GLOBAL MYCELIUM MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

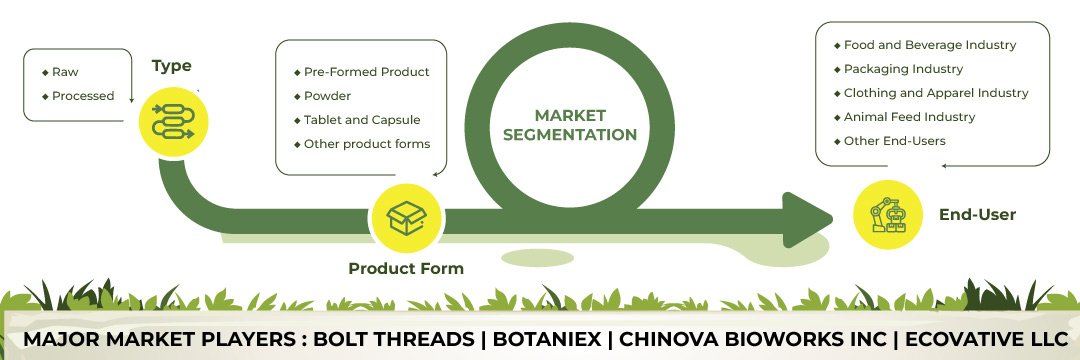

Global Mycelium Market by Type (Raw, Processed) Market by Product Form (Pre-formed Product, Powder, Tablet and Capsule, Other Product Forms) Market by End-user (Food and Beverage Industry, Packaging Industry, Clothing and Apparel Industry, Animal Feed Industry, Other End-users) by Geography

REPORTS » CONSUMER GOODS » FOOD AND BEVERAGES » GLOBAL MYCELIUM MARKET FORECAST 2023-2032

MARKET OVERVIEW

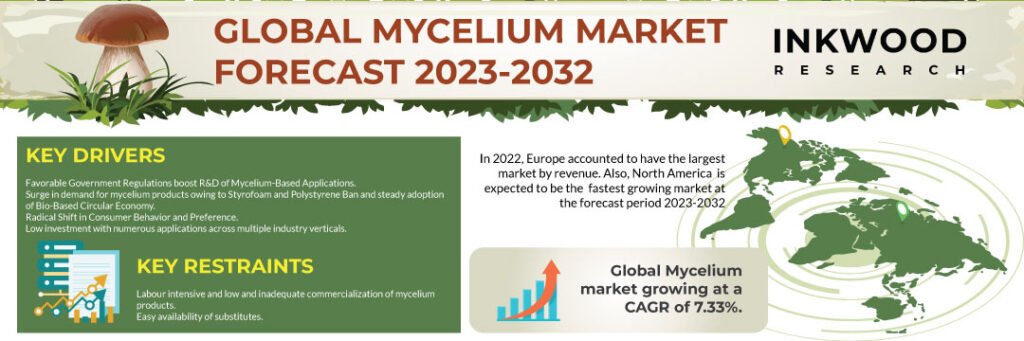

The global mycelium market was valued at $2935.82 million in 2022 and is expected to reach $5858.91 million by 2032, growing at a CAGR of 7.33% during the forecast period, 2023-2032.

Mycelia are fungi colonies found below or on the surface of the earth and are represented as Shiro masses on mycelia. These are finger-like structures that grow outward, similar to roots, in search of water and nutrients to satisfy the needs of the fungal body.

Due to their solid wall structures, mycelia can travel through soil or other surfaces with ease. The rigid fibrous structure of mycelium can be used as an edible plant-based meat, to create materials like leather, and as a replacement for plastics.

Read our latest blog on the Mycelium Market

GROWTH ENABLERS

Key enablers of the global mycelium market growth are:

- Favorable government regulations boost R&D of mycelium-based applications

- Styrofoam and polystyrene ban and steady adoption of bio-based circular economy surges demands

- Radical shift in consumer behavior and preference

- Manufacturers are placing a strong emphasis on employing natural, vegan, and animal-free ingredients in cosmetics.

- Due to its numerous advantages for skincare, mycelium is being used as a primary raw material in clean-label compounds made from plant extracts, including scents & perfumes, skincare products, and others.

