GLOBAL AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

SCOPE OF THE REPORT

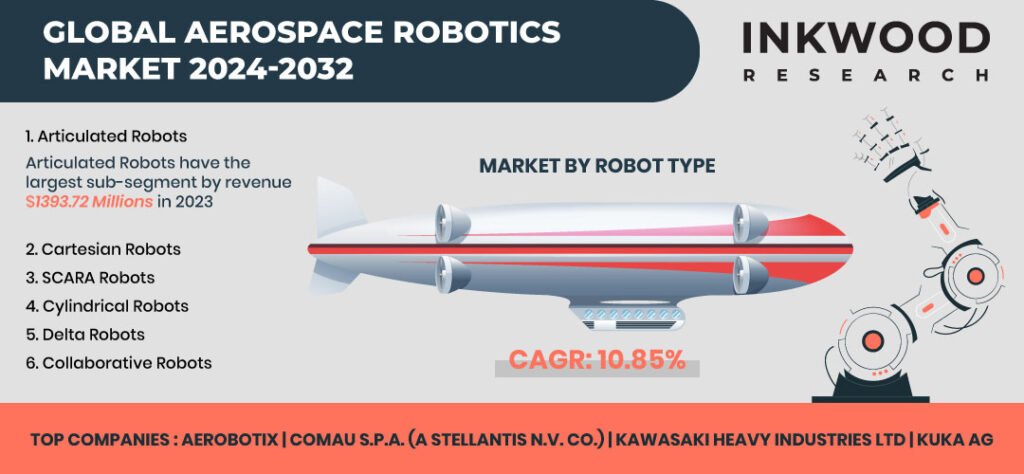

Global Aerospace Robotics Market by Robot Type (Articulated Robots, Cartesian Robots, Scara Robots, Cylindrical Robots, Delta Robots, Collaborative Robots) Market by Application (Drilling & Fastening, Non-destructive Testing & Inspection, Welding & Soldering, Sealing & Dispensing, Material Handling, Assembling & Disassembling, Other Applications) Market by Level of Automation (Fully Automated, Semi-automated, Manual Systems With Robotic Assistance) Market by End-user (Original Equipment Manufacturers (OEM), Maintenance, Repair, and Overhauls (MRO))by Geography

MARKET OVERVIEW

The global aerospace robotics market size was $3308.92 million in 2023 and is expected to reach $8310.64 million by 2032, growing at a CAGR of 10.93% during the forecast period 2024-2032. The base year considered for the study is 2023, and the estimated period is between 2024 and 2032.

The market study has also analyzed the impact of COVID-19 on the global aerospace robotics market qualitatively as well as quantitatively.

Aerospace robotics involves using industrial robots in the aerospace industry to handle tasks such as manufacturing, assembly, inspection, and maintenance. These robots enhance the precision and efficiency of jobs like welding, painting, and drilling, resulting in improved productivity and safety. Equipped with advanced sensors and software, aerospace robots can tackle complex tasks with remarkable accuracy and reliability.

Read our latest blog on the Aerospace Robotics Market

GROWTH ENABLERS

Key growth enablers of the global aerospace robotics market:

- Rising aircraft demand in the commercial, military, and civil sectors

- The increasing passenger traffic necessitates additional aircraft in commercial aviation, prompting airlines to expand and modernize their fleets. The growing need for military aircraft due to rising defense spending and technological improvements necessitates the use of precision manufacturing techniques. In addition to this, the demand for reliable and efficient aircraft in civil aviation, including government operations and emergency services, is boosting the popularity of robotics use in the aerospace industry.

- According to IATA, there was an upswing in total aviation traffic by 36.9% in 2023 compared to 2022, reaching 94.1% of pre-pandemic 2019 levels. In December 2023, it surged to 97.5% of December 2019 levels, marking a 25.3% increase over the previous year. Domestic traffic experienced an upswing of 30.4%, surpassing 2019 levels by 3.9%, while international traffic saw an upswing of 41.6%, reaching 88.6% of 2019 levels.

