GLOBAL BIOTECHNOLOGY REAGENTS MARKET FORECAST 2020-2028

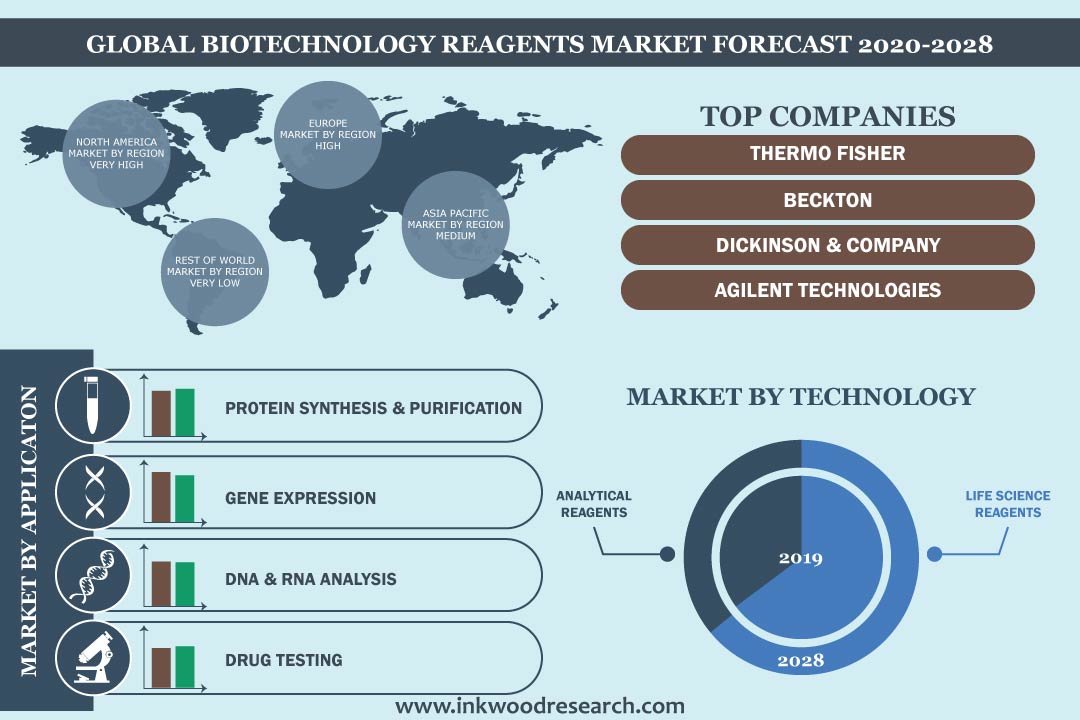

Global Biotechnology Reagents Market by Application (Protein Synthesis & Purification, Gene Expression, Dna & Rna Analysis, Drug Testing) by Technology (Life Science Reagents, Analytical Reagents) by Geography.

The global biotechnology reagents market is anticipated to grow at a CAGR of 6.70% between 2020 and 2028, and is estimated to generate revenue of $70241 million by 2028. A varied assortment of biochemical reagents is acknowledged for the identification of certain metabolomics, as well as to distinguish between bacteria.

The global biotechnology reagents industry is primarily driven by the following factors:

- Large investment in biotechnology by the corporates and research organizations

- Evolving landscape of the biotechnology industry

- Increasing protein profiling applications

The important drivers increasing growth in the global biotechnology reagents market are the large investment in biotechnology by the corporates and research organizations and the evolving landscape of the biotechnology industry. The increasing R&D expenditure is amongst the significant factor propelling the entire biotechnology sector in the medium term. The technological innovations result in better productivity, and are a key driver for many of the current biopharmaceutical trends (for example, metabolomics, proteomics), which is expected to drive the global biotechnology reagents market during the forecast period.

To know more about this report, request a free sample copy.

