GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT MARKET FORECAST 2019-2027

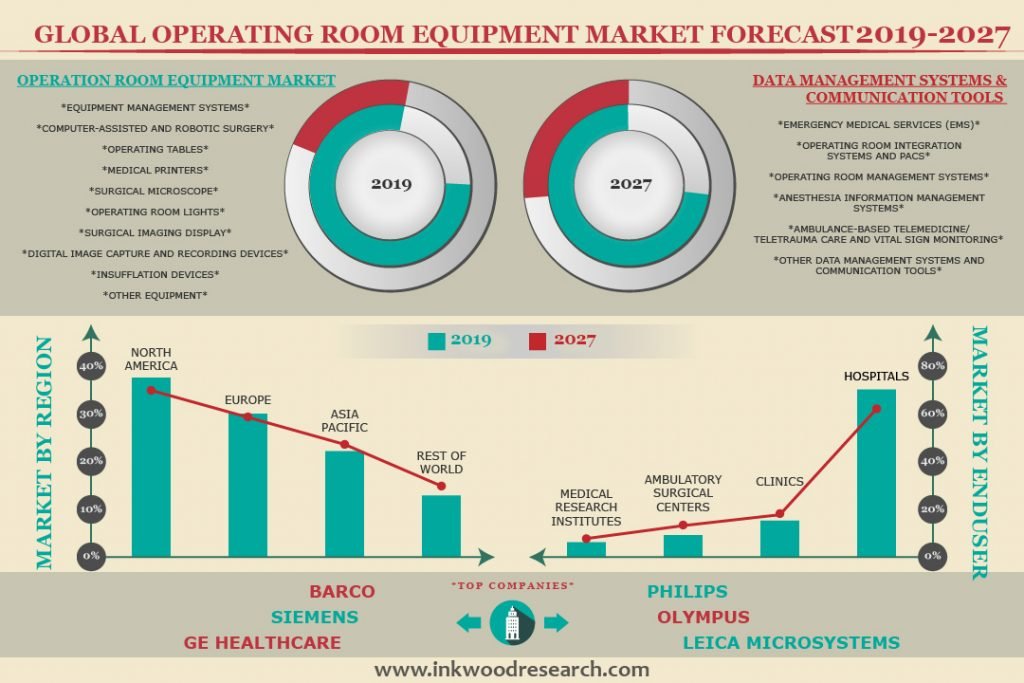

Operating Room Equipment Market by Type (Operating Room Equipment & Operating Room Data Management Systems and Communication Tools) by End-user (Hospitals, Clinics, Ambulatory Surgical Centers, & Medical Research Institutes) Market by Region

The global operating room equipment management system market is anticipated to grow at a CAGR of 4.20% between 2019 and 2027. Operating room (OR) in medical settings refers to a facility wherein different surgical procedures are performed for the treatment of diverse pathological and physiological conditions in a sterile environment. The operating room equipment management system market is primarily driven by the following factors:

- An increasing number of ASCS (ambulatory surgical centers)

- Increasing demand for hybrid OR

- Rising geriatric population and increasing chronic cases

- Increasing number of surgeries

- Surge in minimally invasive surgeries

- Upsurge in fast-tracked regulatory approvals

To learn more about this report, request a free sample copy

The important drivers increasing growth in the global operating room equipment management system market are increasing number of ASCS (ambulatory surgical centers) and increasing demand for hybrid OR. All ASCs require an OR (operating room) to undertake the surgeries; therefore the growing number of ASCs all over the world have recognized this as a key factor expediting the growth of the market for OR equipment. A hybrid OR (Operating room) is an advanced level OR that was equipped with advanced medical imaging devices.

The global operating room equipment management system market by type comprises of OR equipment and OR data management systems and communication tools. The market for operating room equipment can be broadly divided into equipment management systems (surgical booms), computer-assisted and robotic surgery, operating tables, medical printers, surgical microscope, operating room lights, surgical imaging display, digital image capture and recording devices, insufflation devices and other OR equipment. Equipment control and asset management involves the management of medical devices within a facility and may be supported by automated information systems. The other segment includes switch point control systems, documentation stations and other allied systems. The global OR data management systems and communications tools market is diversified into emergency medical services (EMS), operating room integration systems and PACS, operating room management systems, anesthesia information management systems, ambulance-based telemedicine/teletrauma care, vital sign monitoring and others. The increasing numbers of data-sharing devices have fuelled the adoption of OR data management systems among hospitals and clinics.