- Mycelium is also used in the cosmetic formulations of lipsticks, lotions, and cosmetics products, among other personal care and beauty items.

- For instance, Evocative LLC produces skincare and beauty products based on mycelium, such as makeup sponges and cosmetic product packaging.

- In the garment and apparel industry, behemoths like adidas are working with mycelium producers to create vegan products that do not harm the environment.

- Low investment with numerous applications across multiple industry verticals

GROWTH RESTRAINTS

Key factors restraining the global mycelium market growth are:

- Labor-intensive and low and inadequate commercialization of mycelium products

- Easy availability of substitutes

- Almost all key players are looking for plant-based alternatives to the already available solutions since they are sustainable and environmentally viable.

- Whereas sources such as soy and pea protein are widely available in the food & beverage business, making it challenging for emerging mycelium products to compete in the plant-based market.

- Further, Styrofoam & polystyrene bans and restrictions in the packaging sector have fueled the demand for sustainable & alternative packaging materials.

- In addition, due to the processing and manufacturing expenses, mycelium-based packaging is not a cost-effective substitute for polystyrene.

- As a result, mycelium goods face significant challenges since the market for plant-based products is oversaturated with competing items.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Mycelium Market | Top Trends

- The market for mycelium as a protein and packaging substitute is expanding. This has surged the demand for the commercialization of bacon, steak, and other plant-based food products made from mycelium. Mycelium is frequently used to precisely replicate the flavor and texture of traditional meat dishes, which requires only small-scale investments.

- Mycelium can be used to construct a bio-based board for embedding electronics and functioning as an electronic component. In a proper density setting, the mycelium’s tiny cells could be used as a charge carrier or storage medium. Mycelium-based bioelectronics includes fungi photosensors, analog computing, fungi oscillators, and other kinds of electronics.

- Mycelium is a readily available and nutrient-rich raw material for the production of a variety of medicines and pharmaceuticals. This is attributed to its high concentration of polyphenolics, phenolics, vitamins, selenium, and other bioactive chemicals. Simultaneously, there is a growing demand for mycelium-based protein powders, dietary supplements, health drinks, and other alternatives to conventional diets. Furthermore, the bioactive substances found in mycelium, such as phenolics, terpenoids, polysaccharides, selenium, and others, are proven to have anti-aging, antioxidant, anti-wrinkle, skin-whitening, skin-revitalizing, and moisturizing properties.

MARKET SEGMENTATION

Need a custom report or have specific data requirements? Let us know!

Market Segmentation – Type, Product Form, and End-User –

Market by Type:

- Raw

- Processed

- Processed is the largest revenue-generating type in the global mycelium market.

- Processed mycelium is a processed and stabilized mycelium that can be utilized in the place of foam, insulation, flooring, furniture, and panels. It has a higher adoption rate due to its low density, fire safety, and good acoustic absorption qualities.

- Further, it can be utilized as an insulation against thermal conductivity, among other things. Given the numerous purposes it serves, including insulation, door cores, paneling, flooring, cabinets, and other furniture, processed mycelium can find applications in building supplies.

Market by Product Form:

- Pre-Formed Product

- Powder

- Tablet and Capsule

- Tablet and capsule is the fastest-growing product form in the global mycelium market.

- Mycelium tablets are used for therapeutic purposes and to prevent food spoiling. For instance, POME Cordyceps Mycelium Tablets are used as a remedy for respiratory system illnesses.

- Mycelium tablets are made using Ophiocordyceps Sinensis mycelium species through piping vibration technology.

- Inserting mycelium tablets into food packaging is another way to prevent food from spoiling. Mycelium produces carbon dioxide while absorbing oxygen, rendering longer shelf life for packaged foods.

- Other Product Forms

Market by End-User:

- Food & Beverage Industry

- Packaging Industry

- Clothing and Apparel Industry

- Animal Feed Industry

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, The Netherlands, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Philippines, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is among the largest revenue-generating regions in the global mycelium market.

- The Asia-Pacific mycelium market growth is attributed to the rising per capita consumption of mushrooms and the growing adoption of cutting-edge mycelium farming techniques.

