GLOBAL AMNIOTIC MEMBRANE MARKET FORECAST 2023-2032

SCOPE OF THE REPORT

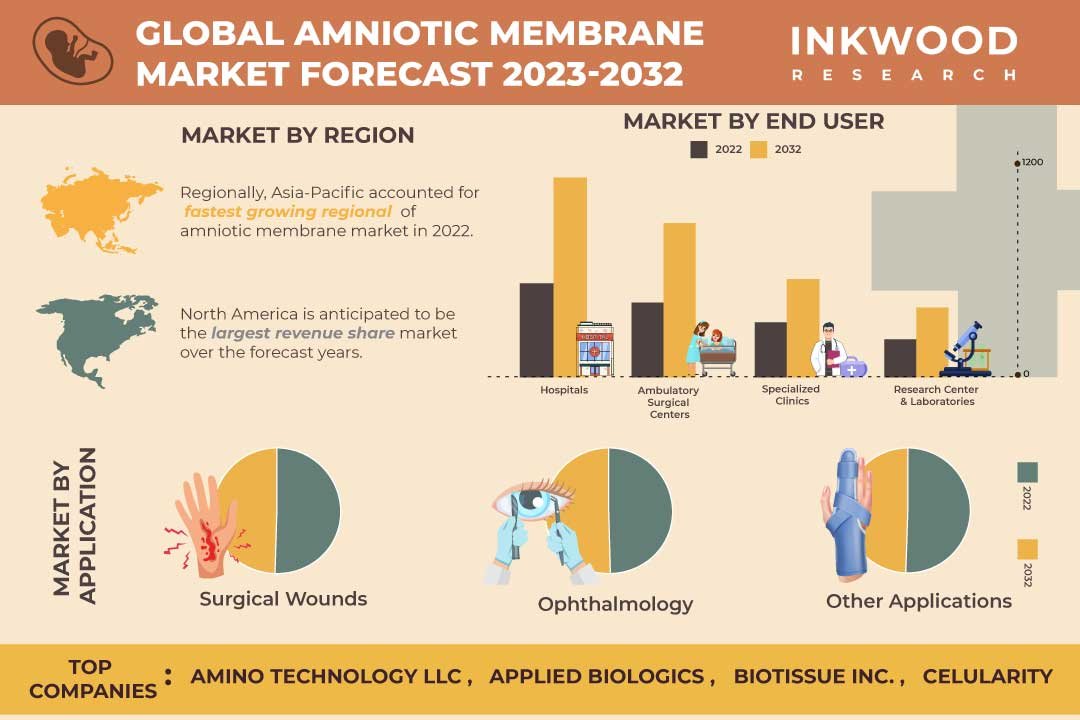

Global Amniotic Membrane Market by Product (Cryopreserved Amniotic Membrane, Lyophilized Amniotic Membrane) Market by Application (Surgical Wounds, Ophthalmology, Other Applications) Market by End-user (Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Research Centers & Laboratories) by Geography

REPORTS » HEALTHCARE » BIOTECHNOLOGY » GLOBAL AMNIOTIC MEMBRANE MARKET FORECAST 2023-2032

MARKET OVERVIEW

In terms of revenue, the global amniotic membrane market was valued at $1426.97 million in 2022, and is expected to reach $2891.80 million by 2032, growing at a CAGR of 7.27% during the forecast period, 2023-2032.

The amnion, widely known as the amniotic membrane (AM), is a fine membrane in the fetal placenta’s interior, completely enclosing the embryo, and defines the amniotic cavity filled with amniotic fluid. The amniotic membrane cells’ pluripotent qualities, which make them a desirable source for tissue transplantation, have been a focus of recent research with regard to the amnion’s structure and function. Along with anti-angiogenic and pro-apoptotic properties, AM exhibits anti-bacterial, anti-inflammatory, anti-viral, and immunological properties.