- The aerospace industry has expanded production rates due to the growing demand for aircraft. Aircraft manufacturers are increasingly focusing on automation and robots, which offer crucial precision and efficiency. Cutting-edge robotic systems ensure high-quality output, minimize errors, and save a significant amount of money by reducing waste and labor costs. The unique requirements of the military, commercial, and civil aviation industries continue to drive ongoing advancements in robotics, resulting in innovative solutions for various applications. This need fuels innovation and enhances manufacturing efficiency, which is the driving force behind the aircraft robotics sector.

- Automation and robotics to boost aerospace manufacturing efficiency

- Enhanced robotic capabilities due to technological advancements

GROWTH RESTRAINTS

Key growth restraining factors of the global aerospace robotics market:

- High initial costs of robotics in aircraft manufacturing hinder market demand

- Safety and regulatory concerns regarding robotics integration to challenge market growth

- Thorough risk assessments, intensive worker training, and sophisticated safety mechanisms included in the robots are required to ensure safe interaction between human workers and robots in close proximity. Additionally, the potential for hacks or malfunctioning robots necessitates fail-safe systems and strong cybersecurity measures.

- Regulatory compliance adds complexity to robotics integration in the aerospace industry. Companies need to stay informed to avoid legal issues and production delays, as regulatory bodies like the US Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) frequently update their regulations. Diverse national standards make adhering to these regulations challenging, and non-compliance can result in significant fines and damage to reputation.

- Lack of trained workforce for advanced robotics impedes market demand

To Know More About This Report, Request a Free Sample Copy

KEY MARKET TRENDS

Global Aerospace Robotics Market | Top Market Trends- The integration of cobots is expanding in the aerospace industry due to their utilization in the assembly and manufacturing of aircraft. This enables safe and effective human-robot cooperation, enhancing productivity and accuracy in challenging tasks.

- Factories are increasingly adopting mobile robotic platforms. These robots provide greater flexibility compared to traditional fixed stations, enabling production lines to adjust to changing demands and product variations. This results in a more agile and responsive manufacturing environment.

- The integration of 3D printing and robots is gaining traction. This allows for on-demand manufacturing of customized components directly on production lines, as well as rapid prototyping. Hence, this trend reflects a shift towards manufacturing processes that are increasingly adaptable and responsive.

- There is a growing emphasis on utilizing IoT-enabled robotic systems for predictive maintenance and condition monitoring. This optimizes manufacturing processes by anticipating and addressing potential issues proactively rather than waiting for them to occur.

MARKET SEGMENTATION

Need a custom report or have specific data requirements? Let us know!

Market Segmentation – Robot Type, Application, Level of Automation, and End-User –

Market by Robot Type:

- Articulated Robots

- In 2023, the articulated robots segment dominated the robot type category in the global aerospace robotics market.

- An articulated robot, equipped with rotary joints, is a highly adaptable type of robot commonly used in the aerospace sector. These robots can range from simple models with two joints to complex systems featuring ten or more joints. Powered by electric motors, they excel in tasks requiring agility and precision, such as cutting, welding, painting, and material handling.

- Moreover, these devices, often resembling robotic arms, can be articulated or non-articulated. The 6- to 7-axis versions are particularly favored for their versatility, ease of maintenance, and ability to align with multiple planes. This encompasses a wide range of upstream and downstream operations, including automation in plastic injection molding processes.

- In essence, KUKA Robotics, Staubli Robotics, Epson Robots, FANUC Corporation, and ABB Ltd are some of the top manufacturers of articulated robots.

- Cartesian Robots

- SCARA Robots

- Cylindrical Robots

- Delta Robots

- Collaborative Robots

Market by Application:

- Drilling & Fastening

- Non-Destructive Testing & Inspection

- Welding & Soldering

- Sealing & Dispensing

- Material Handling

- Assembling & Disassembling

- Other Applications

Market by Level of Automation:

- Fully Automated

- Semi-Automated

- Manual Systems with Robotic Assistance

Market by End-User:

- Original Equipment Manufacturers (OEM)

- Maintenance, Repair, and Overhauls (MRO)

- The maintenance, repair, and overhauls segment is anticipated to be the fastest-growing end-user category over the forecast period.

- Maintenance, repair, and overhaul (MRO) encompass a comprehensive set of services aimed at ensuring that aircraft remain operational, safe, and compliant with regulations. This includes routine maintenance, major repairs, complete overhauls, and modifications to aircraft and their components.

