GLOBAL IOT MANAGED SERVICES MARKET FORECAST 2019-2027

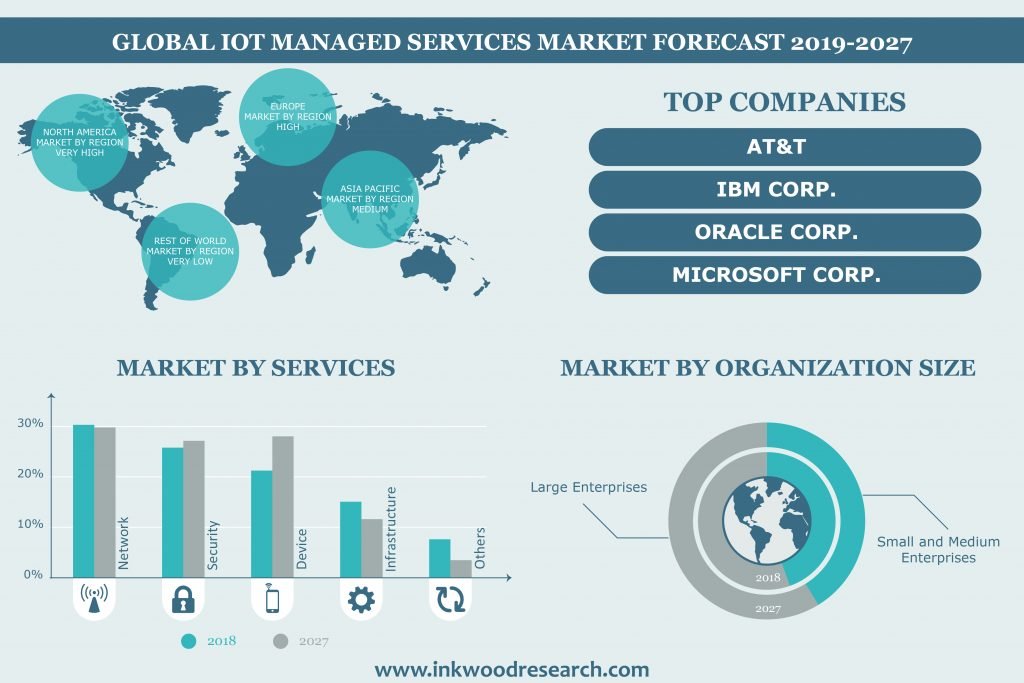

Global Iot Managed Services Market by Services (Network Management, Security Management, Device Management, Infrastructure Management, Others) by Organization Size (Large Enterprise, Small & Medium Enterprise) by End Users (Automotive & Transport, It & Telecom, Healthcare, Bfsi, Manufacturing, Others) by Geography.

The Internet of things (IoT) is the network of devices, vehicles, and home appliances that are integrated with electronics, software, actuators, and connectivity, which allows them to connect, interact and exchange data. Further, managed services are the practices of outsourcing on a proactive basis of certain processes and functions intended to improve operations and further cut the expenses. It is an alternative to the break/fix or on-demand outsourcing model where the service provider performs on-demand services and bills the customer (entity) only for the work done.

Global IoT managed services market is anticipated to grow with 24.78% CAGR during the forecast period 2019-2027. The base year considered for the study is 2018 and the estimated period is between 2019 and 2027. The key factors that are responsible for the market advancement are:

- Growing number of machine-to-machine connections

- Requirement for cost-efficient managed services promoting market growth

- Expansion of next-generation processors for IoT devices

To know more about this report, request a free sample copy.

However, the market is primarily driven by the growing number of machine-to-machine connections. The ongoing deployment of LTE and technological advancements in various fields have boosted the number of connected devices. Some of the commonly connected devices are sensors, smartphones, tablet computers, laptops, and desktop personal computers. The trend of a high attraction towards connectivity is observed worldwide. The emergence of new technologies like ZigBee, which works on inexpensive batteries, improves the ease of handling and comfort in the development of connected devices. The emergence of new applications and technological advancements in the field of wireless connectivity technologies such as general packet radio service (GPRS), Wi-Fi and worldwide interoperability for microwave access (WiMax) are increasing the number of connected devices as these services are helping these devices to integrate and resonate their functions in tandem. The connected devices provide seamless and rapid activation experience, monitoring and diagnostics which requires to be maintained properly.

