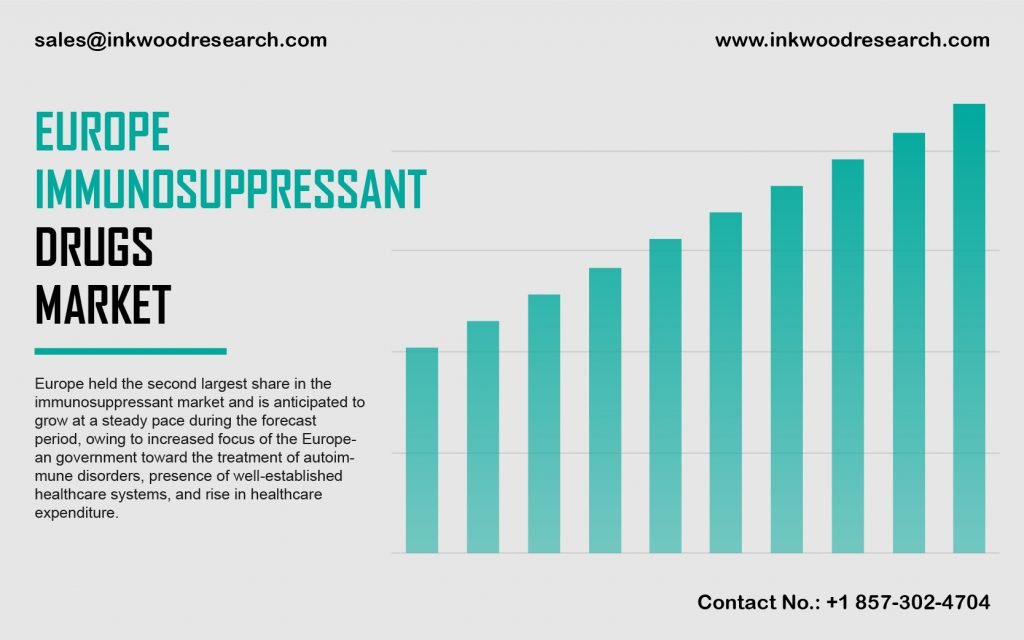

EUROPE IMMUNOSUPPRESSANT DRUGS MARKET FORECAST 2019-2028

The Europe immunosuppressant drugs market is set to record growth, registering a CAGR of 4.06% during the forecast period, 2019-2028. The earnest government participation in terms of treatment of autoimmune disorders, a rich presence of enhanced healthcare systems, and the growing healthcare expenditure, are the important factors propelling the market growth. The European region also boasts of the presence of key players.

To learn more about this report, request a free sample copy

The countries assessed for growth evaluation of the Europe immunosuppressant drugs market are France, Italy, Germany, Russia, Belgium, Poland, the United Kingdom, and the rest of Europe. In the UK, a huge chunk of the population is affected by 80 different autoimmune conditions. These diseases are said to be incurable, while the autoimmune attacks can be kept under check thanks to the latest developments. There has also been a rise in the number of donations, but the number of transplants was fewer. In Italy, an increase in transplantations and donations was registered, which is a fueling factor of market growth in the country. The donations rose by 24.4% between 2014 and 2018. In Poland, the graph for organ transplants registered an upward trend after several years of inactivity. The transplants that took place were that of kidneys, heart, liver, and pancreas. The number of transplants with regard to living donors have been relatively low in Poland, in comparison to other European countries.

F. Hoffmann-La Roche Ltd is a science and technology innovator that markets, manufactures, and designs pharmaceuticals across the world. The product portfolio of the company includes CellCept (mycophenolate mofetil) and Valcyte (valganciclovir). The company acquired Tusk Therapeutics in September 2018. The company has its headquarters in Basel, Switzerland.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- DEVELOPMENT OF IMMUNOSUPPRESSANT DRUGS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASE IN THE NUMBER OF AUTOIMMUNE DISORDERS