- Similar to OEMs, MRO facilities are also reaping the benefits of robotic integration. Robots automate time-consuming and potentially hazardous tasks such as inspections, cleaning, and part replacement. This allows human technicians to focus on more complex maintenance activities, leading to improved overall efficiency and safety. Additionally, robots equipped with sensors can conduct non-destructive testing (NDT) with greater accuracy and consistency compared to manual methods.

GEOGRAPHICAL STUDY

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- In 2023, North America was the largest region in the global aerospace robotics market.

- North America’s dominance in the global aerospace robotics market stems from a confluence of factors. The region boasts a well-established and prominent aerospace industry with major players like Boeing and Lockheed Martin. This existing infrastructure creates a natural demand for automation solutions like robotics to improve efficiency and production capabilities.

- Moreover, innovation receives significant support from government initiatives in North America. For example, programs like the Canadian government’s Strategic Aerospace and Defense Initiative (SADI), launched in 2007, provide repayable funding for R&D initiatives in aerospace, space, defense, and security sectors. The US government’s National Robotics Initiative (NRI) aims to bolster fundamental robotics research and development. Building upon previous NRI efforts, the NRI-3.0 program is dedicated to integrated robot systems research.

- Additionally, North America boasts a well-developed robotics industry featuring leading companies such as Aerobotix, Electroimpact Inc, JR Automation, and Kassow Robots. This established expertise results in a readily available pool of technology and talent for the development and implementation of aerospace robotics systems.

- Europe: The United Kingdom, Germany, France, Italy, Spain, Switzerland, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Singapore, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, the Middle East & Africa

MAJOR PLAYERS

Major players in the global aerospace robotics market:

- Aerobotix

- Comau SpA (A Stellantis NV Company)

- Kawasaki Heavy Industries Ltd

- KUKA AG

- FANUC Corporation

- Universal Robots A/S (A Teradyne Inc Company)

Key strategies adopted by some of these companies:

- FANUC and Loop Technology reached an agreement in April 2024, marking a significant milestone in the aerospace sector. This deal involves the supply of the largest robots ever purchased for aerospace applications in the UK. The agreement, signed in April 2024, highlights the increasing significance of advanced robotics in boosting manufacturing efficiency and precision within the aerospace industry.

- Aerobotix and Manufacturing Automation Systems showcased their adaptive pathing robot technology at Automate 2024. This intelligent adaptive sanding technology, presented in May 2024, represents a significant advancement in robotic sanding, offering improved part quality control and time savings in path programming.

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2024-2032 |

| Base Year | 2023 |

| Market Historical Years | 2018-2022 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Robot Type, Application, Level of Automation, and End-User |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | ABB Ltd, Aerobotix, Comau SpA (A Stellantis NV Company), Electroimpact Inc, FANUC Corporation, Kassow Robots, Kawasaki Heavy Industries Ltd, KUKA AG, MTM Robotics LLC (An Airbus Robotics Company), Nachi-Fujikoshi Corp, Seiko Epson, Stäubli International AG, Universal Robots A/S (A Teradyne Inc Company), Wilder Systems, Yaskawa Electric Corporation |

