ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET FORECAST 2021-2028

Asia-Pacific OTC Artificial Tears Market by Formulation (Preservative Based, Non-preservative Based) Market by Product (Solution, Ointment, Gel, Spray Solution, Emulsion, Suspension) Market by Type of Container (Plastic Multi-dose Container, Plastic Single-dose Container, Spray) Market by Application (Dry Eye Syndrome, Allergies, Contact Lens Moisture Retention, Infections, Uv & Blue Light Protection, Other Applications) Market by Distribution Channel( Drug Stores & Retail Pharmacies, Hospital Pharmacies, Online Pharmacies) by Geography

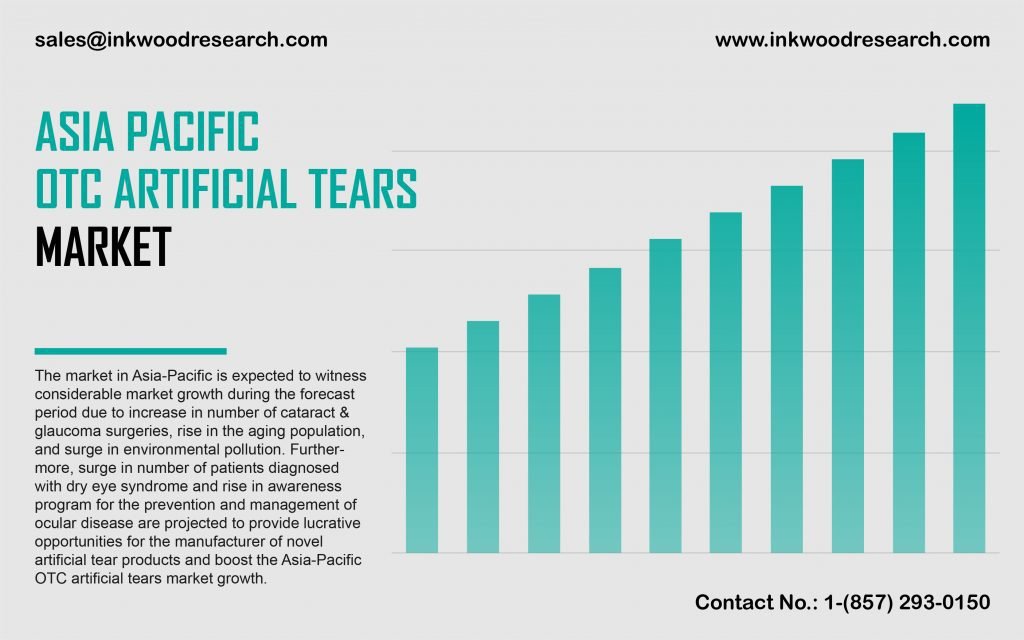

The Asia-Pacific OTC artificial tears market is anticipated to grow with a CAGR of 5.58% over the forecasting years of 2021 to 2028. The rising number of cataract and glaucoma surgeries performed, the increasing rates of patients diagnosed with dry eye syndrome, the surge in environmental pollution, and the growing senior populace are among the key drivers associated with the region’s market growth.

To learn more about this report, request a free sample copy

The Asia-Pacific OTC artificial tears market growth assessment encompasses the study of Indonesia, China, South Korea, Japan, India, Singapore, Australia & New Zealand, Thailand, and the rest of the Asia-Pacific. Dry eye disease is critically underdiagnosed in India, with aging significantly contributing to the condition’s development. Besides, the majority of individuals over the age of 65 experience dry eye symptoms in the country. As per the report by the Ministry for Statistics and Program Implementation in 2016, India has more than 103 million elderly individuals, out of which, around 8.5% of the population is estimated to be impacted by dry eyes. As a result, the condition’s incidence is continually rising in India.