The high cost of operating room equipment management system and lack of coordination among the surgical team are the major factors hindering the operating room equipment management system market. The high costs associated with certain OR equipment has led to lesser adoption of these devices in medical settings. For instance, the cost of surgical navigation systems is very high, requiring huge capital investment for the installation of the system. Lack of coordination among the surgical team has resulted in an increased frequency of errors in the OR.

The global operating room equipment management system market segments include types and end users.

Types are segmented into:

- OR equipment

- Equipment management systems (surgical booms)

- Boom systems

- Combination mounting solutions

- Other equipment management systems

- Computer-assisted and robotic surgery

- Cameras

- Motion control

- Retractors

- 3D vision

- Forceps

- Needle drivers

- Other computer-assisted and robotic surgery

- Operating tables

- General operating tables

- Specialty operating tables

- Mobile operating table

- Hydraulic surgical operating table

- Electromatic operation table

- Orthopedic table

- Medical printers

- Medical grade photo printers

- Non-medical grade ink-jet printers

- Surgical microscope

- Neurosurgery microscope market

- Spine microscope market

- Ophthalmology/optometry microscope market

- ENT microscope market

- Plastic reconstructive surgery microscope market

- Other surgical microscope

- Operating room lights

- Halogen

- Led

- Xenon

- Surgical imaging display

- C-arm x-ray

- 3d ultrasound

- PET

- Infrared imaging system

- Surgical navigation system

- 3D interactive display systems

- Digital image capture and recording devices

- Insufflation devices

- Insufflator systems

- Insufflator tubing

- Veress needles

- Other or equipment

- OR data management systems and communication tools

- Emergency medical services (EMS)

- Operating room integration systems and PACS

- Operating room management systems

- Anesthesia information management systems

- Ambulance-based telemedicine/teletrauma care and vital sign monitoring

- Other OR DMS

- Equipment management systems (surgical booms)

End users are segmented into:

- Hospitals

- Clinics

- Ambulatory surgical centers

- Medical research institutes

This report covers the present market conditions and the growth prospects of the global operating room equipment management system market for 2019-2027 and considered the revenue generated through the sales of operating room equipment management system for types and End users to calculate the market size by considering 2018 as the base year.

Geographically, the global operating room equipment management system market has been segmented on the basis of four major regions, which include:

- North America Operating Room Equipment Market: The United States & Canada

- Asia-Pacific Operating Room Equipment Market: China, India, Japan, Australia, South Korea & Rest of APAC

- Europe Operating Room Equipment Market: The United Kingdom, France, Germany, Italy, Spain & Rest of Europe

- Rest of World: Latin America & the Middle East and Africa

The operating room equipment management system market in North America is expected to hold the largest share by 2027. Most parts of North America are categorized as developed and high-end markets. The growth in the operating room equipment market in the United States is expected to increase at a rate marginally higher than the rate expected globally. This is primarily due to a huge demand for lower costs, where operating rooms will use innovative methods, and also greater use of hybrid operating rooms. Hospitals are constantly facing specific demands to provide quality care and control costs by eliminating wasteful expenditure on materials, effort and time.

On the other hand, the Asia-Pacific market is anticipated to be the fastest-growing region in the operating room equipment management system market. In Asia-Pacific, India, China, and Japan are an emerging economy with beneficial investment potential due to its robust financial systems and open policy of foreign direct investments (FDI) contributing towards the growth of operating room equipment market. Furthermore, development in healthcare infrastructure is expected to contribute toward the growth of the operating room equipment market in India.