- Japan is among the top five exporters of mycelium globally, alongside fresh & dried mushrooms. Thus, other nations use Japanese mushrooms to make various mycelium products like packaging materials and synthetic leather. Mycelium is the primary ‘plant’ portion of the mushroom.

- Whereas in India, the government recently proposed to make better infrastructure facilities for the production of quality mushroom farming fertilizers & compost and mushroom cultivation training for farmers to reap the economic benefits of mushroom farming and mycelium.

- Rest of World: Latin America, Middle East & Africa

MAJOR PLAYERS

Some of the major players in the global mycelium market are:

- Chinova Bioworks

- Mycovation

- Meati Inc

- PRIME ROOTS

Key strategies adopted by some of these companies:

- In September 2023, Meati Inc launched a direct-to-consumer internet storefront to make product delivery and subscriptions possible for its clients. A $169 Innovation Kitchen Subscription offers four existing products and at least one brand-new one every month. At the same time, the Meati Marketplace will let individuals test its alternative meats before they hit the shops.

- In May 2023, ChiberTM, a clean-label shelf-life extender, was the first mushroom fiber to be certified as an ingredient list item by Whole Foods Market. Food & beverage businesses now have a clean label option to improve the quality and freshness of their products while also boosting transparency and sustainability due to Whole Foods Market’s approval of ChiberTM for use in their stores.

- In June 2023, PRIME ROOTS and Quorn established a partnership to create prospects for the market expansion of alternative meats based on mycelium. Together, the businesses will also create new goods. Quorn will invest a small amount in PRIME ROOTS.

- In December 2022, the Lambert Spawn Company, based in Pennsylvania, sold its mushroom spawn production plant, Lambert Spawn Europa, to Ecovative. The new line helps Ecovative continue its quick international growth as a producer and supplier of mycelium to other businesses.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Type, Product Form, End-user |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Bolt Threads, Botaniex, Chinova Bioworks Inc, Ecovative LLC,m Groundwork BioAg, Meati Inc, Mogu srl, Monaghan Group, Mycorena AB, MycoTechnology Inc, Mycovation, MycoWorks, Nature’s Fynd, PRIME ROOTS, Quorn |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON MYCELIUM MARKET

- MAJOR MARKET FINDINGS

- SIGNIFICANT INVESTMENTS AND FUNDING IN GLOBAL MYCELIUM MARKET

- BOOMING MYCOCOSMETICS IN BEAUTY INDUSTRY

- MYCELIUM BRICK: AN EMERGING MATERIAL

MARKET DYNAMICS

- KEY DRIVERS

- FAVORABLE GOVERNMENT REGULATIONS BOOST R&D OF MYCELIUM-BASED APPLICATIONS

- STYROFOAM AND POLYSTYRENE BAN AND STEADY ADOPTION OF BIO-BASED CIRCULAR ECONOMY SURGES DEMANDS

- RADICAL SHIFT IN CONSUMER BEHAVIOR AND PREFERENCE

- NUMEROUS APPLICATIONS ACROSS MULTIPLE INDUSTRY VERTICALS WITH LOW INVESTMENT

- KEY RESTRAINTS

- LABOR-INTENSIVE AND LOW & INADEQUATE COMMERCIALIZATION OF MYCELIUM PRODUCTS

- EASY AVAILABILITY OF SUBSTITUTES

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- AN ECO-FRIENDLY PACKAGING AND PROTEIN ALTERNATIVE

- MYCELIUM-BASED ORGANO-ELECTRONICS

- UTILIZATION OF MYCELIUM IN THE SKIN CARE AND PHARMACEUTICAL INDUSTRIES

- MYCELIUM VERSATILITY ATTRACTS NUMEROUS START-UPS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH MAPPING PROSPECT FOR UNITED STATES

- GROWTH MAPPING PROSPECT FOR UNITED KINGDOM

- GROWTH MAPPING PROSPECT FOR JAPAN

- GROWTH MAPPING PROSPECT FOR MEXICO

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- KEY MARKET TRENDS

MARKET BY TYPE

- RAW

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PROCESSED

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RAW

MARKET BY PRODUCT FORM

- PRE-FORMED PRODUCT

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POWDER

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TABLET AND CAPSULE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER PRODUCT FORMS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PRE-FORMED PRODUCT

