GLOBAL VASCULAR GUIDEWIRES MARKET FORECAST 2019-2027

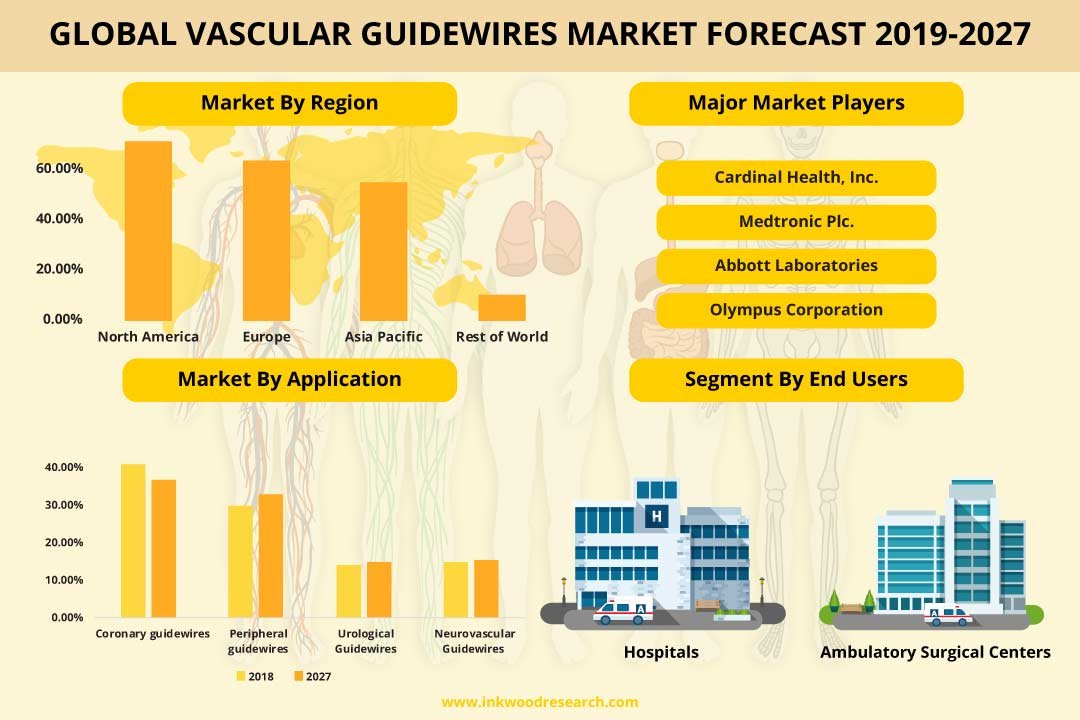

Global Vascular Guidewires Market by Application (Coronary Guidewires, Peripheral Guidewires, Urological Guidewires, Neurovascular Guidewires) by Coating Type (Coated, Non-coated) by End User (Hospitals, Ambulatory Surgical Centers) by Geography.

The global vascular guidewires market is anticipated to grow at a CAGR of 5.46% between 2019 and 2027 and generate revenue of $1614.2 million by 2027. Vascular is a network of vessels that carry blood. The guidewire is a thin and usually flexible wire that can be inserted into the vessel to act as a guide for subsequent insertion of a stiffer or bulkier instrument.

The vascular guidewires market is primarily driven by the following factors:

- The rise in prevalence of chronic diseases

- Increasing demand for MI procedures

- Awareness among patients about treatment options

- Prevailing high unmet medical needs

To know more about this report, request a free sample copy.

The important drivers increasing growth in the global vascular guidewires market are a rise in the incidence of chronic diseases and growing demand for MI procedures. Also, the rising prevalence of chronic diseases along with the rapidly increasing geriatric population globally drives the demand for the vascular guidewires. Incidence of chronic diseases such as cardiovascular diseases, obstruction of arteries, plaque development, and other problems increase with age. MI procedures lead to faster recovery, less pain, fewer post-surgery infections, reduced hospital stays, minimize incision marks, control bleeding, cause minimal complications, and offer high accuracy. Due to these benefits, surgeons and patients are increasingly opting for MI surgeries.