In terms of services segment, device management segment leads the market in terms of revenue with around XX% market share in 2018. Device management is the process of managing the implementation, operation, and maintenance of a physical and/or virtual device. It is a broad term that includes various administrative tools and processes for the maintenance and upkeep of computing, network, mobile and/or virtual device. The device management service is an important aspect of the IoT ecosystem. Many IoT ecosystems consist of numerous devices deployed to a cloud platform. The device management service helps to gain better performance by increasing the efficiency and provide a better customer experience. The requirement of documented policies and procedures and need to develop strong service capability is satisfied by the device management service.

With the growing adoption of IoT managed services from numerous end user industries, global IoT managed services market is also facing some challenges. Increasing complexity in IoT becomes problematic for service providers to handle, lack of infrastructure support for IoT devices in emerging nations, data loss due to vulnerable security is a constant threat in IoT environment, low awareness of IoT amongst the customers & lack of industry standards for IoT services. In semi-open or closed loops, IoT will often be considered and studied as a complex system due to the huge number of different links, interactions between autonomous actors and its capacity to integrate new actors. At the overall stage, it will likely be seen as a chaotic environment. As a practical approach, not all elements in the Internet of things run in a global, public space. Subsystems are often implemented to mitigate the risks of privacy, control, and reliability.

The report on global IOT managed services includes segmentation on the basis of services, organization size and end users.

Services is sub-segmented into:

- Network management

- Security management

- Device management

- Infrastructure management

- Others

Organization Size is sub-segmented into:

- Large enterprise

- Small & Medium enterprise

End Users is sub-segmented into:

- Automotive & Transport

- IT & Telecom

- Healthcare

- BFSI

- Manufacturing

- Others

Geographically, the global IOT managed services market has been segmented on the basis of four major regions, which includes:

- North America Iot Managed Services Market : the United States & Canada

- Europe Iot Managed Services Market : United Kingdom, France, Italy, Russia, Spain, Germany & Rest of Europe

- Asia Pacific Iot Managed Services Market : China, India, Japan, Australia, South Korea & Rest of Asia Pacific

- Rest of World: Latin America, Middle East & Africa

The regional paradigm of global IOT managed services market is dominated by North America region by capturing the largest market share in terms of revenue of XX% in 2018. North America is the dominant market for IoT in transportation and has major players offering advanced solutions. Major players in the IoT transportation market in North America are investing heavily in the IoT technology solutions in the region. Vendors in this market are into R&D innovation and plan different IoT services and solutions to cater to the demands of the transportation industry. The factors that drive the North American market include growth in demand for effective deployment and faster delivery of the IoT based solution in the transportation industry. Further, the rise in the need for fuel efficiency and remote monitoring of vehicles fuel the market in North America.

On the flip side, the Asia Pacific region is expected to surge with the fastest growth rate during the forecast period. Growing government initiatives to encourage healthcare providers & other healthcare organizations to adopt EHR & EMR technology and aggressive investments from nonprofit entities and private sectors to achieve improved clinical outcomes, seamless information exchange & recognize cost savings are some of the factors that are expected to drive IoT in the healthcare industry. In terms of technology adoption in the region, Singapore, Japan, Australia and South Korea have been the belligerent adopters in the healthcare sector, whereas China, Thailand, India, and Malaysia are the emerging markets who are steadily adopting the services. Many multinational & domestic pharmaceutical and medical device companies are based in the region.

Global IOT managed services includes segmentation on the basis of services, organization size, and end users. Services is sub-segmented into network management, security management, device management, infrastructure management & others. Organization size is sub-segmented into large enterprise & small & medium enterprise. The end-users division is further sub-segmented into automotive & transport, IT & telecom, healthcare, BFSI, manufacturing & others.

The market has a number of players, and some of the key players involved in global IoT managed services market are:

- Accenture PLC

- Cisco Systems Inc.

- Honeywell International Inc.

- Huawei Technologies

- International Business Machines Corporation (IBM Corp.)

- Other companies

Market share analysis along with company profiles of the prominent market players are discussed in detail. Most of the companies are looking for strategies such as merger & acquisition, partnership, contracts, agreements, new product launch, to gain a competitive edge over other companies. In November 2018, IBM and VMware, Inc. announced new offerings to help accelerate enterprise hybrid cloud adoption. This includes a new IBM Services offering to help migrate and extend mission-critical VMware workloads to the IBM Cloud, and new integrations to help enterprises to modernize applications with Kubernetes and containers. Also, Microsoft released a blockchain development kit on its Azure cloud platform designed to enable seamless integration of blockchain with Microsoft’s and third-party SaaS offerings. This kit extends the capabilities of the company’s blockchain developer templates and Azure Blockchain Workbench, which incorporates Azure services for key management, off-chain identity and data, monitoring, and messaging APIs into a reference architecture that can be used to build blockchain-based applications rapidly.

