GLOBAL INDUSTRIAL FURNACE MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

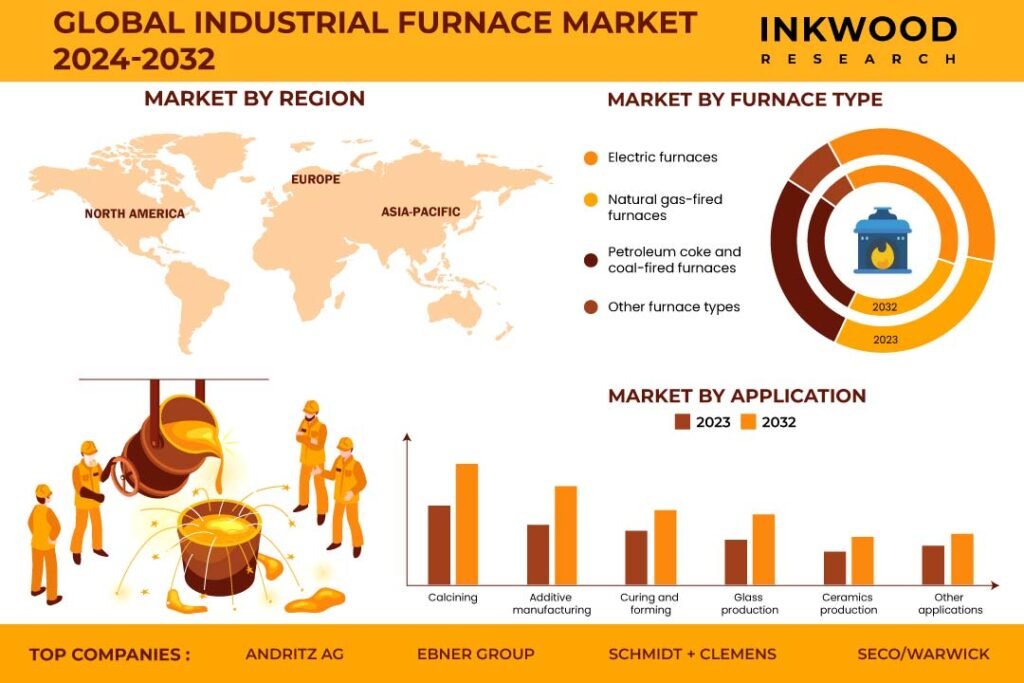

Global Industrial Furnace Market by Furnace Type (Electric Furnaces, Natural Gas-fired Furnaces, Petroleum Coke and Coal-fired Furnaces, Other Furnace Types) Market by Arrangement (Box Type, Tube or Clamshell Type, Top Loading Furnace, Bottom Loading and Car Bottom Furnace, Other Arrangements) Market by Mode of Operation (Batch Type, Continuous Type) Market by Application (Calcining, Additive Manufacturing, Curing and Forming, Glass Production, Ceramics Production, Other Applications) by Geography

REPORTS » CHEMICALS AND MATERIALS » ADVANCED MATERIALS » GLOBAL INDUSTRIAL FURNACE MARKET FORECAST 2024-2032

MARKET OVERVIEW

The global industrial furnace market was valued at $12154.14 million in 2023 and is expected to reach $18507.33 million by 2032, growing at a CAGR of 4.70% during the forecast period 2024-2032. The study’s base year is 2023, and the estimated period is between 2024 and 2032.

The industrial furnace industry is essential for supporting manufacturing processes across diverse sectors. It provides high-temperature thermal processing solutions for industries ranging from automotive and aerospace to metal production and ceramics. The market continues to evolve, driven by the demand for energy-efficient and high-performance furnaces capable of meeting stringent quality standards and environmental regulations.

Further, the domain is experiencing steady growth, driven by the demand for industrial furnaces across various sectors. This highlights the importance of focusing on reliable industrial furnace manufacturers and suppliers to meet the growing need for high-quality industrial furnace equipment. The types of industrial furnaces vary based on their fuel source and function, with common types including industrial electric furnaces and gas/fuel-operated models.

These furnaces play a crucial role in processing materials in industries such as automotive, aerospace, and agriculture (for equipment). They are also integral to defense equipment manufacturing. Regular industrial furnace maintenance is critical to ensure smooth operation and optimal performance. Determining how often furnace maintenance is needed depends on the specific furnace and usage patterns. Additionally, reliable industrial furnace service providers can assist with maintenance plans and ensure furnaces function efficiently.