MARKET BY END-USER

- FOOD AND BEVERAGE INDUSTRY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PACKAGING INDUSTRY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CLOTHING AND APPAREL INDUSTRY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ANIMAL FEED INDUSTRY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FOOD AND BEVERAGE INDUSTRY

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA MYCELIUM MARKET DRIVERS

- NORTH AMERICA MYCELIUM MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA MYCELIUM MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES MYCELIUM MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA MYCELIUM MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE MYCELIUM MARKET DRIVERS

- EUROPE MYCELIUM MARKET CHALLENGES

- KEY PLAYERS IN EUROPE MYCELIUM MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM MYCELIUM MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY MYCELIUM MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE MYCELIUM MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN MYCELIUM MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND MYCELIUM MARKET SIZE & OPPORTUNITIES

- THE NETHERLANDS

- THE NETHERLANDS MYCELIUM MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE MYCELIUM MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC MYCELIUM MARKET DRIVERS

- ASIA-PACIFIC MYCELIUM MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC MYCELIUM MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA MYCELIUM MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN MYCELIUM MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA MYCELIUM MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA MYCELIUM MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA MYCELIUM MARKET SIZE & OPPORTUNITIES

- PHILIPPINES

- PHILIPPINES MYCELIUM MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM MYCELIUM MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND MYCELIUM MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC MYCELIUM MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD MYCELIUM MARKET DRIVERS

- REST OF WORLD MYCELIUM MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD MYCELIUM MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA MYCELIUM MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA MYCELIUM MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- BOLT THREADS

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BOTANIEX

- COMPANY OVERVIEW

- PRODUCT LIST

- CHINOVA BIOWORKS INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ECOVATIVE LLC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- GROUNDWORK BIOAG

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MEATI INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MOGU SRL

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MONAGHAN GROUP

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MYCORENA AB

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MYCOTECHNOLOGY INC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MYCOVATION

- COMPANY OVERVIEW

- PRODUCT LIST

- MYCOWORKS

- COMPANY OVERVIEW

- PRODUCT LIST

- NATURE’S FYND

- COMPANY OVERVIEW

- PRODUCT LIST

- PRIME ROOTS

- COMPANY OVERVIEW

- PRODUCT LIST

- QUORN

- COMPANY OVERVIEW

- PRODUCT LIST

- BOLT THREADS

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – MYCELIUM

TABLE 2: LEGISLATIONS IMPOSED ACROSS COUNTRIES FOR THE ADOPTION OF ECO-FRIENDLY PACKAGING

TABLE 3: GLOBAL MYCELIUM MARKET, BY TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL MYCELIUM MARKET, BY TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 5: GLOBAL RAW MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL RAW MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 7: GLOBAL PROCESSED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL PROCESSED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 9: GLOBAL MYCELIUM MARKET, BY PRODUCT FORM, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL MYCELIUM MARKET, BY PRODUCT FORM, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 11: GLOBAL PRE-FORMED PRODUCT MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL PRE-FORMED PRODUCT MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 13: GLOBAL POWDER MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL POWDER MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 15: GLOBAL TABLET AND CAPSULE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 16: GLOBAL TABLET AND CAPSULE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 17: GLOBAL OTHER PRODUCT FORMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL OTHER PRODUCT FORMS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 19: GLOBAL MYCELIUM MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL MYCELIUM MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 21: GLOBAL FOOD & BEVERAGE INDUSTRY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL FOOD & BEVERAGE INDUSTRY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 23: GLOBAL PACKAGING INDUSTRY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL PACKAGING INDUSTRY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 25: GLOBAL CLOTHING AND APPAREL INDUSTRY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL CLOTHING AND APPAREL INDUSTRY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 27: GLOBAL ANIMAL FEED INDUSTRY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL ANIMAL FEED INDUSTRY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 29: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 31: GLOBAL MYCELIUM MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 32: GLOBAL MYCELIUM MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 33: NORTH AMERICA MYCELIUM MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 34: NORTH AMERICA MYCELIUM MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 35: KEY PLAYERS OPERATING IN NORTH AMERICA MYCELIUM MARKET

