ASIA-PACIFIC EUBIOTICS MARKET FORECAST 2021-2028

Asia-Pacific Eubiotics Market by Product (Probiotics, Organic Acid, Prebiotics, Essential Oils) Market by Form (Solid Form/dry Form, Liquid) Market by Packaging (Bulk Packaging, Stand-up Pouches/portion Control) Market by Livestock (Swine, Poultry, Ruminants, Aquaculture, Other Livestock) Market by Application (Gut Health, Immunity, Yield Management, Other Applications) Market by End-user (Animals, Humans) by Geography

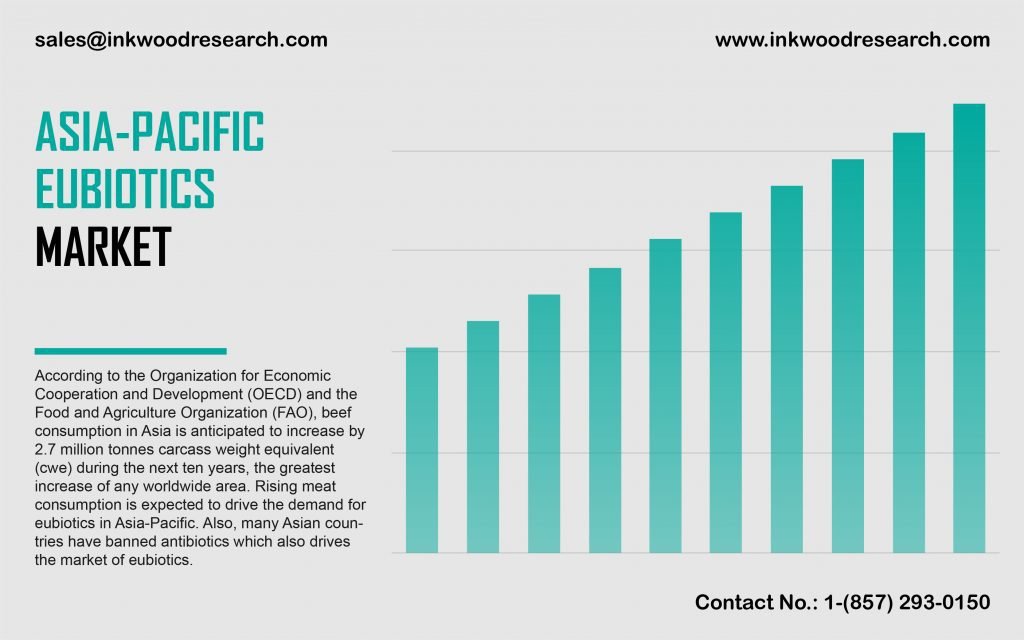

The Asia-Pacific eubiotics market is anticipated to register a CAGR of 7.68% over the forecasting period of 2021 to 2028. The market growth of the region is strengthened by increasing disposable incomes, the surge in meat consumption, the ban on antibiotics, as well as the population’s changing lifestyles.

To learn more about this report, request a free sample copy

The Asia-Pacific eubiotics market growth assessment entails the analysis of Japan, China, Thailand, Vietnam, Australia & New Zealand, India, South Korea, Indonesia, and the rest of the Asia-Pacific. China is the largest meat manufacturer, importer, and consumer, with pork products dominating the market globally. Although domestic meat production is severely challenged by constrained water and land reserves, the country continues to import a substantial amount of meat from international markets. However, from 2018 to 2019, numerous serious outbreaks of African swine fever, a fatal pig disease, killed one-fourth of the global pig population and nearly 60% of China’s hog herd.

As per the World Animal Health Organization (OIE), more than 16,700 animals were culled during the classical swine fever (CSF) outbreak in Japan, including pigs and wild boars bred for meat. As eubiotics boost the immune system of animals, their usage helps prevent such epidemics. Hence, these outbreaks play a critical role in stimulating the demand for eubiotics across the country. Therefore, the aforementioned factors are set to propel the market growth in the Asia-Pacific during the forecasted years.

Neospark Drugs and Chemicals Private Limited, headquartered in India, is a major manufacturer of a diverse range of animal health and aquaculture products. The company commercializes, produces, and develops specialized product packages, including feed supplements, drug formulations, premixes, toxin binders, and toxin control products, among others. Its product Ultramin offers the necessary amino acids and minerals in balanced proportion for enhanced metabolic activity in buffaloes and cattle.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- RISING AWARENESS AND CONCERNS ABOUT ANIMAL HEALTH

- INCREASED MEAT CONSUMPTION

- INCREASED DEMAND FOR MANUFACTURED FEEDS

- KEY RESTRAINTS

- UNAWARENESS ABOUT EUBIOTICS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON EUBIOTICS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PRODUCT

- PROBIOTICS

- ORGANIC ACID

- PREBIOTICS

- ESSENTIAL OILS

- MARKET BY FORM

- SOLID FORM/DRY FORM

- LIQUID

- MARKET BY PACKAGING

- BULK PACKAGING

- STAND-UP POUCHES/PORTION CONTROL

- MARKET BY LIVESTOCK

- SWINE

- POULTRY

- RUMINANTS

- AQUACULTURE

- OTHER LIVESTOCK

- MARKET BY APPLICATION

- GUT HEALTH

- IMMUNITY

- YIELD MANAGEMENT

- OTHER APPLICATIONS

- MARKET BY END-USER

- ANIMALS

- HUMANS

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS

- COMPANY PROFILES

- ANPARIO PLC

- ARCHER DANIELS MIDLAND CO (ADM)