Leading industrial furnace suppliers offer furnace solutions customized to specific industries, like the industrial furnace for agriculture equipment. It is used in processes like drying and heating agricultural products. Simultaneously, the industrial furnace for defense equipment caters to the unique requirements of the defense sector, including applications like metal casting and heat treatment.

Read our latest blog on the Industrial Furnace Market

GROWTH ENABLERS

Key growth enablers of the global industrial furnace market:

- Expansion of industrialization & furnace demand

- Rising demand for metals in diverse industries

- A rapid increase in the automotive and construction sectors has fueled the demand for a large volume of sheet metals in China and India. The sheet metal processing market in Asia-Pacific is projected to grow at a substantial CAGR during the forecast period.

- Metallurgy & chemical industry growth fuel furnace demand

- Rising technological innovations

GROWTH RESTRAINTS

Key growth restraining factors of the global industrial furnace market:

- Capital burden of industrial furnaces

- The price of industrial furnaces can vary significantly depending on the manufacturer. Factors such as technology and the quality of steel used contribute to these variations. Additionally, additional components like walking beams, charging conveyors, igniters, pushers, hoppers, gas valves, burners, and heat exchangers can also contribute to higher costs within an industrial furnace.

- Regulatory complexity in industrial furnace manufacturing amidst rising emission standards

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Industrial Furnace Market | Top Market Trends

- Ongoing technological advancements in industrial heating equipment are driving new business trends aimed at mitigating carbon emissions. The rapid adoption of Industry 4.0 technologies is expected to increase demand for improved process heating technologies. Advancements in process heating systems also contribute to this growing demand. This includes advanced sensors and control systems related to combustion products and the development of integrated heating systems.

- Lightweight metals are known for their high strength-to-weight ratio, making them invaluable for applications where weight reduction is crucial. The automotive industry is particularly focused on creating lightweight vehicles to lower carbon emissions and enhance fuel efficiency. Metals like magnesium and aluminum are known for their lightweight properties. They are replacing traditional heavier materials and driving the demand for such lightweight metals.

MARKET SEGMENTATION

Market Segmentation – Furnace Type, Arrangement, Mode of Operation, and Application –

Market by Furnace Type:

- Electric Furnaces

- Natural Gas-Fired Furnaces

- Petroleum Coke and Coal-Fired Furnaces

- Other Furnace Types

Market by Arrangement:

- Box Type

- Tube or Clamshell Type

- Top Loading Furnace

- Bottom Loading and Car Bottom Furnace

- Other Arrangements

Market by Mode of Operation:

- Batch Type

- Continuous Type

Market by Application:

- Calcining

- In 2023, the calcining segment dominated the application category.

- Calcination refers to the heating of metal ore to high temperatures in the absence or limited supply of air or oxygen.

- This process is widely used in industrial applications across mineral processing, recycling, and manufacturing industries. The extensive use of furnaces for calcination in various sectors will increase demand for industrial furnaces, thereby driving market growth.

- Additive Manufacturing

- Curing and Forming

- Glass Production

- Ceramics Production

- Other Applications

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Belgium, Poland, and Rest of Europe

- In 2023, Europe was the dominating region.

- The countries in Europe are significantly focused on boosting industrial production, supported by a robust expansion of the manufacturing sector. This emphasis is driving the growth of the industrial furnace market in the region.

- Further, the rising demand for steel in Europe presents new business opportunities for installing furnaces.

- Asia-Pacific: China, Japan, India, South Korea, Australia & New Zealand, Thailand, Indonesia, Vietnam, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global industrial furnace market:

- Andritz AG

- Carbolite Gero Limited

- Gasbarre Products Inc

- International Thermal Systems

- NUTEC Group (NUTEC Bickley)

- Schmidt + Clemens

- SECO/WARWICK

- Stericox India Private Limited

- Thermal Product Solutions (TPS)

Key strategies adopted by some of these companies:

- Metsa Group and Andritz announced plans in March 2024 to construct a demo plant for developing new lignin products.

