EUROPE ENCRYPTION SOFTWARE MARKET FORECAST 2019-2028

Europe Encryption Software Market by Component (Software, Services) by Deployment (on-premise, Cloud) by Organization Size (Large Enterprises, Small & Medium Enterprises) by Function (Disk Encryption, Communication Encryption, File/folder Encryption, Cloud Encryption) by Industrial Vertical (Bfsi, It & Telecom, Government & Public Sector, Retail, Healthcare, Aerospace & Defense, Media & Entertainment, Others) and by Geography.

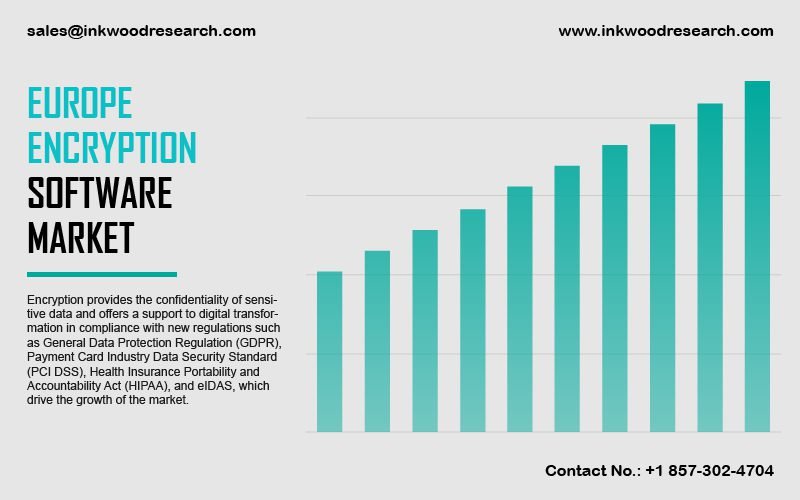

The Europe encryption software market is estimated to project a CAGR of 12.41% during the forecast period, 2019-2028. The shifting trend towards digital transformation by several European countries is one of the primary drivers of market growth in the region. Also, the rising incidence of cyberattacks in the virtual environments is resulting in an increasing need for data encryption solutions.

To know more about this report, request a free sample copy

The United Kingdom, Poland, Germany, Belgium, France, Russia, Italy, and the rest of Europe, are analyzed for the Europe encryption software market growth assessment. In the United Kingdom, there is a rising demand for encryption services to safeguard the confidentiality and integrity of electronic information transmitted on public telecommunication networks. The UK government thus proposed to make arrangements for licensing Trusted Third Parties (TTP) that provide such services. The licensing policy will protect the customers and preserve the ability of the intelligence and law enforcement agencies. Italy encompasses high internet penetration, and rising inclination towards cashless transactions. The latter warrants for increased need for network security solutions. The country was one of the victims of data-related identity theft attacks. One such attack on Unicredit exposed the information about 400,000 customers. Also, the rising penetration of cloud-based security solution providers in the country has resulted in higher adoption of the solutions by SMEs. As per the Italian Cyber Security Association (CLUSIT), cyberattacks increased by 30% in 2016. In the same year, espionage attacks grew by 39%. Such factors are set to propel the demand for the market under study.

Sophos Ltd. is one of the leading providers of information technology security and data protection solutions. The company offers Next-Gen Firewall and UTM, Secure Web Gateway, Secure Wi-Fi, etc. The product portfolio also includes SafeGuard encryption, Sophos cloud, endpoint protection, etc. The company launched Xstream architecture for Sophos XG Firewall with high-performance Transport Layer Security (TLS) in February 2020. It is capable of eliminating significant security risks with regard to encrypted network traffic.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASING NUMBER OF DATA BREACHES AND FORCE ATTACKS