TABLE OF CONTENT

-

RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

-

EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- SCOPE OF STUDY

- CRISIS SCENARIO ANALYSIS

- IMPACT OF COVID-19 ON THE GLOBAL AEROSPACE ROBOTICS MARKET

- MAJOR MARKET FINDINGS

- INCREASING USE OF ROBOTICS TO MANAGE THE BACKLOG OF AIRCRAFT ORDERS

- ENHANCED SAFETY AND PRECISION IN AEROSPACE MANUFACTURING THROUGH ROBOTICS

- RISE OF NEW AEROSPACE COMPANIES IN THE ASIAN REGION

-

MARKET DYNAMICS

- KEY DRIVERS

- RISING AIRCRAFT DEMAND IN THE COMMERCIAL, MILITARY, AND CIVIL SECTORS

- AUTOMATION AND ROBOTICS TO BOOST AEROSPACE MANUFACTURING EFFICIENCY

- ENHANCED ROBOTIC CAPABILITIES DUE TO TECHNOLOGICAL ADVANCEMENTS

- KEY RESTRAINTS

- HIGH INITIAL COSTS OF ROBOTICS IN AIRCRAFT MANUFACTURING HINDER MARKET DEMAND

- SAFETY AND REGULATORY CONCERNS REGARDING ROBOTICS INTEGRATION TO CHALLENGE MARKET GROWTH

- LACK OF TRAINED WORKFORCE FOR ADVANCED ROBOTICS IMPEDES MARKET DEMAND

- KEY DRIVERS

-

KEY ANALYTICS

- KEY MARKET TRENDS

- RISING INTEGRATION OF COLLABORATIVE ROBOTS (COBOTS) IN AIRCRAFT ASSEMBLY AND MANUFACTURING

- DEVELOPMENT OF MOBILE ROBOTIC PLATFORMS FOR FLEXIBLE MANUFACTURING AND ADAPTIVE PRODUCTION LINES

- ADOPTION OF 3D PRINTING TECHNOLOGIES INTEGRATED WITH ROBOTIC SYSTEMS FOR RAPID PROTOTYPING AND CUSTOMIZED COMPONENT FABRICATION

- GROWING FOCUS ON PREDICTIVE MAINTENANCE AND CONDITION MONITORING USING IOT-ENABLED ROBOTIC SYSTEMS TO OPTIMIZE MANUFACTURING PROCESSES

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- GROWTH PROSPECT MAPPING

- GROWTH PROSPECT MAPPING FOR UNITED STATES

- GROWTH PROSPECT MAPPING FOR FRANCE

- GROWTH PROSPECT MAPPING FOR CHINA

- GROWTH PROSPECT MAPPING FOR MIDDLE EAST & AFRICA

- MARKET MATURITY ANALYSIS

- MARKET CONCENTRATION ANALYSIS

- VALUE CHAIN ANALYSIS

- RAW MATERIALS

- ASSEMBLY AND INTEGRATION OF ROBOTS

- SYSTEM DESIGN AND ENGINEERING

- DEPLOYMENT AND INSTALLATION

- END-USER

- KEY BUYING CRITERIA

- COST

- PRECISION AND ACCURACY

- RELIABILITY AND DURABILITY

- EASE OF PROGRAMMING AND OPERATION

- MAINTENANCE AND SUPPORT

- KEY MARKET TRENDS

-

MARKET BY ROBOT TYPE

- ARTICULATED ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CARTESIAN ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SCARA ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- CYLINDRICAL ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DELTA ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- COLLABORATIVE ROBOTS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ARTICULATED ROBOTS

-

MARKET BY APPLICATION

- DRILLING & FASTENING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- NON-DESTRUCTIVE TESTING & INSPECTION

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- WELDING & SOLDERING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEALING & DISPENSING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MATERIAL HANDLING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ASSEMBLING & DISASSEMBLING

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- OTHER APPLICATIONS

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- DRILLING & FASTENING

-

MARKET BY LEVEL OF AUTOMATION

- FULLY AUTOMATED

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- SEMI-AUTOMATED

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- FULLY AUTOMATED

-

MARKET BY END-USER

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- MAINTENANCE, REPAIR, AND OVERHAULS (MRO)

- MARKET FORECAST FIGURE

- SEGMENT ANALYSIS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

-

GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- NORTH AMERICA AEROSPACE ROBOTICS MARKET DRIVERS

- NORTH AMERICA AEROSPACE ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN NORTH AMERICA AEROSPACE ROBOTICS MARKET

- COUNTRY ANALYSIS

- UNITED STATES

- UNITED STATES AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- CANADA

- CANADA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- UNITED STATES

- EUROPE

- MARKET SIZE & ESTIMATES

- EUROPE AEROSPACE ROBOTICS MARKET DRIVERS

- EUROPE AEROSPACE ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN EUROPE AEROSPACE ROBOTICS MARKET

- COUNTRY ANALYSIS

- UNITED KINGDOM

- UNITED KINGDOM AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- GERMANY

- GERMANY AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- FRANCE

- FRANCE AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- ITALY

- ITALY AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- SPAIN

- SPAIN AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- SWITZERLAND

- SWITZERLAND AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- POLAND

- POLAND AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- REST OF EUROPE

- REST OF EUROPE AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- UNITED KINGDOM

