INDIA LIQUEFIED NATURAL GAS (LNG) MARKET

Natural gas is a fossil fuel majorly comprising methane. Like other fossil fuels, it is formed deep beneath the earth’s surface due to the decomposition of dead plants and animals under extreme heat and pressures. Although natural gas is cleaner than the majority of other fossilized fuels, its calorific value is lower than fossil fuels such as petrol, diesel, and LPG.

To learn more about this report, request a free sample copy

Liquified natural gas (LNG) entails compressed natural gas liquified at -290 degrees, useful for transportation and heat generation. India is one of the world’s most rapidly increasing energy users. The growing population and burgeoning economy are the primary drivers of rising natural gas consumption. As of 2020, the country’s total proven reserves are 1.30 trillion cubic meters.

Natural gas usage in India has risen as a result of targeted policies encouraging the use of PNG (piped natural gas) as a cooking fuel and CNG (compressed natural gas) as fuel for urban transportation via city gas distribution (CGD) networks. The natural gas pipeline network in India is approximately 13,722 kilometers long. Moreover, the country’s natural gas accounts for around 6.72% of primary energy consumption.

In July 1997, the Indian government authorized the creation of a Joint Venture Company (JVC) to secure competitive liquefied natural gas (LNG) supplies and construct infrastructure for LNG import and consumption. Petronet LNG Limited was created in 1998 as a joint venture business by GAIL (India) Ltd (GAIL), Oil & Natural Gas Corporation Ltd (ONGC), Indian Oil Corporation Ltd (IOCL), and Bharat Petroleum Corporation Ltd (BPCL) to import LNG and establish LNG terminals throughout the nation.

Qatar was India’s sole LNG supplier until 2004 and continues to be the leading LNG provider today; however, the spectrum of suppliers is getting more diversified. Since 2006, India has been augmenting its supply portfolio by importing LNG from various nations, including Nigeria, Algeria, Australia, Yemen, Trinidad & Tobago, the United Arab Emirates, Russia, Norway, Oman, and Indonesia.

The Indian government is actively pushing natural gas to diversify its energy mix toward cleaner fuels, reduce oil reliance, and combat urban air pollution. Over the last few years, there has been increased emphasis on quickly expanding gas infrastructure, such as interstate and intrastate pipelines, LNG import terminals, city gas distribution networks covering more than 70% of the population, and CNG/LNG stations around the country.

Since LNG is highly flammable and major exporting takes place by the sea, many regulations must be followed by industry players. Key regulatory authorities governing the LNG market in the country are the Ministry of Petroleum and Natural Gas (MOP&NG), GAIL (India) Limited, and Indian Oil Corporation Limited (IOCL).

The top LNG companies in the country are the Oil and Natural Gas Corporation (ONGC), Bharat Petroleum Corporation Limited (BPCL), Indian Oil Corporation Ltd (IOCL), GAIL (India) Ltd, Petronet LNG, Gujarat Gas Limited, Adani Total Gas, and others.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- INDIA LNG MARKET: EXECUTIVE SUMMARY

- INDIA OVERALL ECONOMIC CONDITIONS

- INDIA PRIMARY ENERGY CONSUMPTION

- NATURAL GAS

- INDIA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- TOTAL PROVED RESERVES

- NATURAL GAS PRODUCTION

- NATURAL GAS CONSUMPTION

- INDIA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- LIQUIFIED NATURAL GAS

- VALUE CHAIN ANALYSIS

- EXPLORATION AND PRODUCTION

- LIQUEFACTION

- SHIPPING

- STORAGE AND REGASIFICATION

- END-USERS

- TRADE

- IMPORTS

- LNG TERMINALS

- LIST OF LNG IMPORT TERMINALS

- REGULATORY FRAMEWORK FOR LNG

- VALUE CHAIN ANALYSIS

LIST OF TABLES

TABLE 1: INDIA NATURAL GAS PRODUCTION, 2016-2020 (IN EXAJOULES)

TABLE 2: INDIA NATURAL GAS CONSUMPTION, 2016-2020 (IN EXAJOULES)

TABLE 3: INDIA LNG IMPORTS, 2016-2020 (IN BILLION CUBIC METERS)

TABLE 4: LNG IMPORT TERMINALS, EXISTING

TABLE 5: LNG IMPORT TERMINALS, NOT YET BUILT

TABLE 6: REGULATORY FRAMEWORK

LIST OF FIGURES

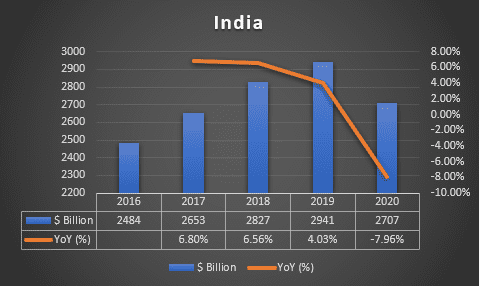

FIGURE 1: INDIA GROSS DOMESTIC PRODUCT, 2016-2020 ($ BILLION)

FIGURE 2: PRIMARY ENERGY CONSUMPTION, BY FUEL TYPES, 2019 & 2020 (IN %)

FIGURE 3: PRIMARY ENERGY CONSUMPTION, 2016-2020 (EXAJOULES)

FIGURE 4: INDIA NATURAL GAS TOTAL PROVED RESERVES, 2000, 2010, AND 2020 (IN TRILLION CUBIC METERS)

FIGURE 5: INDIA NATURAL GAS PRODUCTION VS CONSUMPTION, 2016-2020 (IN EXAJOULES)

FIGURE 6: VALUE CHAIN ANALYSIS

INDIA GROSS DOMESTIC PRODUCT, 2016-2020, ($ BILLION)

GDP (constant 2010 US$)

Source: World Bank

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.