ASIA-PACIFIC ANIMAL NUTRITION MARKET FORECAST 2021-2028

Asia Pacific Animal Nutrition Market by Product Type (Amino Acids, Vitamins, Minerals, Enzymes, Fish Oils and Nutrition Lipids, Eubiotics, Carotenoids, Other Product Types) Market by Species (Poultry, Swine, Ruminants, Pets, Other Species) Market by Application (Animal Feed Manufacturers, Farms, Veterinarians, Households, Other Applications) by Geography

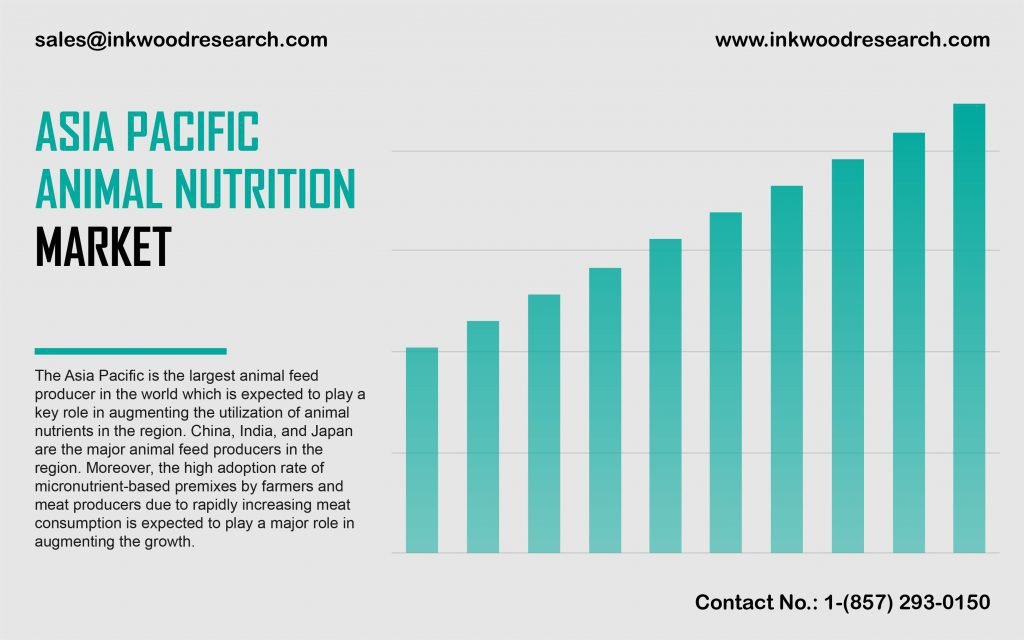

The Asia-Pacific animal nutrition market is expected to record a CAGR of 6.46% during the forecast period, 2021-2028. The region is the largest animal feed producer in the world. This aspect is estimated to be a key factor in increasing the utilization of animal nutrients in the region.

To learn more about this report, request a free sample copy

The Asia-Pacific animal nutrition market growth assessment includes the analysis of Australia & New Zealand, Japan, China, Indonesia, Vietnam, Thailand, South Korea, India, and Rest of Asia-Pacific. In China, beef consumption is on the rise, increasing by 70% in the last 20 years. Also, the rising disposable incomes have contributed to the growing purchase of premium pet foods. In addition, there has been an increase in the number of pet dogs and cats, reaching 99.15 million in 2019, as per the 2019 Chinese Pet Industry whitepaper.

In India, the market growth is driven by the thriving dairy industry, supplemented by the White Revolution 2.0, which has led to the fast-paced growth of the cattle population. At present, the country has the largest cattle population worldwide. Additionally, the Department of Animal Husbandry & Dairying under the Ministry of Fisheries increasingly prioritizes livestock and the availability of accurate and up-to-date livestock data. Furthermore, India is one of the fastest-growing animal feed markets. Also, the aqua, dairy, and poultry industries account for the major share of the animal feed industry. Moreover, the manufacture of modern animal feed products entails blending and selecting ingredients to increase the quality of its end products like meat, eggs, milk, etc., and maintain animal health.

