CANADA LIQUEFIED NATURAL GAS (LNG) MARKET

Natural gas is a fossil fuel majorly comprising of methane. As with other fossil fuels, it is formed deep beneath the earth’s surface due to the decomposition of dead plants and animals under extreme heat and pressures. Natural gas is cleaner than most other fossilized fuels. However, its calorific value is lower than the fossil fuels like petrol, diesel, and LPG.

To learn more about this report, request a free sample copy

Besides feed gas cost aspects, there are various factors for many US LNG projects moving forward while Canadian initiatives have stalled. These include indigenous land rights, Greenfield versus Brownfield building, labor availability at certain sites, environmental studies, and government changes.

Canada is the fourth-largest natural gas producer globally (after the United States, Russia, and Iran). Production had increased by 1.3% per year on an average between 2013 and 2019 but later dropped by 2% in 2020, equivalent to 172 bcm (billion cubic meters). The production mainly comes from the Alberta region (70% of the total production). The total proved reserves of the country as of 2020 are 2.0 trillion cubic meters. This forms 1.3% of the global total proved reserves.

However, liquefying natural gas is a cost-effective alternative in some places where pipeline transit is not feasible. When natural gas is frozen to around -260°F, it becomes Liquified Natural Gas, also known as LNG. The volume decrease is 600 times that of the original.

For many years, industry officials have benefitted by building up more capacity for LNG in Canada, specifically along the West Coast. The reason is its shorter shipping distance to key Asian importing markets than the US Gulf Coast and the closeness to prolific shale basins that provide feed gas.

Moreover, factors such as uncertainty over the global prices, bigger challenges to the securing partners and further commercial agreements with buyers, the high infrastructure costs in Canada as compared to the US, the requirement to get indigenous groups on board with the industry, and the pandemic have impacted the Canada LNG market growth. LNG Canada, backed by Canada in Kitimat and British Columbia, is the only major LNG terminal still under construction in the country. Woodfibre LNG, which delayed its terminal work in Squamish, BC, until summer 2021, is the only other major project that has been sanctioned in recent years.

LNG is highly flammable, and major exporting takes place by the sea. As a result, many regulations must be followed by the industry players. Key regulatory authorities that govern the LNG industry in the country are Natural Resources Canada (NRCan), Canada Energy Regulator (CER), and Impact Assessment Agency (IAAC).

The top LNG companies in the country are Encana, CNR, Repsol, etc.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- CANADA LNG MARKET: EXECUTIVE SUMMARY

- CANADA OVERALL ECONOMIC CONDITIONS

- CANADA PRIMARY ENERGY CONSUMPTION

- NATURAL GAS

- CANADA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- TOTAL PROVED RESERVES

- NATURAL GAS PRODUCTION

- NATURAL GAS CONSUMPTION

- CANADA NATURAL GAS TOTAL PROVED RESERVES, PRODUCTION, AND CONSUMPTION

- LIQUIFIED NATURAL GAS (LNG)

- VALUE CHAIN ANALYSIS

- EXPLORATION AND PRODUCTION

- LIQUEFACTION

- SHIPPING

- STORAGE AND REGASIFICATION

- END-USERS

- TRADE

- EXPORTS

- IMPORTS

- LNG TERMINALS

- LIST OF LNG EXPORT TERMINALS

- LIST OF LNG IMPORT TERMINALS

- REGULATORY FRAMEWORK FOR LNG

- VALUE CHAIN ANALYSIS

LIST OF TABLES

TABLE 1: CANADA NATURAL GAS TOTAL PROVED RESERVES, 2000, 2010, AND 2020 (IN TRILLION CUBIC METERS)

TABLE 2: CANADA NATURAL GAS PRODUCTION, 2016-2020 (IN EXAJOULES)

TABLE 3: CANADA NATURAL GAS CONSUMPTION, 2016-2020 (IN EXAJOULES)

TABLE 4: CANADA LNG EXPORTS, 2016-2020 (IN BILLION CUBIC METERS)

TABLE 5: CANADA LNG IMPORTS, 2016-2020 (IN BILLION CUBIC METERS)

TABLE 6: LNG EXPORT TERMINALS, NOT YET BUILT

TABLE 7: LNG IMPORT TERMINALS, EXISTING

TABLE 8: REGULATORY FRAMEWORK

LIST OF FIGURES

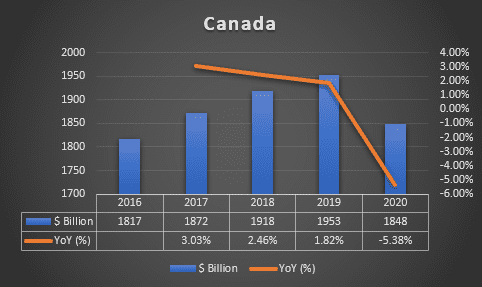

FIGURE 1: CANADA GROSS DOMESTIC PRODUCT, 2016-2020 ($ BILLION)

FIGURE 2: PRIMARY ENERGY CONSUMPTION, BY FUEL TYPES, 2019 & 2020 (IN %)

FIGURE 3: PRIMARY ENERGY CONSUMPTION, 2016-2020 (EXAJOULES)

FIGURE 4: CANADA NATURAL GAS PRODUCTION VS CONSUMPTION, 2016-2020 (IN EXAJOULES)

FIGURE 5: VALUE CHAIN ANALYSIS

CANADA GROSS DOMESTIC PRODUCT, 2016-2020, ($ BILLION)

GDP (constant 2010 US$)

Source: World Bank

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.