The technology with regard to the biotechnology reagents market is used extensively for various purposes. In life sciences, a wide range of biotechnology reagents is employed in several applications like medicine, agriculture, diagnostics, and environmental science. PCR is mainly used for the diagnosis of infectious diseases, in forensics, and various other biological purposes. The cell culture reagent market has varied applications in the biotechnology and pharmaceutical market. The rising number of private diagnostics centers and increasing cases of chronic diseases like cancer and asthma have resulted in the growth of the IVD market.

The expression and transfection involve the introduction of purified nucleic acid into the eukaryotic cells by non-viral methods. The analytical grade reagents are high purity reagents that are used for analytics and clinical purposes in laboratories. Chromatography is the process of separating chemical mixtures. It consists of two phases. One is the moving phase called Eluent, and the other is a stationary phase. The mass spectrometer measures the mass within the sample and separates them on the basis of mass to charge ratio. Electrophoresis is the technology of separation of macromolecules like DNA, RNA, and proteins, etc. Flow cytometry is the process of measuring multiple characteristics of single cell-like optical and fluorescence characteristics of a cell.

The high cost of biopharmaceutical research and drug development and contamination issues are the major factors hindering the market growth of the Biotechnology Reagents. The complexities and cost of biopharmaceutical research have also increased, which is hampering the research and development process. The microbial adulteration of constant cell cultures by a wide variety of microorganisms is problematic in cell culture laboratories worldwide

The global biotechnology reagents market segments include application and technology.

Application is segmented into:

- Drug testing

- Protein synthesis & purification

- DNA & RNA analysis

- Gene expression

Technology is segmented into:

- Life Science Reagents

- PCR

- Master mixes

- PCR reagent kit

- Cell culture

- Sera

- Media and reagents

- Invitro diagnostic

- Microbiology culture

- Hematology

- Immunoassay

- Clinical chemistry

- Molecular diagnostics

- Expression and transfection

- PCR

- Analytical reagents

- Chromatography

- Liquid chromatography

- Gas chromatography

- Ion chromatography

- Superfluid chromatography

- Other chromatography

- Mass spectrometry

- Proteomics

- Drug discovery

- Genomics

- Clinical testing

- Other mass spectrometry

- Electrophoresis

- Gel electrophoresis

- Other electrophoresis

- Flow cytometry

- Chromatography

- Bead-based

- Cell-based

This report covers the present market conditions and the growth prospects of the global biotechnology reagents market trends for 2020-2028 and considered the revenue generated through the sales of Biotechnology Reagents for application and technology and application, by considering 2019 as the base year.

The region has been segmented on the basis of four major regions, which include:

- North America: the United States & Canada

- Asia-Pacific: China, India, Japan, South Korea, Thailand, Indonesia, Vietnam, Australia & New Zealand, and the Rest of Asia Pacific

- Europe: the United Kingdom, France, Germany, Italy, Russia, Belgium, Poland, and the Rest of Europe

- Rest of World: Latin America, the Middle East, and Africa

The biotechnology reagents market in North America is expected to hold the largest market share by 2028, as a result of the thriving pharmaceutical industry, and the surging government funding in life science-based research. The U.S. region dominates the market due to huge funding in life science-based research by government organizations. Canada is expected to grow at the highest rate during the forecast period, as a result of the surging health care expenditure, which has helped to increased consumption of the bio-based reagents in the market. The North America biotechnology reagents market constitutes approx. 82% share in 2019.

The Asia-Pacific market is anticipated to be the fastest-growing region for the biotechnology reagents market report. The increasing demand for GMO crops in the Asia Pacific geography boosts the market of biotechnology reagents in the Asia Pacific countries. China constitutes the highest market share owing to increasing awareness of biopharmaceutical, increasing economic growth, rising pharmaceutical industry, and increasing healthcare spending.

Protein synthesis is a process in which biological cells generate new proteins. In most of the gene sequencing, the steps that require an active gene product can be a focus of the regulatory bodies. DNA and RNA chromatography are extensively being used for nucleic acid analysis and biotech usages. Drug testing is one of the applications that utilize most of the biotech reagents. The chemicals comprising reagents are generally toxic and corrosive in nature. All these applications are anticipated to drive the biotechnology reagents market.

