AFRICA LUBRICANTS MARKET FORECAST 2019-2028

Africa Lubricants Market by Group (Group I, Group Ii, Group Iii, Group Iv, Group V) by Base Stock (Mineral Oil Lubricants, Synthetic Lubricants, Semi-synthetic Lubricants, Bio-based Lubricants) by Product Type (Engine Oil, Transmission and Hydraulic Fluids, Metalworking Fluids, General Industrial Oils, Gear Oil, Greases, Process Oils, Other Types) by End-user (Power Generation, Transportation, Heavy Equipment, Food and Beverage, Metallurgy and Metalworking, Chemical Manufacturing, Other End-users) and by Geography.

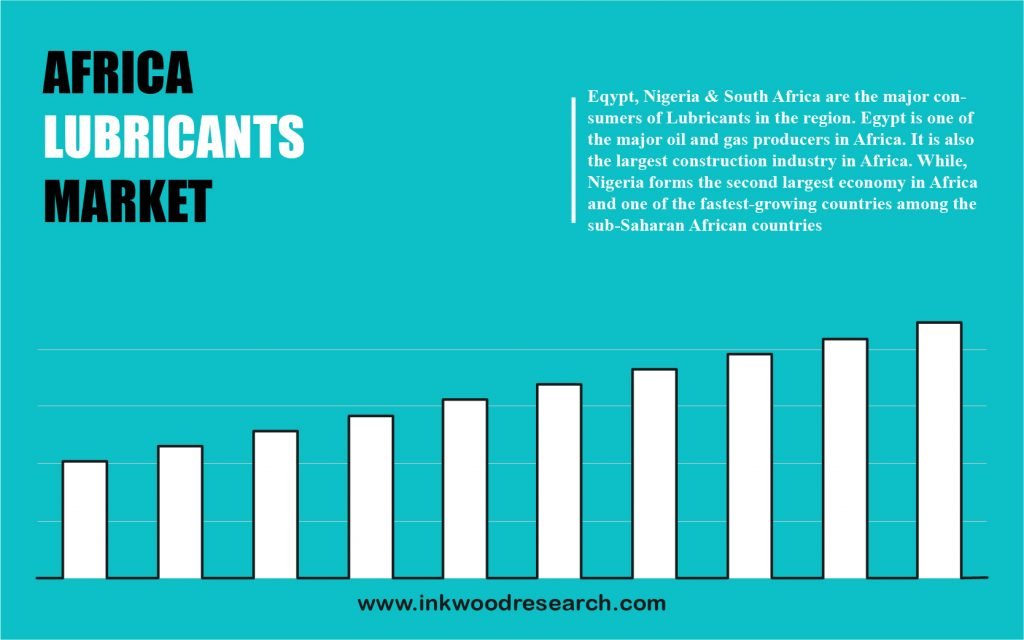

The Africa lubricants market is expected to grow with a CAGR of 0.75%, during the forecast period of 2019 to 2028. The rise in need for high-performance lubricants and emerging countries’ development due to industrialization sustains the market growth in this region.

To know more about this report, request a free sample copy

The Africa lubricants market growth is assessed across Morocco, Egypt, South Africa, Nigeria, Algeria, and the rest of Africa. After a string of new developments, Egypt is witnessing considerable expansion in the automotive industry, aimed at bolstering the national manufacturing capacity. The most recent event took place in January 2019, when Mercedes-Benz, the German manufacturer, declared its plan to commence a vehicle assembly plant in Egypt. Being one of the dominating oil and gas producers in Africa, the county’s oil and gas reserves were estimated at over $xx billion bbl. and 1.8 tcm, respectively, in 2018. Egypt also has the largest construction sector in Africa, and is projected to grow significantly due to an upsurge in foreign investments within numerous construction projects.

Moreover, the automotive division is the largest production sector in South Africa, and the country’s manufacturing witnessed a 3.5% growth in 2018. In recent years, several automobile manufacturers have expanded their exports and productions from South African operations. The ventures essentially depend on incentives offered under the government’s Automotive Production and Development Plan (APDP). Hence, these factors are anticipated to drive the market growth in the region.

