GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

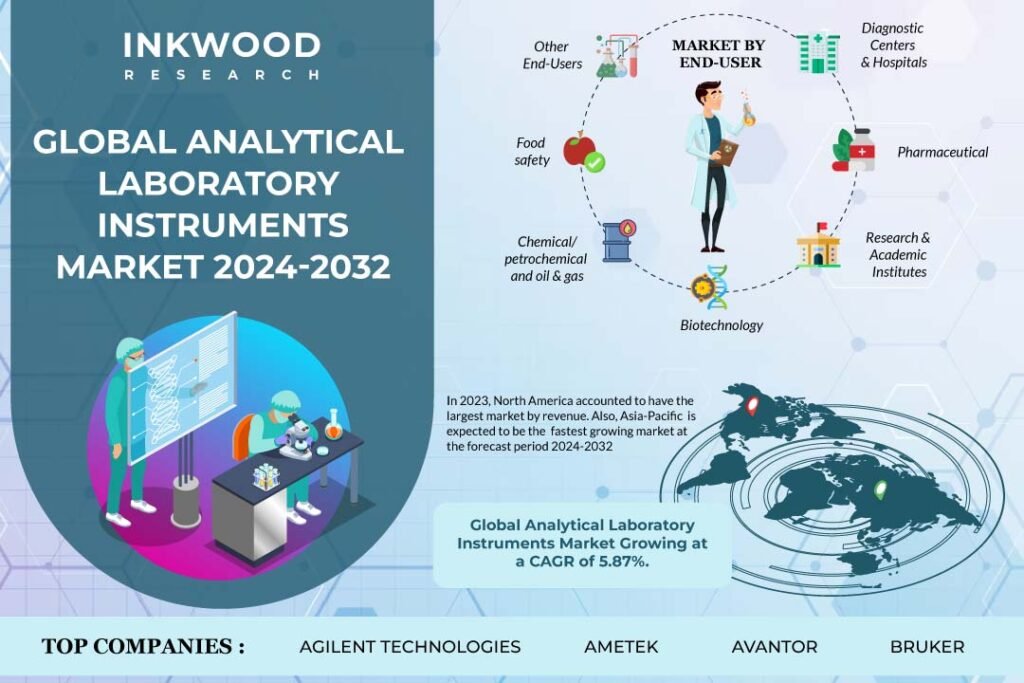

Global Analytical Laboratory Instruments Market by Type (Elemental Analysis Instruments, Molecular Analysis Instruments, Separation Analysis Instruments, Other Types) Market by End-user (Diagnostic Centers & Hospitals, Pharmaceutical, Research & Academic Institutes, Biotechnology, Chemical/petrochemical and Oil & Gas, Food Testing, Other End-users) by Geography

REPORTS » HEALTHCARE » BIOTECHNOLOGY » GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET FORECAST 2024-2032

MARKET OVERVIEW

The global analytical laboratory instruments market was valued at $58556.20 million in 2023 and is expected to reach $98111.55 million by 2032, growing at a CAGR of 5.87% during the forecast period, 2024-2032. The base year considered for the study is 2023, and the estimated period is between 2024 and 2032.

Analytical laboratory instruments constitute a versatile toolkit designed for both qualitative and quantitative sample analysis. These tools are engineered to discern the chemical composition and quantity of individual components within a sample. The wide array of available equipment facilitates a diverse range of testing methods with corresponding applications.

Due to their compatibility across various disciplines, analytical laboratory instruments prove valuable in multiple fields for sample analysis. This instrumentation encompasses devices used in spectroscopy, mass spectrometry, electrochemical analysis, thermal analysis, separation analysis, microscopy, and hybrid technologies (e.g., GC-MS and HPLC-MS).

Examples of these instruments include mass spectrometers, chromatographs (e.g., GC and HPLC), titrators, spectrometers (e.g., AAS, X-ray, and fluorescence), particle size analyzers, rheometers, elemental analyzers (e.g., salt analyzers, CHN analyzers), thermal analyzers, etc.

Read our latest blog on the Analytical Laboratory Instruments Market

GROWTH ENABLERS

Key enablers of the global analytical laboratory instruments market growth are:

- Growing utilization across the chemical and petrochemical sectors

- Chemical and petrochemical laboratories employ sophisticated analytical instruments and software to conduct intricate analyses on substances such as naphtha, natural gas, crude oil, chemicals, and polymers. These instruments play a crucial role in optimizing plant production output.

