 2016-SEPTEMBER 2016)FIGURE 6 WORLDWIDE PURE EV AND PLUG-IN VEHICLE STOCK, 2013-2015 (IN UNITS)FIGURE 7: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY CONVENTIONAL ICE VEHICLES, 2018-2026 (IN $ BILLION)

FIGURE 8: WORLDWIDE MOTOR VEHICLES PRODUCTION STATISTICS 2010-2015

FIGURE 9: WORLDWIDE MOTOR VEHICLES SALES STATISTICS 2010-2015

FIGURE 10: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PURE ELECTRIC VEHICLES, 2018-2026 (IN $ BILLION)

FIGURE 11: APPROXIMATE WORLDWIDE ANNUAL SALES OF PURE-ELECTRIC VEHICLES, 2016

FIGURE 12: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY OTHER VEHICLES, 2018-2026 (IN $ BILLION)

FIGURE 13: WORLDWIDE HYBRID VEHICLE SALES, 2012-2016 (APPROXIMATE VALUE)

FIGURE 14: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY TUBE – FIN, 2018-2026 (IN $ BILLION)

FIGURE 15: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PLATE – BAR, 2018-2026 (IN $ BILLION)

FIGURE 16: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY OTHER DESIGNS, 2018-2026 (IN $ BILLION)

FIGURE 17: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY RADIATORS, 2018-2026 (IN $ BILLION)

FIGURE 18: WORLDWIDE RADIATOR HEAT EXCHANGER MARKET SHARE 2016

FIGURE 19: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY INTERCOOLERS, 2018-2026 (IN $ BILLION)

FIGURE 20: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY AIR-CONDITIONING, 2018-2026 (IN $ BILLION)

FIGURE 21: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY OIL COOLERS, 2018-2026 (IN $ BILLION)

FIGURE 22: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY EXHAUST GAS HEAT EXCHANGER, 2018-2026 (IN $ BILLION)

FIGURE 23: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY OTHER APPLICATIONS, 2018-2026 (IN $ BILLION)

FIGURE 24: PORTER’S FIVE FORCE MODEL OF AUTOMOTIVE HEAT EXCHANGER MARKET

FIGURE 25: VALUE CHAIN OF AUTOMOTIVE INDUSTRY

FIGURE 26: NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, REGIONAL OUTLOOK, 2017 & 2026 (IN %)

FIGURE 27: UNITED STATES AUTOMOTIVE HEAT EXCHANGER MARKET, 2018-2026 (IN $ BILLION)

FIGURE 28: UNITED STATES AUTOMOTIVE PRODUCTION STATISTICS, 2011-2015 (IN UNITS)

FIGURE 29: UNITED STATES AUTOMOTIVE SALES STATISTICS, 2011-2015 (IN UNITS)

FIGURE 30: CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, 2018-2026 (IN $ BILLION)

FIGURE 31: CANADA AUTOMOTIVE PRODUCTION STATISTICS, 2011-2015 (IN UNITS)

FIGURE 32: CANADA AUTOMOTIVE SALES STATISTICS, 2011-2015 (IN UNITS)

FIGURE 33: MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2016 (%)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY VEHICLE TYPE

- CONVENTIONAL ICE VEHICLES

- PURE ELECTRIC VEHICLES

- OTHER VEHICLES

- MARKET BY DESIGN

- TUBE – FIN

- PLATE – BAR

- OTHER DESIGNS

- MARKET BY APPLICATIONS

- RADIATORS

- INTERCOOLERS

- AIR-CONDITIONING

- OIL COOLERS

- EXHAUST GAS HEAT EXCHANGER

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.