GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET FORECAST 2019-2028

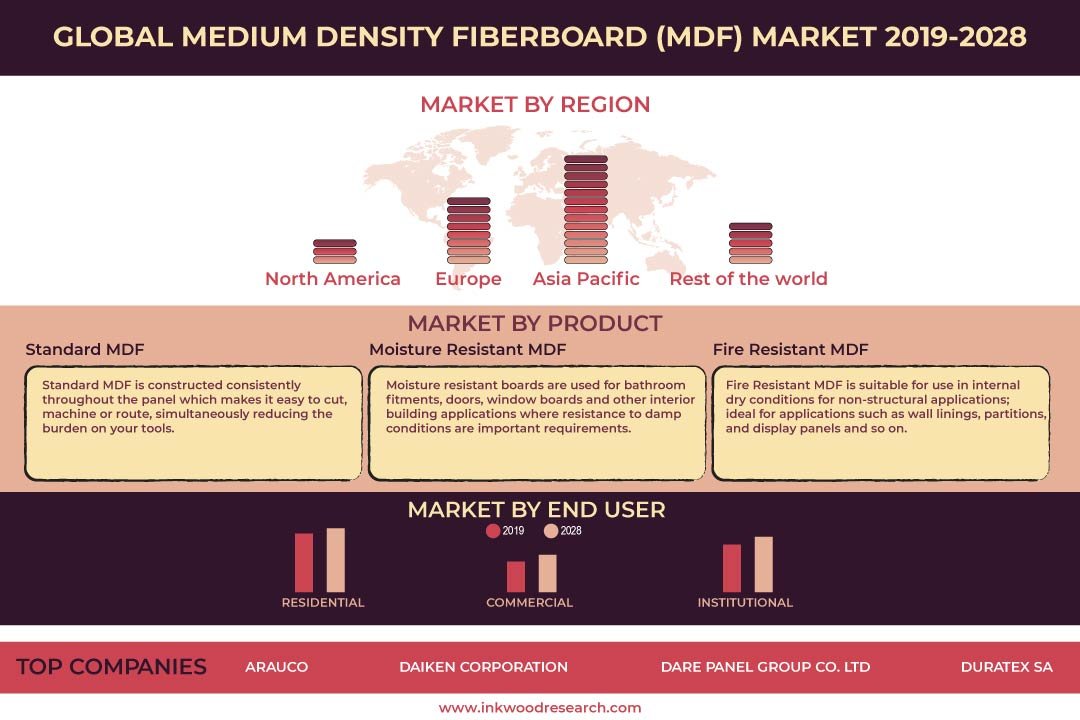

Global Medium Density Fiberboard (MDF) Market by Product (Standard MDF, Moisture-resistant MDF, Fire Resistant MDF) by Application (Cabinet, Flooring, Furniture, Molding, Door and Millwork, Packaging System, Other Applications) by End-user (Residential, Commercial, Institutional) and by Geography.

Inkwood Research anticipates that the global medium density fiberboard (MDF) market will reach 132.07 billion cubic meters by 2028, growing at a CAGR of 3.72% during the forecast period.

Medium density fiberboard is a factory-made wood product. It is similar to particleboard, which is made from fragments of wood that is mixed with gum, and then hard-pressed into sheets. The growing demand for MDF in the furniture industry is expected to drive the market growth. Moreover, the easy availability of raw materials is also expected to contribute to market growth.

To learn more about this report, request a free sample copy

Key factors driving the global medium density fiberboard (MDF) market growth:

- Rising demand for MDF for furniture

- MDF sheet is used as a substitute material for furniture construction, given its features like durability, resistance, and low production costs. It meets the needs and demands posed in relation to eco-friendly production in the furniture industry.

- According to a report published by the World Bank, the organized furniture industry is growing at a rate of 20% every year. This is expected to increase the demand for MDF in furniture manufacturing during the forecast period.

- Easy obtainability of raw materials

- Increasing importance of the production of specialty MDF in European regions

Key factors restraining market growth:

- Stern government regulations

- Several government regulations are expected to hamper the global MDF market growth during the forecast period.

- For Instance, The American National Standard for Medium Density Fiberboard categorizes MDF by mechanical and physical characteristics and recognizes product grades. The standard was established through the support of the Composite Panel Association (CPA), in combination with users and general interest groups.

