GLOBAL INDUSTRIAL BIOMASS BOILER MARKET FORECAST 2025-2032

SCOPE OF THE REPORT

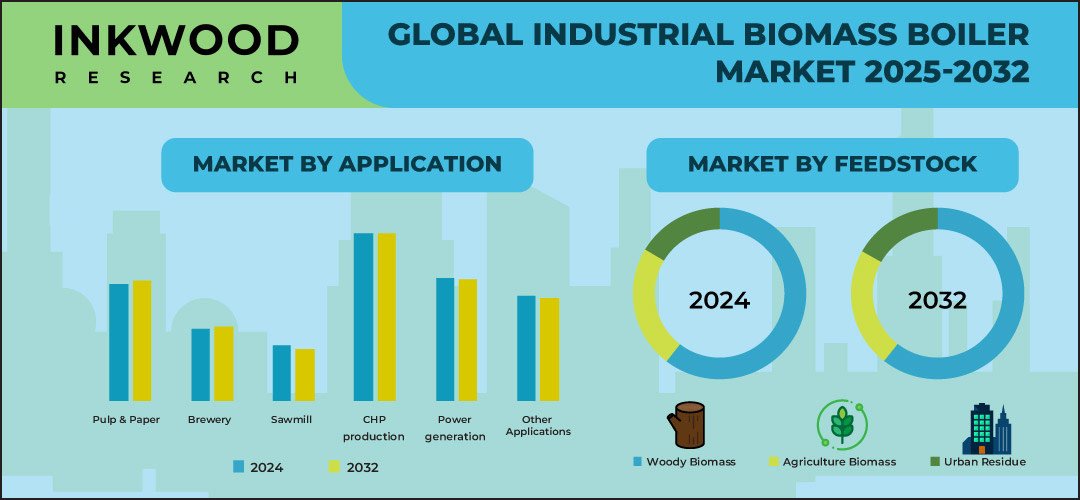

Global Industrial Biomass Boiler Market by Feedstock (Woody Biomass, Agriculture Biomass, Urban Residue) Market by Capacity (2-10 MW, 10-25 MW, 25-50 MW) Market by Application (Combined Heat and Power (CHP) Production, Pulp & Paper, Power Generation, Sawmill, Brewery, Other Applications) Market by Type (Stoker Boilers, Fluidized Bed Boilers) by Geography

REPORTS » ENERGY, POWER & UTILITIES » BIOFUELS » GLOBAL INDUSTRIAL BIOMASS BOILER MARKET FORECAST 2025-2032

MARKET OVERVIEW

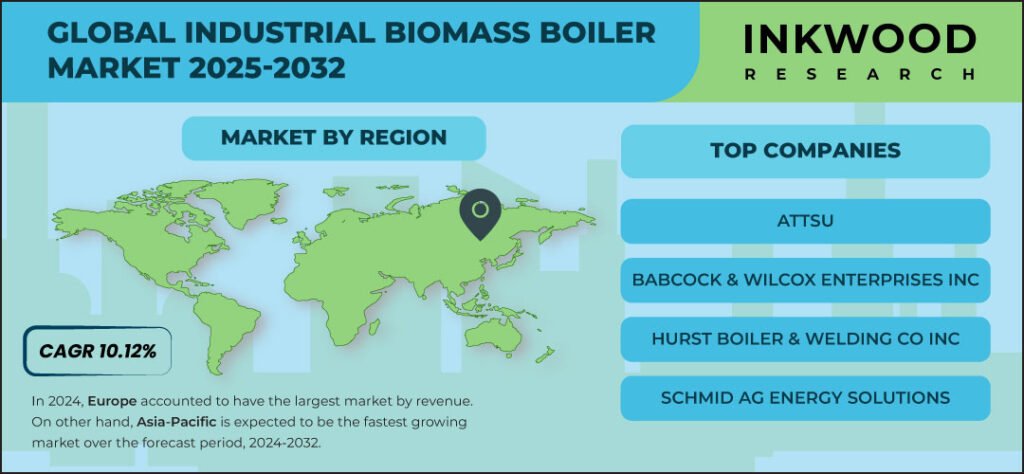

The global industrial biomass boiler market is expected to reach $29081.55 million by 2032, growing at a CAGR of 10.12% during the forecast period, 2025-2032. The base year considered for the study is 2024, and the estimated period is between 2025 and 2032. The market study has also analyzed the impact of COVID-19 and the Russia-Ukraine war on the industrial biomass boiler market qualitatively as well as quantitatively.