- Jupiter Aluminum Industries, JUPALCO, ordered three Vortex furnaces for annealing aluminum coils from SECO/WARWICK in March 2024. These solutions are equipped with an effective, recently patented Vortex 2.0 system.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Furnace Type, Arrangement, Mode of Operation, and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Andritz AG, Carbolite Gero Limited, Gasbarre Products Inc, International Thermal Systems, NUTEC Group (NUTEC Bickley), Schmidt + Clemens, SECO/WARWICK, Stericox India Private Limited, Thermal Product Solutions (TPS), Advance Furnace Technologies, EBNER Group, Epcon Industrial Systems LP, Inductotherm Europe Ltd, Mahler GmbH, Thermcraft Incorporated |

TABLE OF CONTENTS

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON INDUSTRIAL FURNACE MARKET

- IMPACT OF RUSSIA-UKRAINE WAR ON INDUSTRIAL FURNACE MARKET

- MAJOR MARKET FINDINGS

- ELECTRIC FURNACES ARE THE WIDELY USED FURNACE TYPE

- TUBE OR CLAMSHELL TYPE IS THE FASTEST-GROWING INDUSTRIAL FURNACE ARRANGEMENT

- BATCH TYPE IS THE MAJORLY USED MODE OF OPERATION

- ADDITIVE MANUFACTURING IS THE FASTEST-GROWING INDUSTRIAL FURNACE APPLICATION

MARKET DYNAMICS

- KEY DRIVERS

- EXPANSION OF INDUSTRIALIZATION & FURNACE DEMAND

- RISING DEMAND FOR METALS IN DIVERSE INDUSTRIES

- METALLURGY & CHEMICAL INDUSTRY GROWTH FUEL FURNACE DEMAND

- RISING TECHNOLOGICAL INNOVATIONS

- KEY RESTRAINTS

- CAPITAL BURDEN OF INDUSTRIAL FURNACES

- REGULATORY COMPLEXITY IN INDUSTRIAL FURNACE MANUFACTURING AMIDST RISING EMISSION STANDARDS

- KEY DRIVERS

KEY ANALYTICS

- KEY MARKET TRENDS

- INDUSTRIAL DRIVE TOWARDS ENERGY EFFICIENCY AND SUSTAINABILITY

- EXPANDING OPPORTUNITIES IN ADVANCED AND SPECIALTY FURNACES SECTOR

- RISE OF LIGHTWEIGHT MATERIALS IN INDUSTRIAL APPLICATIONS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR POLAND

- GROWTH PROSPECT MAPPING FOR INDIA

- GROWTH PROSPECT MAPPING FOR VIETNAM

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIAL SUPPLIERS

- COMPONENT PROVIDERS

- INDUSTRIAL FURNACE MANUFACTURERS

- END-USERS

- AFTERMARKET SERVICES

- REGULATORY FRAMEWORK

- KEY BUYING CRITERIA

- OPERATING TEMPERATURE

- EXTERIOR MATERIAL

- INSULATION

- TEMPERATURE CONTROLLER

- CHAMBER DESIGN

- MUFFLES

- ATMOSPHERE/MOISTURE CONTROLS

- SUSTAINABILITY OVERVIEW

- ENVIRONMENT IMPACT

- SOCIAL IMPACT

- GOVERNMENT IMPACT

- CASE STUDY

- KEY MARKET TRENDS

MARKET BY FURNACE TYPE

- ELECTRIC FURNACES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NATURAL GAS-FIRED FURNACES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PETROLEUM COKE AND COAL-FIRED FURNACES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER FURNACE TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ELECTRIC FURNACES

MARKET BY ARRANGEMENT

- BOX TYPE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TUBE OR CLAMSHELL TYPE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- TOP LOADING FURNACE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BOTTOM LOADING AND CAR BOTTOM FURNACE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER ARRANGEMENTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BOX TYPE

MARKET BY MODE OF OPERATION

- BATCH TYPE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CONTINUOUS TYPE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BATCH TYPE

MARKET BY APPLICATION

- CALCINING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ADDITIVE MANUFACTURING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CURING AND FORMING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- GLASS PRODUCTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CERAMICS PRODUCTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CALCINING

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA INDUSTRIAL FURNACE MARKET DRIVERS

- NORTH AMERICA INDUSTRIAL FURNACE MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA INDUSTRIAL FURNACE MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE INDUSTRIAL FURNACE MARKET DRIVERS

- EUROPE INDUSTRIAL FURNACE MARKET CHALLENGES

- KEY PLAYERS IN EUROPE INDUSTRIAL FURNACE MARKET

- COUNTRY ANALYSIS

- GERMANY

- GERMANY INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- UNITED KINGDOM INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- GERMANY

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC INDUSTRIAL FURNACE MARKET DRIVERS

- ASIA-PACIFIC INDUSTRIAL FURNACE MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC INDUSTRIAL FURNACE MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD INDUSTRIAL FURNACE MARKET DRIVERS

- REST OF WORLD INDUSTRIAL FURNACE MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD INDUSTRIAL FURNACE MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA INDUSTRIAL FURNACE MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY MARKET STRATEGIES