The report scope of the global medium density fiberboard (MDF) market covers the segmentation analysis of product, application, and end-user.

Market by Product:

- Moisture Resistant MDF

- Standard MDF

- Standard MDF is set to dominate the product segment.

- Standard MDF can be dyed over to give them a wood-like look, and hence, can be used as an alternative for wood.

- It has a growing mandate in the furniture manufacturing industry due to its minimal costs. These aspects are expected to proliferate their demand during the forecast period.

- Fire Resistant MDF

Geographically, the global medium density fiberboard (MDF) market has been segmented based on four major regions, which includes:

- North America: the United States and Canada

- Europe: the United Kingdom, Germany, France, Netherlands, Spain, Italy, Belgium, Russia, Poland, Denmark, Sweden, and Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Malaysia, Thailand, Vietnam, and Rest of Asia Pacific

- The Asia Pacific is set to both dominate and lead the global market by 2028.

- By 2025, India is projected to account for 20% of the world’s working-age population.

- Also, for every dependent person (the elderly or children), it is projected that there will be two employable individuals in the working age.

- India’s demographic edge is expected to play a significant role in the country’s growth story over the medium term.

- It also emphasizes its attractiveness as an investment destination with an abundant supply of young and skilled labor.

- Rest of World: Latin America, the Middle East & Africa.

The major players in the global medium density fiberboard (MDF) market are:

- Arauco

- Daiken Corporation

- Dare Panel Group Co Ltd

- Duratex SA

- Others

Key strategies adopted by some of these companies:

In January 2019, Arauco Company announced the purchase of MASISA’s industrial assets in Mexico. It entails industrial complexes located in Zitácuaro and Durango.

Key trends of the global medium density fiberboard (MDF) market:

- The growing demand for readymade furniture is fueling the growth of the market.

- Moisture resistant MDF is projected to record the highest CAGR in the product segment.

- Increasing residential construction is fueling market demands.

Frequently Asked Questions & Answers (FAQ):

- Which is the major application in the medium density fiberboard (MDF) market?

A: Furniture is the major application in the medium density fiberboard (MDF) market.

- What has been the impact of COVID-19 on the global MDF industry?

A: Due to COVID-19, disruptions such as higher material costs, the dearth of supplies, and slower project completions are impacting the demand for MDF.

- Which region is projected to offer lucrative growth opportunities in the medium density fiberboard (MDF) market?

A: The Asia Pacific is set to offer lucrative growth opportunities in the medium density fiberboard (MDF) market.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- RISE IN DEMAND FOR MDF FOR FURNITURE

- EASY OBTAINABILITY OF RAW MATERIALS

- INCREASING IMPORTANCE OF PRODUCTION OF SPECIALTY MDF IN EUROPE

- KEY RESTRAINTS

- STERN GOVERNMENT REGULATIONS

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- IMPACT OF COVID-19 ON MEDIUM DENSITY FIBERBOARD (MDF) MARKET

- MARKET BY PRODUCT

- STANDARD MDF

- MOISTURE-RESISTANT MDF

- FIRE RESISTANT MDF

- MARKET BY APPLICATION

- CABINET

- FLOORING

- FURNITURE

- MOLDING, DOOR AND MILLWORK

- PACKAGING SYSTEM

- OTHER APPLICATIONS

- MARKET BY END-USER

- RESIDENTIAL

- COMMERCIAL

- INSTITUTIONAL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SPAIN

- DENMARK

- RUSSIA

- NETHERLANDS

- SWEDEN

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- MALAYSIA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ARAUCO

- DAIKEN CORPORATION

- DARE PANEL GROUP CO LTD

- DURATEX SA

- EGGER GROUP

- EUCATEX SA

- FANTONI SPA

- MASISA (GRUPO NUEVA COMPANY)

- KASTAMONU ENTEGRE

- KOROSTEN MDF MANUFACTURE

- KRONOPLUS LIMITED (KRONOSPAN LIMITED)

- NELSON PINE INDUSTRIES LIMITED (SUMITOMO FORESTRY CO. LTD)

- NORBORD INC

- ROSEBURG

- SWISS KRONO AG

TABLE LIST

TABLE 1: MARKET SNAPSHOT – MEDIUM DENSITY FIBERBOARD (MDF)