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- ASIA-PACIFIC AEROSPACE ROBOTICS MARKET DRIVERS

- ASIA-PACIFIC AEROSPACE ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN ASIA-PACIFIC AEROSPACE ROBOTICS MARKET

- COUNTRY ANALYSIS

- CHINA

- CHINA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- JAPAN

- JAPAN AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- INDIA

- INDIA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- SOUTH KOREA

- SOUTH KOREA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- SINGAPORE

- SINGAPORE AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- AUSTRALIA & NEW ZEALAND

- AUSTRALIA & NEW ZEALAND AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- REST OF ASIA-PACIFIC

- REST OF ASIA-PACIFIC AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- CHINA

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- REST OF WORLD AEROSPACE ROBOTICS MARKET DRIVERS

- REST OF WORLD AEROSPACE ROBOTICS MARKET CHALLENGES

- KEY PLAYERS IN REST OF WORLD AEROSPACE ROBOTICS MARKET

- REGIONAL ANALYSIS

- LATIN AMERICA

- LATIN AMERICA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA AEROSPACE ROBOTICS MARKET SIZE & OPPORTUNITIES

- LATIN AMERICA

- NORTH AMERICA

-

COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- COMPANY PROFILES

- ABB LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- AEROBOTIX

- COMPANY OVERVIEW

- PRODUCTS

- COMAU SPA (A STELLANTIS NV COMPANY)

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ELECTROIMPACT INC

- COMPANY OVERVIEW

- PRODUCTS

- FANUC CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KAWASAKI HEAVY INDUSTRIES LTD

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- KASSOW ROBOTS

- COMPANY OVERVIEW

- PRODUCTS

- KUKA AG

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- MTM ROBOTICS LLC (AN AIRBUS ROBOTICS COMPANY)

- COMPANY OVERVIEW

- PRODUCTS

- NACHI-FUJIKOSHI CORP

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- STÄUBLI INTERNATIONAL AG

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- SEIKO EPSON

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- UNIVERSAL ROBOTS A/S (A TERADYNE INC COMPANY)

- COMPANY OVERVIEW

- PRODUCTS

- WILDER SYSTEMS

- COMPANY OVERVIEW

- PRODUCTS

- YASKAWA ELECTRIC CORPORATION

- COMPANY OVERVIEW

- PRODUCTS

- STRENGTHS & CHALLENGES

- ABB LTD

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – AEROSPACE ROBOTICS

TABLE 2: GLOBAL AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 3: GLOBAL AEROSPACE ROBOTICS MARKET, BY ROBOT TYPE, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 4: GLOBAL ARTICULATED ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 5: GLOBAL ARTICULATED ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 6: GLOBAL CARTESIAN ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 7: GLOBAL CARTESIAN ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 8: GLOBAL SCARA ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 9: GLOBAL SCARA ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 10: GLOBAL CYLINDRICAL ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 11: GLOBAL CYLINDRICAL ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 12: GLOBAL DELTA ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 13: GLOBAL DELTA ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 14: GLOBAL COLLABORATIVE ROBOTS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 15: GLOBAL COLLABORATIVE ROBOTS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 16: GLOBAL AEROSPACE ROBOTICS MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 17: GLOBAL AEROSPACE ROBOTICS MARKET, BY APPLICATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 18: GLOBAL DRILLING & FASTENING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 19: GLOBAL DRILLING & FASTENING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 20: GLOBAL NON-DESTRUCTIVE TESTING & INSPECTION MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 21: GLOBAL NON-DESTRUCTIVE TESTING & INSPECTION MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 22: GLOBAL WELDING & SOLDERING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 23: GLOBAL WELDING & SOLDERING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 24: GLOBAL SEALING & DISPENSING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 25: GLOBAL SEALING & DISPENSING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 26: GLOBAL MATERIAL HANDLING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 27: GLOBAL MATERIAL HANDLING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 28: GLOBAL ASSEMBLING & DISASSEMBLING MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 29: GLOBAL ASSEMBLING & DISASSEMBLING MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 30: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 31: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 32: GLOBAL AEROSPACE ROBOTICS MARKET, BY LEVEL OF AUTOMATION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 33: GLOBAL AEROSPACE ROBOTICS MARKET, BY LEVEL OF AUTOMATION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 34: GLOBAL FULLY AUTOMATED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 35: GLOBAL FULLY AUTOMATED MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 36: GLOBAL SEMI-AUTOMATED MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 37: GLOBAL SEMI-AUTOMATED MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 38: GLOBAL MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 39: GLOBAL MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 40: GLOBAL AEROSPACE ROBOTICS MARKET, BY END-USER, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 41: GLOBAL AEROSPACE ROBOTICS MARKET, BY END-USER, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 42: GLOBAL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 43: GLOBAL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 44: GLOBAL MAINTENANCE, REPAIR, AND OVERHAULS (MRO) MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 45: GLOBAL MAINTENANCE, REPAIR, AND OVERHAULS (MRO) MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 46: GLOBAL AEROSPACE ROBOTICS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 47: GLOBAL AEROSPACE ROBOTICS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 48: NORTH AMERICA AEROSPACE ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 49: NORTH AMERICA AEROSPACE ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 50: KEY PLAYERS OPERATING IN NORTH AMERICA AEROSPACE ROBOTICS MARKET