The applications of vascular guidewires market are used extensively for various purposes. Coronary guidewires are most commonly used during the Percutaneous Coronary Intervention (PCI) or coronary angioplasty, a non-surgical procedure. A coronary guidewire is an integral part of a process to implant a coronary stent, and this procedure is well known as a Percutaneous Coronary Intervention (PCI). Peripheral guidewires are a vital part of the peripheral vascular stenting procedure performed to improve blood flow in the arteries and veins. The peripheral guidewire is commonly used in treating conditions called intermittent claudication, also known as peripheral vascular diseases using peripheral stents. Urological guidewires are used in getting access to the dilating urinary strictures, urinary tract, removing kidney stones, and providing provisional drainage. Neurovascular guidewires are metallic and non-metallic structures, which guide a catheter through the blood vessels for placement in cardiology and radiology angiographic procedures.

The issue in lost guidewire retrieval and risks associated with the use of guidewires are the major factors hindering the vascular guidewires market. During complex coronary procedures, excessive bending of vascular guidewire leads to high tensile load over the wire, which may lead to entrapment and fracture of the guidewire into the patient’s vascular system. One of the significant issues is the loss of guidewires during surgeries. The lost guidewires need to be retrieved immediately, and if left untreated, may lead to serious cardiovascular complications and sometimes be fatal.

The Global Vascular guidewires market segments include Application, Coating Type, and End-user.

Application is sub-segmented into:

- Coronary guidewires

- Peripheral guidewires

- Urological Guidewires

- Neurovascular Guidewires

Coating Type is sub-segmented into:

- Coated

- Hydrophilic coating

- Hydrophobic coating

- Non-Coated

End User is sub-segmented into:

- Hospitals

- Ambulatory Surgical Centers

This report covers the present market conditions and the growth prospects of the global vascular guidewires market for 2019-2027. It considered the revenue generated through the sales of vascular guidewires for application, coating type as well as the end user to calculate the market size by considering 2018 as the base year.

On the basis of geography, the global vascular guidewires market has been segmented into four major regions:

- North America Vascular Guidewires Market: The United States & Canada

- Asia-Pacific Vascular Guidewires Market: China, India, Japan, Australia, South Korea & Rest of Asia Pacific

- Europe Vascular Guidewires Market: The United Kingdom, France, Germany, Italy, Spain & Rest of Europe

- Rest of World: Latin America & Middle East and Africa

The Vascular guidewires market in North America is expected to hold the largest share by 2027 due to the rise in prevalence of chronic disorders, the high adoption rate of vascular guidewires, the presence of highly sophisticated healthcare infrastructure, and a favorable reimbursement framework. North America vascular guidewires market constitutes approximately 37% share. Development of advanced devices, acceptance of minimally invasive surgeries, and acquisitions & mergers to obtain novel technologies are the important market trends. On the other hand, the Asia Pacific market is anticipated to be the fastest-growing region for the vascular guidewires market during the forecast period. It offers lucrative opportunities in the vascular guidewires market. Asia-Pacific is densely populated, with India and China being the most populated countries. The rise in disposable income and growing medical tourism is increasing the demand for guidewires. Growing awareness about the use of MI procedures in treating various vascular diseases has led to increased adoption of guidewires.

The vascular guidewires market is segmented on coating type, which is sub-divided into coated & non-coated. The market is also segmented on the basis of end user, which is sub-divided into hospitals and ambulatory surgical centers. The coating alters lubricity, tactile feel, tractability, and steerability of a guidewire. The coated segment is further divided into the hydrophilic coating and hydrophobic coating. The coating type is further segmented into the hydrophilic coating and hydrophobic coating. Hospitals are well-equipped with cardiovascular units to cater to various needs of cardiac procedures. ASCs provide services for a few medical specialties such as urological, orthopedics, ophthalmology, and pain management.

There are several players, and some of the major players of the global vascular guidewires market are:

- Cardinal Health, Inc.

- Medtronic Plc.

- Abbott Laboratories

- Olympus Corporation

- Boston Scientific Corporation

Company profiles covers the analysis of important players. Cardinal Health Inc. develops, manufactures, and distributes drug-eluting stents, catheters, and guidewires for interventional medicine, marginally invasive computer-based imaging, and electrophysiology applications. The company has operations in more than 50 countries. Boston Scientific Corporation has broad guidewires product portfolio and has provided different varieties of guidewires with the innovative technology in the market. For example, the Asahi Tip with dual-coil technology provides better torque ability and optimal tip flexibility with durable tip-shape retention.