The major market players of the biotechnology reagents market are:

- Abbott Laboratories

- Agilent Technologies Inc.

- Becton, Dickinson & Company (Bd)

- Bio-Rad Laboratories Inc.

- Perkinelmer

Company Profiles covers an analysis of important players. Abbott Laboratories (Abbott or ‘the company’) is a health care company that discovers, develops, manufactures, and markets generic pharmaceuticals, nutritional products, medical devices, and diagnostics. PerkinElmer (PerkinElmer or ‘the company’) offers products, services, and solutions focused on improving the health and safety of people and the environment. The company has manufacturing and assembly plants, research laboratories, administrative offices, and other facilities located in 16 states in the US and 31 foreign countries.

Key findings of the global biotechnology reagents market:

- The flow cytometry market is the fastest-growing segment in analytical reagents.

- Life science reagent is the major revenue-generating market.

- Analytical reagents have witnessed impressive growth during the forecast period.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- MARKET DRIVERS

- LARGE INVESTMENT IN BIOTECHNOLOGY BY THE CORPORATES AND RESEARCH ORGANIZATIONS

- EVOLVING LANDSCAPE OF THE BIOTECHNOLOGY INDUSTRY

- INCREASING PROTEIN PROFILING APPLICATIONS

- MARKET RESTRAINTS

- HIGH COST OF BIOPHARMACEUTICAL RESEARCH AND DRUG DEVELOPMENT

- CONTAMINATION ISSUES

- REGULATORY DIFFERENCE IN VARIOUS COUNTRIES

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- NEW ENTRANTS

- SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- INDUSTRY RIVALRY

- KEY BUYING CRITERIA

- SUSTAINABILITY

- QUALITY OF PRODUCT

- COST

- AVAILABILITY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY APPLICATION

- PROTEIN SYNTHESIS & PURIFICATION

- GENE EXPRESSION

- DNA & RNA ANALYSIS

- DRUG TESTING

- MARKET BY TECHNOLOGY

- LIFE SCIENCE REAGENTS

- PCR

- MASTER MIXES

- PCR REAGENT KIT

- CELL CULTURE

- SERA

- MEDIA AND REAGENTS

- INVITRO DIAGNOSTIC

- MICROBIOLOGY CULTURE

- HEMATOLOGY

- IMMUNOASSAY

- CLINICAL CHEMISTRY

- MOLECULAR DIAGNOSTIC

- EXPRESSION AND TRANSFECTION

- PCR

- ANALYTICAL REAGENTS

- CHROMATOGRAPHY

- LIQUID CHROMATOGRAPHY

- GAS CHROMATOGRAPHY

- ION CHROMATOGRAPHY

- SUPER FLUID CHROMATOGRAPHY

- OTHER CHROMATOGRAPHY

- MASS SPECTROMETRY

- PROTEOMICS

- DRUG DISCOVERY

- GENOMICS

- CLINICAL TESTING

- OTHER MASS SPECTROMETRY

- ELECTROPHORESIS

- GEL ELECTROPHORESIS

- OTHER ELECTROPHORESIS

- FLOW CYTOMETRY

- BEAD BASED

- CELL BASED

- CHROMATOGRAPHY

- LIFE SCIENCE REAGENTS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ABBOTT LABORATORIES

- AGILENT TECHNOLOGIES INC.

- BECTON, DICKINSON & COMPANY (BD)

- BIO-RAD LABORATORIES INC.

- BIO-TECHNE CORPORATION

- CORNING INC.

- GE HEALTHCARE

- INVIVOSCRIBE TECHNOLOGIES INC

- LONZA GROUP LTD.

