GLOBAL ANTI-ACNE DERMAL PATCH MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

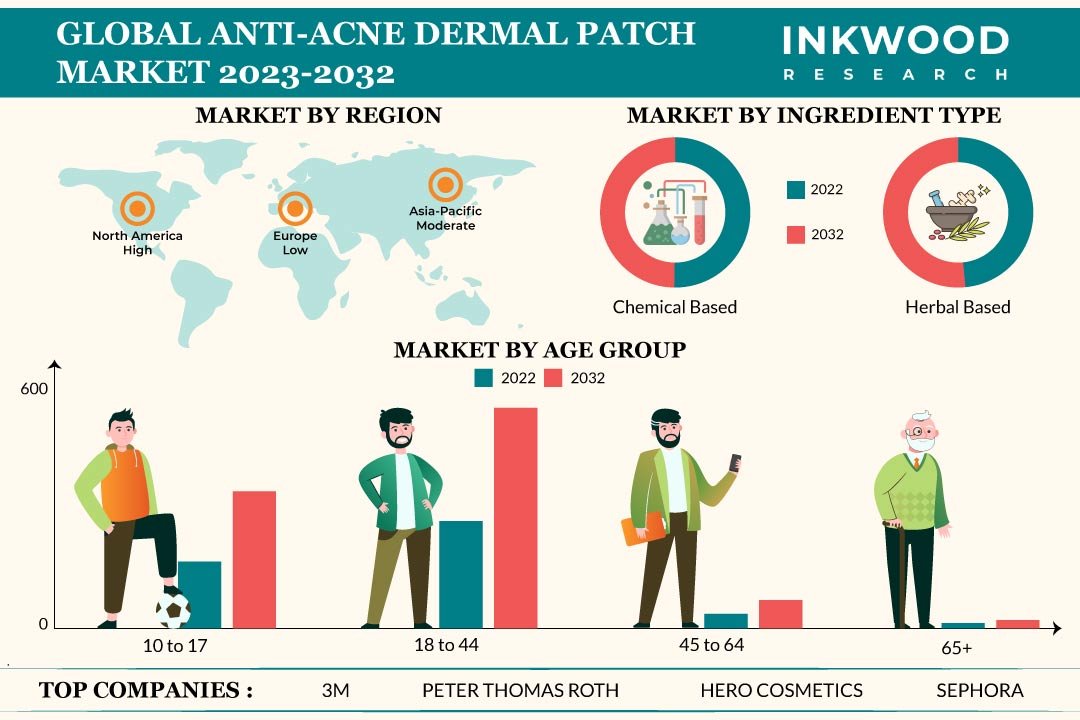

Global Anti-acne Dermal Patch Market by Ingredient Type (Chemical-based, Herbal-based) Market by Age Group (10 to 17, 18 to 44, 45 to 64, Above 65) Market by Distribution Channel (Pharmacies & Drug Store, E-commerce Platforms, Retail Stores) by Geography

REPORTS » CONSUMER GOODS » PERSONAL CARE » GLOBAL ANTI-ACNE DERMAL PATCH MARKET FORECAST 2023-2032

MARKET OVERVIEW

The global anti-acne dermal patch market was valued at $478.74 million in 2022, and is expected to reach $971.37 million by 2032, growing at a CAGR of 7.32% during the forecast period, 2023-2032.

Anti-acne dermal patch is commonly known as a pimple patch. It has become a popular choice among the masses as an acne pain reliever. It comprises active ingredients like hydrocolloids that help reduce the pain and inflammation caused by an acne breakout.

There is a growing preference for non-prescription acne treatment. The strong social media presence of acne patch brands and celebrity endorsements have contributed to the anti-acne dermal patch market expansion. Gen-Z shoppers are the major end-users in this market.

Read our latest blog on the Anti-Acne Dermal Patch Market

GROWTH ENABLERS

Key growth enablers for the global anti-acne dermal patch market are:

- Growing acne incidence and skin sensitivity among adults & teens

- Rising media commercialization

- High psychological impact of acne

- A Journal of Cutaneous Medicine and Surgery article on the social and psychological impact of acne treatment states that acne has a long-term psychosocial impact on adults. This has resulted in the wider use of acne patches among teens and adults.