Key Findings of the global vascular guidewires market:

- Coronary guidewires are the majorly used application

- Hydrophobic coating is the fastest-growing coated type

- Hospitals are the highest revenue-generating end-users

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- CORONARY GUIDEWIRES ARE THE MAJORLY USED APPLICATION

- HYDROPHOBIC COATING IS THE FASTEST GROWING COATED TYPE

- HOSPITALS ARE THE HIGHEST REVENUE GENERATING END USERS

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- RISE IN PREVALENCE OF CHRONIC DISEASES

- INCREASING DEMAND FOR MI PROCEDURES

- AWARENESS AMONG PATIENTS ABOUT TREATMENT OPTIONS

- PREVAILING HIGH UNMET MEDICAL NEEDS

- MARKET RESTRAINTS

- RISKS ASSOCIATED WITH THE USE OF GUIDEWIRES

- UNFAVORABLE PREFERENCE FOR DRUGS

- ISSUE IN LOST GUIDEWIRE RETRIEVAL

- MARKET OPPORTUNITIES

- TECHNOLOGICAL ADVANCEMENTS

- SURGE IN THE ADOPTION OF VASCULAR PROCEDURES

- MARKET CHALLENGES

- COMPLEXITIES ASSOCIATED IN THE MANUFACTURING OF VASCULAR GUIDEWIRES

- PRICING COUPLED WITH PAUCITY OF PRODUCT DIFFERENTIATION

- MARKET BY APPLICATION

- CORONARY GUIDEWIRES

- PERIPHERAL GUIDEWIRES

- UROLOGICAL GUIDEWIRES

- NEUROVASCULAR GUIDEWIRES

- MARKET BY COATING TYPE

- COATED

- HYDROPHILIC COATING

- HYDROPHOBIC COATING

- NON-COATED

- COATED

- MARKET BY END USER

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

- KEY ANALYTICS

- PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE PRODUCTS

- BARGAINING POWER OF BUYER

- BARGAINING POWER OF SUPPLIER

- INTENSITY OF COMPETITIVE RIVALRY

- VALUE CHAIN ANALYSIS

- REGULATORY FRAMEWORK

- SUPPLY CHAIN ANALYSIS

- PATENT ANALYSIS

- OPPORTUNITY MATRIX

- PORTER’S FIVE FORCES MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- GERMANY

- FRANCE

- THE UNITED KINGDOM

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

- SOUTH KOREA

- REST OF APAC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- COMPANY PROFILES

- ABBOTT

- B BRAUN MELSUNGEN AG

- BECTON DICKINSON AND COMPANY

- BIOTRONIK SE & CO. KG

- BOSTON SCIENTIFIC CORPORATION

- CARDINAL HEALTH INC.

- COOK MEDICAL LLC

- EDWARD LIFESCIENCES

- GALTNEEDLETECH

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- MERIT MEDICAL SYSTEMS

- OLYMPUS CORPORATION

- TERUMO

TABLE LIST

TABLE 1 GLOBAL VASCULAR GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 2 MAJOR COMPLICATIONS CAUSED BY GUIDEWIRES DURING ENDOVASCULAR OR STENTING PROCEDURES

TABLE 3 GLOBAL VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 4 GLOBAL CORONARY GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 5 GLOBAL PERIPHERAL GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 6 GLOBAL UROLOGICAL GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 7 GLOBAL NEUROVASCULAR GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 8 GLOBAL VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 9 GLOBAL COATED MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 10 GLOBAL NON-COATED MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 11 GLOBAL VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 12 GLOBAL HOSPITALS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 13 GLOBAL AMBULATORY SURGICAL CENTERS MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 14 GLOBAL VASCULAR GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 15 NORTH AMERICA VASCULAR GUIDEWIRES MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 16 THE UNITED STATES VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 17 THE UNITED STATES VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 18 THE UNITED STATES VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 19 CANADA VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 20 CANADA VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 21 CANADA VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 22 EUROPE VASCULAR GUIDEWIRES MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 23 GERMANY VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 24 GERMANY VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 25 GERMANY VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 26 FRANCE VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 27 FRANCE VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 28 FRANCE VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 29 THE UNITED KINGDOM VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 30 THE UNITED KINGDOM VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 31 THE UNITED KINGDOM VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 32 ITALY VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 33 ITALY VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 34 ITALY VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 35 SPAIN VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 36 SPAIN VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 37 SPAIN VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 38 ASIA PACIFIC VASCULAR GUIDEWIRES MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 39 JAPAN VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 40 JAPAN VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 41 JAPAN VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 42 CHINA VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 43 CHINA VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 44 CHINA VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 45 INDIA VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 46 INDIA VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 47 INDIA VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 48 AUSTRALIA VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 49 AUSTRALIA VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 50 AUSTRALIA VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 51 SOUTH KOREA VASCULAR GUIDEWIRES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 52 SOUTH KOREA VASCULAR GUIDEWIRES MARKET BY COATING TYPE 2019-2027 ($ MILLION)