Key findings of the global IoT managed services market:

- Growing demand for device management services boosting the market growth

- Increasing adoption of IoT solutions and services by the manufacturing industry

- North America anticipated holding dominant share in the market

- Asia Pacific region is expected to be the fastest growing amongst all other regions

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- GROWING DEMAND FOR DEVICE MANAGEMENT SERVICES BOOSTING THE MARKET GROWTH

- INCREASING ADOPTION OF IOT SOLUTIONS AND SERVICES BY MANUFACTURING INDUSTRY

- NORTH AMERICA IS ANTICIPATED TO HOLD DOMINANT SHARE IN THE MARKET

- ASIA PACIFIC REGION IS EXPECTED TO BE FASTEST GROWING AMONGST ALL OTHER REGIONS

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- GROWING NUMBER OF MACHINE-TO-MACHINE CONNECTIONS

- REQUIREMENT FOR COST EFFICIENT MANAGED SERVICES PROMOTING MARKET GROWTH

- EXPANSION OF NEXT GENERATION PROCESSORS FOR IOT DEVICES

- MARKET RESTRAINTS

- INCREASING COMPLEXITY IN IOT BECOMES DIFFICULT FOR SERVICE PROVIDERS TO HANDLE

- LACK OF INFRASTRUCTURE SUPPORT FOR IOT DEVICES IN EMERGING NATIONS

- MARKET OPPORTUNITIES

- GROWING DEMAND FOR BIG DATA

- INCREASING SMART CITY IMPLEMENTATION ACROSS THE GLOBE

- MARKET CHALLENGES

- DATA LOSS DUE TO VULNERABLE SECURITY IS A CONSTANT THREAT IN IOT ENVIRONMENT

- LOW AWARENESS OF IOT AMONGST THE CUSTOMERS

- LACK OF INDUSTRY STANDARDS FOR IOT SERVICES

- MARKET BY SERVICES

- NETWORK MANAGEMENT

- SECURITY MANAGEMENT

- DEVICE MANAGEMENT

- INFRASTRUCTURE MANAGEMENT

- OTHERS

- MARKET BY ORGANIZATION SIZE

- LARGE ENTERPRISE

- SMALL & MEDIUM ENTERPRISE

- MARKET BY END USERS

- AUTOMOTIVE & TRANSPORT

- IT & TELECOM

- HEALTHCARE

- BFSI

- MANUFACTURING

- OTHERS

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- FRANCE

- ITALY

- RUSSIA

- SPAIN

- GERMANY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ACCENTURE PLC

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- CISCO SYSTEMS INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- HONEYWELL INTERNATIONAL INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- HUAWEI TECHNOLOGIES

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM CORP.)

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- INTEL CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- MICROSOFT CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- SAMSUNG CORPORATION

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- ALPHABET INC.

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- QUALCOMM INCORPORATED

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- INFOSYS

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- TATA CONSULTANCY SERVICES

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- HEWLETT PACKARD ENTERPRISE

- OVERVIEW

- PRODUCT PORTFOLIO

- STRATEGIC INITIATIVES

- SCOT ANALYSIS

- ACCENTURE PLC

LIST OF TABLES

TABLE 1. GLOBAL IOT MANAGED SERVICES MARKET BY GEOGRAPHY 2019-2027 (IN $ MILLION)

TABLE 2. GLOBAL IOT MANAGED SERVICES MARKET BY SERVICES 2019-2027 (IN $ MILLION)

TABLE 3. GLOBAL NETWORK MANAGEMENT MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 4. GLOBAL SECURITY MANAGEMENT MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 5. GLOBAL DEVICE MANAGEMENT MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 6. GLOBAL INFRASTRUCTURE MANAGEMENT MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 7. GLOBAL OTHERS MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 8. GLOBAL IOT MANAGED SERVICES MARKET, BY ORGANIZATION SIZE 2019-2027 (IN $ MILLION)

TABLE 9. GLOBAL LARGE ENTERPRISE MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 10. GLOBAL SMALL & MEDIUM ENTERPRISE MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 11. GLOBAL IOT MANAGED SERVICES MARKET BY END USERS 2019-2027, (IN $ MILLION)

TABLE 12. GLOBAL AUTOMOTIVE & TRANSPORT MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 13. GLOBAL IT & TELECOM MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 14. GLOBAL HEALTHCARE MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 15. GLOBAL BFSI MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 16. GLOBAL MANUFACTURING MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 17. GLOBAL OTHERS MARKET BY REGION 2019-2027 (IN $ MILLION)