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ANDRITZ AG

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- ADVANCE FURNACE TECHNOLOGIES

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- CARBOLITE GERO LIMITED

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- EBNER GROUP

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- EPCON INDUSTRIAL SYSTEMS LP

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- GASBARRE PRODUCTS INC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- INDUCTOTHERM EUROPE LTD

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- INTERNATIONAL THERMAL SYSTEMS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- MAHLER GMBH

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- NUTEC GROUP (NUTEC BICKLEY)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- SCHMIDT + CLEMENS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- SECO/WARWICK

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- STERICOX INDIA PRIVATE LIMITED

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- THERMAL PRODUCT SOLUTIONS (TPS)

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRENGTHS & CHALLENGES

- THERMCRAFT INCORPORATED

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- ANDRITZ AG

- KEY MARKET STRATEGIES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – INDUSTRIAL FURNACE

TABLE 2: GLOBAL INDUSTRIAL FURNACE MARKET, BY FURNACE TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL INDUSTRIAL FURNACE MARKET, BY FURNACE TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL ELECTRIC FURNACES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL ELECTRIC FURNACES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL NATURAL GAS-FIRED FURNACES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL NATURAL GAS-FIRED FURNACES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL PETROLEUM COKE AND COAL-FIRED FURNACES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL PETROLEUM COKE AND COAL-FIRED FURNACES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL OTHER FURNACE TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL OTHER FURNACE TYPES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL INDUSTRIAL FURNACE MARKET, BY ARRANGEMENT, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL INDUSTRIAL FURNACE MARKET, BY ARRANGEMENT, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL BOX TYPE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL BOX TYPE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL TUBE OR CLAMSHELL TYPE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL TUBE OR CLAMSHELL TYPE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL TOP LOADING FURNACE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL TOP LOADING FURNACE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL BOTTOM LOADING AND CAR BOTTOM FURNACE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL BOTTOM LOADING AND CAR BOTTOM FURNACE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL OTHER ARRANGEMENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL OTHER ARRANGEMENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL INDUSTRIAL FURNACE MARKET, BY MODE OF OPERATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL INDUSTRIAL FURNACE MARKET, BY MODE OF OPERATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL BATCH TYPE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL BATCH TYPE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: GLOBAL CONTINUOUS TYPE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL CONTINUOUS TYPE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: GLOBAL INDUSTRIAL FURNACE MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL INDUSTRIAL FURNACE MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 32: GLOBAL CALCINING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL CALCINING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: GLOBAL ADDITIVE MANUFACTURING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL ADDITIVE MANUFACTURING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: GLOBAL CURING AND FORMING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL CURING AND FORMING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 38: GLOBAL GLASS PRODUCTION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL GLASS PRODUCTION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 40: GLOBAL CERAMICS PRODUCTION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL CERAMICS PRODUCTION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 44: GLOBAL INDUSTRIAL FURNACE MARKET, BY REGIONAL OUTLOOK, HISTORICAL YEARS, 2020-2023 (IN $ MILLION)

TABLE 45: GLOBAL INDUSTRIAL FURNACE MARKET, BY REGIONAL OUTLOOK, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 46: NORTH AMERICA INDUSTRIAL FURNACE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: NORTH AMERICA INDUSTRIAL FURNACE MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 48: KEY PLAYERS OPERATING IN NORTH AMERICA INDUSTRIAL FURNACE MARKET

TABLE 49: EUROPE INDUSTRIAL FURNACE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 50: EUROPE INDUSTRIAL FURNACE MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 51: KEY PLAYERS OPERATING IN EUROPE INDUSTRIAL FURNACE MARKET

TABLE 52: ASIA-PACIFIC INDUSTRIAL FURNACE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 53: ASIA-PACIFIC INDUSTRIAL FURNACE MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 54: KEY PLAYERS OPERATING IN ASIA-PACIFIC INDUSTRIAL FURNACE MARKET

TABLE 55: REST OF WORLD INDUSTRIAL FURNACE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 56: REST OF WORLD INDUSTRIAL FURNACE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 57: KEY PLAYERS OPERATING IN REST OF WORLD INDUSTRIAL FURNACE MARKET

TABLE 58: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 59: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 60: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR POLAND