- The global market growth for analytical laboratory instruments is driven by the rising chemical and petrochemical production worldwide. The increasing demand for chemicals and petrochemicals in product manufacturing has led to the widespread adoption of analytical instruments for testing purity and analyzing chemical compounds.

- Advancement in technologies

- Robust expansion in the pharmaceutical and biopharmaceutical sectors

GROWTH RESTRAINTS

Key growth restraining factors of the global analytical laboratory instruments market are:

- Elevated expenses associated with components and instruments

- Insufficiently trained laboratory professionals

- The field of clinical laboratory science is grappling with a significant workforce shortage, as only one-third of the required training programs are completed annually. This shortage poses challenges in workload management and staff turnover, compelling under-compensated employees to take on additional shifts or part-time positions.

- Laboratories incur substantial costs to secure adequately trained personnel, thereby contributing to the overall decline in the number of laboratory professionals.

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Analytical Laboratory Instruments Market | Top Trends

- Advancements in technology empower manufacturers of analytical laboratory instruments to reduce instrument size and improve operational efficiency by integrating multiple functions into a single device.

- Incorporating artificial intelligence enhances operations, automates processes, and optimizes real-time performance, streamlining workflows and freeing scientists from repetitive tasks. In advanced imaging applications such as cellular and tissue analysis, AI enhances data visualization, analysis, anomaly detection, classification, and interpretation, leading to improved experimental outcomes and insights.

- Nanotechnology has significantly impacted chromatography, enhancing separation techniques, efficiency, and sensitivity. The utilization of popular nanomaterials such as carbon nanotubes, silica, and magnetic nanoparticles enhances interactions with analytes, resulting in increased surface area and improved separation techniques.

MARKET SEGMENTATION

Market Segmentation – Type and End-User –

Market by Type:

- Elemental Analysis Instruments

- In 2023, the market for analytical laboratory instruments, specifically elemental analysis instruments, constituted the largest market share. These instruments are designed to analyze the type or quantity of elements present in a given sample.

- An elemental analyzer is a specialized instrument in analytical chemistry that measures the concentrations of elements in a sample, enabling researchers to comprehend its elemental makeup. Elemental analyzers employ techniques such as ICP-OES, X-ray fluorescence, combustion analysis, and ICP-MS for precise and accurate quantification.

- Molecular Analysis Instruments

- Separation Analysis Instruments

- Other Instruments

Market by End-User:

- Diagnostic Centers & Hospitals

- Pharmaceutical

- Research & Academic Institutes

- Biotechnology

- Chemical/Petrochemical and Oil & Gas

- The chemical/petrochemical and oil & gas segments constitute the fastest-growing segments in the analytical laboratory instruments market.

- The chemical and petrochemical industry prioritizes accurate measurements of flow, pressure, temperature, and gas analysis for efficient energy management, process reliability, and reduced emissions, requiring reliable measurement equipment for optimal technological processes.

- Analytical instruments and techniques are utilized in various oil analysis applications, including determining refinery suitability and assessing environmental damage after spills. This is because crude oil, primarily composed of hydrocarbons, also contains elements like sulfur, nitrogen, oxygen, and metals.

- Food Testing

- Other End-Users

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- The Asia-Pacific region is anticipated to be the fastest-growing market during the forecast period. The region has experienced a surge in drug development, clinical trials, and quality control demands. This surge has further propelled laboratories to use sophisticated analytical instruments for accurate testing, research, and drug approvals, thereby fueling market growth.

- Rest of World: Latin America and the Middle East & Africa

MAJOR PLAYERS

The major players in the global analytical laboratory instruments market are:

- Agilent Technologies

- Bruker

- Malvern Panalytical Limited

- Mettler-Toledo

- PerkinElmer

- Shimadzu Corporation

- Thermo Fisher Scientific

- Waters Corporation

Key strategies adopted by some of these companies:

- In November 2023, Bruker Optics introduced the MOBILE-IR II, a portable, battery-powered FT-IR spectrometer, enabling users worldwide to perform routine and advanced applications in the field.