TABLE 51: EUROPE AEROSPACE ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 52: EUROPE AEROSPACE ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 53: KEY PLAYERS OPERATING IN EUROPE AEROSPACE ROBOTICS MARKET

TABLE 54: ASIA-PACIFIC AEROSPACE ROBOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 55: ASIA-PACIFIC AEROSPACE ROBOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 56: KEY PLAYERS OPERATING IN ASIA-PACIFIC AEROSPACE ROBOTICS MARKET

TABLE 57: REST OF WORLD AEROSPACE ROBOTICS MARKET, BY REGION, HISTORICAL YEARS, 2018-2022 (IN $ MILLION)

TABLE 58: REST OF WORLD AEROSPACE ROBOTICS MARKET, BY REGION, FORECAST YEARS, 2024-2032 (IN $ MILLION)

TABLE 59: KEY PLAYERS OPERATING IN REST OF WORLD AEROSPACE ROBOTICS MARKET

TABLE 60: LIST OF MERGERS & ACQUISITIONS

TABLE 61: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 62: LIST OF PARTNERSHIPS & AGREEMENTS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR UNITED STATES

FIGURE 4: GROWTH PROSPECT MAPPING FOR FRANCE

FIGURE 5: GROWTH PROSPECT MAPPING FOR CHINA

FIGURE 6: GROWTH PROSPECT MAPPING FOR MIDDLE EAST & AFRICA

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: GLOBAL AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY ROBOT TYPE, IN 2023

FIGURE 12: GLOBAL AEROSPACE ROBOTICS MARKET, BY ARTICULATED ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 13: GLOBAL AEROSPACE ROBOTICS MARKET, BY CARTESIAN ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 14: GLOBAL AEROSPACE ROBOTICS MARKET, BY SCARA ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 15: GLOBAL AEROSPACE ROBOTICS MARKET, BY CYLINDRICAL ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 16: GLOBAL AEROSPACE ROBOTICS MARKET, BY DELTA ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 17: GLOBAL AEROSPACE ROBOTICS MARKET, BY COLLABORATIVE ROBOTS, 2024-2032 (IN $ MILLION)

FIGURE 18: GLOBAL AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2023

FIGURE 19: GLOBAL AEROSPACE ROBOTICS MARKET, BY DRILLING & FASTENING, 2024-2032 (IN $ MILLION)

FIGURE 20: GLOBAL AEROSPACE ROBOTICS MARKET, BY NON-DESTRUCTIVE TESTING & INSPECTION, 2024-2032 (IN $ MILLION)

FIGURE 21: GLOBAL AEROSPACE ROBOTICS MARKET, BY WELDING & SOLDERING, 2024-2032 (IN $ MILLION)

FIGURE 22: GLOBAL AEROSPACE ROBOTICS MARKET, BY SEALING & DISPENSING, 2024-2032 (IN $ MILLION)

FIGURE 23: GLOBAL AEROSPACE ROBOTICS MARKET, BY MATERIAL HANDLING, 2024-2032 (IN $ MILLION)