The global industrial biomass boiler market is witnessing robust growth as industries increasingly adopt biomass energy systems for cleaner and sustainable operations. These systems harness renewable resources such as wood, agricultural residues, and urban waste, aligning with global efforts to reduce carbon emissions. The demand for eco-friendly industrial boilers is fueled by stringent environmental regulations and the growing need for energy-efficient solutions in manufacturing, power generation, and other industrial sectors.

Industrial biomass energy solutions offer a dual advantage of cost-effectiveness and reduced dependency on fossil fuels, driving adoption across industries like pulp & paper, food & beverage, and chemical processing. Key players in the market are innovating to enhance the efficiency and reliability of these systems, enabling industries to meet their energy requirements sustainably. Moreover, the rising focus on biomass energy production is supported by government incentives and subsidies, particularly in regions like Europe and Asia-Pacific.

The market also reflects increasing interest in industrial renewable energy solutions, as businesses prioritize long-term strategies to mitigate environmental impacts. Advanced boiler technologies, including stoker and fluidized bed systems, are catering to diverse industrial needs while optimizing energy use. As industries transition to cleaner energy, the role of industrial biomass heating in decentralizing energy solutions is expanding. This trend is expected to drive market growth further, solidifying biomass boilers as a cornerstone in global renewable energy strategies. This shift underscores their relevance in achieving energy sustainability goals across various regions.

Read our latest blog on the Industrial Biomass Boiler Market

GROWTH ENABLERS

Key enablers of the global industrial biomass boiler market growth:

- Support from government regulations

- Cost efficiency & environment friendliness

- Advancements in technology

- Technological progress in energy generation is improving the efficiency of energy yield from waste materials, supporting industry operations.

- Many companies are also adopting waste-to-energy (WTE) methods to reduce waste and simultaneously generate energy for internal use.

- Processes such as gasification, pyrolysis, combustion, incineration, and anaerobic digestion are central to converting agricultural and other waste materials into electricity.

GROWTH RESTRAINTS

Key growth restraining factors of the global industrial biomass boiler market:

- High installation costs

- Biomass boilers can cost three to four times more than conventional fossil fuel boilers, which impacts their affordability for some industries. Installation expenses vary depending on the manufacturer, boiler type, and installer.

- For larger biomass systems, installation costs increase significantly and depend on specific industrial requirements, further contributing to the financial challenge.

- Tedious handling process compared to traditional boilers

- Higher requirement for efficient management systems

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Industrial Biomass Boiler Market | Top Trends

- Growing opportunity for biomass energy

- Rising environmental concerns are aiding the industrial biomass power market

- As climate change continues to pose significant risks, governments, industries, and consumers are increasingly prioritizing sustainable energy solutions to mitigate environmental impacts.

- Biomass power generation, which utilizes organic and renewable feedstocks such as wood, agricultural residues, and urban waste, offers a low-carbon alternative to fossil fuels, reducing greenhouse gas emissions and air pollution.

- Growth in demand from biomass district heating

- Earning revenue stream from carbon trading

MARKET SEGMENTATION

Need a custom report or have specific data requirements? Let us know!

Market Segmentation – Feedstock, Capacity, Application, and Type –

Market by Feedstock:

- Woody Biomass

- Agriculture Biomass

- According to the International Renewable Energy Agency, the global biomass supply is projected to range between 97 EJ/yr and 147 EJ/yr by 2030 in terms of primary energy.

- Agricultural residues and waste are expected to account for 38%-45% of this total, equivalent to 37 EJ/yr to 39 EJ/yr, while energy crops and forest products will make up the remainder.

- Urban Residue

Market by Capacity:

- 2-10 MW

- 10- 25 MW

- 25- 50 MW

Market by Application:

- Combined Heat and Power (CHP) Production

- Biomass boilers in CHP plants utilize renewable feedstock such as wood chips, agricultural residues, and organic waste to produce steam.

- The integration of biomass boilers into CHP systems significantly reduces reliance on fossil fuels, cutting greenhouse gas emissions and helping industries meet sustainability targets.

- Pulp & Paper

- Power Generation

- Sawmill

- Brewery

- Other Applications

Market by Type:

- Stoker Boilers

- Fluidized Bed Boilers

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- The demand for industrial biomass boilers in the United States is experiencing significant growth, driven by the increasing focus on renewable energy, stringent environmental regulations, and the rising awareness of sustainable industrial practices.

- One of the primary drivers of the growing demand is the US government’s emphasis on reducing carbon emissions to combat climate change. Policies such as the Clean Air Act and state-level initiatives like California’s Renewable Energy Portfolio Standards mandate industries to adopt greener energy solutions.