The operating room equipment management system market is segmented based on end users and are sub-divided into hospitals, clinics, ambulatory surgical centers, and medical research institutes. The size of operating rooms and facilities is dependent upon the size of the hospital, the branches of medicine that cater to and the type of the hospital, among other factors. Moreover, different end users have different requirements, which is fueling the growth of different equipment. For example, ambulatory services are responsible for the demand for portable MRI devices and other portable health-related equipment. An clinic with good infrastructure, adequate staff, adequate medicine and sufficient supplies of goods and medicine administrative processes and sufficient bulk supplies that usages applicable clinical policies guidelines and protocols as well as stakeholder and partner support, to safeguard the consistency and provision of quality health services for the community is an ideal clinic.

The major market players of the global operating room equipment management system market are:

- Getinge AB

- Stryker Corporation

- Steris

- Smith & Nephew PLC

- Trumpf Medical

Company Profiles covers analysis of important players.

Getinge AB is one of the leading global providers of products and systems for healthcare and life science industries. It operates in Western Europe, Canada, the US, and other countries. The group is headquartered in Getinge, Sweden. Trumpf Medical develops and manufactures medical equipment for operating rooms, intensive care units, and related clinical areas that provide the best possible support for hospital staff and the efficient and safe care of patients.

Key Findings of the global operating room equipment management system market:

- OR data management systems and communication tools are anticipated to grow significantly during the forecast period.

- Hospitals to generate the highest revenue in terms of the end user.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS IS ANTICIPATED TO GROW SIGNIFICANTLY DURING THE FORECAST PERIOD

- HOSPITALS TO GENERATE THE HIGHEST REVENUE IN TERMS OF END USER

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- INCREASING NUMBER OF ASCS (AMBULATORY SURGICAL CENTERS)

- INCREASING DEMAND FOR HYBRID OR

- RISING GERIATRIC POPULATION AND INCREASING CHRONIC CASES

- INCREASING NUMBER OF SURGERIES

- SURGE IN MINIMALLY INVASIVE SURGERIES

- UPSURGE IN FAST TRACKED REGULATORY APPROVALS

- MARKET RESTRAINTS

- HIGH COST OF OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM

- LACK OF COORDINATION AMONG THE SURGICAL TEAM

- MARKET OPPORTUNITIES

- GROWING DEMAND FOR LED OPERATING ROOM LIGHTS

- UNTAPPED POTENTIAL OF EMERGING MARKETS

- TECHNOLOGICAL ADVANCEMENT

- MARKET CHALLENGES

- REIMBURSEMENT CUTS

- LIMITED POST SALE SERVICES

- EXTENDED REPLACEMENT CYCLE OF EQUIPMENT

- MARKET BY TYPE

- OR EQUIPMENT

- EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS)

- BOOM SYSTEMS

- COMBINATION MOUNTING SOLUTIONS

- OTHER EQUIPMENT MANAGEMENT SYSTEMS

- COMPUTER-ASSISTED AND ROBOTIC SURGERY

- CAMERAS

- MOTION CONTROL

- RETRACTORS

- 3D VISION

- FORCEPS

- NEEDLE DRIVERS

- OTHER COMPUTER-ASSISTED AND ROBOTIC SURGERY

- OPERATING TABLES

- GENERAL OPERATING TABLES

- SPECIALTY OPERATING TABLES

- MOBILE OPERATING TABLE

- HYDRAULIC SURGICAL OPERATING TABLE

- ELECTROMATIC OPERATION TABLE

- ORTHOPEDIC TABLE

- MEDICAL PRINTERS

- MEDICAL GRADE PHOTO PRINTERS

- NON-MEDICAL GRADE INK-JET PRINTERS

- SURGICAL MICROSCOPE

- NEUROSURGERY MICROSCOPE MARKET

- SPINE MICROSCOPE MARKET

- OPHTHALMOLOGY/OPTOMETRY MICROSCOPE MARKET

- ENT MICROSCOPE MARKET

- PLASTIC RECONSTRUCTIVE SURGERY MICROSCOPE MARKET

- OTHER SURGICAL MICROSCOPE

- OPERATING ROOM LIGHTS

- HALOGEN

- LED

- XENON

- SURGICAL IMAGING DISPLAY

- C-ARM X-RAY

- 3D ULTRASOUND

- PET

- INFRARED IMAGING SYSTEM

- SURGICAL NAVIGATION SYSTEM

- 3D INTERACTIVE DISPLAY SYSTEMS

- DIGITAL IMAGE CAPTURE AND RECORDING DEVICES

- INSUFFLATION DEVICES

- INSUFFLATOR SYSTEMS

- INSUFFLATOR TUBING

- VERESS NEEDLES

- OTHER OR EQUIPMENT

- OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS

- EMERGENCY MEDICAL SERVICES (EMS)

