GLOBAL SURFACE VISION & INSPECTION MARKET FORECAST 2019-2027

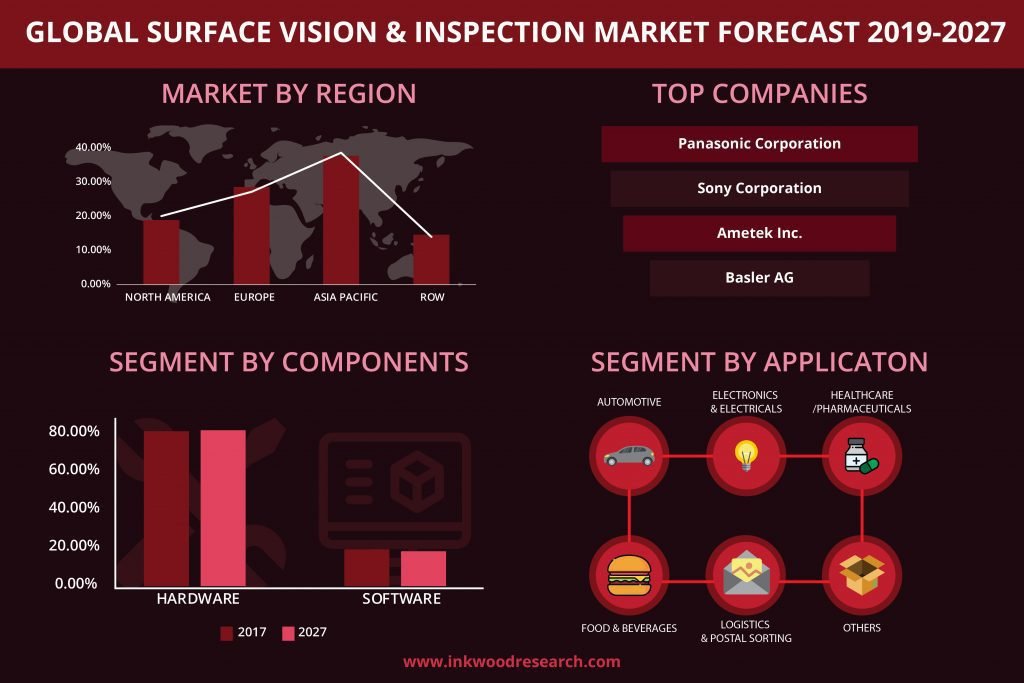

Surface Vision & Inspection Market by Application (Automotive, Electronics & Electricals, Healthcare/pharmaceuticals, Food & Beverages, Logistics & Postal Sorting And Others), by Components (Hardware, Software) & Geography.

A surface vision & inspection technology can be used for the inspection and visualization of defects on the ground or machined components (e.g., cracks, pitting and changes in material quality). Inspecting objects for scratches, cracks, wear, or checking surfaces for proper finish, roughness and texture, are typical tasks of surface quality inspection. Global surface vision & inspection market is anticipated to grow with 7.12% CAGR during the forecast period 2019-2027. The base year considered for the study is 2018. Global surface vision & inspection market is increasing because of the following factors:

- Adoption of vision inspection across all industries

- The surge in demand for automation in industry

- The surge in the trend of product miniaturization

- The rise in need of quality inspection

However, the global surface vision & inspection market is driven by a rise in need of quality inspection across all types of industries. In this competitive world, quality plays a vital role. Maintaining quality and relationships with customers is an important element that enhances growth. For ensuring that level of quality, mainly in a long-run, is a difficult task. Moreover, the rules and regulations have become stricter due to which the quality inspection has become a very important aspect for every manufacturer. Thus to avoid mistakes and do a proper defect detection along with tolerance monitoring surface vision & inspection systems are widely adopted. Some surface vision & inspection systems also provide component measurement, and some also provide feedback data to the customer about their product quality and process capability.

In terms of application segment, automotive leads the market in terms of revenue with around XX% market share in 2018. The automotive industry has always promoted automation in production processes from the production line and robot-supported manufacturing to today’s fourth industrial revolution. The automotive industry is also known for its considerable innovation. The automotive industry is, therefore, the biggest customer of surface vision & inspection technology globally. Due to the high-quality requirements, the automotive sector places a series of special demands on surface vision & inspection technology. Solutions must be very robust, reliable and powerful. Furthermore, enormous price pressures in the automotive and supplier industries call for competitively priced products that offer maximum value and are nevertheless suited to reduce production costs over the long term. Other vital aspects are the long-term availability of the on surface vision & inspection products.