- In August 2023, Thermo Fisher Scientific introduced the Thermo Scientific iCAP RQplus ICP-MS Analyzer. This new trace elemental analyzer simplifies everyday analyses in environmental, food, pharmaceutical, and industrial testing laboratories.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Type and End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Agilent Technologies, AMETEK, Avantor, Bruker, Danaher Corporation (SCIEX), Hitachi Limited, JEOL, LECO Corporation, Malvern Panalytical Limited, Mettler-Toledo, PerkinElmer, Shimadzu Corporation, Thermo Fisher Scientific, Waters Corporation, ZEISS Group |

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON ANALYTICAL LABORATORY INSTRUMENTS MARKET

- MAJOR MARKET FINDINGS

- ELEMENTAL ANALYSIS INSTRUMENTS CONSTITUTE THE HIGHEST MARKET SHARE BY TYPE

- DIAGNOSTIC CENTERS AND HOSPITALS ARE THE MAJOR END-USERS

-

MARKET DYNAMICS

- KEY DRIVERS

- GROWING UTILIZATION ACROSS THE CHEMICAL AND PETROCHEMICAL SECTORS

- ADVANCEMENT IN TECHNOLOGIES

- ROBUST EXPANSION IN THE PHARMACEUTICAL AND BIOPHARMACEUTICAL SECTORS

- KEY RESTRAINTS

- ELEVATED EXPENSES ASSOCIATED WITH COMPONENTS AND INSTRUMENTS

- INSUFFICIENTLY TRAINED LABORATORY PROFESSIONALS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- DOWNSIZING OF ANALYTICAL INSTRUMENTS FOR ENHANCED EFFICIENCY AND FUNCTIONALITY

- INCORPORATION OF AI

- NANOTECHNOLOGICAL ADVANCEMENTS IN CHROMATOGRAPHY

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR GERMANY

- GROWTH PROSPECT MAPPING FOR INDIA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RESEARCH AND DEVELOPMENT ALONG WITH REGULATORY APPROVAL

- RAW MATERIAL PROCUREMENT

- MANUFACTURING

- DISTRIBUTION

- REGULATORY FRAMEWORK

- KEY BUYING CRITERIA

- ACCURACY AND PRECISION

- VERSATILITY AND RANGE

- EASE OF USE

- SCALABILITY

- INTEGRATION CAPABILITIES

- RELIABILITY AND DURABILITY

- REGULATORY COMPLIANCE

- MAINTENANCE AND SUPPORT

- TECHNOLOGICAL ADVANCEMENTS

- ENVIRONMENTAL IMPACT

- KEY MARKET TRENDS

-

MARKET BY TYPE

- ELEMENTAL ANALYSIS INSTRUMENTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MOLECULAR ANALYSIS INSTRUMENTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEPARATION ANALYSIS INSTRUMENTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER TYPES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ELEMENTAL ANALYSIS INSTRUMENTS

-

MARKET BY END-USER

- DIAGNOSTIC CENTERS & HOSPITALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- PHARMACEUTICAL

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RESEARCH & ACADEMIC INSTITUTES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- BIOTECHNOLOGY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CHEMICAL/PETROCHEMICAL AND OIL & GAS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FOOD TESTING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER END-USERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DIAGNOSTIC CENTERS & HOSPITALS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET DRIVERS

- NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET DRIVERS

- EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET

- COUNTRY ANALYSIS

- GERMANY

- GERMANY ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- UNITED KINGDOM ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- GERMANY

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET DRIVERS

- ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET DRIVERS

- REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA ANALYTICAL LABORATORY INSTRUMENTS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AGILENT TECHNOLOGIES

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- AMETEK

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- AVANTOR

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- BRUKER

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- DANAHER CORPORATION (SCIEX)

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HITACHI LIMITED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- JEOL

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- LECO CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MALVERN PANALYTICAL LIMITED

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- METTLER-TOLEDO

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- PERKINELMER

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SHIMADZU CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- THERMO FISHER SCIENTIFIC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- WATERS CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ZEISS GROUP

- COMPANY OVERVIEW

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- AGILENT TECHNOLOGIES

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ANALYTICAL LABORATORY INSTRUMENTS

TABLE 2: RESEARCH AND DEVELOPMENT SPENDING BY LEADING PHARMACEUTICAL COMPANIES IN 2022 (IN $ MILLIONS)