- Moreover, Canada’s vast forestry and agricultural sectors provide an abundant supply of biomass feedstocks, significantly reducing transportation costs and ensuring steady fuel availability. Regions such as British Columbia, Quebec, and Ontario lead the way due to their robust forestry industries.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, India, Japan, Australia & New Zealand, South Korea, Malaysia, Indonesia, Vietnam, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

Our market research reports offer an in-depth analysis of individual country-level market size and growth statistics. We cover the segmentation analysis, key growth factors, and macro-economic trends within the industrial biomass boiler market, providing detailed insights into –

MAJOR PLAYERS

Major players in the global industrial biomass boiler market:

- Babcock & Wilcox Enterprises Inc

- Detroit Stoker Company

- Industrial Boilers America

- KMW Energy Group

- Schmid AG Energy Solutions

- Sigma Thermal

- Wellons Canada

Key strategies adopted by some of these companies:

- In September 2024, Babcock & Wilcox was awarded a Front-End Engineering and Design Contract for Canada’s first Waste-to-Energy plant with carbon capture and sequestration, showcasing its commitment to enhancing sustainable energy solutions.

- In May 2024, KMW Energy Group announced a collaboration with Peregrine Turbine Technologies to develop and implement a supercritical carbon dioxide (sCO2) energy conversion system integrated with KMW’s biomass systems, aiming to improve energy efficiency and sustainability at their facility in Maine.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2025-2032 |

| Base Year | 2024 |

| Market Historical Years | 2018-2023 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Feedstock, Capacity, Application, and Type |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | ATTSU, Babcock & Wilcox Enterprises Inc, Coima SRL, Detroit Stoker Company, Hurst Boiler & Welding Co Inc, Industrial Boilers America, KMW Energy Group, Mawera GmbH, Saatotuli Canada Enterprises Inc, Schmid AG Energy Solutions, Sigma Thermal, Triple Green Products, Wellons Canada |

TABLE OF CONTENTS

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON THE GLOBAL INDUSTRIAL BIOMASS BOILER MARKET

- IMPACT OF RUSSIA-UKRAINE WAR ON THE GLOBAL INDUSTRIAL BIOMASS BOILER MARKET

- MAJOR MARKET FINDINGS

- FEEDSTOCK DIVERSIFICATION IN INDUSTRIAL BIOMASS BOILER

- RESEARCH AND DEVELOPMENT INVESTMENTS – A TROPE IN INDUSTRIAL BIOMASS BOILER MARKET

- INTEGRATION WITH RENEWABLE ENERGY SYSTEMS

-

MARKET DYNAMICS

- KEY DRIVERS

- SUPPORT FROM GOVERNMENT REGULATIONS

- COST EFFICIENCY & ENVIRONMENT FRIENDLINESS

- ADVANCEMENTS IN TECHNOLOGY

- KEY RESTRAINTS

- HIGH INSTALLATION COSTS

- TEDIOUS HANDLING PROCESS COMPARED TO TRADITIONAL BOILERS

- HIGHER REQUIREMENT OF EFFICIENT MANAGEMENT SYSTEMS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- GROWING OPPORTUNITY FOR BIOMASS ENERGY

- RISING ENVIRONMENTAL CONCERNS ARE AIDING THE INDUSTRIAL BIOMASS POWER MARKET

- GROWTH IN DEMAND FROM BIOMASS DISTRICT HEATING

- EARNING REVENUE STREAM FROM CARBON TRADING

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR NORTH AMERICA

- GROWTH PROSPECT MAPPING FOR EUROPE

- GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

- GROWTH PROSPECT MAPPING FOR REST OF WORLD

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- FEEDSTOCK SUPPLIERS

- COMPONENT SUPPLIERS

- TECHNOLOGY PROVIDERS

- MANUFACTURERS

- DISTRIBUTORS

- END-USERS

- SERVICE PROVIDERS

- KEY BUYING CRITERIA

- FUEL FLEXIBILITY

- COST STRUCTURE

- THERMAL EFFICIENCY

- CAPABILITY AND SCALABILITY

- EMISSION STANDARD

- EASE OF INSTALLATION

- ANCILLARY SYSTEMS AND FEATURES

- GLOBAL INDUSTRIAL BIOMASS BOILER MARKET REGULATORY FRAMEWORK

- KEY MARKET TRENDS

-

MARKET BY FEEDSTOCK

- WOODY BIOMASS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AGRICULTURE BIOMASS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- URBAN RESIDUE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WOODY BIOMASS

-

MARKET BY CAPACITY

- 2-10 MW

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 10-25 MW

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 25-50 MW

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- 2-10 MW

-

MARKET BY APPLICATION

- COMBINED HEAT AND POWER (CHP) PRODUCTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PULP & PAPER

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- POWER GENERATION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SAWMILL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BREWERY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COMBINED HEAT AND POWER (CHP) PRODUCTION