While aging is a common cause of dry eyes, numerous medications and medical conditions may also result in the disease’s occurrence. According to the 2019 survey conducted by Johnson & Johnson Vision, 70% of people living in Singapore often suffer from Meibomian Gland Dysfunction (MGD) symptoms, a primary cause of dry eye disease. Therefore, these factors are set to propel the market growth in the Asia-Pacific over the forecast period.

Sun Pharmaceutical Industries Ltd, headquartered in India, is a specialty pharmaceutical firm that manufactures and commercializes active pharmaceutical ingredients (APIs) as well as pharmaceutical formulations in India and internationally. It provides affordable and high-quality medicines trusted by patients and healthcare professionals in more than 150 countries globally. The company’s portfolio includes branded generics, generics, antiretrovirals (ARVs), over-the-counter (OTC) products, and intermediates.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- PREVALENCE OF ALLERGIC CONJUNCTIVITIS AND DRY EYE DISEASE

- PROGRESSIONS IN RESEARCH AND DEVELOPMENT IN THE OPTOMETRY SECTOR

- SUSCEPTIBILITY OF GERIATRIC POPULATION TO EYE DISEASES

- DEMAND FOR THE OTC ARTIFICIAL TEARS FOR THE TREATMENT OF PATIENTS

- KEY RESTRAINTS

- ACCESSIBILITY OF SUBSTITUTE THERAPIES

- RISK OF SIDE EFFECTS RELATED TO THE OTC ARTIFICIAL TEARS DRUG

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON OTC ARTIFICIAL TEARS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY FORMULATION

- PRESERVATIVE BASED

- NON-PRESERVATIVE BASED

- MARKET BY PRODUCT

- SOLUTION

- OINTMENT

- GEL

- SPRAY SOLUTION

- EMULSION

- SUSPENSION

- MARKET BY TYPE OF CONTAINER

- PLASTIC MULTI-DOSE CONTAINER

- PRESERVATIVE-FREE SYSTEM

- PRESERVED SYSTEMS

- PLASTIC SINGLE-DOSE CONTAINER

- SPRAY

- PRESERVED SYSTEMS

- PRESERVATIVE-FREE SYSTEM

- PLASTIC MULTI-DOSE CONTAINER

- MARKET BY APPLICATION

- DRY EYE SYNDROME

- ALLERGIES

- CONTACT LENS MOISTURE RETENTION

- INFECTIONS

- UV & BLUE LIGHT PROTECTION

- OTHER APPLICATIONS

- MARKET BY DISTRIBUTION CHANNEL

- DRUG STORES & RETAIL PHARMACIES

- HOSPITAL PHARMACIES

- ONLINE PHARMACIES

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- INDONESIA

- THAILAND

- SINGAPORE

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS, ANNOUNCEMENTS, AND DIVESTITURES

- COMPANY PROFILES

- AKORN INC

- ALCON INC

- ALLERGAN PLC (ACQUIRED BY ABBVIE)

- BAUSCH HEALTH COMPANIES INC

- JOHNSON & JOHNSON

- NICOX SA

- NOVARTIS AG

- OASIS MEDICAL

- OCUSOFT INC

- SANTEN PHARMACEUTICAL CO LTD

- SENTISS PHARMA PVT LTD

- SIMILASAN CORPORATION

- SUN PHARMACEUTICAL INDUSTRIES LTD

- URSAPHARM ARZNEIMITTEL GMBH

- VISUFARMA

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – OTC ARTIFICIAL TEARS

TABLE 2: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY FORMULATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY FORMULATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PRODUCT, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY TYPE OF CONTAINER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY TYPE OF CONTAINER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC PLASTIC MULTI-DOSE CONTAINER MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC PLASTIC MULTI-DOSE CONTAINER MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC SPRAY MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: ASIA-PACIFIC SPRAY MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 12: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 13: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 14: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY DISTRIBUTION CHANNEL, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 16: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 17: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY REGION, FORECAST YEAR 2021-2028 (IN $ MILLION)

TABLE 18: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 19: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 20: LEADING PLAYERS OPERATING IN THE ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET

TABLE 21: LIST OF MERGERS & ACQUISITIONS

TABLE 22: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 23: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 24: LIST OF BUSINESS EXPANSIONS, ANNOUNCEMENTS, AND DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY FORMULATION, IN 2020

FIGURE 6: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PRESERVATIVE BASED, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY NON-PRESERVATIVE BASED, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PRODUCT, IN 2020

FIGURE 9: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY SOLUTION, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY OINTMENT, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY GEL, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY SPRAY SOLUTION, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY EMULSION, 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY SUSPENSION, 2021-2028 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY TYPE OF CONTAINER, IN 2020

FIGURE 16: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PLASTIC MULTI-DOSE CONTAINER, 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC PLASTIC MULTI-DOSE CONTAINER MARKET, BY PRESERVATIVE-FREE SYSTEM, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC PLASTIC MULTI-DOSE CONTAINER MARKET, BY PRESERVED SYSTEMS, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY PLASTIC SINGLE-DOSE CONTAINER, 2021-2028 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY SPRAY, 2021-2028 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC SPRAY MARKET, BY PRESERVED SYSTEMS, 2021-2028 (IN $ MILLION)

FIGURE 22: ASIA-PACIFIC SPRAY MARKET, BY PRESERVATIVE-FREE SYSTEM, 2021-2028 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY APPLICATION, IN 2020

FIGURE 24: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY DRY EYE SYNDROME, 2021-2028 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY ALLERGIES, 2021-2028 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY CONTACT LENS MOISTURE RETENTION, 2021-2028 (IN $ MILLION)

FIGURE 27: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY INFECTIONS, 2021-2028 (IN $ MILLION)

FIGURE 28: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY UV & BLUE LIGHT PROTECTION, 2021-2028 (IN $ MILLION)

FIGURE 29: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 30: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY DISTRIBUTION CHANNEL, IN 2020

FIGURE 31: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY DRUG STORES & RETAIL PHARMACIES, 2021-2028 (IN $ MILLION)

FIGURE 32: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY HOSPITAL PHARMACIES, 2021-2028 (IN $ MILLION)

FIGURE 33: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, BY ONLINE PHARMACIES, 2021-2028 (IN $ MILLION)

FIGURE 34: ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, COUNTRY OUTLOOK, 2020 & 2028 (IN %)

FIGURE 35: CHINA OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 36: JAPAN OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 37: INDIA OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 38: AUSTRALIA & NEW ZEALAND OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 39: SOUTH KOREA OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 40: INDONESIA OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 41: THAILAND OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 42: SINGAPORE OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 43: REST OF ASIA-PACIFIC OTC ARTIFICIAL TEARS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- INDONESIA

- THAILAND

- SINGAPORE

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- MARKET BY FORMULATION

- PRESERVATIVE BASED

- NON-PRESERVATIVE BASED

- MARKET BY PRODUCT

- SOLUTION

- OINTMENT

- GEL

- SPRAY SOLUTION

- EMULSION

- SUSPENSION

- MARKET BY TYPE OF CONTAINER

- PLASTIC MULTI-DOSE CONTAINER

- PRESERVATIVE-FREE SYSTEM

- PRESERVED SYSTEMS

- PLASTIC SINGLE-DOSE CONTAINER

- SPRAY

- PRESERVED SYSTEMS

- PRESERVATIVE-FREE SYSTEM

- PLASTIC MULTI-DOSE CONTAINER

- MARKET BY APPLICATION

- DRY EYE SYNDROME

- ALLERGIES

- CONTACT LENS MOISTURE RETENTION

- INFECTIONS

- UV & BLUE LIGHT PROTECTION

- OTHER APPLICATIONS

- MARKET BY DISTRIBUTION CHANNEL

- DRUG STORES & RETAIL PHARMACIES

- HOSPITAL PHARMACIES

- ONLINE PHARMACIES

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.