GLOBAL SURGICAL IMAGING MARKET FORECAST 2019-2027

Global Surgical Imaging Market by Modality Type (Mobile C-arms, Mini C-arms, Other Modality Type) by Technology (Image Intensifier, Flat Panel Detector (Fpd)) by Application (Neurosurgery, Orthopedic & Trauma Surgery, Cardiovascular, General Surgery, Other Application) by Geography.

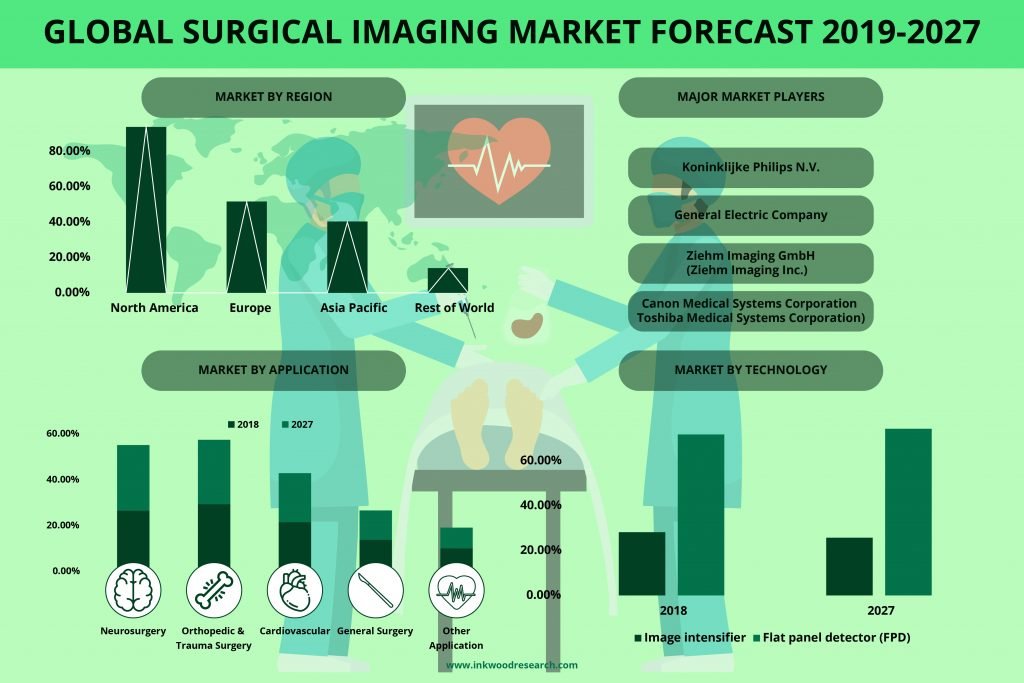

The global surgical imaging market is anticipated to grow at a CAGR of 5.04% between 2019 and 2027 to generate revenue of $2055.5 million by 2027. The surgical imaging market is expected to experience significant growth during the forecast period, owing to the growth in a number of minimally invasive surgical processes across geographies.

The global surgical imaging market is primarily driven by the following factors:

- The rising number of minimally invasive surgical procedures

- Rising geriatric population

- Increased usage of flat panel detector

To know more about this report, request a free sample copy.

The important driver increasing the growth in the global surgical imaging market is the number of minimally invasive surgical processes and the rise in the geriatric population. Surgical imaging systems are widely used in different minimally invasive surgical processes, and there is an increase in the number of minimally surgical procedures, which is anticipated to fuel the demand for surgical imaging devices, thereby driving the market growth. The rising projection of the geriatric population signals a high prevalence of various diseases that include cancer, neurodegenerative disorders, and others amongst them.