-

MARKET BY TYPE

- STOKER BOILERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FLUIDIZED BED BOILERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- STOKER BOILERS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET DRIVERS

- NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE INDUSTRIAL BIOMASS BOILER MARKET DRIVERS

- EUROPE INDUSTRIAL BIOMASS BOILER MARKET CHALLENGES

- KEY PLAYERS IN EUROPE INDUSTRIAL BIOMASS BOILER MARKET

- COUNTRY ANALYSIS

- GERMANY

- GERMANY INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- UNITED KINGDOM INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- GERMANY

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET DRIVERS

- ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- MALAYSIA

- MALAYSIA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET DRIVERS

- REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA INDUSTRIAL BIOMASS BOILER MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- ATTSU

- COMPANY OVERVIEW

- PRODUCT LIST

- BABCOCK & WILCOX ENTERPRISES INC

- COMPANY OVERVIEW

- PRODUCT LIST

- COIMA SRL

- COMPANY OVERVIEW

- PRODUCT LIST

- DETROIT STOKER COMPANY

- COMPANY OVERVIEW

- PRODUCT LIST

- HURST BOILER & WELDING CO INC

- COMPANY OVERVIEW

- PRODUCT LIST

- INDUSTRIAL BOILERS AMERICA

- COMPANY OVERVIEW

- PRODUCT LIST

- KMW ENERGY GROUP

- COMPANY OVERVIEW

- PRODUCT LIST

- MAWERA GMBH

- COMPANY OVERVIEW

- PRODUCT LIST

- SAATOTULI CANADA ENTERPRISES INC

- COMPANY OVERVIEW

- PRODUCT LIST

- SCHMID AG ENERGY SOLUTIONS

- COMPANY OVERVIEW

- PRODUCT LIST

- SIGMA THERMAL

- COMPANY OVERVIEW

- PRODUCT LIST

- TRIPLE GREEN PRODUCTS

- COMPANY OVERVIEW

- PRODUCT LIST

- WELLONS CANADA

- COMPANY OVERVIEW

- PRODUCT LIST

- ATTSU

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – INDUSTRIAL BIOMASS BOILER

TABLE 2: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET REGULATORY FRAMEWORK

TABLE 3: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY FEEDSTOCK, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 4: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY FEEDSTOCK, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 5: GLOBAL WOODY BIOMASS MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 6: GLOBAL WOODY BIOMASS MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 7: GLOBAL AGRICULTURE BIOMASS MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 8: GLOBAL AGRICULTURE BIOMASS MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 9: GLOBAL URBAN RESIDUE MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 10: GLOBAL URBAN RESIDUE MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 11: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY CAPACITY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 12: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY CAPACITY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 13: GLOBAL 2-10 MW MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 14: GLOBAL 2-10 MW MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 15: GLOBAL 10-25 MW MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 16: GLOBAL 10-25 MW MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 17: GLOBAL 25-50 MW MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 18: GLOBAL 25-50 MW MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 19: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 20: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY APPLICATION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 21: GLOBAL COMBINED HEAT AND POWER (CHP) PRODUCTION MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 22: GLOBAL COMBINED HEAT AND POWER (CHP) PRODUCTION MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 23: GLOBAL PULP & PAPER MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 24: GLOBAL PULP & PAPER MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 25: GLOBAL POWER GENERATION MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 26: GLOBAL POWER GENERATION MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 27: GLOBAL SAWMILL MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 28: GLOBAL SAWMILL MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 29: GLOBAL BREWERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 30: GLOBAL BREWERY MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 31: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 32: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 33: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY TYPE, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 34: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY TYPE, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 35: GLOBAL STOKER BOILERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 36: GLOBAL STOKER BOILERS MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 37: GLOBAL FLUIDIZED BED BOILERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 38: GLOBAL FLUIDIZED BED BOILERS MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 39: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 40: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY GEOGRAPHY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 41: NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 42: NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 43: KEY PLAYERS OPERATING IN NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET

TABLE 44: EUROPE INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 45: EUROPE INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 46: KEY PLAYERS OPERATING IN EUROPE INDUSTRIAL BIOMASS BOILER MARKET

TABLE 47: ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 48: ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET, BY COUNTRY, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 49: KEY PLAYERS OPERATING IN ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET

TABLE 50: REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET, BY REGION, HISTORICAL YEARS, 2018-2023 (IN $ MILLION)

TABLE 51: REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET, BY REGION, FORECAST YEARS, 2025-2032 (IN $ MILLION)