FIGURE 4: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 5: GROWTH PROSPECT MAPPING FOR VIETNAM

FIGURE 6: MARKET MATURITY ANALYSIS

FIGURE 7: MARKET CONCENTRATION ANALYSIS

FIGURE 8: VALUE CHAIN ANALYSIS

FIGURE 9: KEY BUYING CRITERIA

FIGURE 10: GLOBAL INDUSTRIAL FURNACE MARKET, GROWTH POTENTIAL, BY FURNACE TYPE, IN 2023

FIGURE 11: GLOBAL INDUSTRIAL FURNACE MARKET, BY ELECTRIC FURNACES, 2024-2032 (IN $ MILLION)

FIGURE 12: GLOBAL INDUSTRIAL FURNACE MARKET, BY NATURAL GAS-FIRED FURNACES, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL INDUSTRIAL FURNACE MARKET, BY PETROLEUM COKE AND COAL-FIRED FURNACES, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL INDUSTRIAL FURNACE MARKET, BY OTHER FURNACE TYPES, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL INDUSTRIAL FURNACE MARKET, GROWTH POTENTIAL, BY ARRANGEMENT, IN 2023

FIGURE 16: GLOBAL INDUSTRIAL FURNACE MARKET, BY BOX TYPE, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL INDUSTRIAL FURNACE MARKET, BY TUBE OR CLAMSHELL TYPE, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL INDUSTRIAL FURNACE MARKET, BY TOP LOADING FURNACE, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL INDUSTRIAL FURNACE MARKET, BY BOTTOM LOADING AND CAR BOTTOM FURNACE, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL INDUSTRIAL FURNACE MARKET, BY OTHER ARRANGEMENTS, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL INDUSTRIAL FURNACE MARKET, GROWTH POTENTIAL, BY MODE OF OPERATION, IN 2023

FIGURE 22: GLOBAL INDUSTRIAL FURNACE MARKET, BY BATCH TYPE, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL INDUSTRIAL FURNACE MARKET, BY CONTINUOUS TYPE, 2024-2032 (IN $ MILLION)

FIGURE 24: GLOBAL INDUSTRIAL FURNACE MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2023

FIGURE 25: GLOBAL INDUSTRIAL FURNACE MARKET, BY CALCINING, 2024-2032 (IN $ MILLION)

FIGURE 26: GLOBAL INDUSTRIAL FURNACE MARKET, BY ADDITIVE MANUFACTURING, 2024-2032 (IN $ MILLION)

FIGURE 27: GLOBAL INDUSTRIAL FURNACE MARKET, BY CURING AND FORMING, 2024-2032 (IN $ MILLION)

FIGURE 28: GLOBAL INDUSTRIAL FURNACE MARKET, BY GLASS PRODUCTION, 2024-2032 (IN $ MILLION)

FIGURE 29: GLOBAL INDUSTRIAL FURNACE MARKET, BY CERAMICS PRODUCTION, 2024-2032 (IN $ MILLION)

FIGURE 30: GLOBAL INDUSTRIAL FURNACE MARKET, BY OTHER APPLICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 31: NORTH AMERICA INDUSTRIAL FURNACE MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 32: UNITED STATES INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: CANADA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 34: EUROPE INDUSTRIAL FURNACE MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 35: GERMANY INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: UNITED KINGDOM INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: FRANCE INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: ITALY INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: SPAIN INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: BELGIUM INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: POLAND INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: REST OF EUROPE INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: ASIA-PACIFIC INDUSTRIAL FURNACE MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 44: CHINA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: JAPAN INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 46: INDIA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 47: AUSTRALIA & NEW ZEALAND INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 48: SOUTH KOREA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: INDONESIA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 50: THAILAND INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 51: VIETNAM INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 52: REST OF ASIA-PACIFIC INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 53: REST OF WORLD INDUSTRIAL FURNACE MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 54: LATIN AMERICA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FIGURE 55: MIDDLE EAST & AFRICA INDUSTRIAL FURNACE MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

The global industrial furnace market is anticipated to generate a revenue of $18507.33 million in 2032.

Electric furnaces is projected to be the fastest-growing furnace type in the global industrial furnace market over the forecast period.

In 2023, calcining held the largest share in the global industrial furnace market by asserting a share of more than 25%.

RELATED REPORTS

-

GLOBAL FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

ASIA-PACIFIC FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

EUROPE FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

NORTH AMERICA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

UNITED STATES FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GERMANY FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

INDIA FLEXIBLE PLASTIC PACKAGING MARKET FORECAST 2024-2032

-

GLOBAL HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

CHINA HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032

-

GERMANY HIGH-PERFORMANCE CERAMIC COATINGS MARKET FORECAST 2024-2032