Further, the amniotic membrane has garnered the attention of medical professionals due to its potential for treating wounds as a skin substitute, restoring epidermal function, and interacting with the healing process. In addition, it is utilized as a graft or patch in treating eye diseases, depending upon the indication.

Read our latest blog on the Amniotic Membrane Market

GROWTH ENABLERS

Key growth enablers of the global amniotic membrane market are:

- Increasing research on stem cell biology and regenerative medicine

- Growing awareness regarding numerous applications of amniotic membrane

- Rising demand for wound care treatment

- The significance of wound care treatment has recently come to light due to the increasing incidences of burns and traumatic wounds.

- Additionally, the demand for amnion membrane transplant treatments is accelerating due to the rising number of patients with ophthalmic, musculoskeletal, dental, and other disorders.

- Besides, the rapid adoption of amniotic membrane therapies, supported by clinical and economic data, has replaced traditional wound care, attributed to the widespread acceptance of sophisticated methods.

GROWTH RESTRAINTS

Key factors restraining the global amniotic membrane market growth are:

- Difficulties associated with amniotic membrane use

- Amniotic membrane use is linked to certain difficulties. For instance, post-operative problems could arise from improper allograft preparation.

- In addition, the particular formulation of the amniotic membrane and product may have unintended side effects. Furthermore, the membrane function and structure vary according to the donor, which could influence how well the treatment works.

- Variables include the location of the donor relative to the placenta, the duration of the pregnancy, the start of labor, and the donor’s age & race.

- Moreover, different processing and preservation methods can change the membrane’s physiological properties and limit its application.

- Lack of skilled professionals

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Amniotic Membrane Market | Top Trends

- Stem cells have been proposed as a treatment for lung disorders. Particularly, mesenchymal stem cells (MSCs) have been successfully used in various treatment trials for COVID-19 patients. The positive outcomes suggested MSCs as a potential cell treatment for COVID-19.

- With the development of biology and human body science, significant investments have been made in the research and development of amniotic membrane applications. Currently, cellular therapy appears to be the optimal option, given the rising chronic and degenerative diseases.

- Most market participants concentrate on the US market due to the increasing number of surgeries and the popularity of amniotic membrane products. These membranes are estimated to grow in popularity throughout the forecast period, attributed to their usage in reconstructive surgery to lessen scarring and encourage healing.

MARKET SEGMENTATION

Market Segmentation – Product, Application, and End-user – Market by Product:- Cryopreserved Amniotic Membrane

- Cryopreserved amniotic membrane is the largest revenue-generating product in the market.

- Patients with ocular surface abnormalities have been receiving cryopreserved amniotic membrane (CAM) therapy. It is evaluated to reduce the need for follow-up office visits and is frequently reimbursed by insurance.

- An amniotic membrane that has been cryopreserved contains heavy chain hyaluronic acid and pentraxin 3, a specific biologic matrix linked to the amniotic membrane’s anti-inflammatory and regenerative healing properties. HC-HA/PTX3 also encourages epithelial cell adhesion and growth, accelerating the ocular surface’s healing.

- Ocular surface scarred due to chemical burns, corneal epithelial defects linked to the band or bullous keratopathy, dystrophy of epithelial basement membrane and recurrent corneal erosions, keratitis, corneal ulcers, and persistent epithelial defects are a few conditions that may be treated with cryopreserved amniotic membrane.

- Lyophilized Amniotic Membrane

- Surgical Wounds

-

- Surgical wounds are the largest revenue-generating application in the market.

- Fresh human amniotic membrane has been used successfully to fasten the healing of many ailments, including burns, and has had a major positive impact.

- Wounds unresponsive to conventional therapeutic measures also reportedly responded to amniotic membrane application. Therefore, human amniotic membrane dressings are a helpful addition to the treatment of complex wounds.

- For instance, doctors have successfully used lyophilized amniotic membranes to treat such wounds. Additionally, the membrane possesses anti-scarring qualities that decrease the production of scar tissue, which is projected to favor market expansion throughout the forecast period.

