GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET FORECAST 2020-2025

Inkwood Research estimates that the global laser direct structure antenna market, valued at $417.84 million in 2019, is expected to reach $1246.45 million by 2025, projecting a CAGR of 20.06% during the forecast period. The base year considered for the market study is 2019. The forecasted period is between 2020-2025.

The global laser direct structure antenna market growth is boosted by the following factors:

- Rising demand for miniaturization in the consumer electronics industry

- Growing demand for devices with higher antenna ranges and IOT

To know more about this report, request a free sample copy.

With the wave of the connected ecosystem, improved antenna facilities for laptops, tablets, and ultra-books are anticipated to be instrumental in augmenting the growth of the market. The gaming console and AR/VR markets have also observed a significant adoption of the LDS antenna. This strong growth of the AR/VR market and increased sales of gaming consoles, during the forecast period, is expected to augment the growth of the connected devices, and hence, the studied market too. The increasing health concerns are also forcing the consumers to adopt smartwatches, which is further expanding the customer base. Notable watch manufacturers, such as Garmin, Fitbit, Armani, etc., have all released new smartwatches to cater to the growing demand, while leading OEMs, like Fitbit and Apple, are offering smartwatches with advanced capabilities.

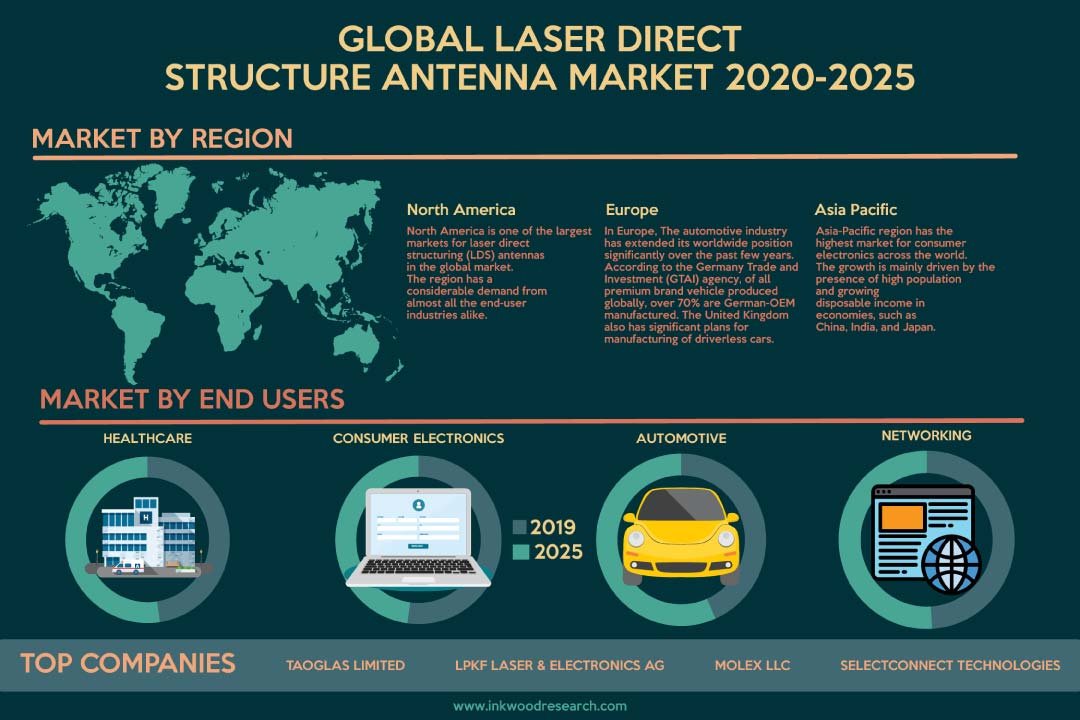

In 2019, the dominating end-user segment was consumer electronics in terms of revenue in the global laser direct structure antenna market with around 61.48% of market share. LDS antennas are extensively used in wearables, gaming consoles, smartphones, laptops, tablets, and accessories. Smartwatches are witnessing widespread adoption and recognition, with leading vendors actively investing in developing newer and more compact watches, with better hardware when compared to the previous iteration. Wearables such as smartwatch also help parents in keeping track of their kids, along with giving them reminders, just like a personal assistant.

The automotive segment is anticipated to grow at the highest CAGR of around 25.37% during the forecast period. Many important automotive applications are utilizing laser direct structuring of 3D MIDs to increase reliability and reduce weight. Modern automobiles have a lot of electronic components in them. LDS is finding major applications in advanced driver-assistance systems (ADAS) for self-driving cars. The demand for ADAS is expected to increase, primarily fuelled by regulatory reforms and consumer interest in safety applications that reduce accidents and protect drivers.

On the other hand, the global laser direct structure antenna market growth is restricted by manufacturing complexity and lack of awareness associated with molded interconnect devices (MID). There is a lack of higher technological expertise as well as a lack of awareness, limiting the widespread adoption of LDS technology. Vendors offering MID products are limited, which are some major factors challenging the studied market growth over the forecast period. In comparison to other processes, LDS is considered as the better method, though there is a need for development, especially regarding the accuracy, quality, as compared to the 2D and 3D normal and micro products, especially with the limited or decline in information for scientific research and industry.

The report on the global laser direct structure antenna market covers the segmentation analysis of end-user.