- OPERATING ROOM INTEGRATION SYSTEMS AND PACS

- OPERATING ROOM MANAGEMENT SYSTEMS

- ANESTHESIA INFORMATION MANAGEMENT SYSTEMS

- AMBULANCE-BASED TELEMEDICINE/TELETRAUMA CARE AND VITAL SIGN MONITORING

- OTHER OR DMS

- EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS)

- OR EQUIPMENT

- MARKET BY END USER

- HOSPITALS

- CLINICS

- AMBULATORY SURGICAL CENTERS

- MEDICAL RESEARCH INSTITUTES

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- INTENSITY OF COMPETITIVE RIVALRY

- VALUE CHAIN ANALYSIS

- OPPORTUNITY MATRIX

- PATENT ANALYSIS

- MARKET TRENDS

- REGULATORY FRAMEWORK

- REGULATION IN NORTH AMERICA

- REGULATION IN THE EUROPEAN UNION (EU)

- REGULATION IN ASIA PACIFIC

- REGULATION IN OTHER COUNTRIES

- PORTER’S FIVE FORCE ANALYSIS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA-PACIFIC

- JAPAN

- CHINA

- INDIA

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MIDDLE EAST AND AFRICA

- LATIN AMERICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- COMPANY PROFILES

- BARCO

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- CANON MEDICAL SYSTEMS CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- CONMED CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- GE HEALTHCARE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- GETINGE AB

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- HILL-ROM HOLDINGS INC.

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- KARL STORZ GMBH & CO. KG

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- LEICA MICROSYSTEMS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVE

- MIZUHO OSI

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- NDS SURGICAL IMAGING LLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- OLYMPUS CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- PHILIPS HEALTHCARE

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- SIEMENS HEALTHINEERS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- SKYTRON LLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- SMITH & NEPHEW PLC

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVE

- SONY MEDICAL SYSTEMS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STERIS

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- STRYKER CORPORATION

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- TRUMPF MEDICAL

- COMPANY OVERVIEW

- PRODUCTS PORTFOLIO

- SCOT ANALYSIS

- STRATEGIC INITIATIVES

- BARCO

TABLE LIST

TABLE 1 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 2 ESTIMATED COST OF OPERATING ROOM

TABLE 3 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 4 GLOBAL OR EQUIPMENTS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 5 GLOBAL OR EQUIPMENTS MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 6 GLOBAL EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS) MARKET BY REGION 2019-2027 ($MILLION)

TABLE 7 GLOBAL EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS) MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 8 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY REGION 2019-2027 ($MILLION)

TABLE 9 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 10 GLOBAL OPERATING TABLES MARKET BY REGION 2019-2027 ($MILLION)

TABLE 11 GLOBAL OPERATING TABLES MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 12 NUMBER OF SURGICAL PROCEDURES (PER 100,000 POPULATIONS)

TABLE 13 GLOBAL MEDICAL PRINTERS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 14 GLOBAL MEDICAL PRINTERS MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 15 GLOBAL SURGICAL MICROSCOPE MARKET BY REGION 2019-2027 ($MILLION)

TABLE 16 GLOBAL SURGICAL MICROSCOPE MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 17 GLOBAL OPERATING ROOM LIGHTS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 18 GLOBAL OPERATING ROOM LIGHTS MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 19 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY REGION 2019-2027 ($MILLION)

TABLE 20 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 21 GLOBAL INSUFFLATION DEVICES MARKET BY REGION 2019-2027 ($MILLION)

TABLE 22 GLOBAL INSUFFLATION DEVICES MARKET BY TYPE 2019-2027 ( $MILLION)