- INCREASED COMPLIANCE REGULATIONS

- GROWING ADOPTION OF VIRTUALIZATION AND CLOUD

- INCREASING MOBILITY

- KEY RESTRAINTS

- HIGH CAPITAL INVESTMENT

- LIMITING THE USE OF ENCRYPTED DEVICES IN SOME OF THE COUNTRIES

- LACK OF AWARENESS AND EDUCATION

- REGULATORY RESTRICTIONS ON CRYPTO-SOFTWARE

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- IMPACT OF COVID-19 ON ENCRYPTION SOFTWARE INDUSTRY

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY COMPONENT

- SOFTWARE

- SERVICES

- MARKET BY DEPLOYMENT

- ON-PREMISE

- CLOUD

- MARKET BY ORGANIZATION SIZE

- LARGE ENTERPRISES

- SMALL & MEDIUM ENTERPRISES

- MARKET BY FUNCTION

- DISK ENCRYPTION

- COMMUNICATION ENCRYPTION

- FILE/FOLDER ENCRYPTION

- CLOUD ENCRYPTION

- MARKET BY INDUSTRIAL VERTICAL

- BFSI

- IT & TELECOM

- GOVERNMENT & PUBLIC SECTOR

- RETAIL

- HEALTHCARE

- AEROSPACE & DEFENSE

- MEDIA & ENTERTAINMENT

- OTHERS

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- COMPANY PROFILES

- CHECK POINT SOFTWARE TECHNOLOGIES

- CISCO SYSTEM INC

- SYMANTEC CORPORATION

- SOPHOS HOLDINGS LTD

- PROOFPOINT

- TREND MICRO INCORPORATED

- BROADCOM INC

- DELL INC

- FIREEYE INC

- FORTINET INC

- INTERNATIONAL BUSINESS MACHINES CORPORATION

- MCAFEE LLC

- MICROSOFT CORPORATION

- ORACLE CORPORATION

- PALO ALTO NETWORKS INC

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ENCRYPTION SOFTWARE

TABLE 2: EUROPE ENCRYPTION SOFTWARE MARKET, BY COMPONENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: EUROPE ENCRYPTION SOFTWARE MARKET, BY COMPONENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: EUROPE ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: EUROPE ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: EUROPE ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: EUROPE ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: EUROPE ENCRYPTION SOFTWARE MARKET, BY FUNCTION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: EUROPE ENCRYPTION SOFTWARE MARKET, BY FUNCTION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: EUROPE ENCRYPTION SOFTWARE MARKET, BY INDUSTRIAL VERTICAL, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: EUROPE ENCRYPTION SOFTWARE MARKET, BY INDUSTRIAL VERTICAL, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 12: EUROPE ENCRYPTION SOFTWARE MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: EUROPE ENCRYPTION SOFTWARE MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: EUROPE ENCRYPTION SOFTWARE MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2019

FIGURE 6: EUROPE ENCRYPTION SOFTWARE MARKET, BY SOFTWARE, 2019-2028 (IN $ MILLION)

FIGURE 7: EUROPE ENCRYPTION SOFTWARE MARKET, BY SERVICES, 2019-2028 (IN $ MILLION)

FIGURE 8: EUROPE ENCRYPTION SOFTWARE MARKET, GROWTH POTENTIAL, BY DEPLOYMENT, IN 2019

FIGURE 9: EUROPE ENCRYPTION SOFTWARE MARKET, BY ON-PREMISE, 2019-2028 (IN $ MILLION)

FIGURE 10: EUROPE ENCRYPTION SOFTWARE MARKET, BY CLOUD, 2019-2028 (IN $ MILLION)

FIGURE 11: EUROPE ENCRYPTION SOFTWARE MARKET, GROWTH POTENTIAL, BY ORGANIZATION SIZE, IN 2019

FIGURE 12: EUROPE ENCRYPTION SOFTWARE MARKET, BY LARGE ENTERPRISES, 2019-2028 (IN $ MILLION)

FIGURE 13: EUROPE ENCRYPTION SOFTWARE MARKET, BY SMALL & MEDIUM ENTERPRISES, 2019-2028 (IN $ MILLION)

FIGURE 14: EUROPE ENCRYPTION SOFTWARE MARKET, GROWTH POTENTIAL, BY FUNCTION, IN 2019

FIGURE 15: EUROPE ENCRYPTION SOFTWARE MARKET, BY DISK ENCRYPTION, 2019-2028 (IN $ MILLION)

FIGURE 16: EUROPE ENCRYPTION SOFTWARE MARKET, BY COMMUNICATION ENCRYPTION, 2019-2028 (IN $ MILLION)

FIGURE 17: EUROPE ENCRYPTION SOFTWARE MARKET, BY FILE/FOLDER ENCRYPTION, 2019-2028 (IN $ MILLION)

FIGURE 18: EUROPE ENCRYPTION SOFTWARE MARKET, BY CLOUD ENCRYPTION, 2019-2028 (IN $ MILLION)

FIGURE 19: EUROPE ENCRYPTION SOFTWARE MARKET, GROWTH POTENTIAL, BY INDUSTRIAL VERTICAL, IN 2019

FIGURE 20: EUROPE ENCRYPTION SOFTWARE MARKET, BY BFSI, 2019-2028 (IN $ MILLION)

FIGURE 21: EUROPE ENCRYPTION SOFTWARE MARKET, BY IT & TELECOM, 2019-2028 (IN $ MILLION)

FIGURE 22: EUROPE ENCRYPTION SOFTWARE MARKET, BY GOVERNMENT & PUBLIC SECTOR, 2019-2028 (IN $ MILLION)

FIGURE 23: EUROPE ENCRYPTION SOFTWARE MARKET, BY RETAIL, 2019-2028 (IN $ MILLION)

FIGURE 24: EUROPE ENCRYPTION SOFTWARE MARKET, BY HEALTHCARE, 2019-2028 (IN $ MILLION)

FIGURE 25: EUROPE ENCRYPTION SOFTWARE MARKET, BY AEROSPACE & DEFENSE, 2019-2028 (IN $ MILLION)

FIGURE 26: EUROPE ENCRYPTION SOFTWARE MARKET, BY MEDIA & ENTERTAINMENT, 2019-2028 (IN $ MILLION)

FIGURE 27: EUROPE ENCRYPTION SOFTWARE MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 28: EUROPE ENCRYPTION SOFTWARE MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 29: UNITED KINGDOM ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 30: GERMANY ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 31: FRANCE ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: ITALY ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: RUSSIA ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: BELGIUM ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: POLAND ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: REST OF EUROPE ENCRYPTION SOFTWARE MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- MARKET BY COMPONENT

- SOFTWARE

- SERVICES

- MARKET BY DEPLOYMENT

- ON-PREMISE

- CLOUD

- MARKET BY ORGANIZATION SIZE

- LARGE ENTERPRISES

- SMALL & MEDIUM ENTERPRISES

- MARKET BY FUNCTION

- DISK ENCRYPTION

- COMMUNICATION ENCRYPTION

- FILE/FOLDER ENCRYPTION

- CLOUD ENCRYPTION

- MARKET BY INDUSTRIAL VERTICAL

- BFSI

- IT & TELECOM

- GOVERNMENT & PUBLIC SECTOR

- RETAIL

- HEALTHCARE

- AEROSPACE & DEFENSE

- MEDIA & ENTERTAINMENT

- OTHERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.