Blaser Swisslube AG primarily functions in the distribution and refinement of petroleum-based products. It manufactures cutting oils, cooling lubricants, and grinding oils as its prime products. The company is headquartered in Switzerland, and is operational all over the world.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- DEVELOPMENT OF LUBRICANTS

- MARKET DEFINITION

- KEY DRIVERS

- NEED FOR HIGH PERFORMANCE LUBRICANTS ON RISE

- GROWTH IN THE MARKET DUE TO INDUSTRIALIZATION OF DEVELOPING AND EMERGING COUNTRIES

- KEY RESTRAINTS

- SLOWDOWN IN AUTOMOBILE INDUSTRY

- LENGTHENING OF OIL DRAIN INTERVALS

- DISRUPTIONS FROM ELECTRIC VEHICLE MARKET

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- KEY BUYING CRITERIA

- FUNCTION

- INGREDIENTS

- PARAMETERS

- EASE OF USE

- LONGEVITY

- COST

- MARKET BY GROUP

- GROUP I

- GROUP II

- GROUP III

- GROUP IV

- GROUP V

- MARKET BY BASE STOCK

- MINERAL OIL LUBRICANTS

- SYNTHETIC LUBRICANTS

- SEMI-SYNTHETIC LUBRICANTS

- BIO-BASED LUBRICANTS

- MARKET BY PRODUCT TYPE

- ENGINE OIL

- TRANSMISSION AND HYDRAULIC FLUIDS

- METALWORKING FLUIDS

- GENERAL INDUSTRIAL OILS

- GEAR OIL

- GREASES

- PROCESS OILS

- OTHER TYPES

- MARKET BY END-USER

- POWER GENERATION

- TRANSPORTATION

- HEAVY EQUIPMENT

- FOOD AND BEVERAGE

- METALLURGY AND METALWORKING

- CHEMICAL MANUFACTURING

- OTHER END-USERS

- GEOGRAPHICAL ANALYSIS

- AFRICA

- EGYPT

- SOUTH AFRICA

- NIGERIA

- ALGERIA

- MOROCCO

- REST OF AFRICA

- AFRICA

- COMPANY PROFILES

- AMSOIL INC

- BASF SE

- BHARAT PETROLEUM CORPORATION LIMITED

- BP PLC

- BLASER SWISSLUBE AG

- CARL BECHEM GMBH

- CHINA NATIONAL PETROLEUM CORPORATION

- CHINA PETROLEUM & CHEMICAL CORPORATION (SINOPEC)

- CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- ENI SPA

- EXXON MOBIL CORPORATION

- FUCHS

- GAZPROM NEFT PJSC

- GULF OIL CORPORATION LIMITED

- HPCL

- IDEMITSU KOSAN COMPANY LTD

- INDIAN OIL CORPORATION LIMITED

- ILLINOIS TOOL WORKS INC

- JX NIPPON OIL & ENERGY CORPORATION

- KLUBER LUBRICATION

- SHELL CORP

TABLE LIST

TABLE 1: MARKET SNAPSHOT – LUBRICANTS

TABLE 2: AFRICA LUBRICANTS MARKET, BY GROUP, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 3: AFRICA LUBRICANTS MARKET, BY GROUP, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 4: AFRICA LUBRICANTS MARKET, BY BASE STOCK, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 5: AFRICA LUBRICANTS MARKET, BY BASE STOCK, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 6: AFRICA LUBRICANTS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 7: AFRICA LUBRICANTS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 8: AFRICA LUBRICANTS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 9: AFRICA LUBRICANTS MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN KILOTONS)

TABLE 10: AFRICA LUBRICANTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN KILOTONS)

TABLE 11: AFRICA LUBRICANTS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN KILOTONS)

FIGURES LIST

FIGURE 1: DEVELOPMENT OF LUBRICANTS

FIGURE 2: FUNCTIONS OF LUBRICANTS

FIGURE 3: KEY INVESTMENT INSIGHTS

FIGURE 4: PORTER’S FIVE FORCE ANALYSIS

FIGURE 5: OPPORTUNITY MATRIX

FIGURE 6: VENDOR LANDSCAPE

FIGURE 7: VALUE CHAIN ANALYSIS

FIGURE 8: KEY BUYING CRITERIA

FIGURE 9: AFRICA LUBRICANTS MARKET, GROWTH POTENTIAL, BY GROUP, IN 2019

FIGURE 10: AFRICA LUBRICANTS MARKET, BY GROUP I, 2019-2028 (IN KILOTONS)

FIGURE 11: AFRICA LUBRICANTS MARKET, BY GROUP II, 2019-2028 (IN KILOTONS)

FIGURE 12: AFRICA LUBRICANTS MARKET, BY GROUP III, 2019-2028 (IN KILOTONS)

FIGURE 13: AFRICA LUBRICANTS MARKET, BY GROUP IV, 2019-2028 (IN KILOTONS)

FIGURE 14: AFRICA LUBRICANTS MARKET, BY GROUP V, 2019-2028 (IN KILOTONS)