TABLE 23 GLOBAL DIGITAL IMAGE CAPTURE AND RECORDING DEVICES MARKET BY REGION 2019-2027 ($MILLION)

TABLE 24 GLOBAL OTHER OR EQUIPMENT MARKET BY REGION 2019-2027 ($MILLION)

TABLE 25 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 26 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 27 GLOBAL EMERGENCY MEDICAL SERVICES (EMS) MARKET BY REGION 2019-2027 ($MILLION)

TABLE 28 GLOBAL OPERATING ROOM INTEGRATION SYSTEMS AND PACS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 29 GLOBAL OPERATING ROOM MANAGEMENT SYSTEMS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 30 GLOBAL ANESTHESIA INFORMATION MANAGEMENT SYSTEMS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 31 GLOBAL AMBULANCE-BASED TELEMEDICINE/TELETRAUMA CARE AND VITAL SIGN MONITORING MARKET BY REGION 2019-2027 ($MILLION)

TABLE 32 GLOBAL OTHER OR DMS MARKET BY REGION 2019-2027 ($MILLION)

TABLE 33 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 34 NUMBER OF ESTIMATED HOSPITALS IN TOP 10 COUNTRIES

TABLE 35 GLOBAL HOSPITALS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 36 GLOBAL CLINICS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 37 GLOBAL AMBULATORY SURGICAL CENTERS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 38 GLOBAL MEDICAL RESEARCH INSTITUTES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 39 KEY PATENTS RELATED TO ORE PRODUCTS

TABLE 40 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 41 NORTH AMERICA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 42 EUROPE OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 43 POPULATION DEMOGRAPHICS IN EUROPEAN COUNTRIES, 2015 AND 2060

TABLE 44 ASIA-PACIFIC OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 45 REST OF WORLD OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE LIST

FIGURE 1 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 2 GROWTH IN NUMBER OF ASCS FROM 1988 TO 2018

FIGURE 3 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET SHARE BY TYPE 2018 & 2027 (%)

FIGURE 4 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY OR EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 5 GLOBAL EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS) MARKET BY BOOM SYSTEMS 2019-2027 ($ MILLION)

FIGURE 6 GLOBAL EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS) MARKET BY COMBINATION MOUNTING SOLUTIONS 2019-2027 ($ MILLION)

FIGURE 7 GLOBAL EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS) MARKET BY OTHER EQUIPMENT MANAGEMENT SYSTEM 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY CAMERAS 2019-2027 ($ MILLION)

FIGURE 9 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY MOTION CONTROL 2019-2027 ( $MILLION)

FIGURE 10 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY RETRACTORS 2019-2027 ($ MILLION)

FIGURE 11 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY 3D VISION 2019-2027 ($ MILLION)

FIGURE 12 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY FORCEPS 2019-2027 ($ MILLION)

FIGURE 13 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY NEEDLE DRIVERS 2019-2027 ($ MILLION)

FIGURE 14 GLOBAL COMPUTER-ASSISTED AND ROBOTIC SURGERY MARKET BY OTHER COMPUTER-ASSISTED AND ROBOTIC SURGERY 2019-2027 ($ MILLION)

FIGURE 15 GLOBAL OPERATING TABLES MARKET BY GENERAL OPERATING TABLES 2019-2027 ($ MILLION)

FIGURE 16 GLOBAL OPERATING TABLES MARKET BY SPECIALTY OPERATING TABLES 2019-2027 ($ MILLION)

FIGURE 17 GLOBAL SPECIALTY OPERATING TABLES MARKET BY MOBILE OPERATING TABLE 2019-2027 ($ MILLION)

FIGURE 18 GLOBAL SPECIALTY OPERATING TABLES MARKET BY HYDRAULIC SURGICAL OPERATING TABLE 2019-2027 ($ MILLION)

FIGURE 19 GLOBAL SPECIALTY OPERATING TABLES MARKET BY ELECTROMATIC OPERATION TABLE 2019-2027 ($ MILLION)

FIGURE 20 GLOBAL SPECIALTY OPERATING TABLES MARKET BY ORTHOPEDIC TABLE 2019-2027 ($ MILLION)