- Ophthalmology

- Other Applications

- Hospitals

- Ambulatory Surgical Centers

- Specialized Clinics

- Research Centers & Laboratories

GEOGRAPHICAL STUDY

Geographical Study Based on Four Major Regions:- North America: The United States & Canada

- Europe: The United Kingdom, Germany, France, Italy, Nordic Countries, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

-

- The amniotic membrane sector is flourishing in Asia-Pacific. South Korea, China, and India are the next major markets for amniotic membrane applications.

- China, the world’s largest market for AM, is witnessing a cosmetic surgery trend due to rising accidents alongside the use of AM in eye surgery to avoid the need for spectacles.

- Thailand has long been a popular destination for South-East Asians seeking cancer treatment, ophthalmology care, skin graft care, and other medical procedures. As a result, the need for the amniotic membrane is projected to rise in Thailand in the years to come.

- With regard to Asia-Pacific, the development of amniotic membrane-based products, such as allografts and suspensions, would benefit from significant investment from both private and public institutions, which would also facilitate opportunities for amniotic membrane product producers to establish their manufacturing base.

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Some of the major players in the global amniotic membrane market are:

- BioTissue Inc

- Celularity

- Integra LifeSciences

- Stryker Corporation

Key strategies adopted by some of these companies:

- In order to sell EPIFIX in Japan, MiMedx Group Inc announced in January 2023 that it had signed an exclusive distribution contract with GUNZE MEDICAL LIMITED (‘Gunze Medical’), a division of Gunze Limited. Gunze Medical is a well-known supplier of goods, such as biodegradable sutures and sheet products, used in various surgical and wound care applications.

- Celularity reported in December 2022 that its business models, commercial stage biomaterial goods, and clinical and experimental stage cellular therapy projects all acquired Halal certification, signifying that they have undergone thorough evaluation to establish their acceptability in line with Islamic law.

- In September 2022, a tri-layer human tissue allograft processed using PURION® named AMNIOEFFECTTM, composed of the chorion membrane layers, amnion, and intermediate of the placenta, was introduced by MiMedx Group Inc.

- On January 2021, Integra LifeSciences Holdings Corporation announced that it successfully acquired ACell Inc. With this acquisition and its exclusive MatriStem UBMTM technologies, Integra will be able to offer more complete solutions for difficult wound treatment.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2023-2032 |

| Base Year | 2022 |

| Market Historical Years | 2018-2021 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Product, Application, End-user |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Amnio Technology LLC, Applied Biologics, BioTissue Inc, Celularity, Corza Ophthalmology, Human Regenerative Technologies LLC, Integra LifeSciences, Labtician Ophthalmics Inc, MiMedx Group Inc, Organogenesis Inc, Smith & Nephew Plc, Skye Biologics LLC, Stryker Corporation, Surgenex LLC, SurgiLogix LLC |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON AMNIOTIC MEMBRANE MARKET

- MAJOR MARKET FINDINGS

- AMNIOTIC MEMBRANE IS MAJORLY USED FOR OCULAR APPLICATIONS

- KEY PLAYERS ARE TARGETING ASIA-PACIFIC

-

MARKET DYNAMICS

- KEY DRIVERS

- INCREASING RESEARCH ON STEM CELL BIOLOGY AND REGENERATIVE MEDICINE

- GROWING AWARENESS REGARDING NUMEROUS APPLICATIONS OF AMNIOTIC MEMBRANE

- RISING DEMAND FOR WOUND CARE TREATMENT

- KEY RESTRAINTS

- DIFFICULTIES ASSOCIATED WITH AMNIOTIC MEMBRANE USE

- LACK OF SKILLED PROFESSIONALS

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR ITALY

- GROWTH PROSPECT MAPPING FOR CHINA

- GROWTH PROSPECT MAPPING FOR MEXICO

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

-

MARKET BY PRODUCT

- CRYOPRESERVED AMNIOTIC MEMBRANE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- LYOPHILIZED AMNIOTIC MEMBRANE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CRYOPRESERVED AMNIOTIC MEMBRANE