- BASF SE

- BEHN MEYER GROUP

- BENEO GMBH

- CARGILL INC

- CHR HANSEN HOLDING A/S

- DUPONT DE NEMOURS INC

- KEMIN INDUSTRIES INC

- KONINKLIJKE DSM NV

- LALLEMAND INC

- LESAFFRE

- NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

- NOVUS INTERNATIONAL INC

- YARA INTERNATIONAL ASA

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – EUBIOTICS

TABLE 2: MAJOR LIVESTOCK DISEASES IN THE WORLD

TABLE 3: COUNTRIES WITH THE HIGHEST ANNUAL MEAT CONSUMPTION

TABLE 4: ASIA-PACIFIC EUBIOTICS MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC EUBIOTICS MARKET, BY PRODUCT, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC EUBIOTICS MARKET, BY FORM, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: ASIA-PACIFIC EUBIOTICS MARKET, BY FORM, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC EUBIOTICS MARKET, BY PACKAGING, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC EUBIOTICS MARKET, BY PACKAGING, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC EUBIOTICS MARKET, BY LIVESTOCK, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: ASIA-PACIFIC EUBIOTICS MARKET, BY LIVESTOCK, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 12: ASIA-PACIFIC EUBIOTICS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 13: ASIA-PACIFIC EUBIOTICS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 14: ASIA-PACIFIC EUBIOTICS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: ASIA-PACIFIC EUBIOTICS MARKET, BY END-USER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 16: ASIA-PACIFIC EUBIOTICS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 17: ASIA-PACIFIC EUBIOTICS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 18: KEY PLAYERS IN ASIA-PACIFIC EUBIOTICS MARKET

TABLE 19: LIST OF MERGERS & ACQUISITIONS

TABLE 20: LIST OF PRODUCT LAUNCHES

TABLE 21: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 22: LIST OF BUSINESS EXPANSIONS

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2020

FIGURE 6: ASIA-PACIFIC EUBIOTICS MARKET, BY PROBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC EUBIOTICS MARKET, BY ORGANIC ACID, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC EUBIOTICS MARKET, BY PREBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC EUBIOTICS MARKET, BY ESSENTIAL OILS, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY FORM, IN 2020

FIGURE 11: ASIA-PACIFIC EUBIOTICS MARKET, BY SOLID FORM/DRY FORM, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC EUBIOTICS MARKET, BY LIQUID, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY PACKAGING, IN 2020

FIGURE 14: ASIA-PACIFIC EUBIOTICS MARKET, BY BULK PACKAGING, 2021-2028 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC EUBIOTICS MARKET, BY STAND-UP POUCHES/PORTION CONTROL, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY LIVESTOCK, IN 2020

FIGURE 17: ASIA-PACIFIC EUBIOTICS MARKET, BY SWINE, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC EUBIOTICS MARKET, BY POULTRY, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC EUBIOTICS MARKET, BY RUMINANTS, 2021-2028 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC EUBIOTICS MARKET, BY AQUACULTURE, 2021-2028 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC EUBIOTICS MARKET, BY OTHER LIVESTOCK, 2021-2028 (IN $ MILLION)

FIGURE 22: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 23: ASIA-PACIFIC EUBIOTICS MARKET, BY GUT HEALTH, 2021-2028 (IN $ MILLION)

FIGURE 24: ASIA-PACIFIC EUBIOTICS MARKET, BY IMMUNITY, 2021-2028 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC EUBIOTICS MARKET, BY YIELD MANAGEMENT, 2021-2028 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC EUBIOTICS MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 27: ASIA-PACIFIC EUBIOTICS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2020

FIGURE 28: ASIA-PACIFIC EUBIOTICS MARKET, BY ANIMALS, 2021-2028 (IN $ MILLION)

FIGURE 29: ASIA-PACIFIC EUBIOTICS MARKET, BY HUMANS, 2021-2028 (IN $ MILLION)

FIGURE 30: ASIA-PACIFIC EUBIOTICS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 31: CHINA EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: JAPAN EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: INDIA EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 34: SOUTH KOREA EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: INDONESIA EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 36: THAILAND EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 37: VIETNAM EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 38: AUSTRALIA & NEW ZEALAND EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 39: REST OF ASIA-PACIFIC EUBIOTICS MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- MARKET BY PRODUCT

- PROBIOTICS

- ORGANIC ACID

- PREBIOTICS

- ESSENTIAL OILS

- MARKET BY FORM

- SOLID FORM/DRY FORM

- LIQUID

- MARKET BY PACKAGING

- BULK PACKAGING

- STAND-UP POUCHES/PORTION CONTROL

- MARKET BY LIVESTOCK

- SWINE

- POULTRY

- RUMINANTS

- AQUACULTURE

- OTHER LIVESTOCK

- MARKET BY APPLICATION

- GUT HEALTH

- IMMUNITY

- YIELD MANAGEMENT

- OTHER APPLICATIONS

- MARKET BY END-USER

- ANIMALS

- HUMANS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.