Market by End-user:

- Healthcare

- Consumer Electronics

- Automotive

- Networking

- Other

Geographically, the global laser direct structure antenna market has been segmented into four major regions:

- North America: the United States and Canada

- Europe: the United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and the Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and the Rest of Asia Pacific

- Rest of World: Latin America, the Middle East & Africa

In 2019, Asia Pacific captured the largest market share of 50.88% in terms of revenue, and is also anticipated to be the fastest-growing region with a CAGR of 21.89% during the forecast period. Asia Pacific region has the highest market for consumer electronics across the world. Companies, such as Samsung, are launching new products to gain a competitive edge. For instance, the company launched its next generation smart wearable devices, the Gear Sport and the Gear Fit 2 Pro. The growth is mainly driven by the growing disposable income in economies and the presence of highly populated countries, such as India, China, and Japan. Wearable medical devices are taking hold across the countries, transforming healthcare by facilitating personalization and convenience.

Some of the eminent players in the global laser direct structure antenna market are:

- Taoglas Limited

- Molex LLC

- Lpkf laser & Electronics AG

- TE Connectivity Ltd

- Others

In March 2019, Taoglas launched Taoglas iDAS antennas designed for use in iDAS to increase constant indoor connectivity.

Key findings of the global laser direct structure antenna market are:

- The Asia Pacific region leads the global laser direct structure antenna market by capturing the largest market share of around 50.88% in 2019.

- Smartwatches are propelling the demand for laser direct structure antennas.

- China is both a huge market for the IoT and a major supplier of the component technologies.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- RISING DEMAND FOR MINIATURIZATION IN THE CONSUMER ELECTRONICS INDUSTRY

- GROWING DEMAND FOR DEVICES WITH HIGHER ANTENNA RANGES AND IOT

- KEY RESTRAINTS

- MANUFACTURING COMPLEXITY AND LACK OF AWARENESS ASSOCIATED WITH MOLDED INTERCONNECT DEVICES (MID)

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY END-USER

- HEALTHCARE

- CONSUMER ELECTRONICS

- AUTOMOTIVE

- NETWORKING

- OTHER

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- TAOGLAS LIMITED

- MOLEX LLC

- LPKF LASER & ELECTRONICS AG

- SELECTCONNECT TECHNOLOGIES

- TE CONNECTIVITY LTD

- PULSE ELECTRONICS CORPORATION(YAGEO CORPORATION)

- AMPHENOL CORPORATION

- TONGDA GROUP HOLDINGS LIMITED

- SHENZHEN SUNWAY COMMUNICATION CO LTD

- LUXSHARE PRECISION INDUSTRY CO LTD

- HARTING TECHNOLOGY GROUP

- HUIZHOU SPEED WIRELESS TECHNOLOGY CO LTD

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – LASER DIRECT STRUCTURE ANTENNA

TABLE 2: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY END-USER, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 4: GLOBAL HEALTHCARE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: GLOBAL HEALTHCARE MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 6: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL CONSUMER ELECTRONICS MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 8: GLOBAL AUTOMOTIVE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL AUTOMOTIVE MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 10: GLOBAL NETWORKING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL NETWORKING MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 12: GLOBAL OTHER MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL OTHER MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 14: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY GEOGRAPHY, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 16: NORTH AMERICA LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: NORTH AMERICA LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 18: EUROPE LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: EUROPE LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 20: ASIA PACIFIC LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: ASIA PACIFIC LASER DIRECT STRUCTURE ANTENNA MARKET, BY COUNTRY, FORECAST YEARS, 2020-2025 (IN $ MILLION)

TABLE 22: REST OF WORLD LASER DIRECT STRUCTURE ANTENNA MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: REST OF WORLD LASER DIRECT STRUCTURE ANTENNA MARKET, BY REGION, FORECAST YEARS, 2020-2025 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 6: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY HEALTHCARE, 2020-2025 (IN $ MILLION)

FIGURE 7: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY CONSUMER ELECTRONICS, 2020-2025 (IN $ MILLION)

FIGURE 8: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY AUTOMOTIVE, 2020-2025 (IN $ MILLION)

FIGURE 9: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY NETWORKING, 2020-2025 (IN $ MILLION)

FIGURE 10: GLOBAL LASER DIRECT STRUCTURE ANTENNA MARKET, BY OTHER, 2020-2025 (IN $ MILLION)

FIGURE 11: NORTH AMERICA LASER DIRECT STRUCTURE ANTENNA MARKET, REGIONAL OUTLOOK, 2019 & 2025 (IN %)

FIGURE 12: UNITED STATES LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 13: CANADA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 14: EUROPE LASER DIRECT STRUCTURE ANTENNA MARKET, REGIONAL OUTLOOK, 2019 & 2025 (IN %)

FIGURE 15: UNITED KINGDOM LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 16: GERMANY LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 17: FRANCE LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 18: ITALY LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 19: RUSSIA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 20: BELGIUM LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 21: POLAND LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 22: REST OF EUROPE LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 23: ASIA PACIFIC LASER DIRECT STRUCTURE ANTENNA MARKET, REGIONAL OUTLOOK, 2019 & 2025 (IN %)

FIGURE 24: CHINA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 25: JAPAN LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 26: INDIA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 27: SOUTH KOREA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 28: INDONESIA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 29: THAILAND LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 30: VIETNAM LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 31: AUSTRALIA & NEW ZEALAND LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 32: REST OF ASIA PACIFIC LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 33: REST OF WORLD LASER DIRECT STRUCTURE ANTENNA MARKET, REGIONAL OUTLOOK, 2019 & 2025 (IN %)

FIGURE 34: LATIN AMERICA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

FIGURE 35: MIDDLE EAST & AFRICA LASER DIRECT STRUCTURE ANTENNA MARKET, 2020-2025 (IN $ MILLION)

- MARKET BY END-USER

- HEALTHCARE

- CONSUMER ELECTRONICS

- AUTOMOTIVE

- NETWORKING

- OTHER

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.