-

MARKET BY APPLICATION

- SURGICAL WOUNDS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OPHTHALMOLOGY

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SURGICAL WOUNDS

-

MARKET BY END-USER

- HOSPITALS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- AMBULATORY SURGICAL CENTERS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SPECIALIZED CLINICS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- RESEARCH CENTERS & LABORATORIES

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- HOSPITALS

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA AMNIOTIC MEMBRANE MARKET DRIVERS

- NORTH AMERICA AMNIOTIC MEMBRANE MARKET CHALLENGES

- NORTH AMERICA AMNIOTIC MEMBRANE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN NORTH AMERICA AMNIOTIC MEMBRANE MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE AMNIOTIC MEMBRANE MARKET DRIVERS

- EUROPE AMNIOTIC MEMBRANE MARKET CHALLENGES

- EUROPE AMNIOTIC MEMBRANE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN EUROPE AMNIOTIC MEMBRANE MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- NORDIC COUNTRIES

- NORDIC COUNTRIES AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- BELGIUM

- BELGIUM AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET ESTIMATES & SIZES

- ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET DRIVERS

- ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET CHALLENGES

- ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- INDONESIA

- INDONESIA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- THAILAND

- THAILAND AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- VIETNAM

- VIETNAM AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET ESTIMATES & SIZES

- REST OF WORLD AMNIOTIC MEMBRANE MARKET DRIVERS

- REST OF WORLD AMNIOTIC MEMBRANE MARKET CHALLENGES

- REST OF WORLD AMNIOTIC MEMBRANE MARKET REGULATORY FRAMEWORK

- KEY PLAYERS IN REST OF WORLD AMNIOTIC MEMBRANE MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA AMNIOTIC MEMBRANE MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- AMNIO TECHNOLOGY LLC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- APPLIED BIOLOGICS

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- BIOTISSUE INC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CELULARITY

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- CORZA OPHTHALMOLOGY

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- HUMAN REGENERATIVE TECHNOLOGIES LLC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- INTEGRA LIFESCIENCES

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- LABTICIAN OPHTHALMICS INC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- MIMEDX GROUP INC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- ORGANOGENESIS INC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SMITH & NEPHEW PLC