TABLE 18. OPPORTUNITY MATRIX

TABLE 19. VENDOR LANDSCAPE

TABLE 20. GLOBAL IOT MANAGED SERVICES MARKET BY GEOGRAPHY 2019-2027 (IN $ MILLION)

TABLE 21. NORTH AMERICA IOT MANAGED SERVICES MARKET BY COUNTRY 2019-2027 (IN $ MILLION)

TABLE 22. EUROPE IOT MANAGED SERVICES MARKET BY COUNTRY 2019-2027 (IN $ MILLION)

TABLE 23. ASIA PACIFIC IOT MANAGED SERVICES MARKET BY COUNTRY 2019-2027 (IN $ MILLION)

TABLE 24. REST OF WORLD IOT MANAGED SERVICES MARKET BY REGION 2019-2027 (IN $ MILLION)

LIST OF FIGURE

FIGURE 1. GLOBAL DEVICE MANAGEMENT MARKET BY TYPE 2018 & 2027 (IN %)

FIGURE 2. GLOBAL IOT MANAGED SERVICES MARKET BY NETWORK MANAGEMENT 2019-2027 (IN $ MILLION)

FIGURE 3. GLOBAL IOT MANAGED SERVICES MARKET BY SECURITY MANAGEMENT 2019-2027 (IN $ MILLION)

FIGURE 4. GLOBAL IOT MANAGED SERVICES MARKET BY DEVICE MANAGEMENT 2019-2027 (IN $ MILLION)

FIGURE 5. GLOBAL IOT MANAGED SERVICES MARKET BY INFRASTRUCTURE MANAGEMENT 2019-2027 (IN $ MILLION)

FIGURE 6. GLOBAL IOT MANAGED SERVICES MARKET BY OTHERS 2019-2027 (IN $ MILLION)

FIGURE 7. GLOBAL IOT MANAGED SERVICES MARKET BY LARGE ENTERPRISE 2019-2027 (IN $ MILLION)

FIGURE 8. GLOBAL IOT MANAGED SERVICES MARKET BY SMALL & MEDIUM ENTERPRISE 2019-2027 (IN $ MILLION)

FIGURE 9. GLOBAL IOT MANAGED SERVICES MARKET BY AUTOMOTIVE & TRANSPORT 2019-2027 (IN $ MILLION)

FIGURE 10. GLOBAL IOT MANAGED SERVICES MARKET BY IT & TELECOM 2019-2027 (IN $ MILLION)

FIGURE 11. GLOBAL IOT MANAGED SERVICES MARKET BY HEALTHCARE 2019-2027 (IN $ MILLION)

FIGURE 12. GLOBAL IOT MANAGED SERVICES MARKET BY BFSI 2019-2027 (IN $ MILLION)

FIGURE 13. GLOBAL IOT MANAGED SERVICES MARKET BY MANUFACTURING 2019-2027 (IN $ MILLION)

FIGURE 14. GLOBAL IOT MANAGED SERVICES MARKET BY OTHERS 2019-2027 (IN $ MILLION)

FIGURE 15. PORTER’S FIVE FORCE ANALYSIS

FIGURE 16. GLOBAL IOT MANAGED SERVICES MARKET REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17. UNITED STATES IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 18. CANADA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 19. UNITED KINGDOM IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 20. FRANCE IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 21. ITALY IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 22. RUSSIA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 23. SPAIN IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 24. GERMANY IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 25. REST OF EUROPE IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 26. CHINA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 27. INDIA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 28. JAPAN IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 29. AUSTRALIA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 30. SOUTH KOREA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLIONS)

FIGURE 31. REST OF ASIA PACIFIC IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 32. LATIN AMERICA IOT MANAGED SERVICES MARKET 2019-2027 (IN $ MILLION)

FIGURE 33. MIDDLE EAST & AFRICA IOT MANAGED SERVICES MARKET,2019-2027 (IN $ MILLION)

- MARKET BY SERVICES

- NETWORK MANAGEMENT

- SECURITY MANAGEMENT

- DEVICE MANAGEMENT

- INFRASTRUCTURE MANAGEMENT

- OTHERS

- MARKET BY ORGANIZATION SIZE

- LARGE ENTERPRISE

- SMALL & MEDIUM ENTERPRISE

- MARKET BY END USERS

- AUTOMOTIVE & TRANSPORT

- IT & TELECOM

- HEALTHCARE

- BFSI

- MANUFACTURING

- OTHERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- FRANCE

- ITALY

- RUSSIA

- SPAIN

- GERMANY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- JAPAN

- AUSTRALIA

- SOUTH KOREA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.