TABLE 36: EUROPE MYCELIUM MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: EUROPE MYCELIUM MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: KEY PLAYERS OPERATING IN EUROPE MYCELIUM MARKET

TABLE 39: ASIA-PACIFIC MYCELIUM MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 40: ASIA-PACIFIC MYCELIUM MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 41: KEY PLAYERS OPERATING IN ASIA-PACIFIC MYCELIUM MARKET

TABLE 42: REST OF WORLD MYCELIUM MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: REST OF WORLD MYCELIUM MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 44: KEY PLAYERS OPERATING IN REST OF WORLD MYCELIUM MARKET

TABLE 45: LIST OF MERGERS & ACQUISITIONS

TABLE 46: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 47: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 48: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR UNITED KINGDOM

FIGURE 5: GROWTH PROSPECT MAPPING FOR JAPAN

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL MYCELIUM MARKET, GROWTH POTENTIAL, BY TYPE, IN 2022

FIGURE 10: GLOBAL MYCELIUM MARKET, BY RAW, 2023-2032 (IN $ MILLION)

FIGURE 11: GLOBAL MYCELIUM MARKET, BY PROCESSED, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL MYCELIUM MARKET, GROWTH POTENTIAL, BY PRODUCT FORM, IN 2022

FIGURE 13: GLOBAL MYCELIUM MARKET, BY PRE-FORMED PRODUCT, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL MYCELIUM MARKET, BY POWDER, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL MYCELIUM MARKET, BY TABLET AND CAPSULE, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL MYCELIUM MARKET, BY OTHER PRODUCT FORMS, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL MYCELIUM MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 18: GLOBAL MYCELIUM MARKET, BY FOOD & BEVERAGE INDUSTRY, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL MYCELIUM MARKET, BY PACKAGING INDUSTRY, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL MYCELIUM MARKET, BY CLOTHING AND APPAREL INDUSTRY, 2023-2032 (IN $ MILLION)

FIGURE 21: GLOBAL MYCELIUM MARKET, BY ANIMAL FEED INDUSTRY, 2023-2032 (IN $ MILLION)

FIGURE 22: GLOBAL MYCELIUM MARKET, BY OTHER END-USERS, 2023-2032 (IN $ MILLION)

FIGURE 23: NORTH AMERICA MYCELIUM MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 24: UNITED STATES MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 25: CANADA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 26: EUROPE MYCELIUM MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 27: UNITED KINGDOM MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: GERMANY MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: FRANCE MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: ITALY MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: SPAIN MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: POLAND MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: THE NETHERLANDS MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: REST OF EUROPE MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: ASIA-PACIFIC MYCELIUM MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 36: CHINA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: JAPAN MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: INDIA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: SOUTH KOREA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: INDONESIA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: PHILIPPINES MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: VIETNAM MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: AUSTRALIA & NEW ZEALAND MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: REST OF ASIA-PACIFIC MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: REST OF WORLD MYCELIUM MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 46: LATIN AMERICA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FIGURE 47: MIDDLE EAST & AFRICA MYCELIUM MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

In addition to China, South Korea is expected to experience potential growth in the global mycelium market due to the quality and technologically advanced mushroom cultivation and mycelium processing systems, from farming to storage and distribution.

Processed mycelium can be used as an alternative to foam, insulation, floorings, furniture, and panels in applications such as insulation, door cores, cabinetry, and other furnishings.

RELATED REPORTS

-

VIETNAM BABY DIAPER MARKET FORECAST 2025-2032

-

UNITED STATES BABY DIAPER MARKET FORECAST 2025-2032

-

THAILAND BABY DIAPER MARKET FORECAST 2025-2032

-

TAIWAN BABY DIAPER MARKET FORECAST 2025-2032

-

SOUTH AFRICA BABY DIAPER MARKET FORECAST 2025-2032

-

INDONESIA BABY DIAPER MARKET FORECAST 2025-2032

-

INDIA BABY DIAPER MARKET FORECAST 2025-2032

-

BRAZIL BABY DIAPER MARKET FORECAST 2025-2032

-

AUSTRALIA & NEW ZEALAND BABY DIAPER MARKET FORECAST 2025-2032

-

ALGERIA BABY DIAPER MARKET FORECAST 2025-2032