- MERCK KGAA

- MERIDIAN BIOSCIENCE INC

- PERKINELMER

- PROMOCELL GMBH

- SIGNALCHEM LIFESCIENCES CORPORATION

- VWR CORPORATION (PART OF AVANTOR)

TABLE LIST

TABLE 1: BIOTECHNOLOGY REAGENTS MARKET AT A GLANCE/MARKET SNAPSHOT/MARKET SUMMARY

TABLE 2: GLOBAL BIOTECHNOLOGY REAGENTS, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL BIOTECHNOLOGY REAGENTS, BY APPLICATION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 4: GLOBAL PROTEIN SYNTHESIS & PURIFICATION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: GLOBAL PROTEIN SYNTHESIS & PURIFICATION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 6: GLOBAL GENE EXPRESSION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL GENE EXPRESSION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 8: GLOBAL DNA & RNA ANALYSIS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL DNA & RNA ANALYSIS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 10: GLOBAL DRUG TESTING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL DRUG TESTING MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 12: GLOBAL BIOTECHNOLOGY REAGENTS, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL BIOTECHNOLOGY REAGENTS, BY TECHNOLOGY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 14: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 16: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 18: GLOBAL PCR MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL PCR MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 20: GLOBAL PCR MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: GLOBAL PCR MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 22: GLOBAL MASTER MIXES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL MASTER MIXES MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 24: GLOBAL PCR REAGENT KITMARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: GLOBAL PCR REAGENT KIT MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 26: GLOBAL CELL CULTURE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: GLOBAL CELL CULTURE MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 28: GLOBAL CELL CULTURE MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: GLOBAL CELL CULTURE MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 30: GLOBAL SERA MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: GLOBAL SERA MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 32: GLOBAL MEDIA AND REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 33: GLOBAL MEDIA AND REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 34: GLOBAL INVITRO DIAGNOSTIC MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 35: GLOBAL INVITRO DIAGNOSTIC MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 36: GLOBAL INVITRO DIAGNOSTIC MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 37: GLOBAL INVITRO DIAGNOSTIC MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 38: GLOBAL EXPRESSION AND TRANSFECTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 39: GLOBAL EXPRESSION AND TRANSFECTION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 40: GLOBAL ANALYTICAL REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 41: GLOBAL ANALYTICAL REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 42: GLOBAL ANALYTICAL REAGENTS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 43: GLOBAL ANALYTICAL REAGENTS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 44: GLOBAL CHROMATOGRAPHY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 45: GLOBAL CHROMATOGRAPHY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 46: GLOBAL CHROMATOGRAPHY MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 47: GLOBAL CHROMATOGRAPHY MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 48: GLOBAL MASS SPECTROMETRY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 49: GLOBAL MASS SPECTROMETRY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 50: GLOBAL MASS SPECTROMETRY MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 51: GLOBAL MASS SPECTROMETRY MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 52: GLOBAL ELECTROPHORESIS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 53: GLOBAL ELECTROPHORESIS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 54: GLOBAL ELECTROPHORESIS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 55: GLOBAL ELECTROPHORESIS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 56: GLOBAL FLOW CYTOMETRY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 57: GLOBAL FLOW CYTOMETRY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 58: GLOBAL FLOW CYTOMETRY MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 59: GLOBAL FLOW CYTOMETRY MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 60: GLOBAL BIOTECHNOLOGY REAGENTS, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 61: GLOBAL BIOTECHNOLOGY REAGENTS, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 62: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 63: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 64: EUROPE BIOTECHNOLOGY REAGENTS, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 65: EUROPE BIOTECHNOLOGY REAGENTS, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 66: ASIA PACIFIC BIOTECHNOLOGY REAGENTS, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 67: ASIA PACIFIC BIOTECHNOLOGY REAGENTS, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 68: REST OF WORLD BIOTECHNOLOGY REAGENTS, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 69: REST OF WORLD BIOTECHNOLOGY REAGENTS, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: KEY BUYING CRITERIA

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE OF BIOTECHNOLOGY REAGENTS MARKET