TABLE 52: LIST OF MERGERS & ACQUISITIONS

TABLE 53: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 54: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 55: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR NORTH AMERICA

FIGURE 4: GROWTH PROSPECT MAPPING FOR EUROPE

FIGURE 5: GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

FIGURE 6: GROWTH PROSPECT MAPPING FOR REST OF WORLD

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, GROWTH POTENTIAL, BY FEEDSTOCK, IN 2024

FIGURE 12: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY WOODY BIOMASS, 2025-2032 (IN $ MILLION)

FIGURE 13: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY AGRICULTURE BIOMASS, 2025-2032 (IN $ MILLION)

FIGURE 14: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY URBAN RESIDUE, 2025-2032 (IN $ MILLION)

FIGURE 15: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, GROWTH POTENTIAL, BY CAPACITY, IN 2024

FIGURE 16: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY 2-10 MW, 2025-2032 (IN $ MILLION)

FIGURE 17: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY 10-25 MW, 2025-2032 (IN $ MILLION)

FIGURE 18: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY 25-50 MW, 2025-2032 (IN $ MILLION)

FIGURE 19: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2024

FIGURE 20: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY COMBINED HEAT AND POWER (CHP) PRODUCTION, 2025-2032 (IN $ MILLION)

FIGURE 21: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY PULP & PAPER, 2025-2032 (IN $ MILLION)

FIGURE 22: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY POWER GENERATION, 2025-2032 (IN $ MILLION)

FIGURE 23: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY SAWMILL, 2025-2032 (IN $ MILLION)

FIGURE 24: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY BREWERY, 2025-2032 (IN $ MILLION)

FIGURE 25: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY OTHER APPLICATIONS, 2025-2032 (IN $ MILLION)

FIGURE 26: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, GROWTH POTENTIAL, BY TYPE, IN 2024

FIGURE 27: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY STOKER BOILERS, 2025-2032 (IN $ MILLION)

FIGURE 28: GLOBAL INDUSTRIAL BIOMASS BOILER MARKET, BY FLUIDIZED BED BOILERS, 2025-2032 (IN $ MILLION)

FIGURE 29: NORTH AMERICA INDUSTRIAL BIOMASS BOILER MARKET, COUNTRY OUTLOOK, 2024 & 2032 (IN %)

FIGURE 30: UNITED STATES INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 31: CANADA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 32: EUROPE INDUSTRIAL BIOMASS BOILER MARKET, COUNTRY OUTLOOK, 2024 & 2032 (IN %)

FIGURE 33: GERMANY INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 34: UNITED KINGDOM INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 35: FRANCE INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 36: ITALY INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 37: SPAIN INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 38: POLAND INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 39: BELGIUM INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 40: REST OF EUROPE INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 41: ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET, COUNTRY OUTLOOK, 2024 & 2032 (IN %)

FIGURE 42: CHINA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 43: INDIA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 44: JAPAN INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 45: AUSTRALIA & NEW ZEALAND INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 46: SOUTH KOREA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 47: MALAYSIA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 48: INDONESIA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 49: VIETNAM INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 50: REST OF ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 51: REST OF WORLD INDUSTRIAL BIOMASS BOILER MARKET, REGIONAL OUTLOOK, 2024 & 2032 (IN %)

FIGURE 52: LATIN AMERICA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FIGURE 53: MIDDLE EAST & AFRICA INDUSTRIAL BIOMASS BOILER MARKET, 2025-2032 (IN $ MILLION)

FAQ’s

FAQs

A: The two primary types are stoker boilers, which use grates to burn solid fuels, and fluidized bed boilers, which suspend fuel in a fluidized bed for efficient combustion of biomass and low-grade fuels.

A: Biomass boilers reduce greenhouse gas emissions, utilize renewable feedstocks, and can lower operational costs when biomass is sourced locally.

A: They can burn various fuels, including woody biomass, agricultural residues, urban waste, and pellets, offering flexibility depending on local availability.

RELATED REPORTS

-

INDIA WIND ENERGY MARKET FORECAST 2025-2032

-

INDIA SOLAR ENERGY MARKET FORECAST 2025-2032

-

INDIA GREEN HYDROGEN MARKET FORECAST 2025-2032

-

UNITED STATES DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

INDIA DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GERMANY DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

BRAZIL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

GLOBAL DATA CENTER ENERGY STORAGE MARKET FORECAST 2025-2032

-

ASIA-PACIFIC INDUSTRIAL BIOMASS BOILER MARKET FORECAST 2025-2032

-

EUROPE INDUSTRIAL BIOMASS BOILER MARKET FORECAST 2025-2032