TABLE 53 SOUTH KOREA VASCULAR GUIDEWIRES MARKET BY END USER 2019-2027 ($ MILLION)

TABLE 54 REST OF WORLD VASCULAR GUIDEWIRES MARKET BY REGION 2019-2027 ($ MILLION)

FIGURE LIST

FIGURE 1 GLOBAL VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 2 INCIDENCE OF CHRONIC DISEASE IN THE UNITED STATES 2018

FIGURE 3 GLOBAL VASCULAR GUIDEWIRES MARKET SHARE BY APPLICATION 2018 & 2027 (%)

FIGURE 4 GLOBAL VASCULAR GUIDEWIRES MARKET BY CORONARY GUIDEWIRES 2019-2027 ($ MILLION)

FIGURE 5 GLOBAL VASCULAR GUIDEWIRES MARKET BY PERIPHERAL GUIDEWIRES 2019-2027 ($ MILLION)

FIGURE 6 GLOBAL VASCULAR GUIDEWIRES MARKET BY UROLOGICAL GUIDEWIRES 2019-2027 ($ MILLION)

FIGURE 7 GLOBAL VASCULAR GUIDEWIRES MARKET BY NEUROVASCULAR GUIDEWIRES 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL VASCULAR GUIDEWIRES MARKET SHARE BY COATING TYPE 2018 & 2027 (%)

FIGURE 9 GLOBAL VASCULAR GUIDEWIRES MARKET BY COATED 2019-2027 ($ MILLION)

FIGURE 10 GLOBAL COATED VASCULAR GUIDEWIRES MARKET BY HYDROPHILIC COATING 2019-2027 ($ MILLION)

FIGURE 11 GLOBAL COATED VASCULAR GUIDEWIRES MARKET BY HYDROPHOBIC COATING 2019-2027 ($ MILLION)

FIGURE 12 GLOBAL VASCULAR GUIDEWIRES MARKET BY NON-COATED 2019-2027 ($ MILLION)

FIGURE 13 GLOBAL VASCULAR GUIDEWIRES MARKET SHARE BY END USER 2018 & 2027 (%)

FIGURE 14 GLOBAL VASCULAR GUIDEWIRES MARKET BY HOSPITALS 2019-2027 ($ MILLION)

FIGURE 15 GLOBAL VASCULAR GUIDEWIRES MARKET BY AMBULATORY SURGICAL CENTERS 2019-2027 ($ MILLION)

FIGURE 16 PORTER’S FIVE FORCE MODEL

FIGURE 17 NUMBER OF PATENTS REGISTERED YEARLY

FIGURE 18 NUMBER OF PATENTS BY COUNTRY

FIGURE 19 NUMBER OF PATENTS BY COMPANY

FIGURE 20 GLOBAL VASCULAR GUIDEWIRES MARKET REGIONAL OUTLOOK 2018 & 2027 (%)

FIGURE 21 THE UNITED STATES VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 22 CANADA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 23 GERMANY VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 24 FRANCE GERIATRIC POPULATION 2012 AND 2017 (MILLIONS)

FIGURE 25 FRANCE VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 26 THE UNITED KINGDOM VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 27 ITALY VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 28 SPAIN VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 29 REST OF EUROPE VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 30 JAPAN VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 31 POPULATION ABOVE 65 YEARS IN JAPAN 2015 & 2050 (%)

FIGURE 32 CHINA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 33 INDIA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 34 POPULATION ABOVE 60 YEARS OF AGE 2015 & 2050 (%)

FIGURE 35 AUSTRALIA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 36 SOUTH KOREA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 37 REST OF APAC VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 38 LATIN AMERICA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 39 MIDDLE EAST AND AFRICA VASCULAR GUIDEWIRES MARKET 2019-2027 ($ MILLION)

FIGURE 40 VASCULAR GUIDEWIRES COMPANY SHARE ANALYSIS 2018 (%)

- MARKET BY APPLICATION

- CORONARY GUIDEWIRES

- PERIPHERAL GUIDEWIRES

- UROLOGICAL GUIDEWIRES

- NEUROVASCULAR GUIDEWIRES

- MARKET BY COATING TYPE

- COATED

- HYDROPHILIC COATING

- HYDROPHOBIC COATING

- NON-COATED

- COATED

- MARKET BY END USER

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- GERMANY

- FRANCE

- THE UNITED KINGDOM

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

- SOUTH KOREA

- REST OF APAC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.