INDIA ALTERNATIVE SWEETENERS MARKET FORECAST 2021-2026

India Alternative Sweeteners Market by Product (High Fructose Syrup, High-intensity Sweetener (Saccharin, Aspartame, Acesulfame Potassium (Ace-k), Sucralose, Neotame, Advantame, Steviol Glycosides, Monk Fruit Extract), Low-intensity Sweetener) by Application (Food, Beverage, Other Applications)

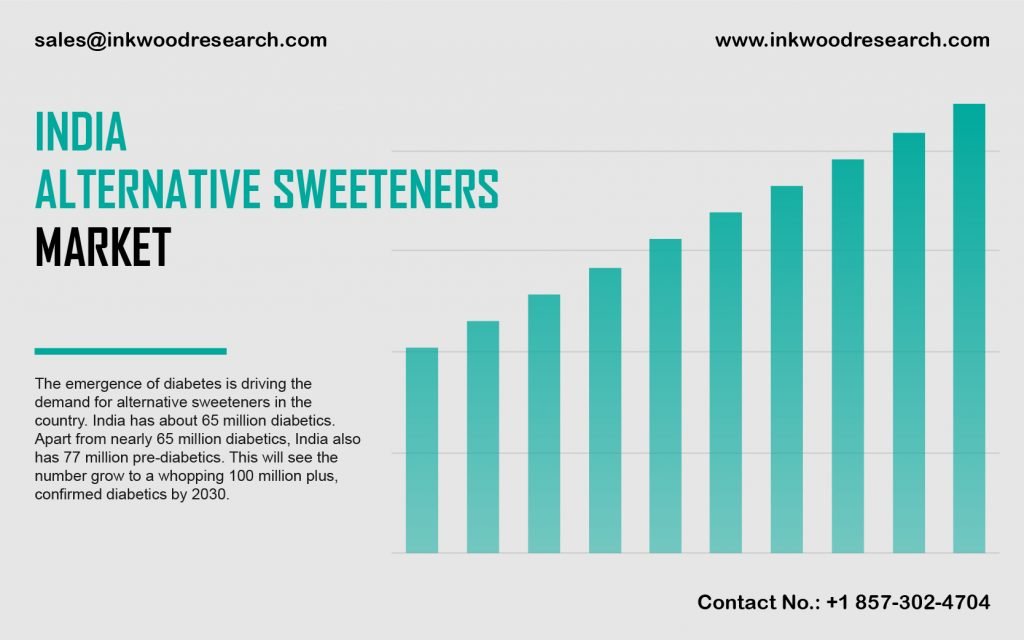

The India alternative sweeteners market is forecasted to record a CAGR of 4.14%, during the studied period. The country’s market growth is fueled by prime factors including, the rising incidence of diabetes and obesity, and the increased adoption of artificial sweeteners. The base year considered for the market study is 2020, and the forecast period is from 2021 to 2026.

To know more about this report, request a free sample copy

While the emergence of diabetes continues to debilitate, globally, India recorded nearly 65 million cases of diabetes. In addition to the overall proportion, the country also has 77 million pre-diabetics. This figure is expected to grow to more than 100 million confirmed diabetics, by 2030. Children aged 13-14 years are also likely to be diabetics, owing to changes in lifestyles, such as the increased consumption of junk food and fast food, the rising rates of obesity, and the lack of physical activity.

Moreover, with the growing awareness regarding the link between health and diet, consumers’ apprehensions over sugar levels are driving the trend of limiting sugar intake. Although the shift away from sugar is years away, the trend towards low-calorie sweeteners is continually augmenting. As a result, these factors are projected to fuel the market growth in India during the forecast years.

Cargill Incorporated, headquartered in the United States, engages in providing agricultural, industrial, food, and financial, services and products. It also offers value-added goods for food feed and fuel, and produces ingredients and protein products for consumer goods distributors as well as firms. The company is operational across the Asia Pacific, the Americas, the Middle East, and Europe.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- COUNTRY SNAPSHOT

- COUNTRY ANALYSIS

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY ANALYTICS

- IMPACT OF COVID-19 ON INDIA ALTERNATIVE SWEETENERS MARKET

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- MARKET BY PRODUCT

- HIGH FRUCTOSE SYRUP

- HIGH-INTENSITY SWEETENER

- SACCHARIN

- ASPARTAME

- ACESULFAME POTASSIUM (ACE-K)