The applications of the surgical imaging market are used extensively for various purposes. The neurosurgery segment is anticipated to exhibit the fastest market growth during the estimated period due to a surge in acceptance of C-arm during neurosurgeries, a rise in the number of neurosurgical hybrids operating rooms, and an increase in the number of the target population. The orthopedic & trauma surgery segment is a major revenue contributor and is anticipated to show dominance during the forecast period, owing to a rise in the adoption of intraoperative surgical imaging. Cardiovascular surgery is the surgery of the heart, which is performed for the treatment of complications arising from ischemic heart disease, vulvar heart disease or congenital heart disease, and heart transplantation. An increase in the number of general surgery is majorly driving the growth of this segment.

The high cost of surgical imaging instruments is one of the major factors hindering the surgical imaging market. Surgical imaging systems are widely used in different forms of surgeries. However, these surgical imaging systems are available at an extremely high price, and thus become unaffordable for small and mid-size hospitals.

The global surgical imaging market segments include modality type, technology, and application.

Types are segmented into:

- Mobile c-arms

- Mini c-arms

- Other modality types

Technology is segmented into:

- Image intensifier

- Flat-panel detector (FPD)

Application is segmented into:

- Cardiovascular

- Neurosurgery

- General surgery

- Orthopedic & trauma surgery

- Other application

This report covers the present market conditions and the growth prospects of the global surgical imaging market for 2019-2027, and considered the revenue generated through the sales of surgical imaging for modality type, technology, and application in calculating the market size by considering 2018 as the base year.

Geographically, the global surgical imaging market has been segmented on the basis of four major regions, which include:

- North America Surgical Imaging Market: The United States and Canada

- Asia-Pacific Surgical Imaging Market: China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific

- Europe Surgical Imaging Market: The United Kingdom, France, Germany, Italy, Spain, and the Rest of Europe

- Rest of World: Latin America, the Middle East, and Africa

The surgical imaging market in North America is expected to hold the largest share by 2027 due to the existence of well-developed healthcare structure along with a higher acceptance of surgical imaging, wide availability of advanced surgical imaging systems, the surge in demand for minimally invasive surgery, and the presence of trained medical professionals. The North America surgical imaging market constitutes approx. 48% share. On the other hand, the Asia-Pacific market is anticipated to be the fastest-growing region for the surgical imaging market. The market growth in this region is attributable to its high population base, growth in awareness about advanced surgical imaging systems, and an increase in demand for minimally invasive surgeries. Asia-Pacific has countries that are in the developing phase, and therefore serve as emerging markets.

The surgical imaging market is segmented on modality type, which is sub-divided into mobile c-arms, mini c-arms, and other modality types. The market is segmented based on technology, which is sub-divided into Image intensifier and Flat panel detector (FPD). A mobile c-arm is a medical imaging device that works on the basis of X-ray technology and has versatile uses in various operating rooms. The mini C-arm permits clinicians to obtain lively images and perform interferences such as injections or manipulations. The C-arm image intensifier is an imaging element, which transforms X-rays into a noticeable, image, and is used in health care. The FPD image can be displayed and analyzed with the latest software/computer advances.

The major market players of the global surgical imaging market are:

- Koninklijke Philips N.V.

- General Electric Company

- Ziehm Imaging GmbH (Ziehm Imaging Inc.)

- Canon Medical Systems Corporation (Toshiba Medical Systems Corporation)

- Siemens Healthineers AG

Company Profiles covers the analysis of important players.

Koninklijke Philips N.V. (Philips or ‘the company’), the parent company of the Philips Group, is a health technology company focused on improving people’s health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment, and home care. Siemens Healthineers is a medical technology company that manufactures and markets clinical diagnostics and therapeutic systems. The company’s major products include medical imaging, ultrasound, point of care testing, healthcare IT, clinical specialties and diseases, and laboratory diagnostics systems and devices.