- COMPANY OVERVIEW

- FINANCIAL ANALYSIS

- PRODUCT LIST

- STRENGTHS & CHALLENGES

- SKYE BIOLOGICS LLC

- COMPANY OVERVIEW

- PRODUCT LIST

- STRYKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT LIST

- SURGENEX LLC

- COMPANY OVERVIEW

- PRODUCT LIST

- SURGILOGIX LLC

- COMPANY OVERVIEW

- PRODUCT LIST

- AMNIO TECHNOLOGY LLC

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – AMNIOTIC MEMBRANE

TABLE 2: GLOBAL AMNIOTIC MEMBRANE MARKET, BY PRODUCT, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 3: GLOBAL AMNIOTIC MEMBRANE MARKET, BY PRODUCT, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 4: GLOBAL CRYOPRESERVED AMNIOTIC MEMBRANE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 5: GLOBAL CRYOPRESERVED AMNIOTIC MEMBRANE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 6: GLOBAL LYOPHILIZED AMNIOTIC MEMBRANE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 7: GLOBAL LYOPHILIZED AMNIOTIC MEMBRANE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 8: GLOBAL AMNIOTIC MEMBRANE MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 9: GLOBAL AMNIOTIC MEMBRANE MARKET, BY APPLICATION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 10: GLOBAL SURGICAL WOUNDS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 11: GLOBAL SURGICAL WOUNDS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 12: GLOBAL OPHTHALMOLOGY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 13: GLOBAL OPHTHALMOLOGY MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 14: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 15: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 16: GLOBAL AMNIOTIC MEMBRANE MARKET, BY END-USER, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 17: GLOBAL AMNIOTIC MEMBRANE MARKET, BY END-USER, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 18: GLOBAL HOSPITALS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 19: GLOBAL HOSPITALS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 20: GLOBAL AMBULATORY SURGICAL CENTRES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 21: GLOBAL AMBULATORY SURGICAL CENTRES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 22: GLOBAL SPECIALIZED CLINICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 23: GLOBAL SPECIALIZED CLINICS MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 24: GLOBAL RESEARCH CENTERS & LABORATORIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 25: GLOBAL RESEARCH CENTERS & LABORATORIES MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 26: GLOBAL AMNIOTIC MEMBRANE MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 27: GLOBAL AMNIOTIC MEMBRANE MARKET, BY GEOGRAPHY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 28: NORTH AMERICA AMNIOTIC MEMBRANE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 29: NORTH AMERICA AMNIOTIC MEMBRANE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 30: NORTH AMERICA REGULATORY FRAMEWORK

TABLE 31: KEY PLAYERS OPERATING IN NORTH AMERICA AMNIOTIC MEMBRANE MARKET

TABLE 32: EUROPE AMNIOTIC MEMBRANE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 33: EUROPE AMNIOTIC MEMBRANE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 34: EUROPE REGULATORY FRAMEWORK

TABLE 35: KEY PLAYERS OPERATING IN EUROPE AMNIOTIC MEMBRANE MARKET

TABLE 36: ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 37: ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET, BY COUNTRY, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 38: ASIA-PACIFIC REGULATORY FRAMEWORK

TABLE 39: KEY PLAYERS OPERATING IN ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET

TABLE 40: REST OF WORLD AMNIOTIC MEMBRANE MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 41: REST OF WORLD AMNIOTIC MEMBRANE MARKET, BY REGION, FORECAST YEARS, 2023-2032 (IN $ MILLION)

TABLE 42: REST OF WORLD REGULATORY FRAMEWORK

TABLE 43: KEY PLAYERS OPERATING IN REST OF WORLD AMNIOTIC MEMBRANE MARKET

TABLE 44: LIST OF ACQUISITIONS

TABLE 45: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 46: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR ITALY

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MEXICO

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: GLOBAL AMNIOTIC MEMBRANE MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2022

FIGURE 10: GLOBAL AMNIOTIC MEMBRANE MARKET, BY CRYOPRESERVED AMNIOTIC MEMBRANE, 2023-2032 (IN $ MILLION)

FIGURE 11: GLOBAL AMNIOTIC MEMBRANE MARKET, BY LYOPHILIZED AMNIOTIC MEMBRANE, 2023-2032 (IN $ MILLION)

FIGURE 12: GLOBAL AMNIOTIC MEMBRANE MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2022

FIGURE 13: GLOBAL AMNIOTIC MEMBRANE MARKET, BY PRODUCT, 2023-2032 (IN $ MILLION)

FIGURE 14: GLOBAL AMNIOTIC MEMBRANE MARKET, BY OPHTHALMOLOGY, 2023-2032 (IN $ MILLION)

FIGURE 15: GLOBAL AMNIOTIC MEMBRANE MARKET, BY OTHER APPLICATIONS, 2023-2032 (IN $ MILLION)

FIGURE 16: GLOBAL AMNIOTIC MEMBRANE MARKET, GROWTH POTENTIAL, BY END-USER, IN 2022

FIGURE 17: GLOBAL AMNIOTIC MEMBRANE MARKET, BY HOSPITALS, 2023-2032 (IN $ MILLION)

FIGURE 18: GLOBAL AMNIOTIC MEMBRANE MARKET, BY AMBULATORY SURGICAL CENTRES, 2023-2032 (IN $ MILLION)