- Unlike most other dermatologic diseases, which are usually limited to areas covered by clothing, acne is frequently visible on the face, aggravating body image and socialization issues.

GROWTH RESTRAINTS

Key factors restraining the global anti-acne dermal patch market growth are:

- Skin neutrality and positivity movement

- Availability of substitutes for acne treatment

- According to dermatologists, acne patches can only prevent acne from spreading and scarring. Also, they are not a permanent solution because the condition may reappear if the underlying conditions are not addressed.

- Prescription medicines and acne drugs are potential substitutes for hydrocolloid patches. Acne medications work either by decreasing oil production and swelling or by treating bacterial infections.

- Topical medications include retinoids which come in creams, gels, and lotions. It also comprises antibiotics and salicylic acid. In addition, oral medications and therapies are effective in treating acne.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Anti-Acne Dermal Patch Market | Top Market Trends

- The prevalence of polycystic ovary syndrome (PCOS) and sedentary lifestyles have led to higher acne incidences. Dietary habits, smoking, and alcohol consumption are also associated with acne severity, according to an article on epidemiological risk factors associated with acne vulgaris in Singapore Chinese Population.

- The online acne patch market is expanding at a rapid rate. Technological advancements like augmented reality, 360-degree views, and interactive VR clips offered to consumers by e-commerce platforms have revolutionized the online market for acne patches. Additionally, skin care brands provide virtual advisors to solve customer queries, make personalized product recommendations, and simplify the purchasing process for the customer.

- Skin care routines are becoming popular among people. Social media plays a key role as people turn to social media platforms to learn about skincare routines and ingredients.

MARKET SEGMENTATION

Market Segmentation – Ingredient Type, Age Group, and Distribution Channel –

Market by Ingredient Type:

- Chemical-Based

- Herbal-Based

- Herbal-based is the fastest-growing ingredient type in the market.

- The increasing shift toward natural and ayurvedic acne treatments has made herbal acne patches popular among consumers. Also, the growing global demand for herbal-based skincare products due to their natural healing properties and lack of side effects is one of the primary factors driving the expansion of the herbal-based segment.

- Further, research and development activities regarding herbal acne patches are increasing. Herbal acne patches are made of silk and mulberries. Similarly, studies concerning the extraction processes for silk and mulberry are on the rise.

Market by Age Group:

- 10 to 17

- 18 to 44

- The 18 to 44 segment is the largest revenue-generating age group in the market.

- This segment comprises either college students or working professionals. This includes those who use smartphones, are active on social media, and are more knowledgeable about products available for acne treatments.

- The prevalence of adult acne can be traced to factors like changes in the body and skin caused by pollution, fluctuating or excessive hormones, stress, poor lifestyle or eating habits, alcohol consumption, and smoking. Besides, the inclination toward instant acne treatment among teens and adults has escalated the adoption of acne patches in this segment.

- Furthermore, the psychological burden associated with acne is highest in this age group, especially among teens and young adults. This is anticipated to offer growth opportunities.

- 45 to 64

- Above 65

Market by Distribution Channel:

- Pharmacies & Drug Stores

- E-Commerce Platforms

- Retail Stores

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:- North America: The United States and Canada

- Europe: The United Kingdom, France, Germany, Spain, Italy, Nordic Countries, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Taiwan, Singapore, Australia & New Zealand, and Rest of Asia-Pacific

- Asia-Pacific is the dominating region in the global anti-acne dermal patch market.

- Acne patches were introduced by South Korea to other countries. K-beauty products are valued and preferred over others due to the use of traditional ingredients backed with scientific procedures. Also, K-beauty has been gaining popularity among key market players in Asia-Pacific, like COSRX. This has led to considerable demand for acne patches in the region.

- India has the world’s largest youth population, which makes up around 66% of the global population. With acne prevalence peaking between the ages of 19 and 30, more of the country’s youth are looking for acne treatment products.