Key findings of the global surgical imaging market:

- Mobile c-arms dominated the surgical imaging market in terms of modality type

- Flat-panel detector (FPD) is the widely used surgical imaging technology

- Orthopedic & trauma surgery constituted the largest market share in terms of application

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- MOBILE C-ARMS DOMINATES THE SURGICAL IMAGING MARKET IN TERMS OF MODALITY TYPE

- FLAT PANEL DETECTOR (FPD) IS THE WIDELY USED SURGICAL IMAGING TECHNOLOGY

- ORTHOPEDIC & TRAUMA SURGERY CONSTITUTED THE LARGEST MARKET SHARE IN TERMS OF APPLICATION

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- RISE IN THE NUMBER OF MINIMALLY INVASIVE SURGICAL PROCEDURES

- RISE IN GERIATRIC POPULATION

- INCREASED USAGE OF FLAT PANEL DETECTOR C-ARMS (FPD-C-ARMS)

- MARKET RESTRAINTS

- HIGH COST OF SURGICAL IMAGING INSTRUMENTS

- MARKET OPPORTUNITIES

- WIDE USAGES OF SURGICAL IMAGING DEVICES

- OPPORTUNITIES IN UNTAPPED EMERGING MARKETS

- MARKET CHALLENGES

- LACK OF SKILLED PROFESSIONALS

- MARKET BY MODALITY TYPE

- MOBILE C-ARMS

- MINI C-ARMS

- OTHER MODALITY TYPE

- MARKET BY TECHNOLOGY

- IMAGE INTENSIFIER

- FLAT PANEL DETECTOR (FPD)

- MARKET BY APPLICATION

- NEUROSURGERY

- ORTHOPEDIC & TRAUMA SURGERY

- CARDIOVASCULAR

- GENERAL SURGERY

- OTHER APPLICATION

- KEY ANALYTICS

- PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- BARGAINING POWER OF SUPPLIERS

- INTENSITY OF COMPETITIVE RIVALRY

- SURGICAL IMAGING MARKET ETYMOLOGY

- VALUE CHAIN ANALYSIS

- REGULATORY FRAMEWORK

- OPPORTUNITY MATRIX

- PORTER’S FIVE FORCES MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- GERMANY

- FRANCE

- THE UNITED KINGDOM

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- MARKET POSITION ANALYSIS

- COMPANY PROFILES

- ALLENGERS MEDICAL SYSTEMS LTD

- CANON MEDICAL SYSTEMS CORPORATION (TOSHIBA MEDICAL SYSTEMS CORPORATION)

- EUROCOLUMBUS

- GENERAL ELECTRIC COMPANY

- GENORAY CO. LTD.

- HOLOGIC, INC.

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- ORTHOSCAN

- SHIMADZU CORPORATION

- SIEMENS HEALTHINEERS AG

- WHALE IMAGING INC.

- ZIEHM IMAGING GMBH (ZIEHM IMAGING INC.)

TABLE LIST

TABLE 1: GLOBAL SURGICAL IMAGING MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 2: GLOBAL SURGICAL IMAGING MARKET, BY MODALITY TYPE, 2019-2027 ($ MILLION)

TABLE 3: GLOBAL MOBILE C-ARMS MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 4: GLOBAL MINI C-ARMS MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 5: GLOBAL OTHER MODALITY TYPE MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 6: GLOBAL SURGICAL IMAGING MARKET, BY TECHNOLOGY, 2019-2027 ($ MILLION)

TABLE 7: GLOBAL IMAGE INTENSIFIER MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 8: GLOBAL FLAT PANEL DETECTOR (FPD) MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 9: GLOBAL SURGICAL IMAGING MARKET, BY APPLICATION, 2019-2027 ($ MILLION)

TABLE 10: GLOBAL NEUROSURGERY MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 11: GLOBAL ORTHOPEDIC & TRAUMA SURGERY MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 12: GLOBAL CARDIOVASCULAR MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 13: GLOBAL GENERAL SURGERY MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 14: GLOBAL OTHER APPLICATION MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 15: GLOBAL SURGICAL IMAGING MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 16: NORTH AMERICA SURGICAL IMAGING MARKET, BY COUNTRY, 2019-2027 ($ MILLION)

TABLE 17: EUROPE SURGICAL IMAGING MARKET, BY COUNTRY, 2019-2027 ($ MILLION)

TABLE 18: ASIA PACIFIC SURGICAL IMAGING MARKET, BY COUNTRY, 2019-2027 ($ MILLION)