FIGURE 19: GLOBAL AMNIOTIC MEMBRANE MARKET, BY SPECIALIZED CLINICS, 2023-2032 (IN $ MILLION)

FIGURE 20: GLOBAL AMNIOTIC MEMBRANE MARKET, BY RESEARCH CENTERS & LABORATORIES, 2023-2032 (IN $ MILLION)

FIGURE 21: NORTH AMERICA AMNIOTIC MEMBRANE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 22: UNITED STATES AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 23: CANADA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 24: EUROPE AMNIOTIC MEMBRANE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN %)

FIGURE 25: UNITED KINGDOM AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 26: GERMANY AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 27: FRANCE AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 28: ITALY AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 29: NORDIC COUNTRIES AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 30: BELGIUM AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 31: POLAND AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 32: REST OF EUROPE AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 33: ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET, COUNTRY OUTLOOK, 2022 & 2032 (IN%)

FIGURE 34: CHINA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 35: JAPAN AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 36: INDIA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 37: SOUTH KOREA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 38: INDONESIA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 39: THAILAND AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 40: VIETNAM AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 41: AUSTRALIA & NEW ZEALAND AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 42: REST OF ASIA-PACIFIC AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 43: REST OF WORLD AMNIOTIC MEMBRANE MARKET, REGIONAL OUTLOOK, 2022 & 2032 (IN %)

FIGURE 44: LATIN AMERICA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 45: MIDDLE EAST & AFRICA AMNIOTIC MEMBRANE MARKET, 2023-2032 (IN $ MILLION)

FIGURE 46: CELULARITY- COMPANY NET PROFIT, IN 2018-2021 (IN $ MILLION)

FIGURE 47: CELULARITY- COMPANY REVENUE, IN 2018-2021 (IN $ MILLION)

FIGURE 48: INTEGRA LIFESCIENCES – COMPANY NET PROFIT, IN 2017-2021 (IN $ MILLION)

FIGURE 49: INTEGRA LIFESCIENCES- COMPANY REVENUE, IN 2017-2021 (IN $ BILLION)

FIGURE 50: MIMEDX GROUP INC – COMPANY NET PROFIT, IN 2017-2021 (IN $ MILLION)

FIGURE 51: MIMEDX GROUP INC- COMPANY REVENUE, IN 2017-2021 (IN $ MILLION)

FIGURE 52: ORGANOGENESIS INC – COMPANY NET PROFIT, IN 2017-2021 (IN $ MILLION)

FIGURE 53: ORGANOGENESIS INC – COMPANY REVENUE, IN 2017-2021 (IN $ MILLION)

FIGURE 54: SMITH & NEPHEW PLC- COMPANY NET PROFIT, IN 2017-2021 (IN $ MILLION)

FIGURE 55: SMITH & NEPHEW PLC- COMPANY REVENUE, IN 2017-2021 (IN $ MILLION)

FAQ’s

FAQs

Amniotic membrane has been shown to aid in repair, healing, and protecting the eye’s surface and has been increasingly used in ophthalmological and dermatological surgeries to promote re-epithelialization and wound healing.

Thailand has the potential to project exponential growth in the global amniotic membrane market, attributed to minimum medical expenditure and the rising demand due to medical tourism.

The rising burn and traumatic wounds, significant expenditure on research & development of amniotic membranes, and wide acceptance of advanced practices have resulted in a rapid shift towards the use of amniotic membrane therapies.

RELATED REPORTS

-

POLAND MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED STATES MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

INDIA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

ASIA-PACIFIC MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

EUROPE MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

NORTH AMERICA MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

GLOBAL MOBILE IMAGING SERVICES MARKET FORECAST 2025-2032

-

UNITED KINGDOM SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

INDIA SEMEN ANALYSIS MARKET FORECAST 2025-2032

-

JAPAN SEMEN ANALYSIS MARKET FORECAST 2025-2032