Tata Chemicals Ltd produces chemical-based products for animal nutrition, food & nutrition, agriculture, and pharmaceuticals. The product portfolio includes nutritional solutions and agro-solutions. Also, it manufactures Alkakarb, an animal nutrition product based on sodium bicarbonate. It is headquartered in Mumbai, India.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES `

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND FOR NUTRITIONAL REQUIREMENTS OF EXISTING LIVESTOCK

- INCREASING DISPOSABLE INCOME DRIVING THE ANIMAL-BASED PRODUCTS’ CONSUMPTION

- INDUSTRIALIZATION OF LIVESTOCK

- KEY CHALLENGES

- PREMIUM PRICING OF ANIMAL NUTRITIONAL PRODUCTS

- LOW-QUALITY COUNTERFEIT PRODUCTS

- ENVIRONMENTAL CHALLENGES IMPACTING THE LIVESTOCK PRODUCTION

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON THE ANIMAL NUTRITION MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PRODUCT TYPE

- AMINO ACIDS

- VITAMINS

- MINERALS

- ENZYMES

- FISH OILS AND NUTRITION LIPIDS

- EUBIOTICS

- CAROTENOIDS

- OTHER PRODUCT TYPES

- MARKET BY SPECIES

- POULTRY

- SWINE

- RUMINANTS

- PETS

- OTHER SPECIES

- MARKET BY APPLICATION

- ANIMAL FEED MANUFACTURERS

- FARMS

- VETERINARIANS

- HOUSEHOLDS

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS, ANNOUNCEMENTS & DIVESTITURES

- COMPANY PROFILES

- ALLTECH INC

- BASF

- BALCHEM CORPORATION

- CARGILL INCORPORATED

- CHURCH & DWIGHT CO INC

- ELANCO ANIMAL HEALTH

- EVONIK INDUSTRIES

- KEMIN INDUSTRIES

- NOVOZYMES

- NUTRIEN

- ROYAL DSM

- SHV NV (NUTRECO)

- TATA CHEMICALS LTD

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – ANIMAL NUTRITION

TABLE 2: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY SPECIES, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY SPECIES, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: LEADING PLAYERS OPERATING IN THE ASIA-PACIFIC ANIMAL NUTRITION MARKET

TABLE 11: LIST OF MERGERS & ACQUISITIONS

TABLE 12: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 13: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 14: LIST OF BUSINESS EXPANSIONS, ANNOUNCEMENTS & DIVESTITURES

FIGURE LIST

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: ASIA-PACIFIC ANIMAL NUTRITION MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 6: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY AMINO ACIDS, 2021-2028 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY VITAMINS, 2021-2028 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY MINERALS, 2021-2028 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY ENZYMES, 2021-2028 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY FISH OILS AND NUTRITION LIPIDS, 2021-2028 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY EUBIOTICS, 2021-2028 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY CAROTENOIDS, 2021-2028 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY OTHER PRODUCT TYPES, 2021-2028 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC ANIMAL NUTRITION MARKET, GROWTH POTENTIAL, BY SPECIES, IN 2020

FIGURE 15: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY POULTRY, 2021-2028 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY SWINE, 2021-2028 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY RUMINANTS, 2021-2028 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY PETS, 2021-2028 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY OTHER SPECIES, 2021-2028 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC ANIMAL NUTRITION MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 21: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY ANIMAL FEED MANUFACTURERS, 2021-2028 (IN $ MILLION)

FIGURE 22: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY FARMS, 2021-2028 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY VETERINARIANS, 2021-2028 (IN $ MILLION)

FIGURE 24: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY HOUSEHOLDS, 2021-2028 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC ANIMAL NUTRITION MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC ANIMAL NUTRITION MARKET, COUNTRY OUTLOOK, 2020 & 2028 (IN %)

FIGURE 27: CHINA ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 28: JAPAN ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 29: INDIA ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 30: AUSTRALIA & NEW ZEALAND ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 31: SOUTH KOREA ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: INDONESIA ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: THAILAND ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 34: VIETNAM ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: REST OF ASIA-PACIFIC ANIMAL NUTRITION MARKET, 2021-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- REST OF ASIA-PACIFIC

- ASIA-PACIFIC

- MARKET BY PRODUCT TYPE

- AMINO ACIDS

- VITAMINS

- MINERALS

- ENZYMES

- FISH OILS AND NUTRITION LIPIDS

- EUBIOTICS

- CAROTENOIDS

- OTHER PRODUCT TYPES

- MARKET BY SPECIES

- POULTRY

- SWINE

- RUMINANTS

- PETS

- OTHER SPECIES

- MARKET BY APPLICATION

- ANIMAL FEED MANUFACTURERS

- FARMS

- VETERINARIANS

- HOUSEHOLDS

- OTHER APPLICATIONS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.