FIGURE 5: GLOBAL BIOTECHNOLOGY REAGENTS MARKET GROWTH POTENTIAL, BY APPLICATION, 2019

FIGURE 6: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY PROTEIN SYNTHESIS & PURIFICATION, 2020-2028 (IN $ MILLION)

FIGURE 7: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY GENE EXPRESSION, 2020-2028 (IN $ MILLION)

FIGURE 8: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY DNA & RNA ANALYSIS, 2020-2028 (IN $ MILLION)

FIGURE 9: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY DRUG TESTING, 2020-2028 (IN $ MILLION)

FIGURE 10: GLOBAL BIOTECHNOLOGY REAGENTS MARKET GROWTH POTENTIAL, BY TECHNOLOGY, 2019

FIGURE 11: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY LIFE SCIENCE REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 12: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY PCR, 2020-2028 (IN $ MILLION)

FIGURE 13: GLOBAL PCR MARKET, BY MASTER MIXES, 2020-2028 (IN $ MILLION)

FIGURE 14: GLOBAL PCR MARKET, BY PCR REAGENT KIT, 2020-2028 (IN $ MILLION)

FIGURE 15: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY CELL CULTURE, 2020-2028 (IN $ MILLION)

FIGURE 16: USE OF ANIMAL SERUM MEDIA IN THE STUDY OF MESENCHYMAL STROMAL CELLS IN CELL CULTURE

FIGURE 17: GLOBAL CELL CULTURE MARKET, BY SERA, 2020-2028 (IN $ MILLION)

FIGURE 18: SUPPLIERS FOCUS ON DEVELOPMENT OF ADVANCED TECHNIQUE IN CELL CULTURE

FIGURE 19: GLOBAL CELL CULTURE MARKET, BY MEDIA AND REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 20: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY INVITRO DIAGNOSTIC, 2020-2028 (IN $ MILLION)

FIGURE 21: GLOBAL INVITRO DIAGNOSTIC MARKET, BY MICROBIOLOGY CULTURE, 2020-2028 (IN $ MILLION)

FIGURE 22: GLOBAL INVITRO DIAGNOSTIC MARKET, BY HEMATOLOGY, 2020-2028 (IN $ MILLION)

FIGURE 23: GLOBAL INVITRO DIAGNOSTIC MARKET, BY IMMUNOASSAY, 2020-2028 (IN $ MILLION)

FIGURE 24: GLOBAL INVITRO DIAGNOSTIC MARKET, BY CLINICAL CHEMISTRY, 2020-2028 (IN $ MILLION)

FIGURE 25: GLOBAL INVITRO DIAGNOSTIC MARKET, BY MOLECULAR DIAGNOSTIC, 2020-2028 (IN $ MILLION)

FIGURE 26: GLOBAL LIFE SCIENCE REAGENTS MARKET, BY EXPRESSION AND TRANSFECTION, 2020-2028 (IN $ MILLION)

FIGURE 27: GLOBAL BIOTECHNOLOGY REAGENTS MARKET, BY ANALYTICAL REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 28: GLOBAL ANALYTICAL REAGENTS MARKET, BY CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 29: GLOBAL CHROMATOGRAPHY MARKET, BY LIQUID CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 30: GLOBAL CHROMATOGRAPHY MARKET, BY GAS CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 31: GLOBAL CHROMATOGRAPHY MARKET, BY ION CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 32: GLOBAL CHROMATOGRAPHY MARKET, BY SUPER FLUID CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 33: GLOBAL CHROMATOGRAPHY MARKET, BY OTHER CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 34: GLOBAL ANALYTICAL REAGENTS MARKET, BY MASS SPECTROMETRY, 2020-2028 (IN $ MILLION)

FIGURE 35: GLOBAL MASS SPECTROMETRY MARKET, BY PROTEOMICS, 2020-2028 (IN $ MILLION)

FIGURE 36: GLOBAL MASS SPECTROMETRY MARKET, BY DRUG DISCOVERY, 2020-2028 (IN $ MILLION)