FIGURE 21 GLOBAL MEDICAL PRINTERS MARKET BY MEDICAL GRADE PHOTO PRINTERS 2019-2027 ($ MILLION)

FIGURE 22 GLOBAL MEDICAL PRINTERS MARKET BY NON-MEDICAL GRADE INK-JET PRINTERS 2019-2027 ($ MILLION)

FIGURE 23 GLOBAL SURGICAL MICROSCOPE MARKET BY NEUROSURGERY MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 24 GLOBAL SURGICAL MICROSCOPE MARKET BY SPINE MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 25 GLOBAL SURGICAL MICROSCOPE MARKET BY OPHTHALMOLOGY/OPTOMETRY MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 26 GLOBAL SURGICAL MICROSCOPE MARKET BY ENT MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 27 GLOBAL SURGICAL MICROSCOPE MARKET BY PLASTIC RECONSTRUCTIVE SURGERY MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 28 GLOBAL SURGICAL MICROSCOPE MARKET BY OTHER SURGICAL MICROSCOPE MARKET 2019-2027 ($ MILLION)

FIGURE 29 GLOBAL OPERATING ROOM LIGHTS MARKET BY HALOGEN MARKET 2019-2027 ($ MILLION)

FIGURE 30 GLOBAL OPERATING ROOM LIGHTS MARKET BY LED MARKET 2019-2027 ($ MILLION)

FIGURE 31 GLOBAL OPERATING ROOM LIGHTS MARKET BY XENON MARKET 2019-2027 ($ MILLION)

FIGURE 32 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY C-ARM X-RAY MARKET 2019-2027 ($ MILLION)

FIGURE 33 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY 3D ULTRASOUND MARKET 2019-2027 ($ MILLION)

FIGURE 34 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY PET MARKET 2019-2027 ($ MILLION)

FIGURE 35 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY INFRARED IMAGING SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 36 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY SURGICAL NAVIGATION SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 37 GLOBAL SURGICAL IMAGING DISPLAY MARKET BY 3D INTERACTIVE DISPLAY SYSTEMS MARKET 2019-2027 ($ MILLION)

FIGURE 38 GLOBAL INSUFFLATION DEVICES MARKET BY INSUFFLATOR SYSTEMS 2019-2027 ($ MILLION)

FIGURE 39 GLOBAL INSUFFLATION DEVICES MARKET BY INSUFFLATOR TUBING 2019-2027 ($ MILLION)

FIGURE 40 GLOBAL INSUFFLATION DEVICES MARKET BY VERESS NEEDLES 2019-2027 ($ MILLION)

FIGURE 41 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY EMERGENCY MEDICAL SERVICES (EMS) 2019-2027 ($ MILLION)

FIGURE 42 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY OPERATING ROOM INTEGRATION SYSTEMS AND PACS 2019-2027 ($ MILLION)

FIGURE 43 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY OPERATING ROOM MANAGEMENT SYSTEMS 2019-2027 ($ MILLION)

FIGURE 44 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY ANESTHESIA INFORMATION MANAGEMENT SYSTEMS 2019-2027 ($ MILLION)

FIGURE 45 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY AMBULANCE-BASED TELEMEDICINE/TELETRAUMA CARE AND VITAL SIGN MONITORING 2019-2027 ($ MILLION)

FIGURE 46 GLOBAL OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS MARKET BY OTHER OR DMS 2019-2027 ($ MILLION)

FIGURE 47 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET SHARE BY END USER 2018 & 2027 (%)

FIGURE 48 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY HOSPITALS 2019-2027 ($ MILLION)

FIGURE 49 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY CLINICS 2019-2027 ($ MILLION)

FIGURE 50 SPECIALTIES SERVED IN ASCS

FIGURE 51 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY AMBULATORY SURGICAL CENTERS 2019-2027 ($ MILLION)

FIGURE 52 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET BY MEDICAL RESEARCH INSTITUTES 2019-2027 ($ MILLION)