TABLE 19: REST OF WORLD SURGICAL IMAGING MARKET, BY REGION, 2019-2027 ($ MILLION)

TABLE 20: SURGICAL IMAGING COMPANY MARKET POSITION ANALYSIS 2018

FIGURE LIST

FIGURE 1: GLOBAL SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 2: GLOBAL SURGICAL IMAGING MARKET SHARE, BY MODALITY TYPE, 2017 & 2027 (%)

FIGURE 3: GLOBAL SURGICAL IMAGING MARKET, BY MOBILE C-ARMS, 2019-2027 ($ MILLION)

FIGURE 4: GLOBAL SURGICAL IMAGING MARKET, BY MINI C-ARMS, 2019-2027 ($ MILLION)

FIGURE 5: GLOBAL SURGICAL IMAGING MARKET, BY OTHER MODALITY TYPE, 2019-2027 ($ MILLION)

FIGURE 6: GLOBAL SURGICAL IMAGING MARKET SHARE, BY TECHNOLOGY, 2017 & 2027 (%)

FIGURE 7: GLOBAL SURGICAL IMAGING MARKET, BY IMAGE INTENSIFIER, 2019-2027 ($ MILLION)

FIGURE 8: GLOBAL SURGICAL IMAGING MARKET, BY FLAT PANEL DETECTOR (FPD), 2019-2027 ($ MILLION)

FIGURE 9: GLOBAL SURGICAL IMAGING MARKET, SHARE BY APPLICATION 2017 & 2027 (%)

FIGURE 10: GLOBAL SURGICAL IMAGING MARKET, BY NEUROSURGERY, 2019-2027 ($ MILLION)

FIGURE 11: GLOBAL SURGICAL IMAGING MARKET, BY ORTHOPEDIC & TRAUMA SURGERY, 2019-2027 ($ MILLION)

FIGURE 12: GLOBAL SURGICAL IMAGING MARKET, BY CARDIOVASCULAR, 2019-2027 ($ MILLION)

FIGURE 13: GLOBAL SURGICAL IMAGING MARKET, BY GENERAL SURGERY, 2019-2027 ($ MILLION)

FIGURE 14: GLOBAL SURGICAL IMAGING MARKET, BY OTHER APPLICATION, 2019-2027 ($ MILLION)

FIGURE 15: PORTER’S FIVE FORCE MODEL

FIGURE 16: MARKET ETYMOLOGY OF SURGICAL IMAGING

FIGURE 17: MANUFACTURING PROCESS OF SURGICAL IMAGING INSTRUMENT

FIGURE 18: GLOBAL SURGICAL IMAGING MARKET, REGIONAL OUTLOOK 2018 & 2027 (%)

FIGURE 19: THE UNITED STATES SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 20: CANADA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 21: GERMANY SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 22: FRANCE SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 23: THE UNITED KINGDOM SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 24: ITALY SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 25: SPAIN SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 26: REST OF EUROPE SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 27: JAPAN SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 28: CHINA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 29: INDIA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 30: AUSTRALIA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 31: SOUTH KOREA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 32: REST OF ASIA-PACIFIC SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 33: LATIN AMERICA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

FIGURE 34: MIDDLE EAST AND AFRICA SURGICAL IMAGING MARKET, 2019-2027 ($ MILLION)

- MARKET BY MODALITY TYPE

- MOBILE C-ARMS

- MINI C-ARMS

- OTHER MODALITY TYPE

- MARKET BY TECHNOLOGY

- IMAGE INTENSIFIER

- FLAT PANEL DETECTOR (FPD)

- MARKET BY APPLICATION

- NEUROSURGERY

- ORTHOPEDIC & TRAUMA SURGERY

- CARDIOVASCULAR

- GENERAL SURGERY

- OTHER APPLICATION

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- GERMANY

- FRANCE

- THE UNITED KINGDOM

- ITALY

- SPAIN

- REST OF EUROPE

- ASIA PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.