FIGURE 37: GLOBAL MASS SPECTROMETRY MARKET, BY GENOMICS, 2020-2028 (IN $ MILLION)

FIGURE 38: GLOBAL MASS SPECTROMETRY MARKET, BY CLINICAL TESTING, 2020-2028 (IN $ MILLION)

FIGURE 39: GLOBAL MASS SPECTROMETRY MARKET, BY OTHER MASS SPECTROMETRY, 2020-2028 (IN $ MILLION)

FIGURE 40: GLOBAL ANALYTICAL REAGENTS MARKET, BY ELECTROPHORESIS, 2020-2028 (IN $ MILLION)

FIGURE 41: GLOBAL ELECTROPHORESIS MARKET, BY GEL ELECTROPHORESIS, 2020-2028 (IN $ MILLION)

FIGURE 42: GLOBAL ELECTROPHORESIS MARKET, BY OTHER ELECTROPHORESIS, 2020-2028 (IN $ MILLION)

FIGURE 43: GLOBAL ANALYTICAL REAGENTS MARKET, BY FLOW CYTOMETRY, 2020-2028 (IN $ MILLION)

FIGURE 44: GLOBAL FLOW CYTOMETRY MARKET, BY CELL BASED, 2020-2028 (IN $ MILLION)

FIGURE 45: GLOBAL FLOW CYTOMETRY MARKET, BY CELL BASED, 2020-2028 (IN $ MILLION)

FIGURE 46: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 47: THE UNITED STATES BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 48: CANADA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 49: EUROPE BIOTECHNOLOGY REAGENTS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 50: THE UNITED KINGDOM BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 51: FRANCE BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 52: GERMANY BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 53: BIOTECHNOLOGY APPLICATIONS IN GERMANY

FIGURE 54: ITALY BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 55: RUSSIA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 56: BELGIUM BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 57: POLAND BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 58: REST OF EUROPE BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 59: ASIA PACIFIC BIOTECHNOLOGY REAGENTS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 60: CHINA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 61: INDIA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 62: JAPAN BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 63: APPLICATION OF JAPANESE BIOTECHNOLOGY

FIGURE 64: SOUTH KOREA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 65: THAILAND BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 66: INDONESIA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 67: VIETNAM BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 68: AUSTRALIA & NEW ZEALAND BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 69: REST OF ASIA PACIFIC BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 70: REST OF WORLD BIOTECHNOLOGY REAGENTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 71: LATIN AMERICA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 72: MIDDLE EAST & AFRICA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

- MARKET BY APPLICATION

- PROTEIN SYNTHESIS & PURIFICATION

- GENE EXPRESSION

- DNA & RNA ANALYSIS

- DRUG TESTING

- MARKET BY TECHNOLOGY

- LIFE SCIENCE REAGENTS

- PCR

- MASTER MIXES

- PCR REAGENT KIT

- CELL CULTURE

- SERA

- MEDIA AND REAGENTS

- INVITRO DIAGNOSTIC

- MICROBIOLOGY CULTURE

- HEMATOLOGY

- IMMUNOASSAY

- CLINICAL CHEMISTRY

- MOLECULAR DIAGNOSTIC

- EXPRESSION AND TRANSFECTION

- PCR

- ANALYTICAL REAGENTS

- CHROMATOGRAPHY

- LIQUID CHROMATOGRAPHY

- GAS CHROMATOGRAPHY

- ION CHROMATOGRAPHY

- SUPER FLUID CHROMATOGRAPHY

- OTHER CHROMATOGRAPHY

- MASS SPECTROMETRY

- PROTEOMICS

- DRUG DISCOVERY

- GENOMICS

- CLINICAL TESTING

- OTHER MASS SPECTROMETRY

- ELECTROPHORESIS

- GEL ELECTROPHORESIS

- OTHER ELECTROPHORESIS

- FLOW CYTOMETRY

- BEAD BASED

- CELL BASED

- CHROMATOGRAPHY

- LIFE SCIENCE REAGENTS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.