As the usage of surface vision & inspection technology is growing rapidly, it will also have some hindrances associated with it. Some of them are the reliability of automation in vision inspection, government regulations may create a hindrance, and difficulty in implementation of surface vision systems & lack of skilled personnel. Despite its numerous business benefits, vision technology still remains to be utilized to its best potential due to lack of expertise. The vision systems in any organization require a high level of expertise in vision technology for their successful post-implementation working. Moreover, some organizations which opt for vision systems find them difficult to operate due to lack of knowledge about the system.

The global surface vision & inspection market segments include various Application & Components:

Applications segment of global surface vision & inspection market includes:

- Automotive

- Electronics & Electricals

- Healthcare/Pharmaceuticals

- Food & Beverages

- Logistics & Postal Sorting

- Others

Components segment of global surface vision & inspection market includes:

- Hardware

- Camera

- Optics

- Lighting equipment

- Frame grabber

- Others

- Software

This report covers the present market conditions and the growth prospects of the global surface vision & inspection market for the forecast period of 2019-2027. The report considers the revenue generated through the sales of surface vision & inspection products for types, which assist in calculating the market size by considering 2018 as the base year.

Geographically, the global surface vision & inspection market has been segmented on the basis of four major regions, which include:

- Surface Vision & Inspection North America Market– the United States & Canada

- Surface Vision & Inspection Europe Market– France, Germany, Italy, Spain, Russia, United Kingdom & Rest of Europe

- Surface Vision & Inspection Asia-Pacific Market –China, Japan, India, Australia, South Korea & Rest of APAC

- Rest of World- Latin America & Middle East and Africa

The regional structure of surface vision & inspection market is dominated by the Asia Pacific region by capturing the largest market share in terms of revenue of XX% in the year 2018. The Asia-Pacific market is mainly driven by the contribution of countries such as China, Japan, India, Australia and the rest of the Asia-Pacific which includes mainly Singapore and Malaysia. The rising demand for automation across several industries such as healthcare, automotive, manufacturing, etc. coupled with increasing demand for robotics are the key factors driving the Asia-Pacific vision & inspection technology market growth. The impressive accuracy of collaborative robots to perform the assigned task within the stipulated time and with the same efficiency increases their demand and deployment across the industries. Automation in the Asia-Pacific region are deployed in the automobile manufacturing industries, & fast moving consumer goods (FMCG) products manufacturing industries.

North America is the fastest growing region registering the CAGR of XX% during the forecast period. North American Region consists of the United States of America & Canada. North America region has a greater demand for surface vision & inspection market. Some of the application of this market include automotive, electronics & electricals, food & beverages, logistics & postal sorting, and healthcare/pharmaceuticals & others. Canada’s automotive industry is centred in the heart of North America’s largest vehicle producing region: the Great Lakes automotive manufacturing cluster. Canada is one of the world’s top 10 producers of light vehicles. Surface vision and inspection technology is used in the automotive sector which is driving the growth for the global surface vision & inspection market in Canada.

The global surface vision & inspection market applications segment includes automotive, electronics & electricals, healthcare or pharmaceuticals, food & beverages, logistics & postal sorting & others. Components segment includes hardware & software. Further, hardware segment comprises of the camera optics, lighting equipment, frame grabber & others.

The major market players of the global surface vision & inspection market are:

- Panasonic Corporation

- Sony Corporation

- Ametek Inc.

- Basler AG

- Datalogic S.P.A.

Market share analysis along with company profiles of the prominent market players are discussed in detail. Most of the companies are looking for strategies such as merger & acquisition, partnership, contracts, agreements, new product launch, in order to gain a competitive edge over other companies. AMETEK Instruments Pvt., Ltd. has established a technology solutions centre at its headquarters in Whitefield, Bangalore, to support the growth of its electronic instrument and electromechanical products businesses in India. AMETEK invested $ 2.5 million in establishing the technology solutions center and expects it to be a great resource for its customers in designing new products; selecting the right equipment to meet their application needs; servicing and calibrating devices, and providing hands-on demonstrations and training. Whereas, Datalogic, a global leader in the automatic data capture and process automation markets, announced the release of IMPACT Software 12.0, the latest version of the well-known software by Datalogic for vision-guided robotics applications. This enhanced release makes it easier to locate objects, quickly compile and format data, and then communicate that data to other automation or databases, ensuring product identification and location for all industries.