FIGURE 15: AFRICA LUBRICANTS MARKET, GROWTH POTENTIAL, BY BASE STOCK, IN 2019

FIGURE 16: AFRICA LUBRICANTS MARKET, BY MINERAL OIL LUBRICANTS, 2019-2028 (IN KILOTONS)

FIGURE 17: AFRICA LUBRICANTS MARKET, BY SYNTHETIC LUBRICANTS, 2019-2028 (IN KILOTONS)

FIGURE 18: AFRICA LUBRICANTS MARKET, BY SEMI-SYNTHETIC LUBRICANTS, 2019-2028 (IN KILOTONS)

FIGURE 19: AFRICA LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS, 2019-2028 (IN KILOTONS)

FIGURE 20: AFRICA LUBRICANTS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2019

FIGURE 21: AFRICA LUBRICANTS MARKET, BY ENGINE OIL, 2019-2028 (IN KILOTONS)

FIGURE 22: AFRICA LUBRICANTS MARKET, BY TRANSMISSION AND HYDRAULIC FLUIDS, 2019-2028 (IN KILOTONS)

FIGURE 23: AFRICA LUBRICANTS MARKET, BY METALWORKING FLUIDS, 2019-2028 (IN KILOTONS)

FIGURE 24: AFRICA LUBRICANTS MARKET, BY GENERAL INDUSTRIAL OILS, 2019-2028 (IN KILOTONS)

FIGURE 25: AFRICA LUBRICANTS MARKET, BY GEAR OIL, 2019-2028 (IN KILOTONS)

FIGURE 26: AFRICA LUBRICANTS MARKET, BY GREASES, 2019-2028 (IN KILOTONS)

FIGURE 27: AFRICA LUBRICANTS MARKET, BY PROCESS OILS, 2019-2028 (IN KILOTONS)

FIGURE 28: AFRICA LUBRICANTS MARKET, BY OTHER TYPES, 2019-2028 (IN KILOTONS)

FIGURE 29: AFRICA LUBRICANTS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 30: AFRICA LUBRICANTS MARKET, BY POWER GENERATION, 2019-2028 (IN KILOTONS)

FIGURE 31: AFRICA LUBRICANTS MARKET, BY TRANSPORTATION, 2019-2028 (IN KILOTONS)

FIGURE 32: AFRICA LUBRICANTS MARKET, BY HEAVY EQUIPMENT, 2019-2028 (IN KILOTONS)

FIGURE 33: AFRICA LUBRICANTS MARKET, BY FOOD AND BEVERAGE, 2019-2028 (IN KILOTONS)

FIGURE 34: AFRICA LUBRICANTS MARKET, BY METALLURGY AND METALWORKING, 2019-2028 (IN KILOTONS)

FIGURE 35: AFRICA LUBRICANTS MARKET, BY CHEMICAL MANUFACTURING, 2019-2028 (IN KILOTONS)

FIGURE 36: AFRICA LUBRICANTS MARKET, BY OTHER END-USERS, 2019-2028 (IN KILOTONS)

FIGURE 37: AFRICA LUBRICANTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 38: EGYPT LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

FIGURE 39: SOUTH AFRICA LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

FIGURE 40: NIGERIA LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

FIGURE 41: ALGERIA LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

FIGURE 42: MOROCCO LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

FIGURE 43: REST OF AFRICA LUBRICANTS MARKET, 2019-2028 (IN KILOTONS)

- GEOGRAPHICAL ANALYSIS

- AFRICA

- EGYPT

- SOUTH AFRICA

- NIGERIA

- ALGERIA

- MOROCCO

- REST OF AFRICA

- AFRICA

- MARKET BY GROUP

- GROUP I

- GROUP II

- GROUP III

- GROUP IV

- GROUP V

- MARKET BY BASE STOCK

- MINERAL OIL LUBRICANTS

- SYNTHETIC LUBRICANTS

- SEMI-SYNTHETIC LUBRICANTS

- BIO-BASED LUBRICANTS

- MARKET BY PRODUCT TYPE

- ENGINE OIL

- TRANSMISSION AND HYDRAULIC FLUIDS

- METALWORKING FLUIDS

- GENERAL INDUSTRIAL OILS

- GEAR OIL

- GREASES

- PROCESS OILS

- OTHER TYPES

- MARKET BY END-USER

- POWER GENERATION

- TRANSPORTATION

- HEAVY EQUIPMENT

- FOOD AND BEVERAGE

- METALLURGY AND METALWORKING

- CHEMICAL MANUFACTURING

- OTHER END-USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.