- Rest of the World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Some of the major players in the global anti-acne dermal patch market are:

- 3M

- Peter Thomas Roth

- Hero Cosmetics

- Sephora

- COSRX

Key strategies adopted by some of these companies:

- September 2022: Church & Dwight announced its acquisition of Hero Cosmetics for $630 million. Hero Cosmetics is popular for its Mighty Patch, the fastest-growing among other acne treatment products. The brand enjoys a vast consumer base among young adults and teenagers, high brand loyalty, and repeat purchases. This acquisition aims to expand the brand’s distribution internationally.

- November 2022: Heyday is an American D2C company with approximately 20 brands in its portfolio. It has announced the acquisition of ZitSticka, an acne patch brand, which will add a wide variety of products to its personal care range. This acquisition was for an undisclosed amount.

- December 2022: Peace Out Skincare is an American brand that launched the first make-up-friendly pimple patch. The patch is OTC registered. It is the thinnest hydrocolloid acne patch that can also be worn with makeup

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Market by Ingredient Type, Age Group, Distribution channel |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | 3M, Peter Thomas Roth, Hero Cosmetics, Sephora, COSRX, Peach & Lily, DermaAngel, Starface, Real, ZitSticka, Peace Out |

TABLE OF CONTENT

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- MAJOR MARKET FINDINGS

- ADOPTION OF SKINCARE ROUTINES

- UPSURGE IN RESEARCH ON NATURAL INGREDIENTS

MARKET DYNAMICS

- KEY DRIVERS

- GROWING ACNE INCIDENCE AND SKIN SENSITIVITY AMONG ADULTS AND TEENS

- RISING MEDIA COMMERCIALIZATION

- HIGH PSYCHOLOGICAL IMPACT OF ACNE

- KEY RESTRAINTS

- SKIN NEUTRALITY AND POSITIVITY MOVEMENT

- AVAILABILITY OF SUBSTITUTES FOR ACNE TREATMENT

- KEY DRIVERS

KEY ANALYTICS

- PARENT MARKET ANALYSIS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR SPAIN

- GROWTH PROSPECT MAPPING FOR INDIA

- GROWTH PROSPECT MAPPING FOR LATIN AMERICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS

- MANUFACTURERS

- DISTRIBUTORS

- END-USER

- KEY BUYING CRITERIA

- SIZE AND COST

- SKIN TONE

- INGREDIENTS

- PRODUCT FEATURES

MARKET BY INGREDIENT TYPE

- CHEMICAL-BASED

- HERBAL-BASED

MARKET BY AGE GROUP

- 10 TO 17

- 18 TO 44

- 45 TO 64

- ABOVE 65

MARKET BY DISTRIBUTION CHANNEL

- PHARMACIES & DRUG STORE

- E-COMMERCE PLATFORMS

- RETAIL STORES

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET DRIVERS

- NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET CHALLENGES

- NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE ANTI-ACNE DERMAL PATCH MARKET DRIVERS

- EUROPE ANTI-ACNE DERMAL PATCH MARKET CHALLENGES

- EUROPE ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE ANTI-ACNE DERMAL PATCH MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- NORDIC COUNTRIES

- NORDIC COUNTRIES ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET DRIVERS

- ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET CHALLENGES

- ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- TAIWAN

- TAIWAN ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- SINGAPORE

- SINGAPORE ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET DRIVERS

- REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET CHALLENGES

- REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA ANTI-ACNE DERMAL PATCH MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- 3M

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- COSRX

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- DERMA ANGEL

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- HERO COSMETICS

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- PEACE OUT

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- PEACH & LILY

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- PETER THOMAS ROTH

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- RAEL

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SEPHORA

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- STARFACE

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ZITSTICKA

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- 3M

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ANTI-ACNE DERMAL PATCH

TABLE 2: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY INGREDIENT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY INGREDIENT TYPE, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL CHEMICAL-BASED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL CHEMICAL-BASED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL HERBAL-BASED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL HERBAL-BASED MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY AGE GROUP, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY AGE GROUP, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL 10 TO 17 AGE GROUP MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL 10 TO 17 AGE GROUP MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL 18 TO 44 AGE GROUP MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL 18 TO 44 AGE GROUP MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL 45 TO 64 AGE GROUP MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL 45 TO 64 AGE GROUP MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL ABOVE 65 AGE GROUP MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL ABOVE 65 AGE GROUP MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY DISTRIBUTION CHANNEL, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL PHARMACIES & DRUG STORES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL PHARMACIES & DRUG STORES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL E-COMMERCE PLATFORMS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL E-COMMERCE PLATFORMS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL RETAIL STORES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL RETAIL STORES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