FIGURE 24: GLOBAL AEROSPACE ROBOTICS MARKET, BY ASSEMBLING & DISASSEMBLING, 2024-2032 (IN $ MILLION)

FIGURE 25: GLOBAL AEROSPACE ROBOTICS MARKET, BY OTHER APPLICATIONS, 2024-2032 (IN $ MILLION)

FIGURE 26: GLOBAL AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY LEVEL OF AUTOMATION, IN 2023

FIGURE 27: GLOBAL AEROSPACE ROBOTICS MARKET, BY FULLY AUTOMATED, 2024-2032 (IN $ MILLION)

FIGURE 28: GLOBAL AEROSPACE ROBOTICS MARKET, BY SEMI-AUTOMATED, 2024-2032 (IN $ MILLION)

FIGURE 29: GLOBAL AEROSPACE ROBOTICS MARKET, BY MANUAL SYSTEMS WITH ROBOTIC ASSISTANCE, 2024-2032 (IN $ MILLION)

FIGURE 30: GLOBAL AEROSPACE ROBOTICS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2023

FIGURE 31: GLOBAL AEROSPACE ROBOTICS MARKET, BY ORIGINAL EQUIPMENT MANUFACTURERS (OEM), 2024-2032 (IN $ MILLION)

FIGURE 32: GLOBAL AEROSPACE ROBOTICS MARKET, BY MAINTENANCE, REPAIR, AND OVERHAULS (MRO), 2024-2032 (IN $ MILLION)

FIGURE 33: NORTH AMERICA AEROSPACE ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 34: UNITED STATES AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 35: CANADA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 36: EUROPE AEROSPACE ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 37: UNITED KINGDOM AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 38: GERMANY AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 39: FRANCE AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 40: ITALY AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 41: SPAIN AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 42: SWITZERLAND AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 43: POLAND AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 44: REST OF EUROPE AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 45: ASIA-PACIFIC AEROSPACE ROBOTICS MARKET, COUNTRY OUTLOOK, 2023 & 2032 (IN %)

FIGURE 46: CHINA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 47: JAPAN AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 48: INDIA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 49: SOUTH KOREA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 50: SINGAPORE AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 51: AUSTRALIA & NEW ZEALAND AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 52: REST OF ASIA-PACIFIC AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 53: REST OF WORLD AEROSPACE ROBOTICS MARKET, REGIONAL OUTLOOK, 2023 & 2032 (IN %)

FIGURE 54: LATIN AMERICA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FIGURE 55: MIDDLE EAST & AFRICA AEROSPACE ROBOTICS MARKET, 2024-2032 (IN $ MILLION)

FAQ’s

FAQs

Major aircraft manufacturers utilizing robotics include Boeing, Airbus, Lockheed Martin, and Northrop Grumman. These companies integrate advanced robotics into their production processes to improve efficiency and uphold rigorous quality standards.

Robotics plays a crucial role in aircraft manufacturing by automating repetitive and precise tasks like welding, painting, drilling, and component assembly. These automated systems contribute to higher production rates, enhanced quality control, reduced labor costs, and improved safety and precision standards.

Leading aerospace robotics companies in the global aerospace robotics market include ABB Group, KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, and Kawasaki Heavy Industries. These companies provide advanced robotic solutions for various aerospace applications, enhancing productivity and precision in manufacturing and maintenance processes.

RELATED REPORTS

-

UNITED STATES AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

FRANCE AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

CHINA AEROSPACE ROBOTICS MARKET FORECAST 2024-2032

-

GLOBAL SHIP RECYCLING MARKET FORECAST 2024-2032

-

BANGLADESH SHIP RECYCLING MARKET FORECAST 2024-2032

-

TURKEY SHIP RECYCLING MARKET FORECAST 2024-2032

-

INDIA SHIP RECYCLING MARKET FORECAST 2024-2032

-

GLOBAL UNMANNED TRAFFIC MANAGEMENT MARKET FORECAST 2024-2032

-

UNITED STATES AIRPORT MOVING WALKWAY SYSTEMS MARKET FORECAST 2024-2032

-

GLOBAL AIRPORT MOVING WALKWAY SYSTEMS MARKET FORECAST 2024-2032