TABLE 3: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 4: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 5: GLOBAL ELEMENTAL ANALYSIS INSTRUMENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 6: GLOBAL ELEMENTAL ANALYSIS INSTRUMENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 7: GLOBAL MOLECULAR ANALYSIS INSTRUMENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 8: GLOBAL MOLECULAR ANALYSIS INSTRUMENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 9: GLOBAL SEPARATION ANALYSIS INSTRUMENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 10: GLOBAL SEPARATION ANALYSIS INSTRUMENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 11: GLOBAL OTHER TYPES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 12: GLOBAL OTHER TYPES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 13: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 14: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 15: GLOBAL DIAGNOSTIC CENTERS & HOSPITALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 16: GLOBAL DIAGNOSTIC CENTERS & HOSPITALS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 17: GLOBAL PHARMACEUTICAL MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 18: GLOBAL PHARMACEUTICAL MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 19: GLOBAL RESEARCH & ACADEMIC INSTITUTES MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 20: GLOBAL RESEARCH & ACADEMIC INSTITUTES MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 21: GLOBAL BIOTECHNOLOGY MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 22: GLOBAL BIOTECHNOLOGY MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 23: GLOBAL CHEMICAL/PETROCHEMICAL AND OIL & GAS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 24: GLOBAL CHEMICAL/PETROCHEMICAL AND OIL & GAS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 25: GLOBAL FOOD TESTING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 26: GLOBAL FOOD TESTING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 27: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 28: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 29: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 30: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 31: NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 32: NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 33: KEY PLAYERS OPERATING IN NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET

TABLE 34: EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: KEY PLAYERS OPERATING IN EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET

TABLE 37: ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 38: ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 39: KEY PLAYERS OPERATING IN ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET

TABLE 40: REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: KEY PLAYERS OPERATING IN REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET

TABLE 43: LIST OF ACQUISITIONS

TABLE 44: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 45: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 46: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR GERMANY

FIGURE 5: GROWTH PROSPECT MAPPING FOR INDIA

FIGURE 6: MARKET MATURITY ANALYSIS

FIGURE 7: MARKET CONCENTRATION ANALYSIS

FIGURE 8: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2023

FIGURE 9: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY ELEMENTAL ANALYSIS INSTRUMENTS, 2024-2032 (IN $ MILLION)

FIGURE 10: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY MOLECULAR ANALYSIS INSTRUMENTS, 2024-2032 (IN $ MILLION)

FIGURE 11: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY SEPARATION ANALYSIS INSTRUMENTS, 2024-2032 (IN $ MILLION)

FIGURE 12: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY OTHER TYPES, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 14: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY DIAGNOSTIC CENTERS & HOSPITALS, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY PHARMACEUTICAL, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY RESEARCH & ACADEMIC INSTITUTES, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY BIOTECHNOLOGY, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY CHEMICAL/PETROCHEMICAL AND OIL & GAS, 2024-2032 (IN $ MILLION)

FIGURE 19: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY FOOD TESTING, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL ANALYTICAL LABORATORY INSTRUMENTS MARKET, BY OTHER END-USERS, 2024-2032 (IN $ MILLION)

FIGURE 21: NORTH AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 22: UNITED STATES ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 23: CANADA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 24: EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 25: GERMANY ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 26: UNITED KINGDOM ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 27: FRANCE ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 28: ITALY ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 29: SPAIN ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 30: BELGIUM ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 31: POLAND ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 32: REST OF EUROPE ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 33: ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 34: CHINA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 35: JAPAN ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: INDIA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 37: SOUTH KOREA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: AUSTRALIA & NEW ZEALAND ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: INDONESIA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: THAILAND ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: VIETNAM ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: REST OF ASIA-PACIFIC ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: REST OF WORLD ANALYTICAL LABORATORY INSTRUMENTS MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 44: LATIN AMERICA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: MIDDLE EAST & AFRICA ANALYTICAL LABORATORY INSTRUMENTS MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

As of 2023, the global analytical laboratory instruments market was valued at $58556.20 million.

As of 2023, diagnostic centers & hospitals hold the largest market share in the global analytical laboratory instruments market.

Molecular analysis instruments are the fastest-growing type in the global analytical laboratory instruments market during the forecast period.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032