TABLE 31: KEY PLAYERS OPERATING IN NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET

TABLE 32: EUROPE ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: EUROPE ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: EUROPE ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

TABLE 35: KEY PLAYERS OPERATING IN EUROPE ANTI-ACNE DERMAL PATCH MARKET

TABLE 36: ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

TABLE 39: KEY PLAYERS OPERATING IN ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET

TABLE 40: REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET REGULATORY FRAMEWORK

TABLE 43: KEY PLAYERS OPERATING IN REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET

TABLE 44: LIST OF ACQUISITIONS

TABLE 45: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 46: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR SPAIN

FIGURE 5: MARKET MATURITY ANALYSIS

FIGURE 6: MARKET CONCENTRATION ANALYSIS

FIGURE 7: VALUE CHAIN ANALYSIS

FIGURE 8: KEY BUYING CRITERIA

FIGURE 9: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, GROWTH POTENTIAL, BY INGREDIENT TYPE, IN 2022

FIGURE 10: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY CHEMICAL-BASED INGREDIENTS, 2023-2032 (IN $ MILLION)

FIGURE 11: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY HEBAL-BASED INGREDIENTS, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, GROWTH POTENTIAL, BY AGE GROUP, IN 2022

FIGURE 13: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY 10 TO 17, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY 18 TO 44, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY 45 TO 64, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY ABOVE 65, 2023-2032 (IN $ MILLION)

FIGURE 17: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, GROWTH POTENTIAL, BY DISTRIBUTION CHANNEL, IN 2022

FIGURE 18: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY PHARMACIES & DRUG STORE, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY E-COMMERCE PLATFORMS, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL ANTI-ACNE DERMAL PATCH MARKET, BY RETAIL STORES, 2023-2032 (IN $ MILLION)

FIGURE 21: NORTH AMERICA ANTI-ACNE DERMAL PATCH MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 22: UNITED STATES ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 23: CANADA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 24: EUROPE ANTI-ACNE DERMAL PATCH MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 25: UNITED KINGDOM ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 26: GERMANY ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: FRANCE ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: ITALY ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: SPAIN ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: NORDIC COUNTRIES ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: REST OF EUROPE ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 33: CHINA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 34: JAPAN ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: INDIA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: SOUTH KOREA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: INDONESIA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: TAIWAN ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: SINGAPORE ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: AUSTRALIA & NEW ZEALAND ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: REST OF ASIA-PACIFIC ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: REST OF WORLD ANTI-ACNE DERMAL PATCH MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 43: LATIN AMERICA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FIGURE 44: MIDDLE EAST & AFRICA ANTI-ACNE DERMAL PATCH MARKET, 2023-2032 (IN $ MILLION)

FAQ’s

FAQs

Anti-acne dermal patches are distributed through pharmacies & drug stores, e-commerce platforms, and retail stores.

North America is the fastest-growing region in the global anti-acne dermal patch market.

Chemical-based is the dominant ingredient type in the global anti-acne dermal patch market.

RELATED REPORTS

-

GLOBAL CANNABIS TESTING MARKET FORECAST 2024-2032

-

AUSTRALIA & NEW ZEALAND CANNABIS TESTING MARKET FORECAST 2024-2032

-

GERMANY CANNABIS TESTING MARKET FORECAST 2024-2032

-

UNITED STATES CANNABIS TESTING MARKET FORECAST 2024-2032

-

GLOBAL PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032

-

ASIA-PACIFIC PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032

-

EUROPE PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032

-

NORTH AMERICA PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032

-

CHINA PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032

-

UNITED KINGDOM PORTABLE AIR PURIFIER MARKET FORECAST 2024-2032