- SUCRALOSE

- NEOTAME

- ADVANTAME

- STEVIOL GLYCOSIDES

- MONK FRUIT EXTRACT

- LOW-INTENSITY SWEETENER

- MARKET BY APPLICATION

- FOOD

- BEVERAGE

- OTHER APPLICATIONS

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGER & ACQUISITIONS

- PRODUCT LAUNCH & DEVELOPMENTS

- PARTNERSHIP & AGREEMENTS

- BUSINESS EXPANSION

- COMPANY PROFILES

- TATE & LYLE PLC

- CARGILL INCORPORATED

- INGREDION INCORPORATED

- NUTRASWEET COMPANY

- PURECIRCLE LTD

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – INDIA ALTERNATIVE SWEETENERS

TABLE 2: INDIA ALTERNATIVE SWEETENERS MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: INDIA ALTERNATIVE SWEETENERS MARKET, BY PRODUCT, FORECAST YEARS, 2021-2026 (IN $ MILLION)

TABLE 4: INDIA ALTERNATIVE SWEETENERS MARKET, BY HIGH-INTENSITY SWEETENER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: INDIA ALTERNATIVE SWEETENERS MARKET, BY HIGH-INTENSITY SWEETENER, FORECAST YEARS, 2021-2026 (IN $ MILLION)

TABLE 6: INDIA ALTERNATIVE SWEETENERS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: INDIA ALTERNATIVE SWEETENERS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2026 (IN $ MILLION)

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: INDIA ALTERNATIVE SWEETENERS MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2020

FIGURE 5: INDIA ALTERNATIVE SWEETENERS MARKET, BY HIGH FRUCTOSE SYRUP, 2021-2026 (IN $ MILLION)

FIGURE 6: INDIA ALTERNATIVE SWEETENERS MARKET, BY HIGH-INTENSITY SWEETENER, 2021-2026 (IN $ MILLION)

FIGURE 7: INDIA ALTERNATIVE SWEETENERS MARKET, GROWTH POTENTIAL, BY HIGH-INTENSITY SWEETENER, IN 2020

FIGURE 8: INDIA ALTERNATIVE SWEETENERS MARKET, BY SACCHARIN, 2021-2026 (IN $ MILLION)

FIGURE 9: INDIA ALTERNATIVE SWEETENERS MARKET, BY ASPARTAME, 2021-2026 (IN $ MILLION)

FIGURE 10: INDIA ALTERNATIVE SWEETENERS MARKET, BY ACESULFAME POTASSIUM (ACE-K), 2021-2026 (IN $ MILLION)

FIGURE 11: INDIA ALTERNATIVE SWEETENERS MARKET, BY SUCRALOSE, 2021-2026 (IN $ MILLION)

FIGURE 12: INDIA ALTERNATIVE SWEETENERS MARKET, BY NEOTAME, 2021-2026 (IN $ MILLION)

FIGURE 13: INDIA ALTERNATIVE SWEETENERS MARKET, BY ADVANTAME, 2021-2026 (IN $ MILLION)

FIGURE 14: INDIA ALTERNATIVE SWEETENERS MARKET, BY STEVIOL GLYCOSIDES, 2021-2026 (IN $ MILLION)

FIGURE 15: INDIA ALTERNATIVE SWEETENERS MARKET, BY MONK FRUIT EXTRACT, 2021-2026 (IN $ MILLION)

FIGURE 16: INDIA ALTERNATIVE SWEETENERS MARKET, BY LOW-INTENSITY SWEETENER, 2021-2026 (IN $ MILLION)

FIGURE 17: INDIA ALTERNATIVE SWEETENERS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 18: INDIA ALTERNATIVE SWEETENERS MARKET, BY FOOD, 2021-2026 (IN $ MILLION)

FIGURE 19: INDIA ALTERNATIVE SWEETENERS MARKET, BY BEVERAGE, 2021-2026 (IN $ MILLION)

FIGURE 20: INDIA ALTERNATIVE SWEETENERS MARKET, BY OTHER APPLICATIONS, 2021-2026 (IN $ MILLION)

- MARKET BY PRODUCT

- HIGH FRUCTOSE SYRUP

- HIGH-INTENSITY SWEETENER

- SACCHARIN

- ASPARTAME

- ACESULFAME POTASSIUM (ACE-K)

- SUCRALOSE

- NEOTAME

- ADVANTAME

- STEVIOL GLYCOSIDES

- MONK FRUIT EXTRACT

- LOW-INTENSITY SWEETENER

- MARKET BY APPLICATION

- FOOD

- BEVERAGE

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.