Key findings of the global surface vision & inspection market:

- Due to high market attractiveness, many global players have already started investing heavily in surface vision & inspection technology.

- The inspection of the miniaturized products is beyond the human visual sense, more advanced system such as vision & inspection technology can be used for inspection and measurements of miniaturized products.

- The surface vision & inspection systems in any organization require a high level of expertise in vision technology for their successful post-implementation working.

- The cost of procuring and installing a single vision & inspection technology can be a costly affair for a small

- The quality inspection has become a very important aspect for every manufacturer as customers have become more knowledgeable.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- INCREASING DEMAND FROM INDUSTRIAL SEGMENT

- GROWING COMPETITIVENESS OF LOCAL VENDORS

- INTENSE COMPETITION

- INCREASED DESIGN COMPLEXITY

- MARKET DYNAMICS

- MARKET DEFINITION & SCOPE

- MARKET DRIVERS

- ADOPTION OF VISION INSPECTION ACROSS ALL INDUSTRIES

- SURGE IN DEMAND FOR AUTOMATION IN INDUSTRY

- SURGE IN TREND OF PRODUCT MINIATURIZATION

- RISE IN NEED OF QUALITY INSPECTION

- MARKET RESTRAINTS

- RELIABILITY OF AUTOMATION IN VISION INSPECTION

- GOVERNMENT REGULATIONS MAY CREATE A HINDRANCE

- MARKET OPPORTUNITIES

- ADOPTION OF IMAGE BASED INSPECTION SYSTEM

- MARKET CHALLENGES

- DIFFICULTY IN IMPLEMENTATION OF SURFACE VISION SYSTEMS

- LACK OF SKILLED PERSONNEL

- MARKET BY APPLICATIONS

- AUTOMOTIVE

- ELECTRONICS & ELECTRICALS

- HEALTHCARE/PHARMACEUTICALS

- FOOD & BEVERAGES

- LOGISTICS & POSTAL SORTING

- OTHERS

- MARKET BY COMPONENTS

- HARDWARE

- CAMERA

- OPTICS

- LIGHTING EQUIPMENT

- FRAME GRABBER

- OTHERS

- SOFTWARE

- HARDWARE

- KEY ANALYTICS

- PORTERS FIVE FORCES ANALYSIS

- BARGAINING POWER OF BUYERS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTES

- THREAT OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PORTERS FIVE FORCES ANALYSIS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- FRANCE

- ITALY

- RUSSIA

- SPAIN

- GERMANY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF APAC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- PANASONIC CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- AMETEK, INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- SONY CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- ALLIED VISION TECHNOLOGIES GMBH

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- BASLER AG

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- DATALOGIC S.P.A.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- FLIR SYSTEMS

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- OMRON CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- NATIONAL INSTRUMENTS CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- KEYENCE CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- PERCEPTRON INC

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- ISRA VISION AG

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- TELEDYNE TECHNOLOGIES INCORPORATED

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- MORITEX CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- MATROX ELECTRONIC SYSTEMS LTD.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- PANASONIC CORPORATION

TABLE LIST

TABLE 1. GLOBAL SURFACE VISION & INSPECTION MARKET, BY GEOGRAPHY 2019-2027 ($ MILLIONS)

TABLE 2. GLOBAL SURFACE VISION & INSPECTION MARKET, BY APPLICATIONS, 2019-2027 (IN $ MILLION)

TABLE 3. GLOBAL AUTOMOTIVE MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 4. GLOBAL ELECTRONICS & ELECTRICALS MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 5. GLOBAL HEALTHCARE/PHARMACEUTICALS MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 6. GLOBAL FOOD & BEVERAGES MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 7. GLOBAL LOGISTICS & POSTAL SORTING MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 8. GLOBAL OTHERS MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 9. GLOBAL SURFACE VISION & INSPECTION MARKET, BY COMPONENTS, 2019-2027 (IN $ MILLION)

TABLE 10. GLOBAL HARDWARE MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 11. GLOBAL SURFACE VISION & INSPECTION MARKET, BY HARDWARE, 2019-2027 (IN $ MILLION)