- RISE IN ORGAN TRANSPLANTATION

- GROWTH IN THE PHARMACEUTICAL INDUSTRY

- KEY RESTRAINTS

- SIDE EFFECTS OF IMMUNOSUPPRESSANT DRUGS

- LACK OF AWARENESS ABOUT ORGAN DONATION

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY DISTRIBUTION CHANNEL

- HOSPITAL PHARMACIES

- RETAIL PHARMACIES

- ONLINE PHARMACIES

- MARKET BY END-USER

- ORGAN TRANSPLANTATION

- AUTOIMMUNE DISORDERS

- OTHERS

- MARKET BY DRUG CLASS

- CORTICOSTEROIDS

- MONOCLONAL ANTIBODIES

- CALCINEURIN INHIBITORS

- MTOR INHIBITORS

- OTHERS

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- COMPANY PROFILES

- ABBVIE INC

- ALLERGAN PLC (ACQUIRED BY ABVIE INC)

- ASTELLAS PHARMA INC

- BRISTOL-MYERS SQUIBB COMPANY

- CIPLA LTD

- REDDY’S LABORATORIES LTD

- F HOFFMANN-LA ROCHE AG

- GLAXOSMITHKLINE PLC

- INTAS PHARMACEUTICALS LTD (ACCORD HEALTHCARE LTD)

- JANSSEN PHARMACEUTICALS NV (JHONSON & JHONSON)

- MYLAN NV

- NOVARTIS INTERNATIONAL AG (SANDOZ)

- PFIZER INC

- SANOFI SA

- VELOXIS PHARMACEUTICALS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – IMMUNOSUPPRESSANT DRUGS

TABLE 2: SIDE EFFECTS OF IMMUNOSUPPRESSANT DRUGS

TABLE 3: TOP 15 POSITIVE NET EXPORTS COUNTRIES AND NEGATIVE NET EXPORTS FOR DRUGS & MEDICINES COUNTRIES

TABLE 4: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY DISTRIBUTION CHANNEL, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY DISTRIBUTION CHANNEL, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY CLASS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY CLASS, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

FIGURES LIST

FIGURE 1: DEVELOPMENT OF IMMUNOSUPPRESSANT DRUGS

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: PORTER’S FIVE FORCE ANALYSIS

FIGURE 4: OPPORTUNITY MATRIX

FIGURE 5: VENDOR LANDSCAPE

FIGURE 6: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, GROWTH POTENTIAL, BY DISTRIBUTION CHANNEL, IN 2019

FIGURE 7: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY HOSPITAL PHARMACIES, 2019-2028 (IN $ MILLION)

FIGURE 8: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY RETAIL PHARMACIES, 2019-2028 (IN $ MILLION)

FIGURE 9: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY ONLINE PHARMACIES, 2019-2028 (IN $ MILLION)

FIGURE 10: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 11: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY ORGAN TRANSPLANTATION, 2019-2028 (IN $ MILLION)

FIGURE 12: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY AUTOIMMUNE DISORDERS, 2019-2028 (IN $ MILLION)

FIGURE 13: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 14: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, GROWTH POTENTIAL, BY CLASS, IN 2019

FIGURE 15: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY CORTICOSTEROIDS, 2019-2028 (IN $ MILLION)

FIGURE 16: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY MONOCLONAL ANTIBODIES, 2019-2028 (IN $ MILLION)

FIGURE 17: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY CALCINEURIN INHIBITORS, 2019-2028 (IN $ MILLION)

FIGURE 18: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY MTOR INHIBITORS, 2019-2028 (IN $ MILLION)

FIGURE 19: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 20: EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, REGIONAL OUTLOOK, 2018 & 2028 (IN %)

FIGURE 21: UNITED KINGDOM IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 22: GERMANY IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 23: FRANCE IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 24: ITALY IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 25: RUSSIA IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 26: BELGIUM IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 27: POLAND IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 28: REST OF EUROPE IMMUNOSUPPRESSANT DRUGS MARKET, 2019-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- EUROPE

- MARKET BY DISTRIBUTION CHANNEL

- HOSPITAL PHARMACIES

- RETAIL PHARMACIES

- ONLINE PHARMACIES

- MARKET BY END-USER

- ORGAN TRANSPLANTATION

- AUTOIMMUNE DISORDERS

- OTHERS

- MARKET BY DRUG CLASS

- CORTICOSTEROIDS

- MONOCLONAL ANTIBODIES

- CALCINEURIN INHIBITORS

- MTOR INHIBITORS

- OTHERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.