FIGURE 53 PORTER’S FIVE FORCE ANALYSIS

FIGURE 54 VALUE CHAIN ANALYSIS

FIGURE 55 PATENT REGISTERED/APPROVED BY REGION

FIGURE 56 GLOBAL OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET REGIONAL OUTLOOK 2018 & 2027 (%)

FIGURE 57 THE UNITED STATES OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 58 PROPORTION OF DEATH CAUSED BY CANCER AND OTHER DISEASE IN CANADA (%)

FIGURE 59 CANADA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 60 THE UNITED KINGDOM OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 61 FRANCE OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 62 GERMANY OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 63 ITALY OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 64 SPAIN OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 65 REST OF EUROPE OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 66 JAPAN OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 67 CHINA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 68 INDIA HEALTHCARE SECTOR

FIGURE 69 INDIA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 70 SOUTH KOREA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 71 AUSTRALIA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 72 REST OF ASIA-PACIFIC OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 73 MIDDLE EAST AND AFRICA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 74 LATIN AMERICA OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 75 OPERATING ROOM EQUIPMENT MANAGEMENT SYSTEM MARKET SHARE ANALYSIS 2017 (%)

- MARKET BY TYPE

- OR EQUIPMENT

- EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS)

- BOOM SYSTEMS

- COMBINATION MOUNTING SOLUTIONS

- OTHER EQUIPMENT MANAGEMENT SYSTEMS

- COMPUTER-ASSISTED AND ROBOTIC SURGERY

- CAMERAS

- MOTION CONTROL

- RETRACTORS

- 3D VISION

- FORCEPS

- NEEDLE DRIVERS

- OTHER COMPUTER-ASSISTED AND ROBOTIC SURGERY

- OPERATING TABLES

- GENERAL OPERATING TABLES

- SPECIALTY OPERATING TABLES

- MOBILE OPERATING TABLE

- HYDRAULIC SURGICAL OPERATING TABLE

- ELECTROMATIC OPERATION TABLE

- ORTHOPEDIC TABLE

- MEDICAL PRINTERS

- MEDICAL GRADE PHOTO PRINTERS

- NON-MEDICAL GRADE INK-JET PRINTERS

- SURGICAL MICROSCOPE

- NEUROSURGERY MICROSCOPE MARKET

- SPINE MICROSCOPE MARKET

- OPHTHALMOLOGY/OPTOMETRY MICROSCOPE MARKET

- ENT MICROSCOPE MARKET

- PLASTIC RECONSTRUCTIVE SURGERY MICROSCOPE MARKET

- OTHER SURGICAL MICROSCOPE

- OPERATING ROOM LIGHTS

- HALOGEN

- LED

- XENON

- SURGICAL IMAGING DISPLAY

- C-ARM X-RAY

- 3D ULTRASOUND

- PET

- INFRARED IMAGING SYSTEM

- SURGICAL NAVIGATION SYSTEM

- 3D INTERACTIVE DISPLAY SYSTEMS

- DIGITAL IMAGE CAPTURE AND RECORDING DEVICES

- INSUFFLATION DEVICES

- INSUFFLATOR SYSTEMS

- INSUFFLATOR TUBING

- VERESS NEEDLES

- OTHER OR EQUIPMENT

- OR DATA MANAGEMENT SYSTEMS AND COMMUNICATION TOOLS

- EMERGENCY MEDICAL SERVICES (EMS)

- OPERATING ROOM INTEGRATION SYSTEMS AND PACS

- OPERATING ROOM MANAGEMENT SYSTEMS

- ANESTHESIA INFORMATION MANAGEMENT SYSTEMS

- AMBULANCE-BASED TELEMEDICINE/TELETRAUMA CARE AND VITAL SIGN MONITORING

- OTHER OR DMS

- EQUIPMENT MANAGEMENT SYSTEMS (SURGICAL BOOMS)

- OR EQUIPMENT

- MARKET BY END USER

- HOSPITALS

- CLINICS

- AMBULATORY SURGICAL CENTERS

- MEDICAL RESEARCH INSTITUTES

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA-PACIFIC

- JAPAN

- CHINA

- INDIA

- SOUTH KOREA

- AUSTRALIA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MIDDLE EAST AND AFRICA

- LATIN AMERICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.