TABLE 12. GLOBAL SOFTWARE MARKET, BY GEOGRAPHY, 2019-2027 ($ MILLIONS)

TABLE 13. OPPORTUNITY MATRIX

TABLE 14. VENDOR LANDSCAPE

TABLE 15. NORTH AMERICA SURFACE VISION & INSPECTION MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 16. EUROPE SURFACE VISION & INSPECTION MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 17. ASIA PACIFIC SURFACE VISION & INSPECTION MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 18. REST OF WORLD SURFACE VISION & INSPECTION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

FIGURES LIST

FIGURE 1. GLOBAL SURFACE VISION & INSPECTION MARKET, BY APPLICATION, 2018 & 2027 (IN $ MILLIONS)

FIGURE 2. GLOBAL SURFACE VISION & INSPECTION MARKET BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 3. GLOBAL SURFACE VISION & INSPECTION MARKET BY ELECTRONICS & ELECTRICALS, 2019-2027 (IN $ MILLION)

FIGURE 4. GLOBAL SURFACE VISION & INSPECTION MARKET BY HEALTHCARE/PHARMACEUTICALS, 2019-2027 (IN $ MILLION)

FIGURE 5. GLOBAL SURFACE VISION & INSPECTION MARKET BY FOOD & BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 6. GLOBAL SURFACE VISION & INSPECTION MARKET BY LOGISTICS & POSTAL SORTING, 2019-2027 (IN $ MILLION)

FIGURE 7. GLOBAL SURFACE VISION & INSPECTION MARKET BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 8. GLOBAL SURFACE VISION & INSPECTION MARKET BY HARDWARE, 2019-2027 (IN $ MILLION)

FIGURE 9. GLOBAL SURFACE VISION & INSPECTION MARKET BY CAMERA, 2019-2027 (IN $ MILLION)

FIGURE 10. GLOBAL SURFACE VISION & INSPECTION MARKET BY OPTICS, 2019-2027 (IN $ MILLION)

FIGURE 11. GLOBAL SURFACE VISION & INSPECTION MARKET BY LIGHTING EQUIPMENT, 2019-2027 (IN $ MILLION)

FIGURE 12. GLOBAL SURFACE VISION & INSPECTION MARKET BY FRAME GRABBER, 2019-2027 (IN $ MILLION)

FIGURE 13. GLOBAL SURFACE VISION & INSPECTION MARKET BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 14. GLOBAL SURFACE VISION & INSPECTION MARKET BY SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 15. GLOBAL SURFACE VISION & INSPECTION MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 16. UNITED STATES SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 17. CANADA SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18. UNITED KINGDOM SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19. FRANCE SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20. ITALY SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21. RUSSIA SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22. SPAIN SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23. GERMANY SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24. REST OF EUROPE SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25. CHINA SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26. INDIA SURFACE VISION & INSPECTION MARKET, 2019-2027 ($MILLIONS)

FIGURE 27. JAPAN SURFACE VISION & INSPECTION MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28. AUSTRALIA SURFACE VISION & INSPECTION MARKET, 2019-2027 ($MILLIONS)

FIGURE 29. SOUTH KOREA SURFACE VISION & INSPECTION MARKET, 2019-2027 ($MILLIONS)

FIGURE 30. REST OF APAC SURFACE VISION & INSPECTION MARKET 2019-2027 ($MILLIONS)

FIGURE 31. LATIN AMERICA SURFACE VISION & INSPECTION MARKET 2019-2027 ($ MILLIONS)

FIGURE 32. MIDDLE EAST AND AFRICA SURFACE VISION & INSPECTION MARKET 2019-2027 ($MILLIONS)

- MARKET BY APPLICATIONS

- AUTOMOTIVE

- ELECTRONICS & ELECTRICALS

- HEALTHCARE/PHARMACEUTICALS

- FOOD & BEVERAGES

- LOGISTICS & POSTAL SORTING

- OTHERS

- MARKET BY COMPONENTS

- HARDWARE

- CAMERA

- OPTICS

- LIGHTING EQUIPMENT

- FRAME GRABBER

- OTHERS

- SOFTWARE

- HARDWARE

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- FRANCE

- ITALY

- RUSSIA

- SPAIN

- GERMANY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF APAC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST AND AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.