TABLE 2: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 3: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY PRODUCT, FORECAST YEARS, 2019-2028(IN MILLION CUBIC METERS)

TABLE 4: GLOBAL STANDARD MDF MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 5: GLOBAL STANDARD MDF MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 6: GLOBAL MOISTURE-RESISTANT MDF MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 7: GLOBAL MOISTURE-RESISTANT MDF MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 8: GLOBAL FIRE RESISTANT MDF MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 9: GLOBAL FIRE RESISTANT MDF MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 10: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 11: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 12: GLOBAL CABINET MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 13: GLOBAL CABINET MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 14: GLOBAL FLOORING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 15: GLOBAL FLOORING MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 16: GLOBAL FURNITURE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 17: GLOBAL FURNITURE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 18: GLOBAL MOLDING, DOOR AND MILLWORK MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 19: GLOBAL MOLDING, DOOR AND MILLWORK MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 20: GLOBAL PACKAGING SYSTEM MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 21: GLOBAL PACKAGING SYSTEM MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 22: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 23: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 24: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 25: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 26: GLOBAL RESIDENTIAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 27: GLOBAL RESIDENTIAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 28: GLOBAL COMMERCIAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 29: GLOBAL COMMERCIAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 30: GLOBAL INSTITUTIONAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 31: GLOBAL INSTITUTIONAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 32: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 33: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 34: NORTH AMERICA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 35: NORTH AMERICA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 36: EUROPE MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 37: EUROPE MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 38: ASIA PACIFIC MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 39: ASIA PACIFIC MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

TABLE 40: REST OF WORLD MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN MILLION CUBIC METERS)

TABLE 41: REST OF WORLD MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2019

FIGURE 6: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY STANDARD MDF, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 7: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY MOISTURE-RESISTANT MDF, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 8: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY FIRE RESISTANT MDF, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 9: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2019

FIGURE 10: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY CABINET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 11: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY FLOORING, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 12: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY FURNITURE, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 13: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY MOLDING, DOOR AND MILLWORK, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 14: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY PACKAGING SYSTEM, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 15: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY OTHER APPLICATIONS, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 16: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 17: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY RESIDENTIAL, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 18: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY COMMERCIAL, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 19: GLOBAL MEDIUM DENSITY FIBERBOARD (MDF) MARKET, BY INSTITUTIONAL, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 20: NORTH AMERICA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 21: UNITED STATES MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 22: CANADA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 23: EUROPE MEDIUM DENSITY FIBERBOARD (MDF) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 24: UNITED KINGDOM MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 25: GERMANY MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 26: FRANCE MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 27: ITALY MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 28: SPAIN MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028(IN MILLION CUBIC METERS)

FIGURE 29: DENMARK MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 30: RUSSIA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 31: NETHERLANDS MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 32: SWEDEN MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 33: BELGIUM MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 34: POLAND MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 35: REST OF EUROPE MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 36: ASIA PACIFIC MEDIUM DENSITY FIBERBOARD (MDF) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 37: CHINA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 38: JAPAN MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 39: INDIA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 40: SOUTH KOREA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 41: INDONESIA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 42: THAILAND MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 43: VIETNAM MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 44: MALAYSIA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 45: REST OF ASIA PACIFIC MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 46: REST OF WORLD MEDIUM DENSITY FIBERBOARD (MDF) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 47: LATIN AMERICA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

FIGURE 48: MIDDLE EAST & AFRICA MEDIUM DENSITY FIBERBOARD (MDF) MARKET, 2019-2028 (IN MILLION CUBIC METERS)

- MARKET BY PRODUCT

- STANDARD MDF

- MOISTURE-RESISTANT MDF

- FIRE RESISTANT MDF

- MARKET BY APPLICATION

- CABINET

- FLOORING

- FURNITURE

- MOLDING, DOOR AND MILLWORK

- PACKAGING SYSTEM

- OTHER APPLICATIONS

- MARKET BY END-USER

- RESIDENTIAL

- COMMERCIAL

- INSTITUTIONAL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- SPAIN

- DENMARK

- RUSSIA

- NETHERLANDS

- SWEDEN

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- MALAYSIA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.